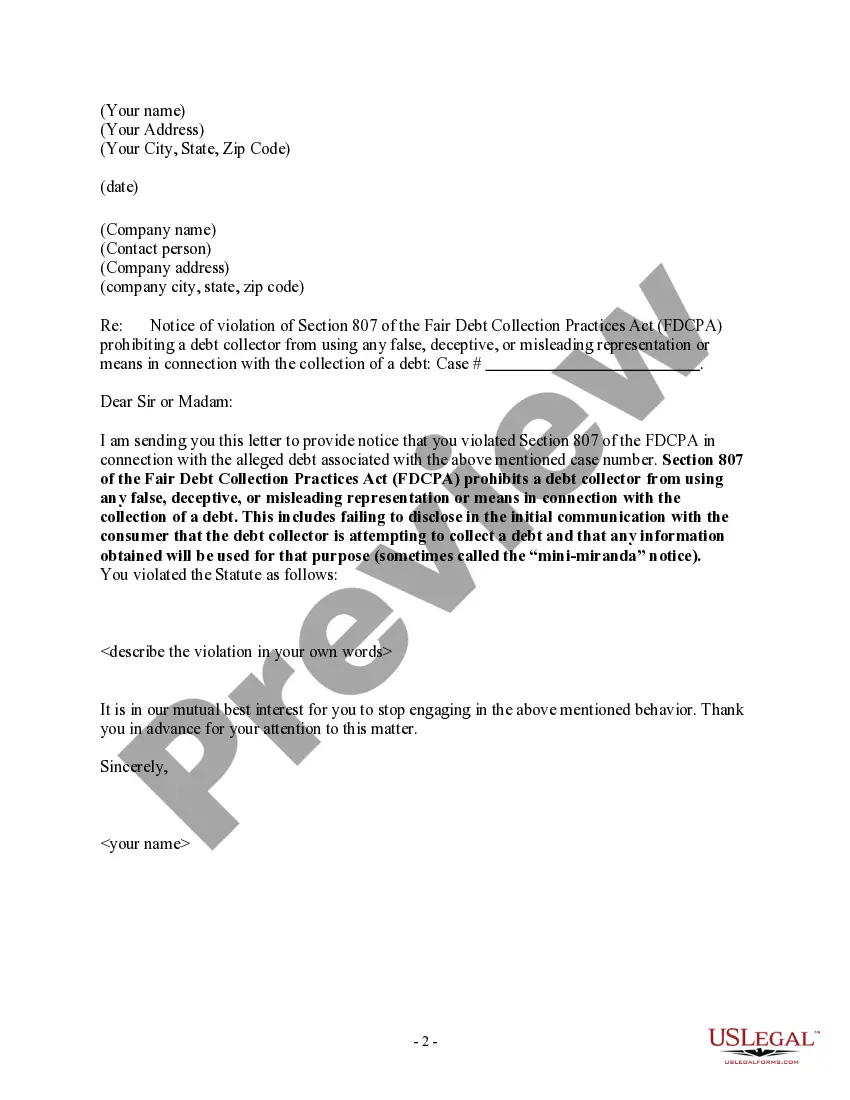

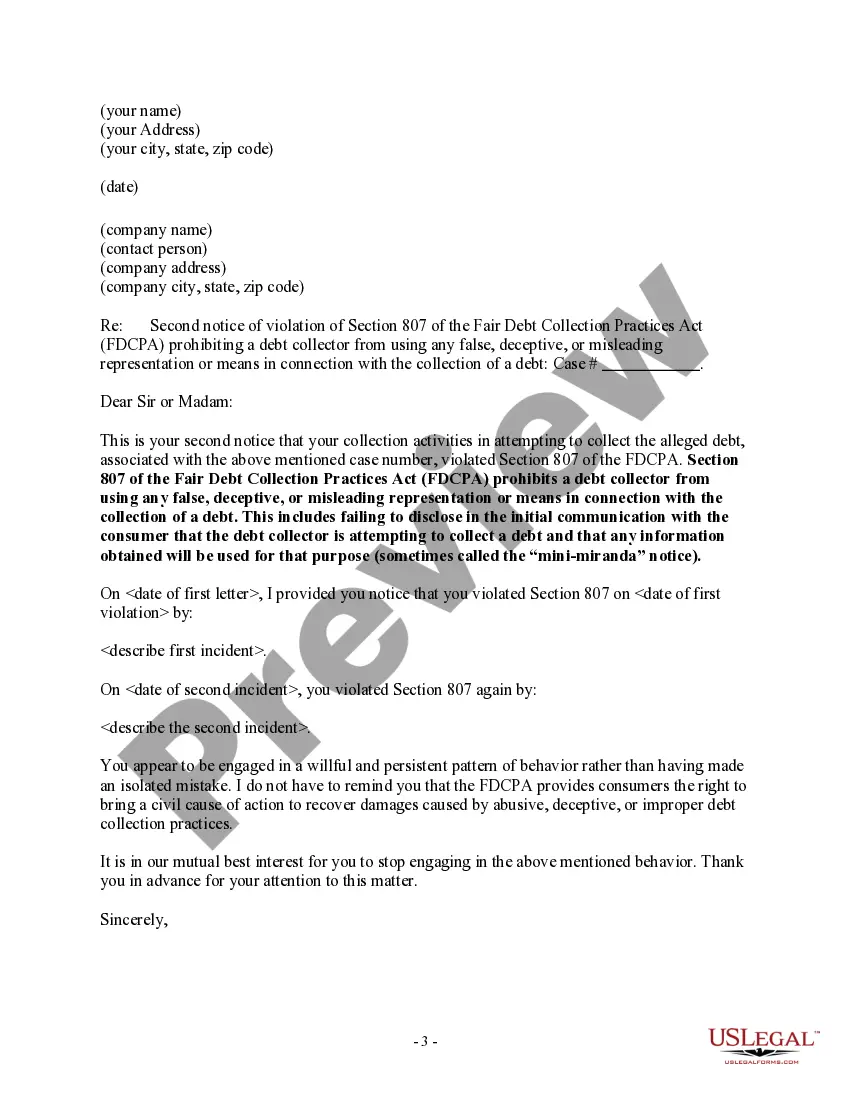

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda) Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda The Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda is a legal document that serves as a notice to debt collectors who fail to provide the required Mini-Miranda warning during communication with consumers. This notice highlights the importance of debt collectors complying with federal and state laws pertaining to consumer rights and fair debt collection practices. The Mini-Miranda warning is a concise statement that debt collectors must provide at the outset of any communication with a consumer, in compliance with the Fair Debt Collection Practices Act (FD CPA) and similar state laws. It ensures that consumers are aware of their rights and provides them with essential information about the debt collection process. By failing to provide the Mini-Miranda warning, debt collectors may violate the FD CPA and other applicable regulations, which can lead to legal consequences and potential civil liability. The Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda acts as a written notification to debt collectors, explicitly informing them of their breach and offering a chance to rectify the situation. This notice outlines the specific communication(s) where the Mini-Miranda warning was omitted and provides a clear warning that failure to comply with the law may result in legal action being taken against the debt collector. Different types of Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda may include: 1. Initial Notice: This type of notice is sent to the debt collector immediately after a violation of the Mini-Miranda requirement is identified. It serves as an initial warning, putting the debt collector on notice and providing them with an opportunity to address the issue promptly. 2. Follow-Up Notice: If the debt collector fails to rectify the violation after receiving the initial notice, a follow-up notice can be sent. This notice emphasizes the continued non-compliance and warns the debt collector that further legal action may be pursued if corrective measures are not taken. 3. Final Notice: In cases where the debt collector persists in their non-compliance despite the initial and follow-up notices, a final notice can be issued. This notice serves as a final warning before taking legal action and may include additional details about potential consequences the debt collector may face. It is important for consumers to understand their rights and how to assert them during debt collection processes. The Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda plays a crucial role in ensuring debt collectors adhere to fair and ethical practices, protecting consumers from unlawful behavior and potential harassment.

Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda The Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda is a legal document that serves as a notice to debt collectors who fail to provide the required Mini-Miranda warning during communication with consumers. This notice highlights the importance of debt collectors complying with federal and state laws pertaining to consumer rights and fair debt collection practices. The Mini-Miranda warning is a concise statement that debt collectors must provide at the outset of any communication with a consumer, in compliance with the Fair Debt Collection Practices Act (FD CPA) and similar state laws. It ensures that consumers are aware of their rights and provides them with essential information about the debt collection process. By failing to provide the Mini-Miranda warning, debt collectors may violate the FD CPA and other applicable regulations, which can lead to legal consequences and potential civil liability. The Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda acts as a written notification to debt collectors, explicitly informing them of their breach and offering a chance to rectify the situation. This notice outlines the specific communication(s) where the Mini-Miranda warning was omitted and provides a clear warning that failure to comply with the law may result in legal action being taken against the debt collector. Different types of Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda may include: 1. Initial Notice: This type of notice is sent to the debt collector immediately after a violation of the Mini-Miranda requirement is identified. It serves as an initial warning, putting the debt collector on notice and providing them with an opportunity to address the issue promptly. 2. Follow-Up Notice: If the debt collector fails to rectify the violation after receiving the initial notice, a follow-up notice can be sent. This notice emphasizes the continued non-compliance and warns the debt collector that further legal action may be pursued if corrective measures are not taken. 3. Final Notice: In cases where the debt collector persists in their non-compliance despite the initial and follow-up notices, a final notice can be issued. This notice serves as a final warning before taking legal action and may include additional details about potential consequences the debt collector may face. It is important for consumers to understand their rights and how to assert them during debt collection processes. The Miami-Dade Florida Notice to Debt Collector — Failure to Provide Mini-Miranda plays a crucial role in ensuring debt collectors adhere to fair and ethical practices, protecting consumers from unlawful behavior and potential harassment.