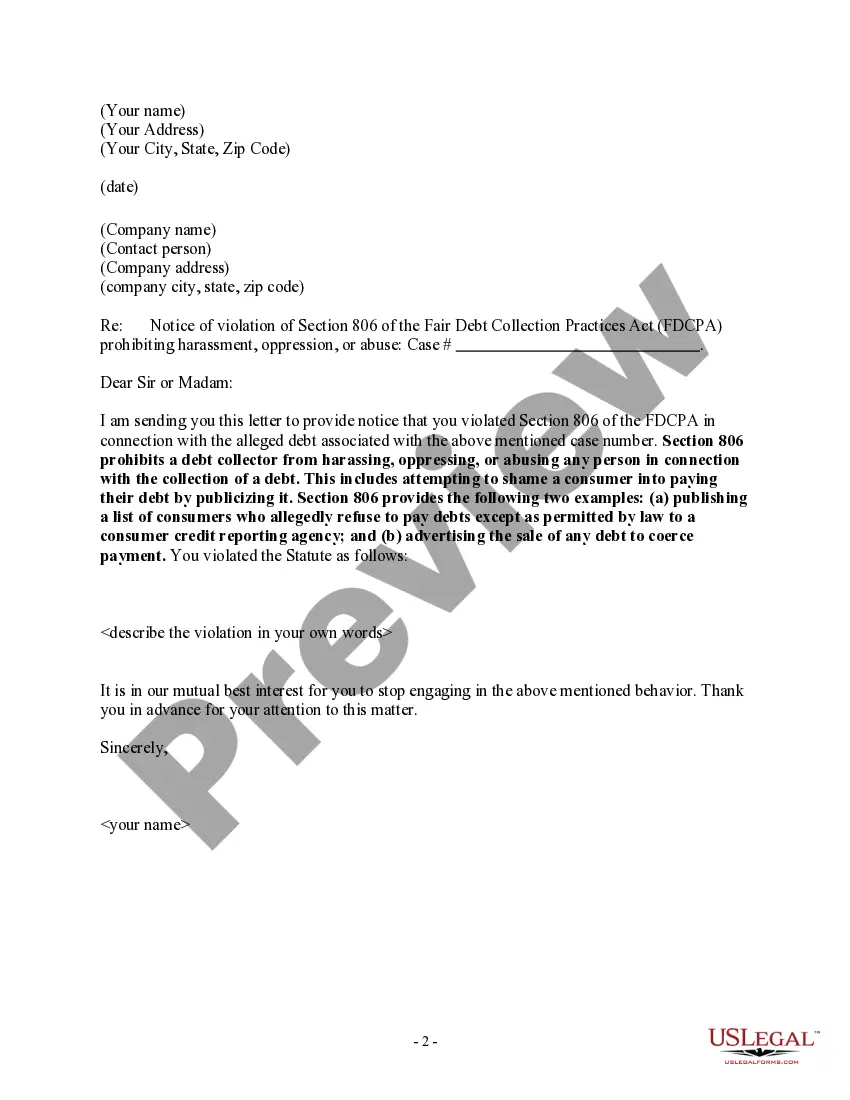

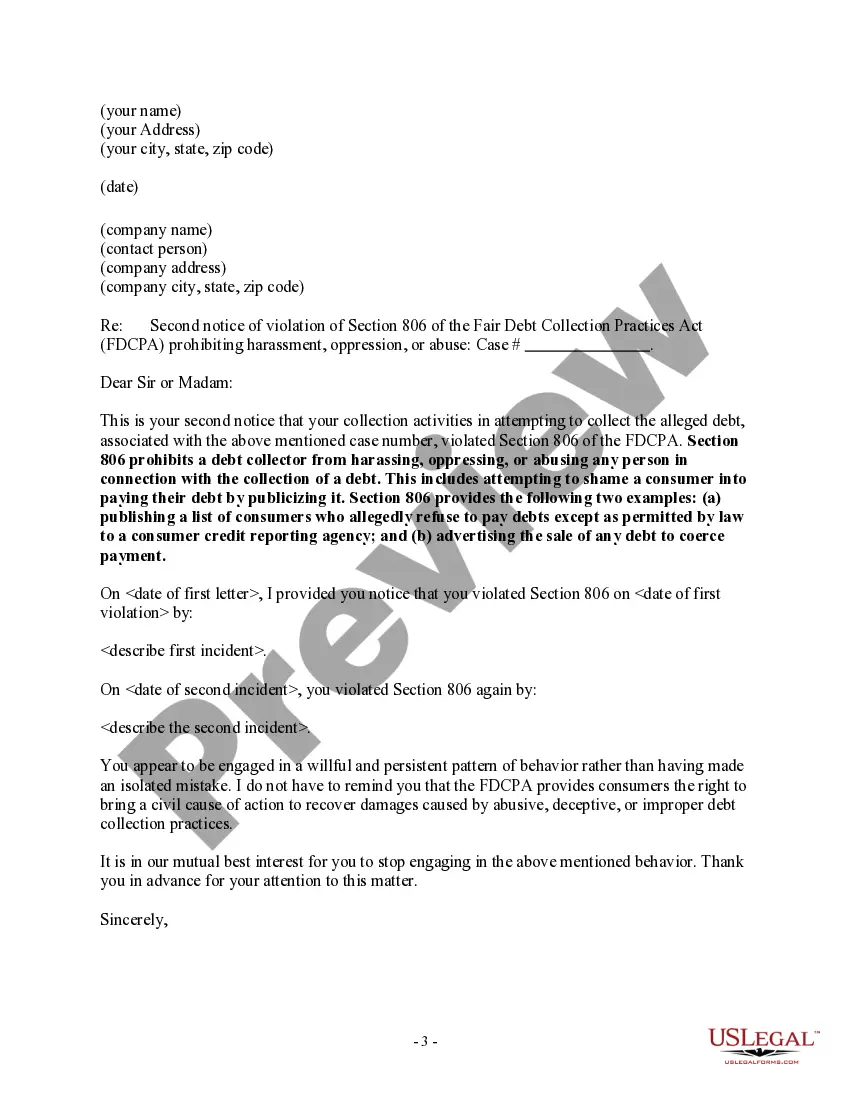

A debt collector may not shame a consumer into paying their debt by publicizing it. Keywords: Lima Arizona, Notice to Debt Collector, Unlawful Publishing of a Debt to Coerce Payment, types, legal implications, consumer rights, Fair Debt Collection Practices Act (FD CPA), consequences, compliance, debt collection laws. Title: Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment: Types and Legal Implications Introduction: In Lima, Arizona, individuals who find themselves dealing with debt collection agencies should be aware of their rights and the consequences of unlawful practices. One such violation is the unlawful publishing of a debt to coerce payment. This article explores the different types of Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment and the legal implications associated with such actions. 1. Definition and Scope: The Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment refers to the act of disclosing debt-related information in a manner that puts undue pressure on a debtor to settle their outstanding balance. 2. Types of Unlawful Publishing of a Debt to Coerce Payment: a. Public Disclosure: This type involves a debt collector revealing sensitive debt information to the public, such as sharing the details on social media platforms, online forums, or public notice boards, causing embarrassment and reputational damage to the debtor. b. Unauthorized Third-Party Communication: Debt collectors engaging in this practice may divulge a debtor's outstanding balance or debt-related details to unrelated individuals, such as friends, family, or employers. Such actions can create unnecessary distress and jeopardize personal relationships or professional standing. c. Publishing False Information: If a debt collector knowingly publishes false information regarding a debt, such as inflating the amount or misrepresenting the debtor's payment history, it constitutes an unlawful tactic to manipulate and coerce payment. 3. Legal Implications and Consumer Rights: a. Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law designed to protect consumers from abusive debt collection practices. Debt collectors found guilty of unlawfully publishing a debt to coerce payment can face legal action and penalties. b. Consumer Rights: Debtors have the right to dispute, validate, and request proof of their debts, as well as protection against harassment, false representation, and abusive practices by debt collectors. Unlawful publishing violates these rights, offering grounds for legal recourse. 4. Consequences of Unlawful Publishing: a. Financial Liability: Debt collectors engaging in unlawful publishing of a debt may be held financially liable for damages resulting from the violation, including compensation for emotional distress, reputational harm, legal fees, and any other losses attributable to their actions. b. Compliance and Reputation: Individuals and companies involved in debt collection must ensure compliance with relevant laws and regulations. Unlawful publishing not only leads to legal consequences but can also severely damage a debt collector's reputation and credibility. Conclusion: Understanding the different types of Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment is crucial for both debtors and debt collectors. Debt collectors must adhere to legal guidelines outlined by the FD CPA to avoid severe consequences for their actions. Debtors, on the other hand, should be aware of their rights and take action if they experience unlawful publishing practices.

Keywords: Lima Arizona, Notice to Debt Collector, Unlawful Publishing of a Debt to Coerce Payment, types, legal implications, consumer rights, Fair Debt Collection Practices Act (FD CPA), consequences, compliance, debt collection laws. Title: Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment: Types and Legal Implications Introduction: In Lima, Arizona, individuals who find themselves dealing with debt collection agencies should be aware of their rights and the consequences of unlawful practices. One such violation is the unlawful publishing of a debt to coerce payment. This article explores the different types of Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment and the legal implications associated with such actions. 1. Definition and Scope: The Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment refers to the act of disclosing debt-related information in a manner that puts undue pressure on a debtor to settle their outstanding balance. 2. Types of Unlawful Publishing of a Debt to Coerce Payment: a. Public Disclosure: This type involves a debt collector revealing sensitive debt information to the public, such as sharing the details on social media platforms, online forums, or public notice boards, causing embarrassment and reputational damage to the debtor. b. Unauthorized Third-Party Communication: Debt collectors engaging in this practice may divulge a debtor's outstanding balance or debt-related details to unrelated individuals, such as friends, family, or employers. Such actions can create unnecessary distress and jeopardize personal relationships or professional standing. c. Publishing False Information: If a debt collector knowingly publishes false information regarding a debt, such as inflating the amount or misrepresenting the debtor's payment history, it constitutes an unlawful tactic to manipulate and coerce payment. 3. Legal Implications and Consumer Rights: a. Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law designed to protect consumers from abusive debt collection practices. Debt collectors found guilty of unlawfully publishing a debt to coerce payment can face legal action and penalties. b. Consumer Rights: Debtors have the right to dispute, validate, and request proof of their debts, as well as protection against harassment, false representation, and abusive practices by debt collectors. Unlawful publishing violates these rights, offering grounds for legal recourse. 4. Consequences of Unlawful Publishing: a. Financial Liability: Debt collectors engaging in unlawful publishing of a debt may be held financially liable for damages resulting from the violation, including compensation for emotional distress, reputational harm, legal fees, and any other losses attributable to their actions. b. Compliance and Reputation: Individuals and companies involved in debt collection must ensure compliance with relevant laws and regulations. Unlawful publishing not only leads to legal consequences but can also severely damage a debt collector's reputation and credibility. Conclusion: Understanding the different types of Lima Arizona Notice to Debt Collector — Unlawful Publishing of a Debt to Coerce Payment is crucial for both debtors and debt collectors. Debt collectors must adhere to legal guidelines outlined by the FD CPA to avoid severe consequences for their actions. Debtors, on the other hand, should be aware of their rights and take action if they experience unlawful publishing practices.