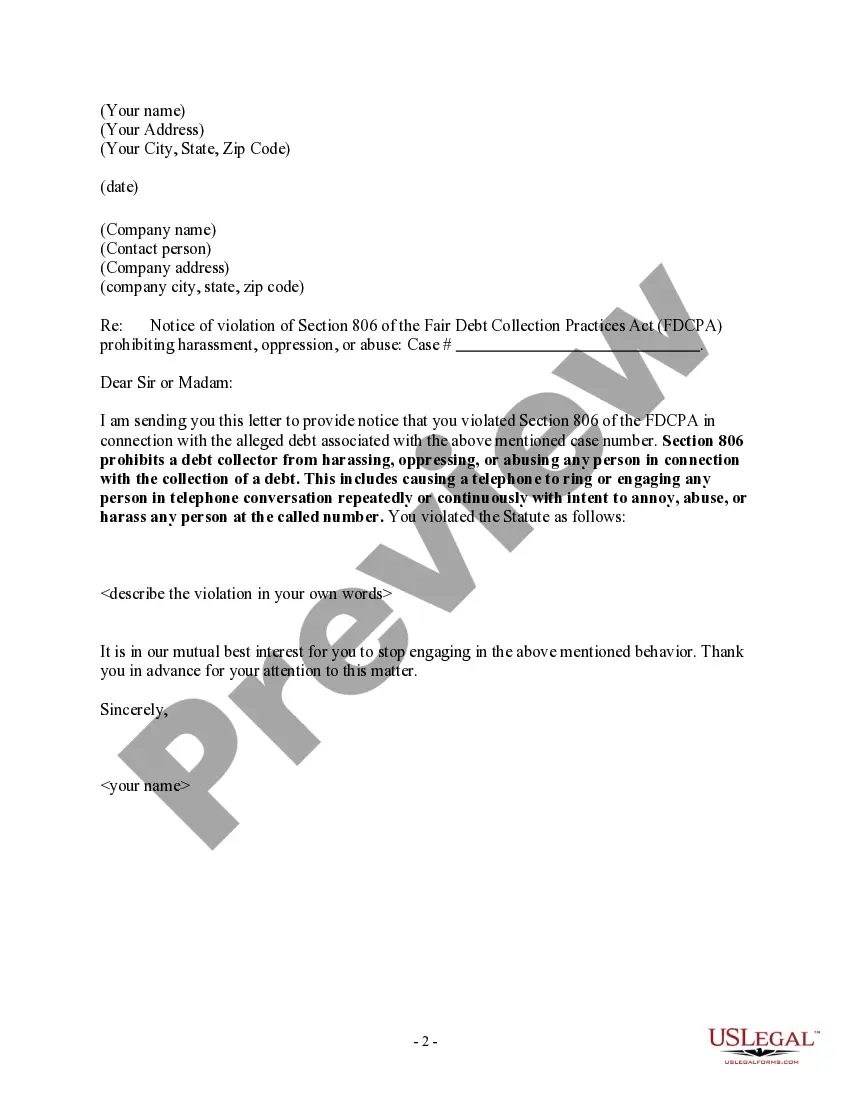

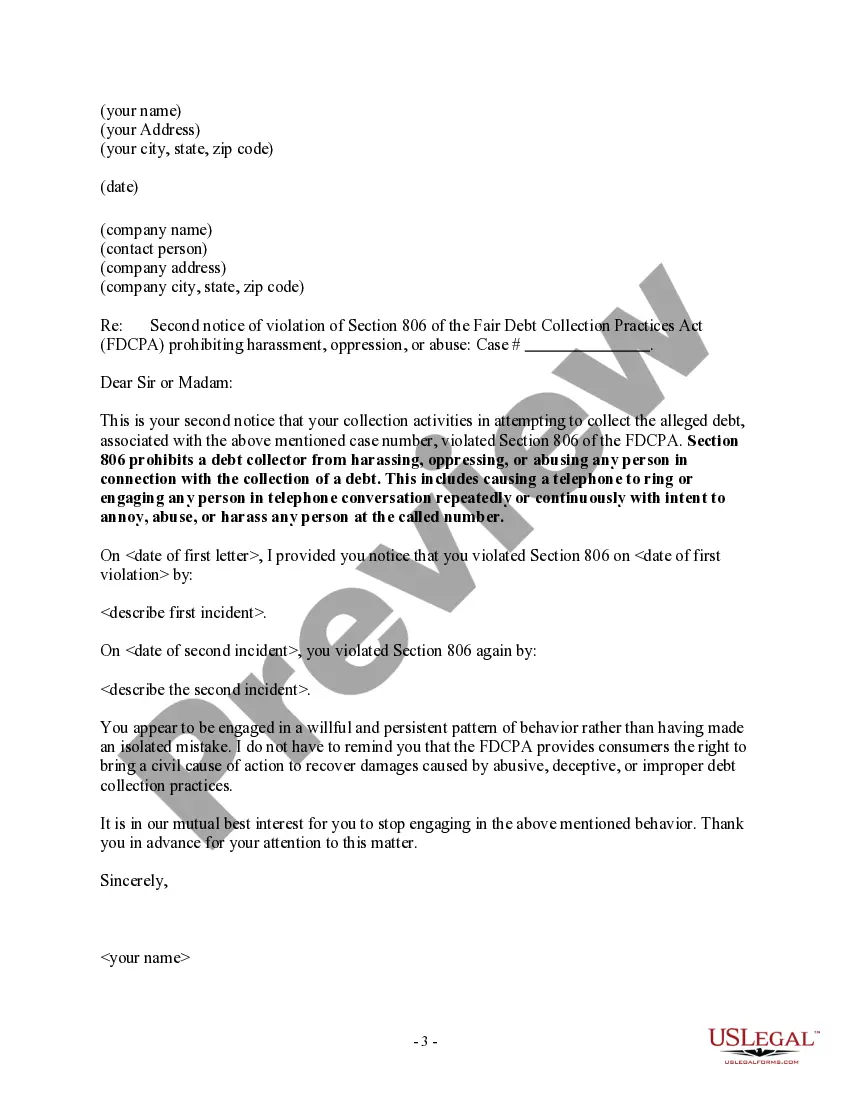

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

Nassau New York Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls

Description

How to fill out Notice To Debt Collector - Unlawful Repeated Or Continuous Telephone Calls?

Managing legal documents is essential in the contemporary world. Nevertheless, you do not always have to seek expert assistance to create some of them from scratch, such as Nassau Notice to Debt Collector - Unlawful Repeated or Continuous Phone Calls, using a platform like US Legal Forms.

US Legal Forms offers over 85,000 documents to choose from in various categories, including living wills, real estate documents, and divorce papers. All documents are organized according to their applicable state, making the search process easier. Additionally, you can find comprehensive resources and guides on the website to simplify any tasks related to document preparation.

Here’s how to acquire and download Nassau Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls.

If you are already a subscriber of US Legal Forms, you can find the desired Nassau Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls, Log In to your account, and download it. It is important to note that our website cannot fully replace a legal expert. If you encounter a particularly complex issue, we recommend seeking the services of an attorney to review your document prior to its execution and submission.

With over 25 years in the industry, US Legal Forms has become a trusted source for a variety of legal documents for millions of customers. Join them today and effortlessly obtain your state-specific forms!

- Review the document's preview and summary (if available) to understand what you will receive after downloading the document.

- Make sure that the template you select is customized for your state/county/region since local laws can influence the validity of certain documents.

- Browse similar document templates or restart your search to locate the appropriate file.

- Click Buy now and set up your account. If you already have one, opt to Log In.

- Select the pricing plan, then an appropriate payment method, and purchase Nassau Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls.

- Choose to save the document template in any provided file format.

- Go to the My documents tab to re-download the document.

Form popularity

FAQ

Debt collectors cannot call you at unusual or inconvenient times or places. Generally, they may call between 8 a.m. and 9 p.m., but you may ask them to call at other times if those hours are inconvenient for you.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Nevertheless, creditors may not call you more than 7 times within 7 consecutive days or call you within 7 days of talking to you about the debt. If your creditor calls you multiple times a day or continues calling even after you answer the phone and speak with them, you are likely facing creditor harassment.