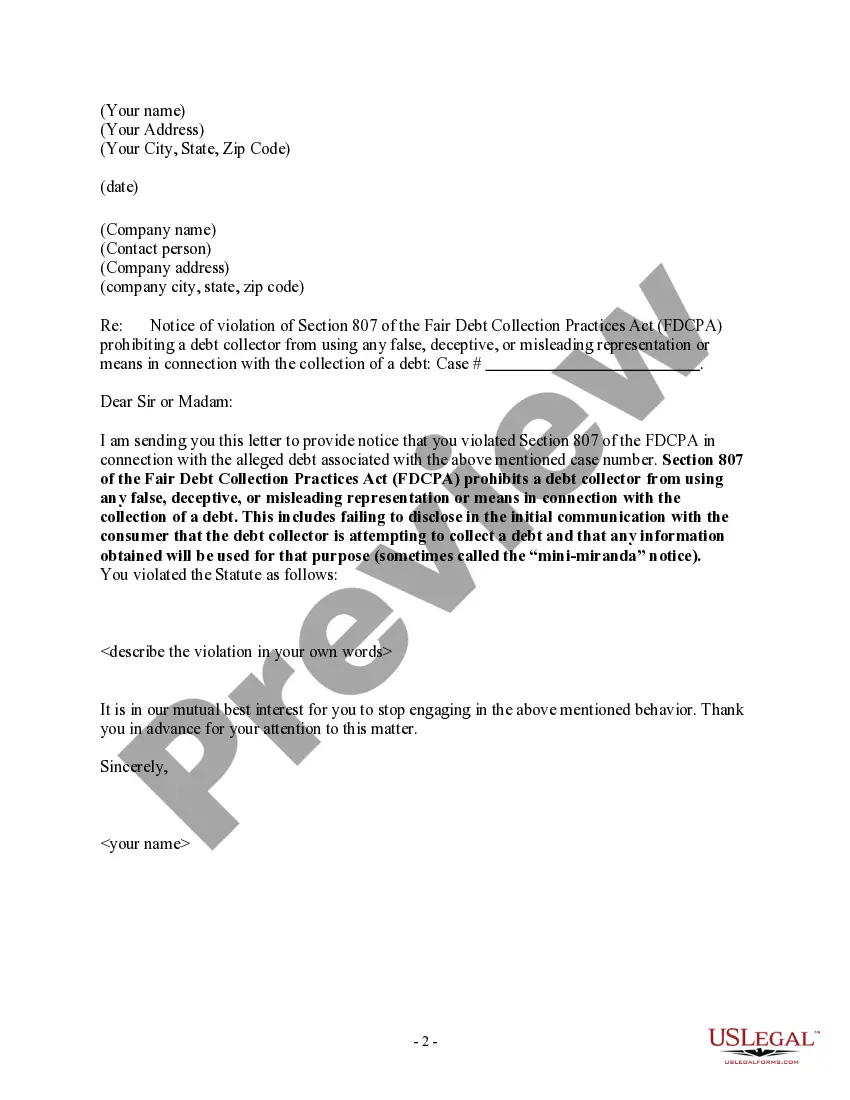

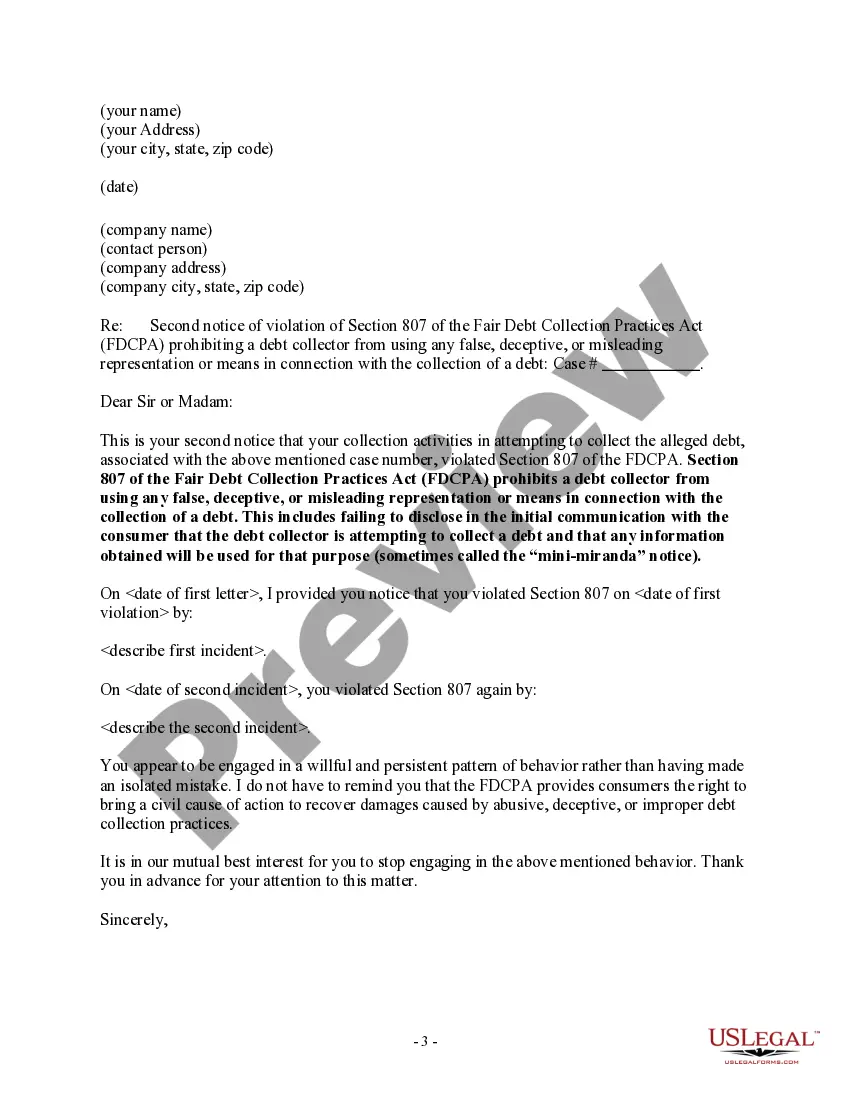

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda) Hennepin Minnesota Notice to Debt Collector — Failure to Provide Mini-Miranda is a legal document that individuals in Hennepin County, Minnesota can use when a debt collector fails to provide the Mini-Miranda warning during communication about a debt. This notice is crucial for protecting consumer rights and ensuring that debt collection practices adhere to state and federal laws. The Mini-Miranda warning is a required statement that debt collectors must provide when contacting individuals regarding unpaid debts. It serves to inform consumers of their rights and prevents the use of deceptive or misleading tactics during debt collection efforts. Failure to provide the Mini-Miranda warning may violate the Fair Debt Collection Practices Act (FD CPA) and can result in legal consequences for the debt collector. The Hennepin Minnesota Notice to Debt Collector — Failure to Provide Mini-Miranda must include specific information to be effective. It should identify the debt collector or agency involved, reference any previous communication about the debt, and state the failure to provide the Mini-Miranda warning. It is essential to include the date of the communication and clearly express the intention to assert legal rights if the debt collector does not rectify the situation promptly. By issuing this notice, individuals in Hennepin County can put debt collectors on notice and warrant that their rights under the FD CPA are upheld. Debt collectors then have the opportunity to correct the error, avoiding potential legal proceedings. If the debt collector ignores the notice or continues to violate the law, the affected individual may have grounds for legal action to seek damages under the FD CPA. It is important to note that there are no different types of Hennepin Minnesota Notice to Debt Collector — Failure to Provide Mini-Miranda. However, the content of the notice may vary depending on the specific circumstances of the debt collection communication. Individuals should tailor the notice to reflect accurate information about the debt collector, dates, and any relevant prior communication details to make it effective.

Hennepin Minnesota Notice to Debt Collector — Failure to Provide Mini-Miranda is a legal document that individuals in Hennepin County, Minnesota can use when a debt collector fails to provide the Mini-Miranda warning during communication about a debt. This notice is crucial for protecting consumer rights and ensuring that debt collection practices adhere to state and federal laws. The Mini-Miranda warning is a required statement that debt collectors must provide when contacting individuals regarding unpaid debts. It serves to inform consumers of their rights and prevents the use of deceptive or misleading tactics during debt collection efforts. Failure to provide the Mini-Miranda warning may violate the Fair Debt Collection Practices Act (FD CPA) and can result in legal consequences for the debt collector. The Hennepin Minnesota Notice to Debt Collector — Failure to Provide Mini-Miranda must include specific information to be effective. It should identify the debt collector or agency involved, reference any previous communication about the debt, and state the failure to provide the Mini-Miranda warning. It is essential to include the date of the communication and clearly express the intention to assert legal rights if the debt collector does not rectify the situation promptly. By issuing this notice, individuals in Hennepin County can put debt collectors on notice and warrant that their rights under the FD CPA are upheld. Debt collectors then have the opportunity to correct the error, avoiding potential legal proceedings. If the debt collector ignores the notice or continues to violate the law, the affected individual may have grounds for legal action to seek damages under the FD CPA. It is important to note that there are no different types of Hennepin Minnesota Notice to Debt Collector — Failure to Provide Mini-Miranda. However, the content of the notice may vary depending on the specific circumstances of the debt collection communication. Individuals should tailor the notice to reflect accurate information about the debt collector, dates, and any relevant prior communication details to make it effective.