A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Alameda California Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

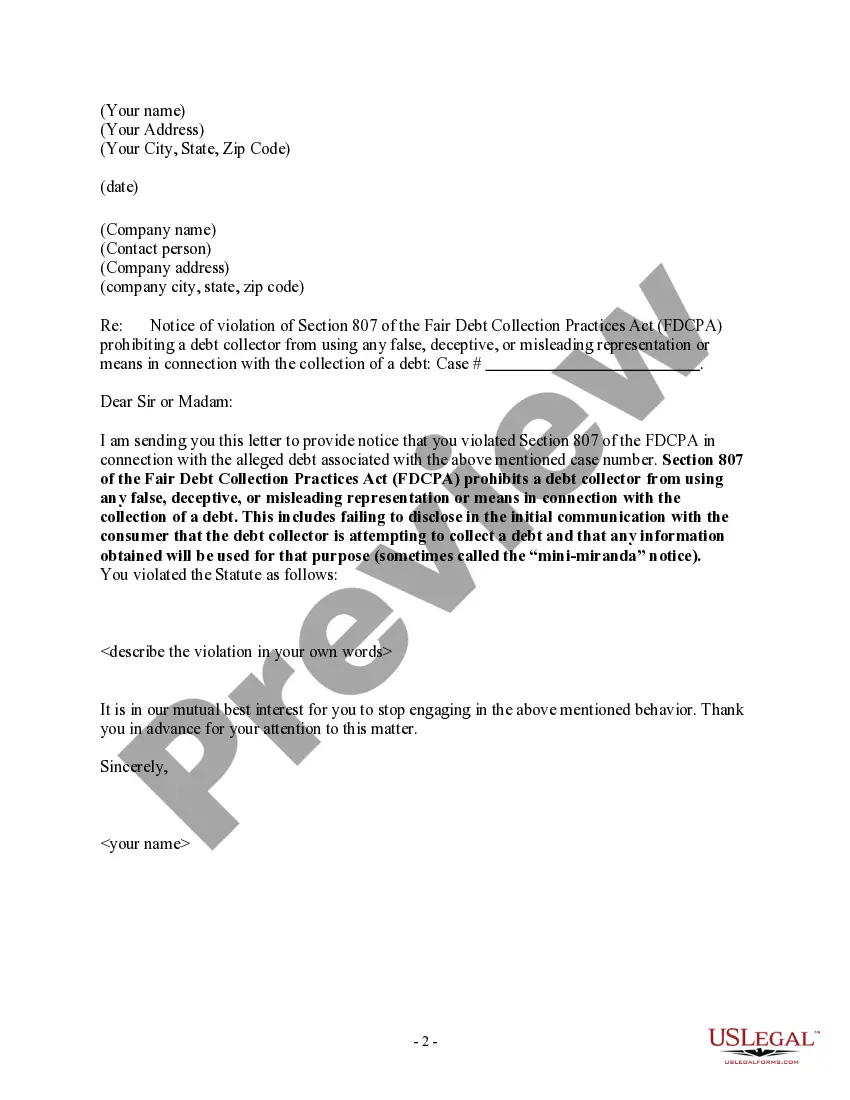

How to fill out Notice To Debt Collector - Failure To Provide Mini-Miranda?

A documentation process consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, transferring ownership, and many other life circumstances necessitate that you prepare formal records that differ across the nation.

That’s why having everything consolidated in one location is so advantageous.

US Legal Forms is the largest online database of current federal and state-specific legal templates. Here, you can effortlessly find and download a document for any individual or business purpose used in your jurisdiction, including the Alameda Notice to Debt Collector - Failure to Provide Mini-Miranda.

This is the simplest and most reliable method to obtain legal documents. All the templates supplied by our library are professionally crafted and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters effectively with US Legal Forms!

- Finding forms on the platform is exceptionally uncomplicated.

- If you already have a subscription to our service, Log In to your account, search for the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Alameda Notice to Debt Collector - Failure to Provide Mini-Miranda will be available for further use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Alameda Notice to Debt Collector - Failure to Provide Mini-Miranda.

- Ensure you have accessed the correct page with your local form.

- Utilize the Preview mode (if accessible) and navigate through the template.

- Examine the description (if available) to confirm the template meets your needs.

- Look for another document using the search feature if the template doesn’t suit you.

- Click Buy Now when you find the requisite template.

Form popularity

FAQ

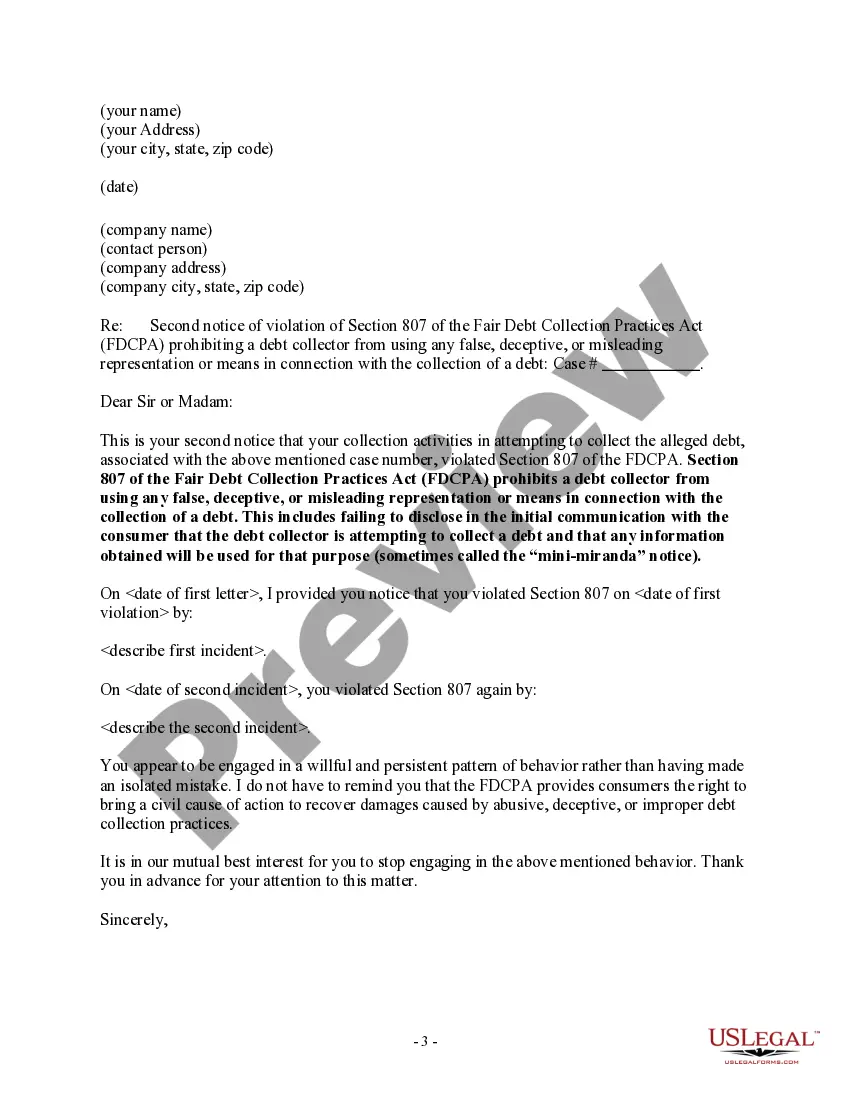

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Under the Mini Miranda rules, when a debt collector contacts you, they must: Identify themselves as a debt collector, State that the communication is an attempt to collect a debt, and. Warn you that any information they obtain from you will be used to assist in their debt collection efforts.

The federal FDCPA says that the collector must disclose in the initial communication that they're attempting to collect a debt and that any information obtained will be used for that purpose.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

The mini Miranda exists to help you understand what you shouldn't say to a debt collector so you don't incriminate yourself. Anything and everything you say to the debt collector during your correspondence can be used against you to build a case.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.