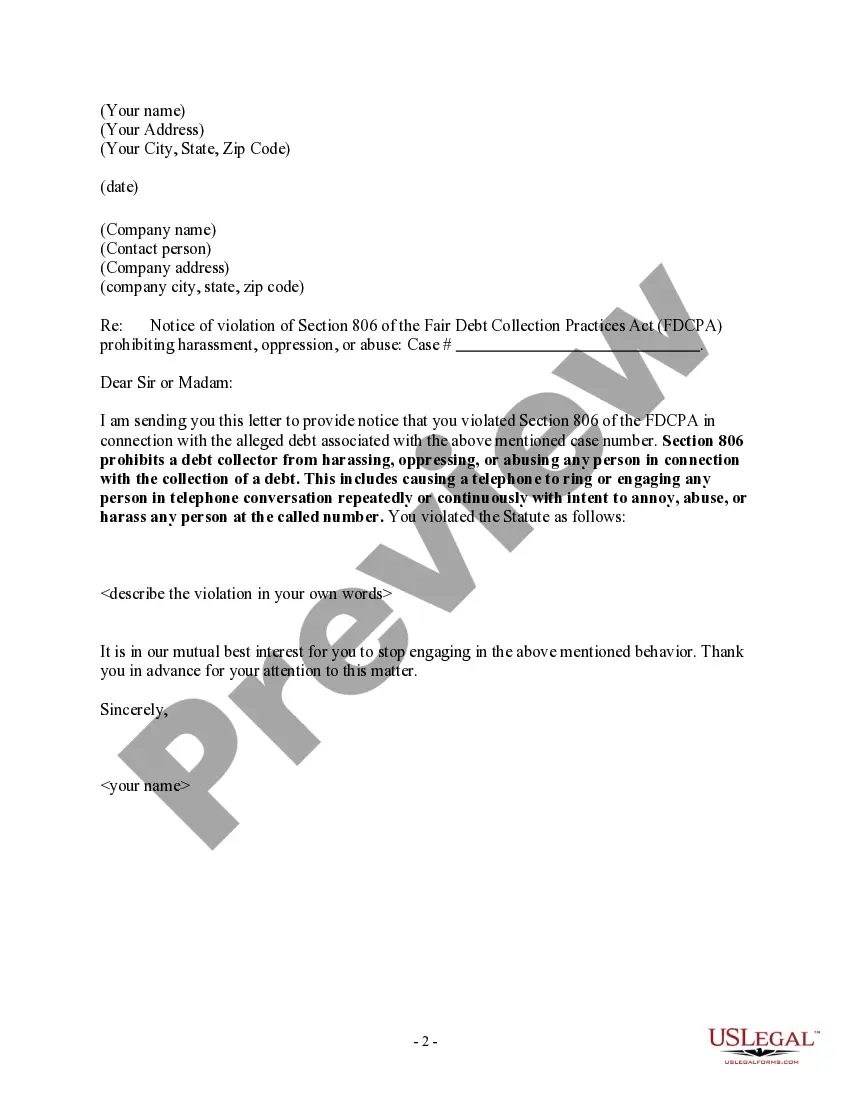

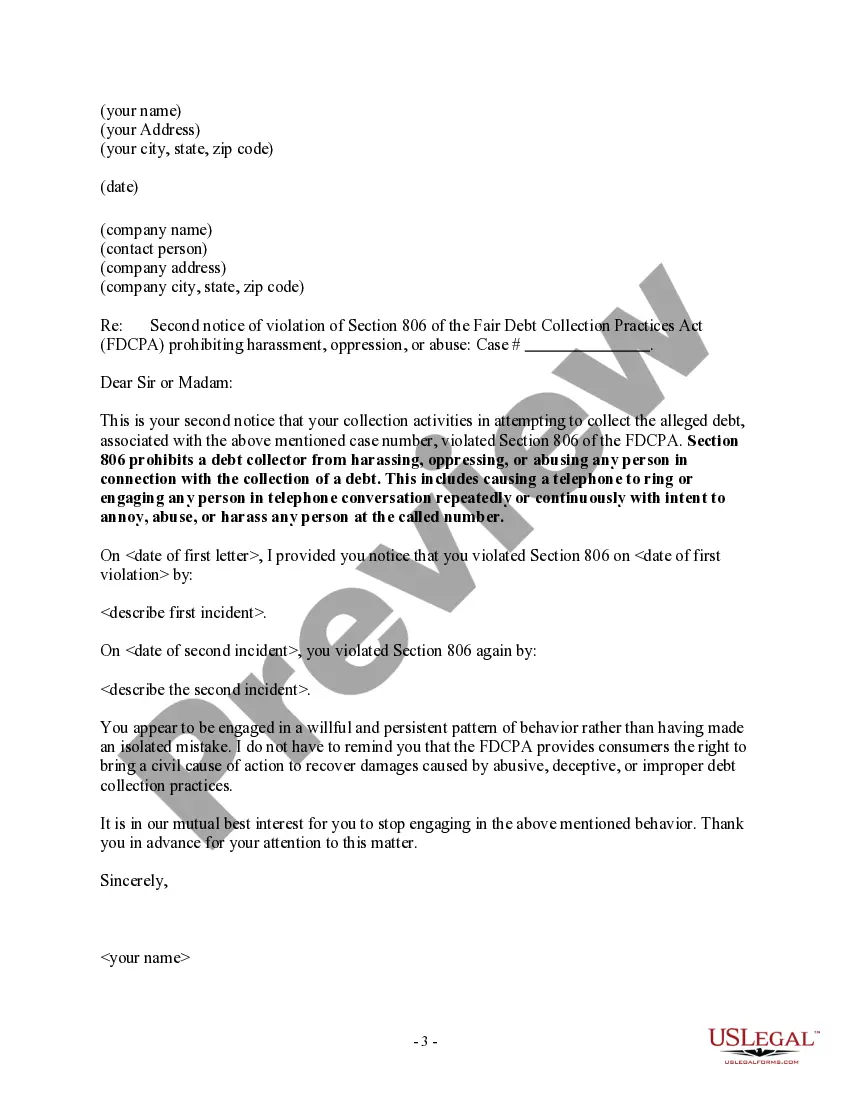

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number. Chicago Illinois Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls In Chicago, Illinois, individuals are protected by various laws and regulations regarding debt collection practices. One such protection is the ability to issue a Notice to Debt Collector when faced with unlawful repeated or continuous telephone calls from debt collectors. This notice serves as a formal warning to debt collectors, informing them that their actions are in violation of the debtor's rights. When a debt collector engages in unlawful repeated or continuous telephone calls, it can be distressing and intrusive for the debtor. These unwanted calls can disrupt their daily life, cause undue stress, and even invade their privacy. Therefore, the Chicago Illinois Notice to Debt Collector is an important tool for debtors to assert their rights and demand that the harassment ceases. The Notice to Debt Collector should contain specific details about the unlawful calls, including dates, times, and frequency of the calls. It should clearly state that the debtor believes these calls to be in violation of the Fair Debt Collection Practices Act (FD CPA) and other relevant laws in Illinois. The debtor may request that the debt collector ceases all contact immediately or limits the contact to certain methods and times, as permitted under the law. Different types of Chicago Illinois Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls may include: 1. Notice to Debt Collector — Written Request: This type of notice is usually sent via certified mail with a return receipt requested. It ensures that the debtor has proof of delivery and provides a paper trail for future reference. 2. Notice to Debt Collector — Cease and Desist: This notice explicitly demands that the debt collector immediately cease all communication attempts, both via telephone and other means, such as mail or email. 3. Notice to Debt Collector — Limited Communication: In this notice, the debtor specifies the acceptable methods and times for the debt collector to contact them. For example, the debtor may request communication only via mail or email during certain hours of the day. 4. Notice to Debt Collector — Dispute of Validity: If the debtor believes that the debt is invalid or inaccurate, this notice can be used to dispute the validity of the debt and demand that the debt collector provide proof of the debt's legitimacy. It is crucial for debtors in Chicago, Illinois, to familiarize themselves with their rights and protections under the FD CPA and state laws. By issuing a Chicago Illinois Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls, debtors can take a proactive step in stopping unwanted harassment and ensuring fair debt collection practices.

Chicago Illinois Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls In Chicago, Illinois, individuals are protected by various laws and regulations regarding debt collection practices. One such protection is the ability to issue a Notice to Debt Collector when faced with unlawful repeated or continuous telephone calls from debt collectors. This notice serves as a formal warning to debt collectors, informing them that their actions are in violation of the debtor's rights. When a debt collector engages in unlawful repeated or continuous telephone calls, it can be distressing and intrusive for the debtor. These unwanted calls can disrupt their daily life, cause undue stress, and even invade their privacy. Therefore, the Chicago Illinois Notice to Debt Collector is an important tool for debtors to assert their rights and demand that the harassment ceases. The Notice to Debt Collector should contain specific details about the unlawful calls, including dates, times, and frequency of the calls. It should clearly state that the debtor believes these calls to be in violation of the Fair Debt Collection Practices Act (FD CPA) and other relevant laws in Illinois. The debtor may request that the debt collector ceases all contact immediately or limits the contact to certain methods and times, as permitted under the law. Different types of Chicago Illinois Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls may include: 1. Notice to Debt Collector — Written Request: This type of notice is usually sent via certified mail with a return receipt requested. It ensures that the debtor has proof of delivery and provides a paper trail for future reference. 2. Notice to Debt Collector — Cease and Desist: This notice explicitly demands that the debt collector immediately cease all communication attempts, both via telephone and other means, such as mail or email. 3. Notice to Debt Collector — Limited Communication: In this notice, the debtor specifies the acceptable methods and times for the debt collector to contact them. For example, the debtor may request communication only via mail or email during certain hours of the day. 4. Notice to Debt Collector — Dispute of Validity: If the debtor believes that the debt is invalid or inaccurate, this notice can be used to dispute the validity of the debt and demand that the debt collector provide proof of the debt's legitimacy. It is crucial for debtors in Chicago, Illinois, to familiarize themselves with their rights and protections under the FD CPA and state laws. By issuing a Chicago Illinois Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls, debtors can take a proactive step in stopping unwanted harassment and ensuring fair debt collection practices.