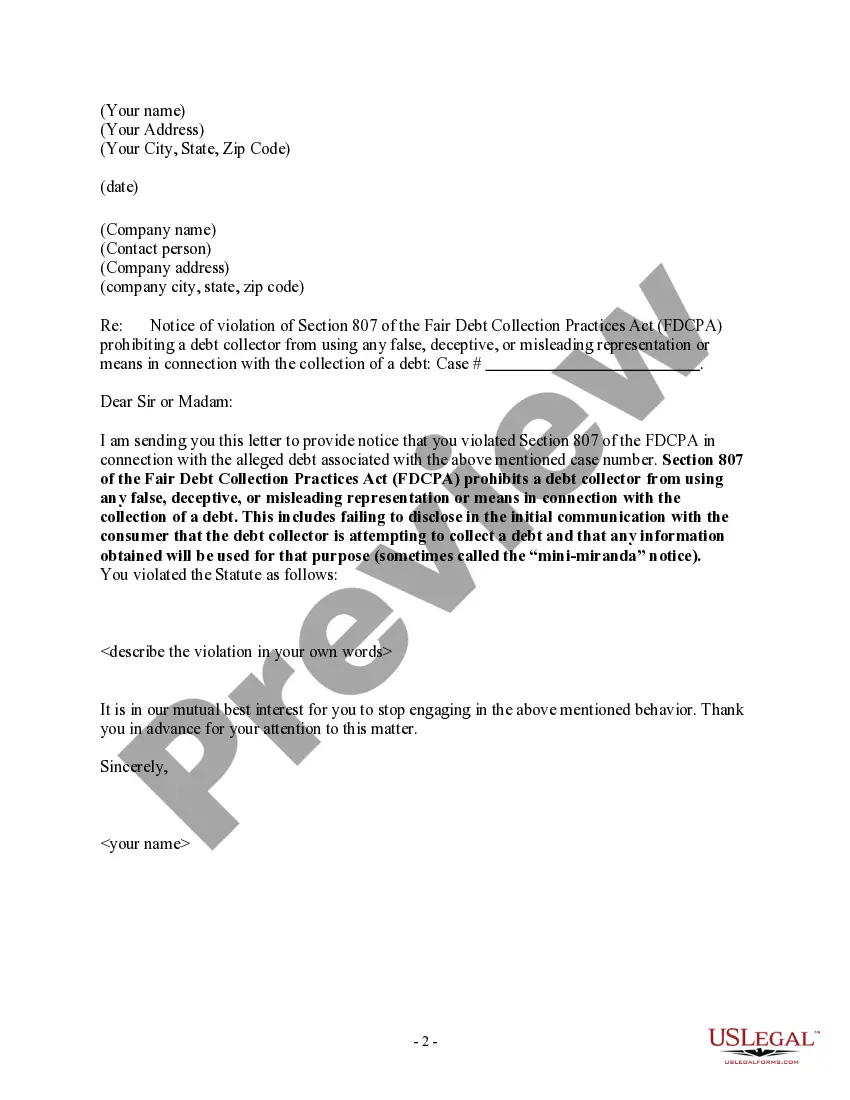

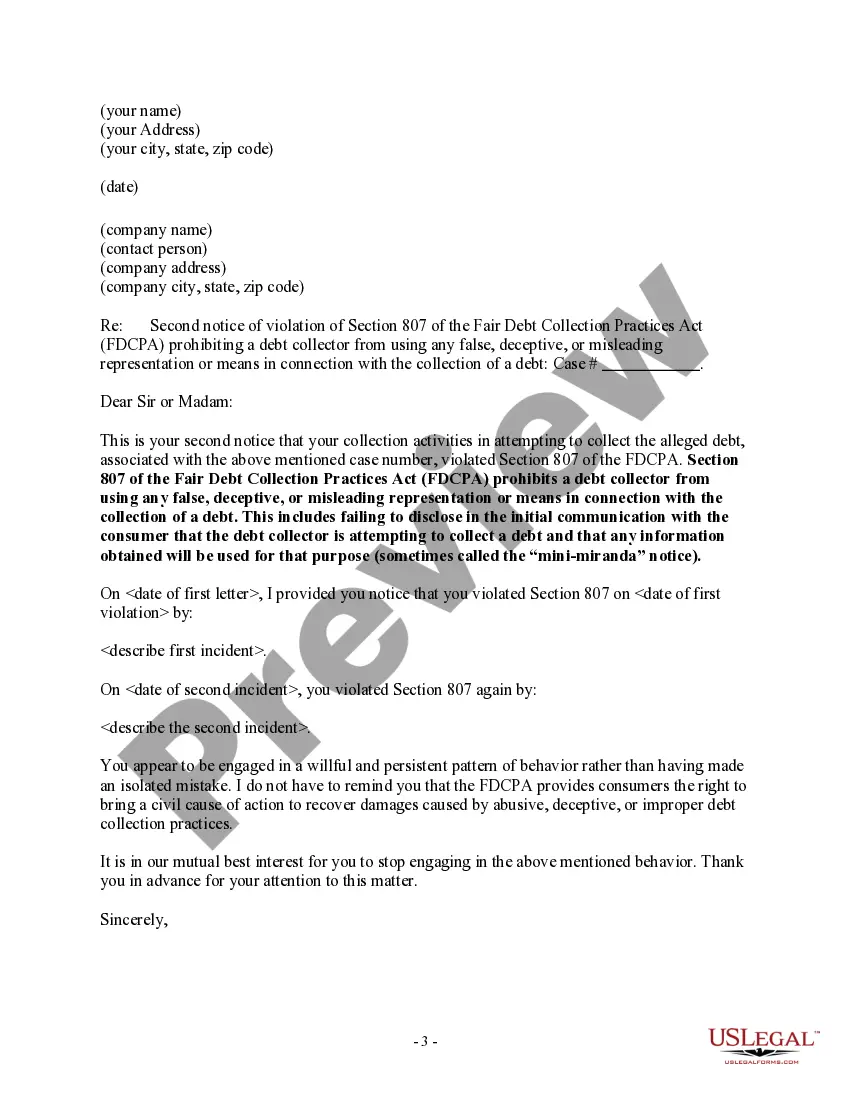

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda) San Diego California Notice to Debt Collector — Failure to Provide Mini-Miranda: In San Diego, California, individuals have legal rights protected by the Fair Debt Collection Practices Act (FD CPA) when dealing with debt collectors. One aspect of these rights is the requirement for debt collectors to provide a "Mini-Miranda" warning, which informs individuals of their rights and the potential consequences of their actions. Failure to provide this warning is a violation of the FD CPA, and individuals have the right to take action against debt collectors who fail to comply. There are different types of San Diego California Notice to Debt Collector — Failure to Provide Mini-Miranda that individuals may encounter, including: 1. Initial Contact Failure to Provide Mini-Miranda: This occurs when a debt collector fails to provide the required warning during the first contact with the consumer. According to the FD CPA, debt collectors must inform consumers that they are attempting to collect a debt and that any information obtained will be used for that purpose. 2. Subsequent Contact Failure to Provide Mini-Miranda: Even after the initial contact, debt collectors may be required to provide the Mini-Miranda warning during subsequent communications. Failure to do so can be considered a violation of debt collection practices. 3. Written Communication Failure to Provide Mini-Miranda: Debt collectors often communicate through written documents such as letters or emails. In these cases, they must include the Mini-Miranda warning in a clear and conspicuous manner. If this warning is missing or hidden within the communication, it may be deemed a violation. 4. Phone Conversation Failure to Provide Mini-Miranda: When debt collectors contact individuals through phone conversations, they must provide the Mini-Miranda warning at the beginning of the conversation or within the first 30 seconds. Failure to do so can be considered a violation of the FD CPA. It is important for individuals in San Diego, California, to be aware of their rights and the obligations placed on debt collectors. If a debt collector fails to provide the Mini-Miranda warning during any of the aforementioned contacts, individuals may have grounds to pursue legal action against the debt collector. It is advisable to consult with an attorney specializing in debt collection laws to understand the best course of action and potential remedies for such violations. By asserting their rights, individuals can protect themselves from unlawful debt collection practices and potentially hold debt collectors accountable for their actions.

San Diego California Notice to Debt Collector — Failure to Provide Mini-Miranda: In San Diego, California, individuals have legal rights protected by the Fair Debt Collection Practices Act (FD CPA) when dealing with debt collectors. One aspect of these rights is the requirement for debt collectors to provide a "Mini-Miranda" warning, which informs individuals of their rights and the potential consequences of their actions. Failure to provide this warning is a violation of the FD CPA, and individuals have the right to take action against debt collectors who fail to comply. There are different types of San Diego California Notice to Debt Collector — Failure to Provide Mini-Miranda that individuals may encounter, including: 1. Initial Contact Failure to Provide Mini-Miranda: This occurs when a debt collector fails to provide the required warning during the first contact with the consumer. According to the FD CPA, debt collectors must inform consumers that they are attempting to collect a debt and that any information obtained will be used for that purpose. 2. Subsequent Contact Failure to Provide Mini-Miranda: Even after the initial contact, debt collectors may be required to provide the Mini-Miranda warning during subsequent communications. Failure to do so can be considered a violation of debt collection practices. 3. Written Communication Failure to Provide Mini-Miranda: Debt collectors often communicate through written documents such as letters or emails. In these cases, they must include the Mini-Miranda warning in a clear and conspicuous manner. If this warning is missing or hidden within the communication, it may be deemed a violation. 4. Phone Conversation Failure to Provide Mini-Miranda: When debt collectors contact individuals through phone conversations, they must provide the Mini-Miranda warning at the beginning of the conversation or within the first 30 seconds. Failure to do so can be considered a violation of the FD CPA. It is important for individuals in San Diego, California, to be aware of their rights and the obligations placed on debt collectors. If a debt collector fails to provide the Mini-Miranda warning during any of the aforementioned contacts, individuals may have grounds to pursue legal action against the debt collector. It is advisable to consult with an attorney specializing in debt collection laws to understand the best course of action and potential remedies for such violations. By asserting their rights, individuals can protect themselves from unlawful debt collection practices and potentially hold debt collectors accountable for their actions.