A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing the character, amount, or legal status of any debt.

Some states have a statute of limitations limiting the length of time a debt may be collected. If a debt is older than the statute of limitations, it is considered "time barred." A debt collector might say you are legally obligated to pay a time barred debt. If so, they are falsely representing the legal status of the debt. Collin Texas Notice to Debt Collector — Falsely Representing a Debt In Collin, Texas, if you find yourself in a situation where a debt collector has falsely represented a debt, it is essential to understand your rights and take action to protect yourself. The law provides specific guidelines and protections to ensure fair and ethical practices are followed in debt collection. A Collin Texas Notice to Debt Collector — Falsely Representing a Debt serves as a formal written notice to inform the debt collector that their actions may be in violation of state and federal laws. This notice is crucial in establishing legal documentation to defend your rights and potentially seek legal remedies. The notice should clearly state the false representation made by the debt collector and provide supporting evidence whenever possible. This could include misleading statements, inaccurate information, or any attempts to intimidate or coerce you into paying a debt that may not be valid. By sending a Collin Texas Notice to Debt Collector — Falsely Representing a Debt, you are asserting your rights under the Fair Debt Collection Practices Act (FD CPA), a federal law designed to protect consumers from abusive debt collection practices. By doing so, you are notifying the debt collector of their potential violation and demanding that they cease any further false representation and provide accurate information regarding the debt. Types of Collin Texas Notice to Debt Collector — Falsely Representing a Debt might include: 1. Notice of False Representation: This notice specifically addresses instances where a debt collector has misrepresented the nature, amount, or validity of a debt. It is crucial to outline the misleading statements made by the collector and provide supporting evidence or documentation to disprove any false claims. 2. Notice of Intimidation or Coercion: In cases where a debt collector has used aggressive or unethical tactics to pressure you into paying a debt, this notice highlights their behavior and requests an immediate cessation of any intimidating or coercive actions. Examples of such behavior may include harassment, threats, or misrepresentations of legal consequences. 3. Notice of Inaccurate Information Reporting: If a debt collector has inaccurately reported information relating to the debt to credit reporting agencies, this notice asserts that their actions are in violation of the Fair Credit Reporting Act (FCRA). It requests that the debt collector rectifies any inaccuracies and updates the credit reporting agencies accordingly. Remember, sending a Collin Texas Notice to Debt Collector — Falsely Representing a Debt is an important step in asserting your rights as a consumer and protecting yourself from unfair and deceptive debt collection practices. Consulting with a legal professional experienced in debt collection laws can provide further guidance and support throughout the process.

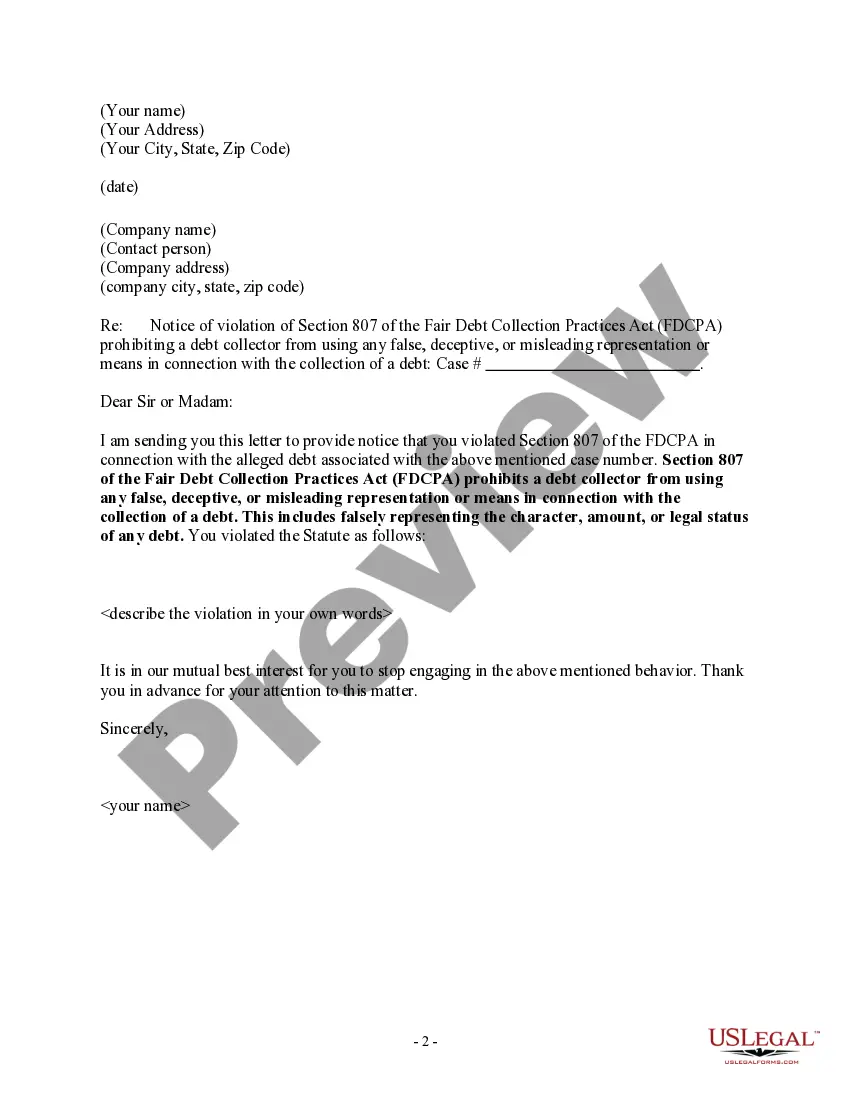

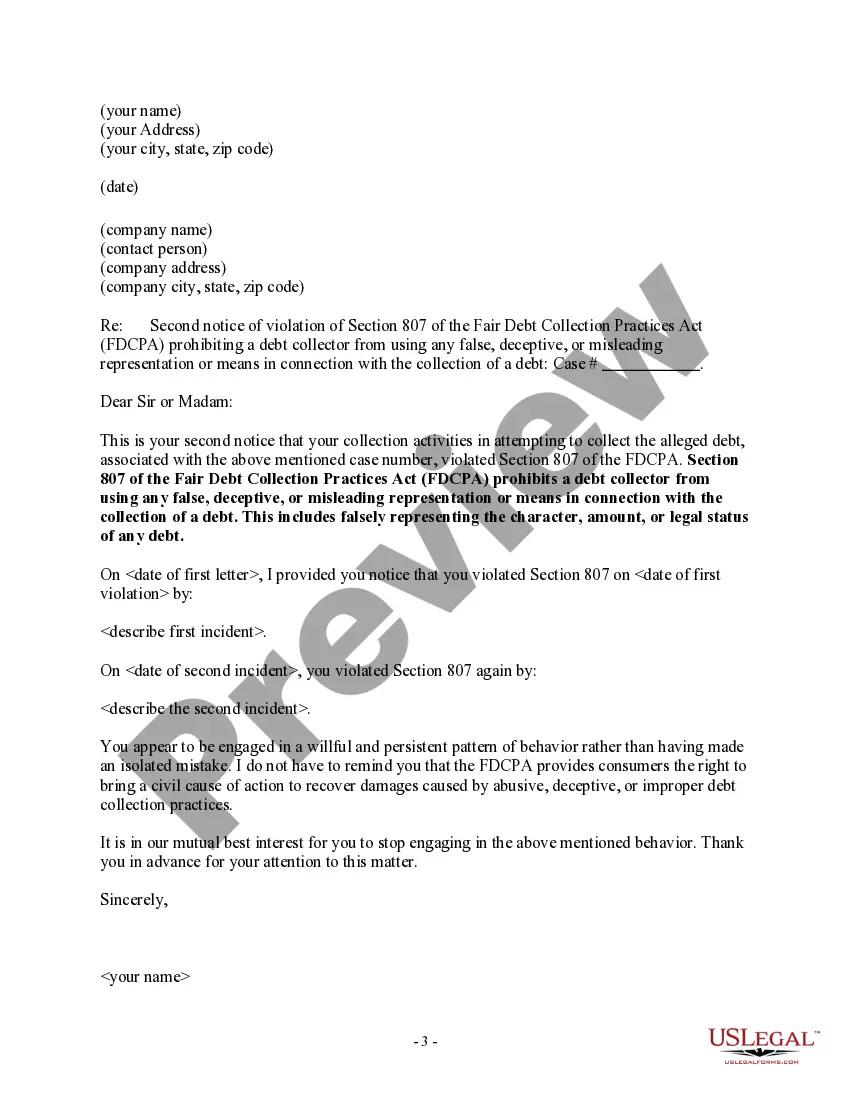

Collin Texas Notice to Debt Collector — Falsely Representing a Debt In Collin, Texas, if you find yourself in a situation where a debt collector has falsely represented a debt, it is essential to understand your rights and take action to protect yourself. The law provides specific guidelines and protections to ensure fair and ethical practices are followed in debt collection. A Collin Texas Notice to Debt Collector — Falsely Representing a Debt serves as a formal written notice to inform the debt collector that their actions may be in violation of state and federal laws. This notice is crucial in establishing legal documentation to defend your rights and potentially seek legal remedies. The notice should clearly state the false representation made by the debt collector and provide supporting evidence whenever possible. This could include misleading statements, inaccurate information, or any attempts to intimidate or coerce you into paying a debt that may not be valid. By sending a Collin Texas Notice to Debt Collector — Falsely Representing a Debt, you are asserting your rights under the Fair Debt Collection Practices Act (FD CPA), a federal law designed to protect consumers from abusive debt collection practices. By doing so, you are notifying the debt collector of their potential violation and demanding that they cease any further false representation and provide accurate information regarding the debt. Types of Collin Texas Notice to Debt Collector — Falsely Representing a Debt might include: 1. Notice of False Representation: This notice specifically addresses instances where a debt collector has misrepresented the nature, amount, or validity of a debt. It is crucial to outline the misleading statements made by the collector and provide supporting evidence or documentation to disprove any false claims. 2. Notice of Intimidation or Coercion: In cases where a debt collector has used aggressive or unethical tactics to pressure you into paying a debt, this notice highlights their behavior and requests an immediate cessation of any intimidating or coercive actions. Examples of such behavior may include harassment, threats, or misrepresentations of legal consequences. 3. Notice of Inaccurate Information Reporting: If a debt collector has inaccurately reported information relating to the debt to credit reporting agencies, this notice asserts that their actions are in violation of the Fair Credit Reporting Act (FCRA). It requests that the debt collector rectifies any inaccuracies and updates the credit reporting agencies accordingly. Remember, sending a Collin Texas Notice to Debt Collector — Falsely Representing a Debt is an important step in asserting your rights as a consumer and protecting yourself from unfair and deceptive debt collection practices. Consulting with a legal professional experienced in debt collection laws can provide further guidance and support throughout the process.