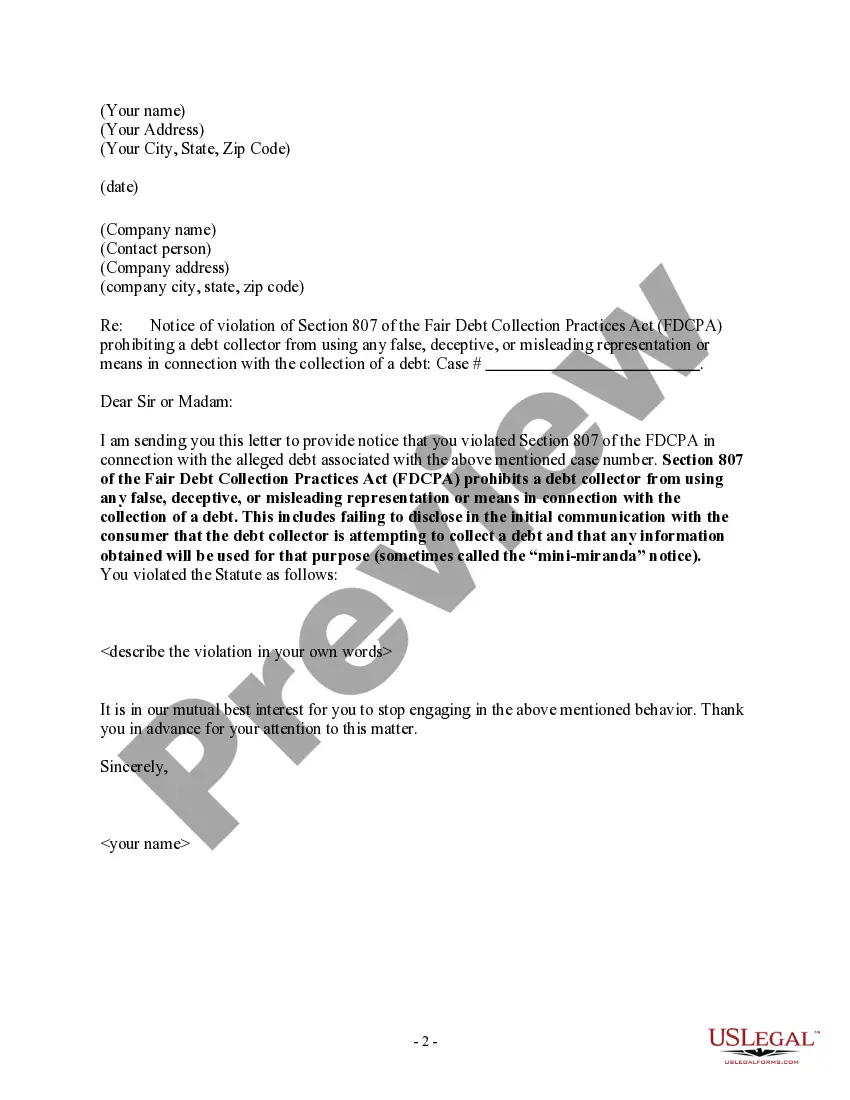

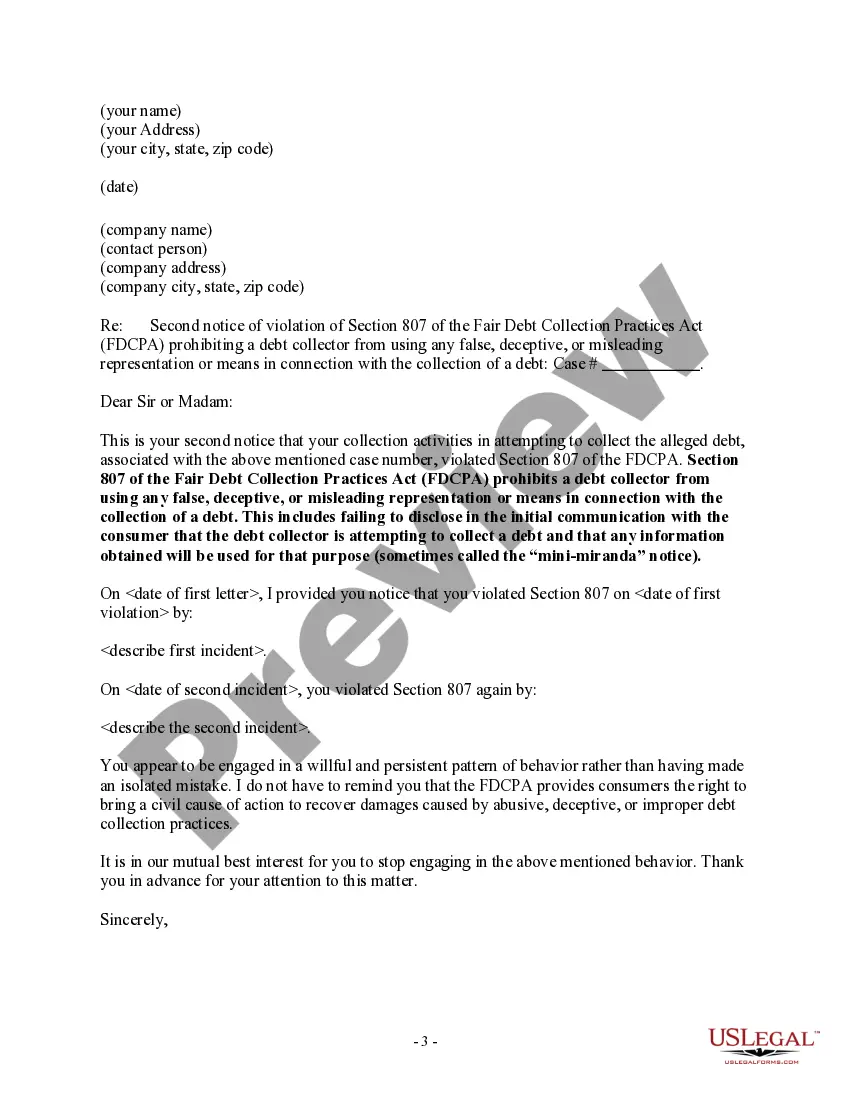

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Bronx New York Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

How to fill out Bronx New York Notice To Debt Collector - Failure To Provide Mini-Miranda?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Bronx Notice to Debt Collector - Failure to Provide Mini-Miranda, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Therefore, if you need the recent version of the Bronx Notice to Debt Collector - Failure to Provide Mini-Miranda, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bronx Notice to Debt Collector - Failure to Provide Mini-Miranda:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Bronx Notice to Debt Collector - Failure to Provide Mini-Miranda and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

The mini Miranda does not have to be stated when you are speaking directly with a creditor. The creditor is the company to which you owe the original debt. If they contact you by phone, email, or in person and identify themselves as the creditor, the company does not need to state the mini Miranda warning.

The federal FDCPA says that the collector must disclose in the initial communication that they're attempting to collect a debt and that any information obtained will be used for that purpose.

The mini Miranda exists to help you understand what you shouldn't say to a debt collector so you don't incriminate yourself. Anything and everything you say to the debt collector during your correspondence can be used against you to build a case.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

Benefits of the Mini-Miranda The mini-Miranda is a consumer protection that prevents debt collectors from deceiving consumers about the purpose of a communication in order to obtain information the consumer may not otherwise have revealed.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included. The disclaimer keeps debt collectors from tricking you into giving up information that can be used against you.