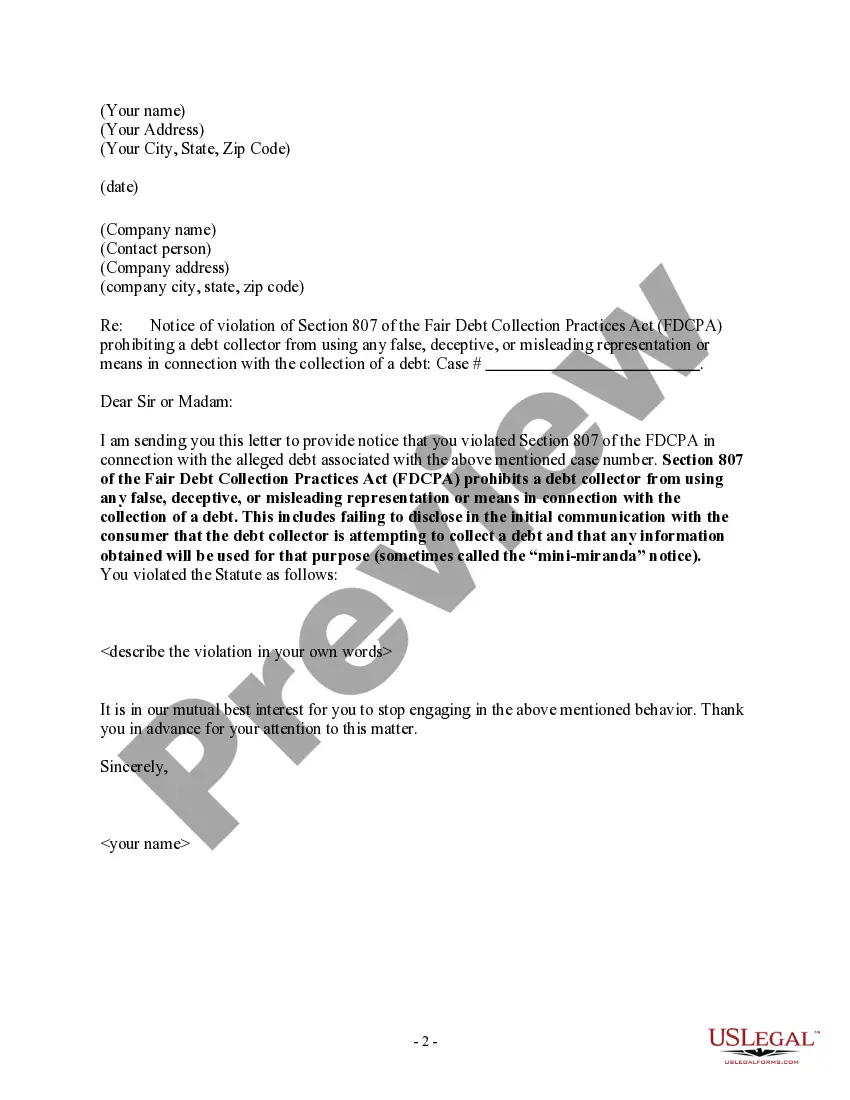

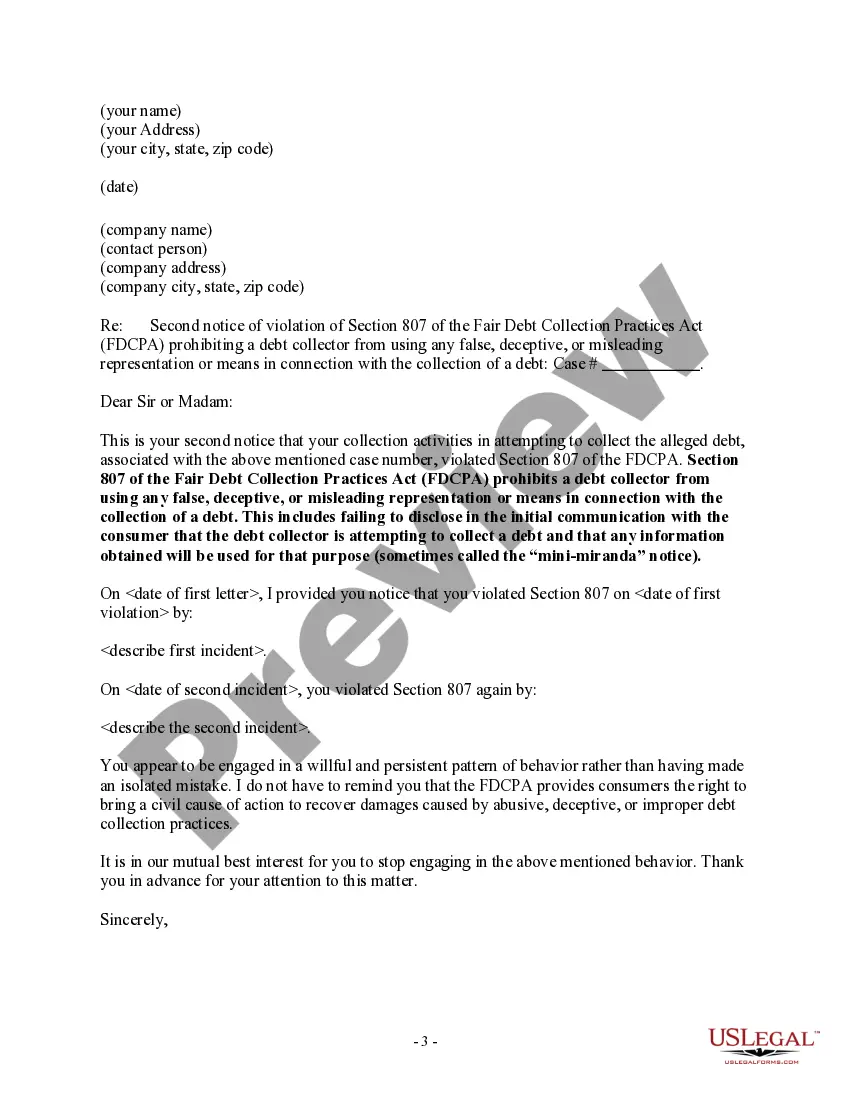

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda) Nassau New York, a county located on Long Island, is home to a diverse community and offers a variety of attractions and amenities. This vibrant region is known for its beautiful beaches, historical landmarks, and proximity to New York City. However, amidst the bustling daily life, individuals may encounter situations requiring them to understand their rights as debtors and the obligations of debt collectors. When debt collection agencies contact individuals in Nassau New York, they are required to follow specific guidelines set forth by federal and state laws. One important aspect of this interaction is the Mini-Miranda warning, which involves the debt collector providing a verbal or written disclosure regarding the purpose of their communication and the consumer's rights. The Notice to Debt Collector — Failure to Provide Mini-Miranda refers to a legal recourse that consumers can take if they have not received the necessary disclosure during debt collection communications. It acts as a formal notice or complaint lodged against the debt collector for failing to adhere to the required procedure. By filing this notice, consumers can assert their rights and take appropriate action. While there may not be different types of Notice to Debt Collector — Failure to Provide Mini-Miranda specific to Nassau New York, various templates or formats could be used depending on the legal requirements or preferences involved. These templates may address different scenarios, such as instances where the failure to provide Mini-Miranda is through phone calls, emails, or written notices, which may have distinct nuances in the legal procedures. When using the Notice to Debt Collector — Failure to Provide Mini-Miranda, it is essential to include relevant information such as the date and time of the communication, the debt collector's name and contact details, and a clear description of the lack of Mini-Miranda disclosure. Additionally, this notice should outline the rights violated, specify the applicable laws, and indicate the potential legal consequences for the debt collector's non-compliance. In Nassau New York, individuals have access to resources and legal support to navigate debt collection matters, ensuring their rights are protected. Whether considering filing a Notice to Debt Collector — Failure to Provide Mini-Miranda or seeking further guidance, it is advised to consult with attorneys specializing in consumer protection or debt-related issues. Understanding one's rights and knowing how to respond to debt collection practices empowers individuals to handle such situations effectively and assert their rights as responsible debtors.

Nassau New York, a county located on Long Island, is home to a diverse community and offers a variety of attractions and amenities. This vibrant region is known for its beautiful beaches, historical landmarks, and proximity to New York City. However, amidst the bustling daily life, individuals may encounter situations requiring them to understand their rights as debtors and the obligations of debt collectors. When debt collection agencies contact individuals in Nassau New York, they are required to follow specific guidelines set forth by federal and state laws. One important aspect of this interaction is the Mini-Miranda warning, which involves the debt collector providing a verbal or written disclosure regarding the purpose of their communication and the consumer's rights. The Notice to Debt Collector — Failure to Provide Mini-Miranda refers to a legal recourse that consumers can take if they have not received the necessary disclosure during debt collection communications. It acts as a formal notice or complaint lodged against the debt collector for failing to adhere to the required procedure. By filing this notice, consumers can assert their rights and take appropriate action. While there may not be different types of Notice to Debt Collector — Failure to Provide Mini-Miranda specific to Nassau New York, various templates or formats could be used depending on the legal requirements or preferences involved. These templates may address different scenarios, such as instances where the failure to provide Mini-Miranda is through phone calls, emails, or written notices, which may have distinct nuances in the legal procedures. When using the Notice to Debt Collector — Failure to Provide Mini-Miranda, it is essential to include relevant information such as the date and time of the communication, the debt collector's name and contact details, and a clear description of the lack of Mini-Miranda disclosure. Additionally, this notice should outline the rights violated, specify the applicable laws, and indicate the potential legal consequences for the debt collector's non-compliance. In Nassau New York, individuals have access to resources and legal support to navigate debt collection matters, ensuring their rights are protected. Whether considering filing a Notice to Debt Collector — Failure to Provide Mini-Miranda or seeking further guidance, it is advised to consult with attorneys specializing in consumer protection or debt-related issues. Understanding one's rights and knowing how to respond to debt collection practices empowers individuals to handle such situations effectively and assert their rights as responsible debtors.