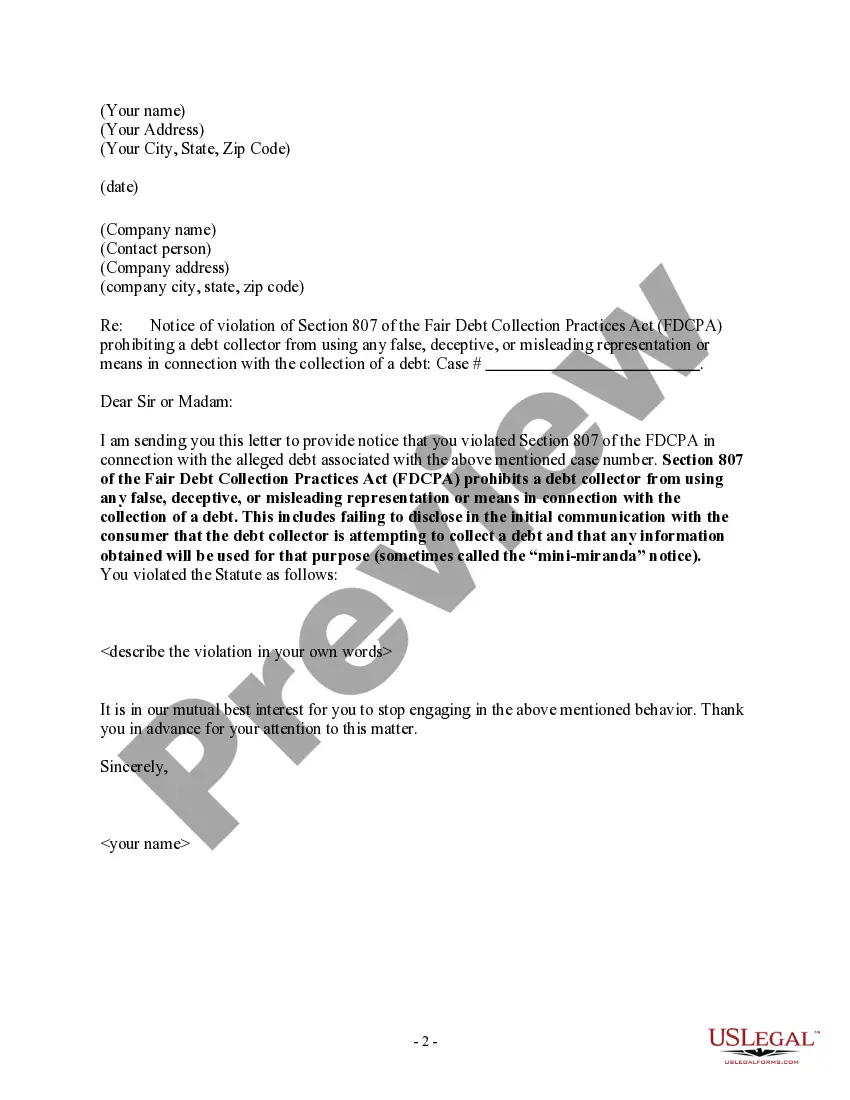

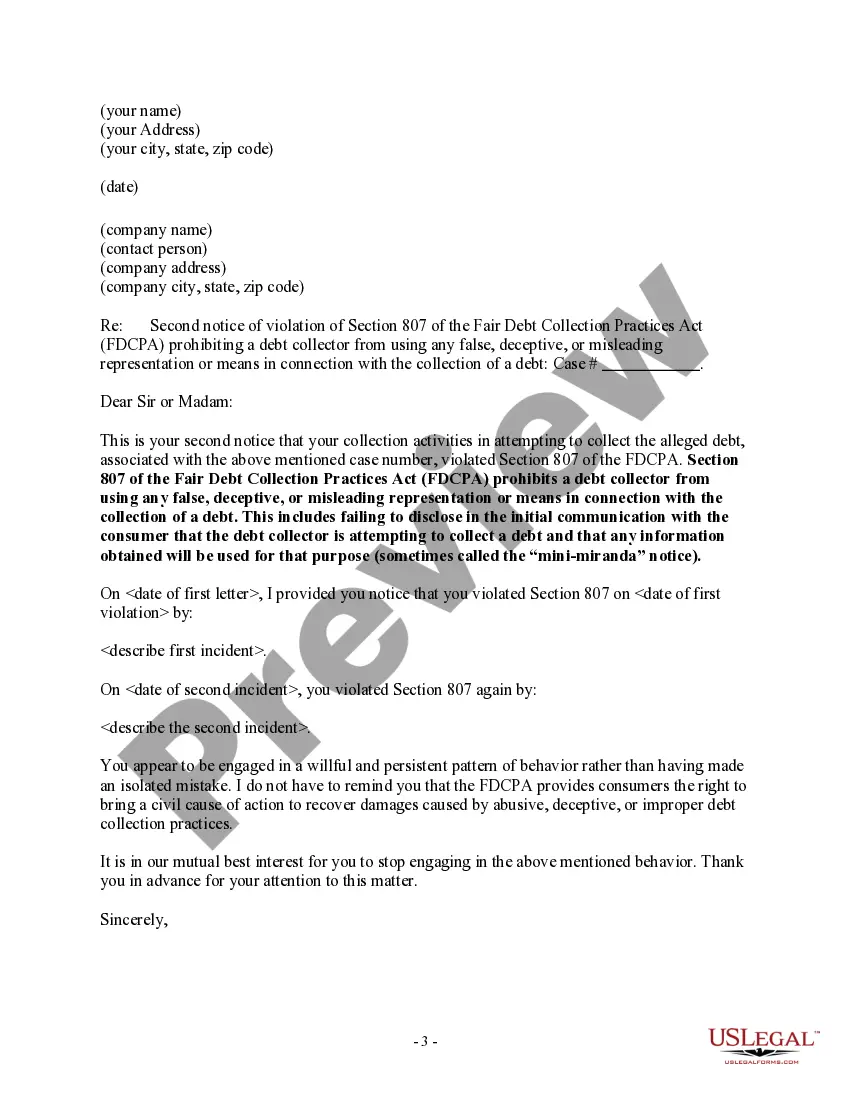

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda) Montgomery, Maryland, located in Montgomery County, is a vibrant and diverse community in the state of Maryland. As one of the most populous counties in the state, Montgomery County is known for its rich history, thriving economy, and numerous cultural attractions. One important aspect of debt collection practices in Montgomery County, Maryland is the requirement for debt collectors to provide a "Mini-Miranda" warning. The Mini-Miranda warning is a statement that debt collectors must provide when contacting consumers regarding a debt. It informs the consumer of their rights and serves as a reminder that any information obtained may be used for the purpose of collecting the debt. The failure to provide the Mini-Miranda warning can have legal implications for debt collectors. If a debt collector fails to provide this warning during a communication with a consumer, it may be considered a violation of the Fair Debt Collection Practices Act (FD CPA), a federal law designed to protect consumers from abusive or deceptive debt collection practices. There are different types of Montgomery County Notice to Debt Collector — Failure to Provide Mini-Miranda notices that may be used in the event of a violation. These notices may be sent to the debt collector informing them of their failure to comply with the FD CPA and requesting corrective action. The specific type of notice may vary depending on the circumstances of the violation and may include additional information such as the consumer's rights, contact information for reporting the violation, and potential legal consequences. It is important for consumers in Montgomery County, Maryland to be aware of their rights when it comes to debt collection practices. If they suspect that a debt collector has failed to provide the Mini-Miranda warning or has engaged in other deceptive or abusive practices, they should consult with a legal professional or contact the appropriate authorities to ensure their rights are protected. In summary, Montgomery, Maryland is a lively and diverse community within Montgomery County, Maryland. It is important for debt collectors operating in this area to adhere to the requirements of the FD CPA, specifically regarding the provision of the Mini-Miranda warning. Failure to comply with these regulations can lead to legal consequences and may result in the issuance of a Montgomery Maryland Notice to Debt Collector — Failure to Provide Mini-Miranda notice.

Montgomery, Maryland, located in Montgomery County, is a vibrant and diverse community in the state of Maryland. As one of the most populous counties in the state, Montgomery County is known for its rich history, thriving economy, and numerous cultural attractions. One important aspect of debt collection practices in Montgomery County, Maryland is the requirement for debt collectors to provide a "Mini-Miranda" warning. The Mini-Miranda warning is a statement that debt collectors must provide when contacting consumers regarding a debt. It informs the consumer of their rights and serves as a reminder that any information obtained may be used for the purpose of collecting the debt. The failure to provide the Mini-Miranda warning can have legal implications for debt collectors. If a debt collector fails to provide this warning during a communication with a consumer, it may be considered a violation of the Fair Debt Collection Practices Act (FD CPA), a federal law designed to protect consumers from abusive or deceptive debt collection practices. There are different types of Montgomery County Notice to Debt Collector — Failure to Provide Mini-Miranda notices that may be used in the event of a violation. These notices may be sent to the debt collector informing them of their failure to comply with the FD CPA and requesting corrective action. The specific type of notice may vary depending on the circumstances of the violation and may include additional information such as the consumer's rights, contact information for reporting the violation, and potential legal consequences. It is important for consumers in Montgomery County, Maryland to be aware of their rights when it comes to debt collection practices. If they suspect that a debt collector has failed to provide the Mini-Miranda warning or has engaged in other deceptive or abusive practices, they should consult with a legal professional or contact the appropriate authorities to ensure their rights are protected. In summary, Montgomery, Maryland is a lively and diverse community within Montgomery County, Maryland. It is important for debt collectors operating in this area to adhere to the requirements of the FD CPA, specifically regarding the provision of the Mini-Miranda warning. Failure to comply with these regulations can lead to legal consequences and may result in the issuance of a Montgomery Maryland Notice to Debt Collector — Failure to Provide Mini-Miranda notice.