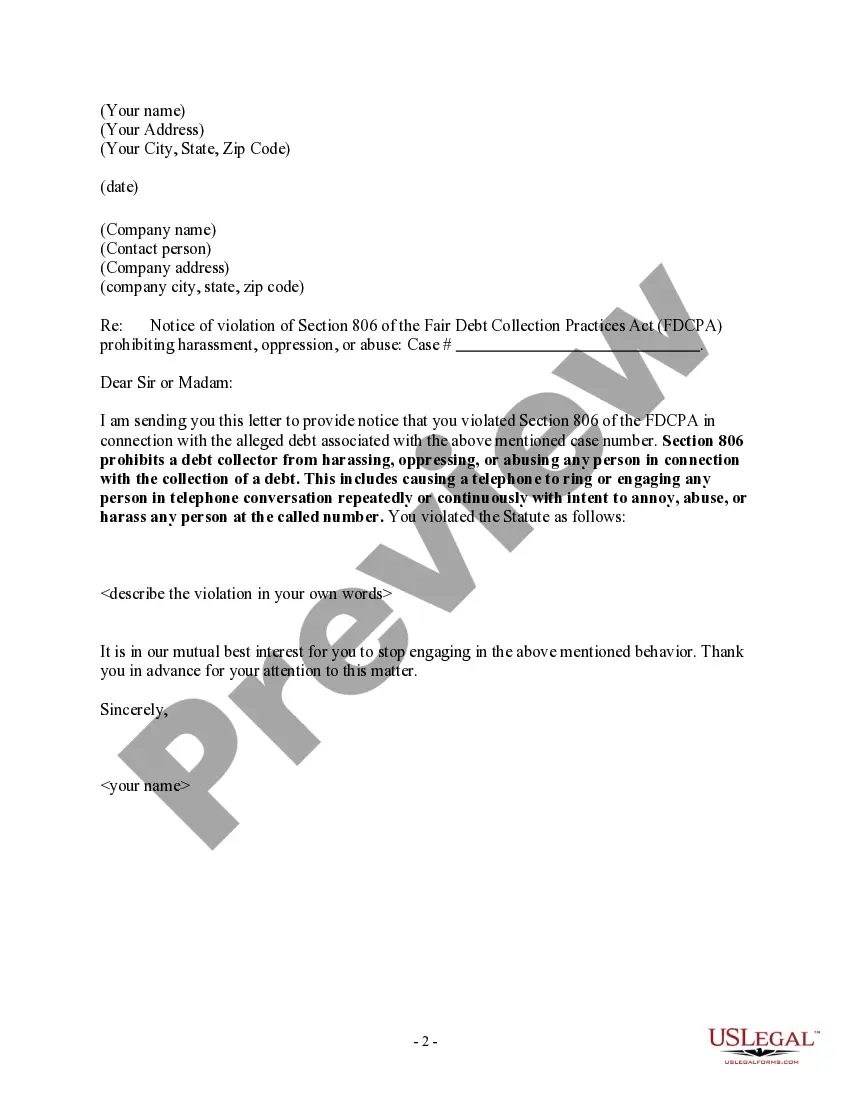

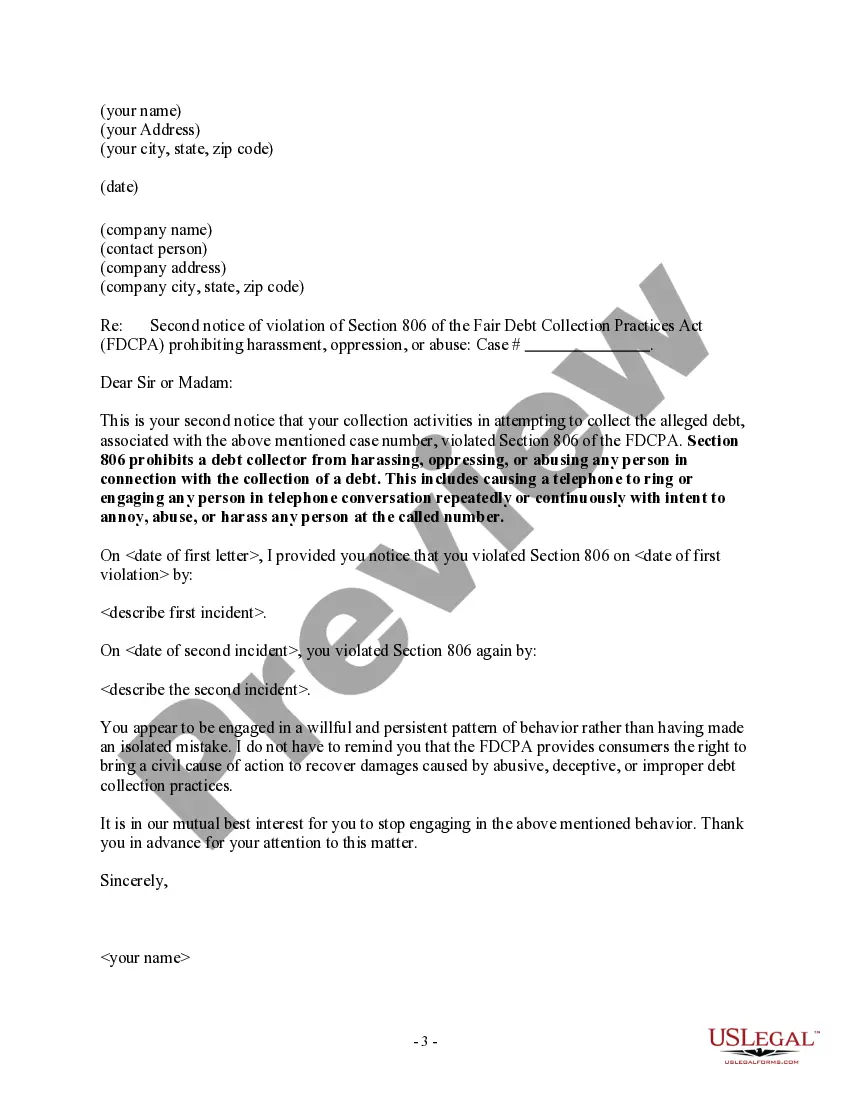

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number. San Diego, California is a beautiful coastal city known for its stunning beaches, vibrant downtown area, and pleasant year-round climate. Located in Southern California, San Diego offers a wide array of attractions, including famous landmarks like the San Diego Zoo, Balboa Park, and USS Midway Museum. When it comes to the San Diego California Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls, there are a few types that individuals should be aware of. These notices are designed to protect consumers from abusive debt collection practices, particularly harassment through continuous or repeated phone calls. Key variations of the San Diego California Notice to Debt Collector include: 1. Unauthorized Phone Calls: This involves debt collectors making repeated or continuous calls without obtaining proper consent from the consumer. The law requires debt collectors to first obtain permission from the debtor before contacting them by phone. 2. Limitations on Calling Hours: This type of notice restricts debt collectors from making phone calls outside predetermined hours. Often, the law specifies that calls should only be made during reasonable times of the day, typically between 8 a.m. and 9 p.m., unless otherwise agreed upon. 3. Prohibition of Harassment: The San Diego California Notice to Debt Collector prohibits debt collectors from using any form of harassment, including using offensive language, threats, or intimidation tactics during phone calls. Additionally, constant or repetitive communication solely intended to annoy, abuse, or harass the debtor is prohibited. 4. Cease and Desist Requests: This type of notice can be sent by the debtor to the collection agency, demanding that all communications cease immediately. Once the debt collector receives this notice, they are required by law to cease all contact, except for specific exceptions such as notifying the debtor of their intent to pursue legal action. It's important for individuals who receive unlawful repeated or continuous telephone calls from debt collectors to familiarize themselves with their rights and take appropriate actions. They can seek legal advice or assistance to file a complaint with the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC) if they believe their rights have been violated. Understanding the San Diego California Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls is crucial for individuals facing debt collection harassment. By knowing their rights and the types of notices available, debtors can protect themselves from ongoing stress and potential violations of consumer protection laws.

San Diego, California is a beautiful coastal city known for its stunning beaches, vibrant downtown area, and pleasant year-round climate. Located in Southern California, San Diego offers a wide array of attractions, including famous landmarks like the San Diego Zoo, Balboa Park, and USS Midway Museum. When it comes to the San Diego California Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls, there are a few types that individuals should be aware of. These notices are designed to protect consumers from abusive debt collection practices, particularly harassment through continuous or repeated phone calls. Key variations of the San Diego California Notice to Debt Collector include: 1. Unauthorized Phone Calls: This involves debt collectors making repeated or continuous calls without obtaining proper consent from the consumer. The law requires debt collectors to first obtain permission from the debtor before contacting them by phone. 2. Limitations on Calling Hours: This type of notice restricts debt collectors from making phone calls outside predetermined hours. Often, the law specifies that calls should only be made during reasonable times of the day, typically between 8 a.m. and 9 p.m., unless otherwise agreed upon. 3. Prohibition of Harassment: The San Diego California Notice to Debt Collector prohibits debt collectors from using any form of harassment, including using offensive language, threats, or intimidation tactics during phone calls. Additionally, constant or repetitive communication solely intended to annoy, abuse, or harass the debtor is prohibited. 4. Cease and Desist Requests: This type of notice can be sent by the debtor to the collection agency, demanding that all communications cease immediately. Once the debt collector receives this notice, they are required by law to cease all contact, except for specific exceptions such as notifying the debtor of their intent to pursue legal action. It's important for individuals who receive unlawful repeated or continuous telephone calls from debt collectors to familiarize themselves with their rights and take appropriate actions. They can seek legal advice or assistance to file a complaint with the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC) if they believe their rights have been violated. Understanding the San Diego California Notice to Debt Collector — Unlawful Repeated or Continuous Telephone Calls is crucial for individuals facing debt collection harassment. By knowing their rights and the types of notices available, debtors can protect themselves from ongoing stress and potential violations of consumer protection laws.