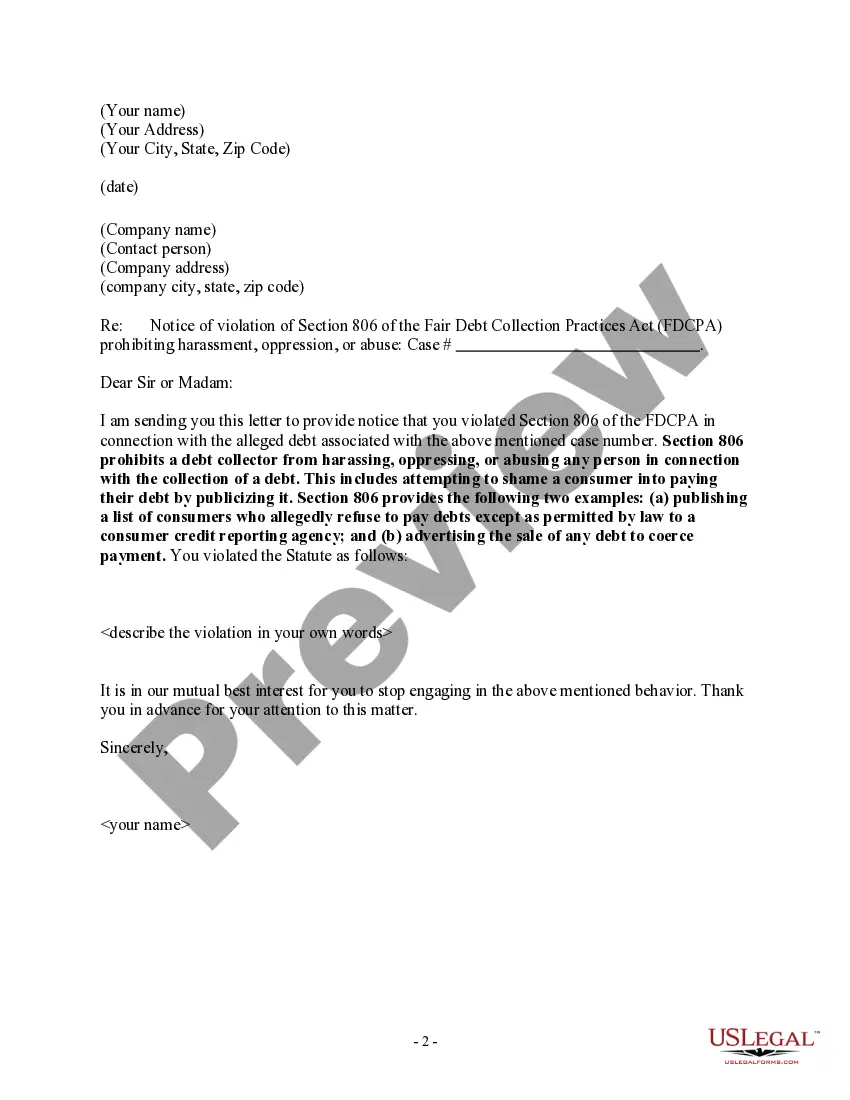

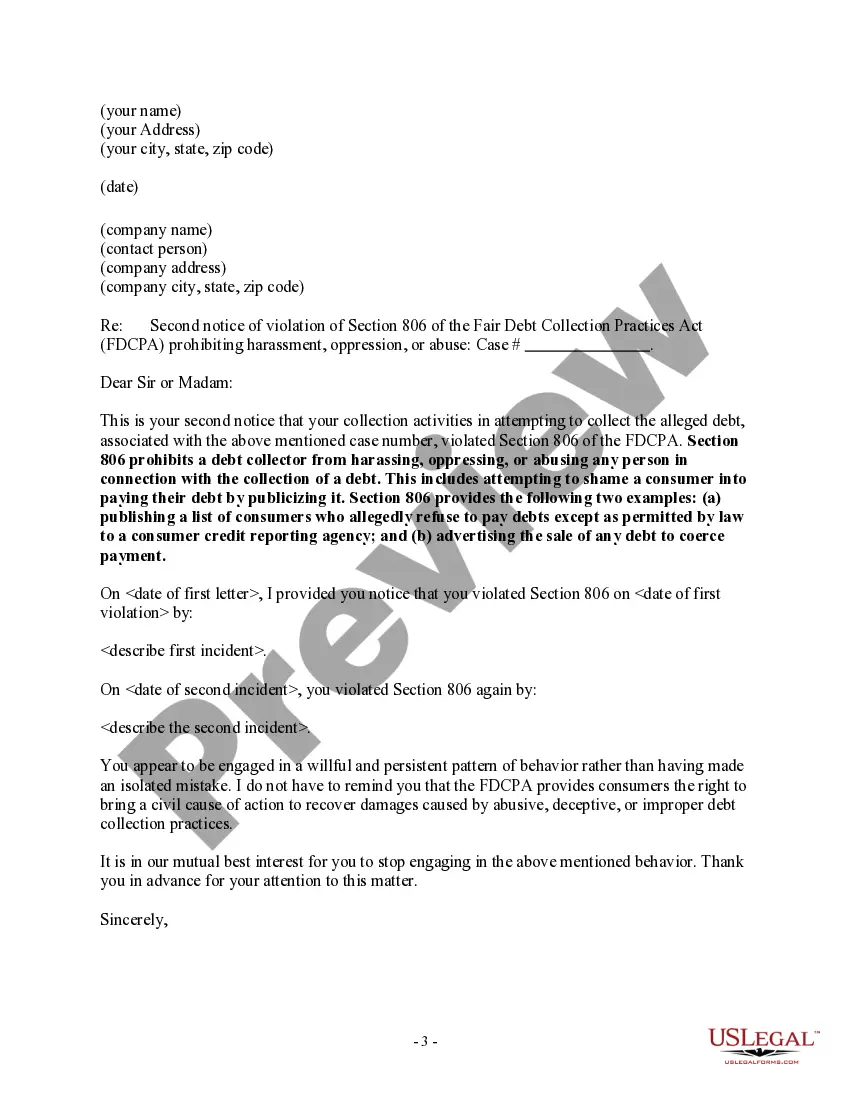

A debt collector may not shame a consumer into paying their debt by publicizing it. Title: Understanding the Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment Introduction: The Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment is a legal document issued to protect consumers from unfair debt collection practices. Debt collectors are prohibited from publishing a debtor's personal financial information to coerce payment. This article will provide an in-depth overview of this notice, its purpose, and the consequences for debt collectors who violate it. Keywords: Harris Texas Notice to Debt Collector, Unlawful Publishing of a Debt, Coerce Payment, Debt Collection Practices, Legal Document, Consumer Protection. Types of Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment: 1. Cease and Desist Notice: A Cease and Desist notice is a type of Harris Texas Notice to Debt Collector used to demand that a debt collector immediately stops publishing a debtor's personal financial information. Once a debtor sends this notice, the debt collector must cease all publishing activities or face legal consequences. 2. Debt Validation Notice: A Debt Validation Notice serves as a legal request for a debt collector to provide specific details regarding the debt they claim the consumer owes. This notice helps consumers determine whether the debt is valid and offers an opportunity to dispute any inaccuracies. When debt collectors unlawfully publish the debt in question to coerce payment, a Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment can be filed. 3. Notice of Violation: If a debt collector continues to publish a debtor's personal financial information despite being previously informed about the violation, the debtor may file a Notice of Violation. This notice serves as an official complaint and escalates the issue to legal authorities. Consequences for Debt Collectors: Debt collectors who unlawfully publish a debtor's financial information to coerce payment can face severe consequences under the Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment. These consequences may include: 1. Legal Action: Debtors have the right to take legal action against debt collectors who engage in unlawful publishing practices. They can seek compensation for damages caused by the breach of privacy and harassment. 2. Fines and Penalties: If found guilty of violating the notice, debt collectors may be subject to fines and penalties imposed by the court. The severity of these fines can vary depending on the extent and impact of the violation. 3. Revocation of Debt Collection License: In extreme cases, a debt collector's license may be revoked for repeated violations of the Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment. This prevents the debt collector from engaging in future collection activities. Conclusion: The Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment serves as a vital safeguard against unfair debt collection practices. It protects consumers from having their personal financial information unlawfully published in an attempt to coerce payment. By understanding this notice and its consequences, consumers can assert their rights and take appropriate legal action against debt collectors who violate them.

Title: Understanding the Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment Introduction: The Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment is a legal document issued to protect consumers from unfair debt collection practices. Debt collectors are prohibited from publishing a debtor's personal financial information to coerce payment. This article will provide an in-depth overview of this notice, its purpose, and the consequences for debt collectors who violate it. Keywords: Harris Texas Notice to Debt Collector, Unlawful Publishing of a Debt, Coerce Payment, Debt Collection Practices, Legal Document, Consumer Protection. Types of Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment: 1. Cease and Desist Notice: A Cease and Desist notice is a type of Harris Texas Notice to Debt Collector used to demand that a debt collector immediately stops publishing a debtor's personal financial information. Once a debtor sends this notice, the debt collector must cease all publishing activities or face legal consequences. 2. Debt Validation Notice: A Debt Validation Notice serves as a legal request for a debt collector to provide specific details regarding the debt they claim the consumer owes. This notice helps consumers determine whether the debt is valid and offers an opportunity to dispute any inaccuracies. When debt collectors unlawfully publish the debt in question to coerce payment, a Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment can be filed. 3. Notice of Violation: If a debt collector continues to publish a debtor's personal financial information despite being previously informed about the violation, the debtor may file a Notice of Violation. This notice serves as an official complaint and escalates the issue to legal authorities. Consequences for Debt Collectors: Debt collectors who unlawfully publish a debtor's financial information to coerce payment can face severe consequences under the Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment. These consequences may include: 1. Legal Action: Debtors have the right to take legal action against debt collectors who engage in unlawful publishing practices. They can seek compensation for damages caused by the breach of privacy and harassment. 2. Fines and Penalties: If found guilty of violating the notice, debt collectors may be subject to fines and penalties imposed by the court. The severity of these fines can vary depending on the extent and impact of the violation. 3. Revocation of Debt Collection License: In extreme cases, a debt collector's license may be revoked for repeated violations of the Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment. This prevents the debt collector from engaging in future collection activities. Conclusion: The Harris Texas Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment serves as a vital safeguard against unfair debt collection practices. It protects consumers from having their personal financial information unlawfully published in an attempt to coerce payment. By understanding this notice and its consequences, consumers can assert their rights and take appropriate legal action against debt collectors who violate them.