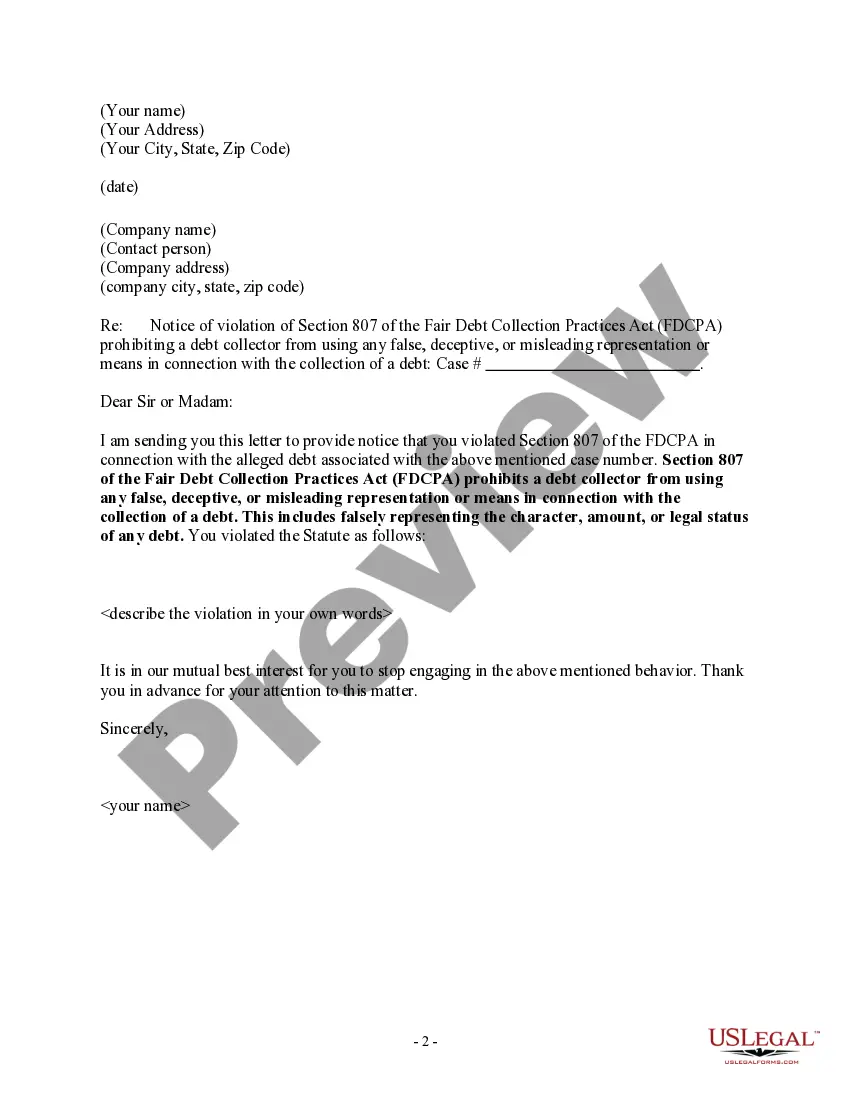

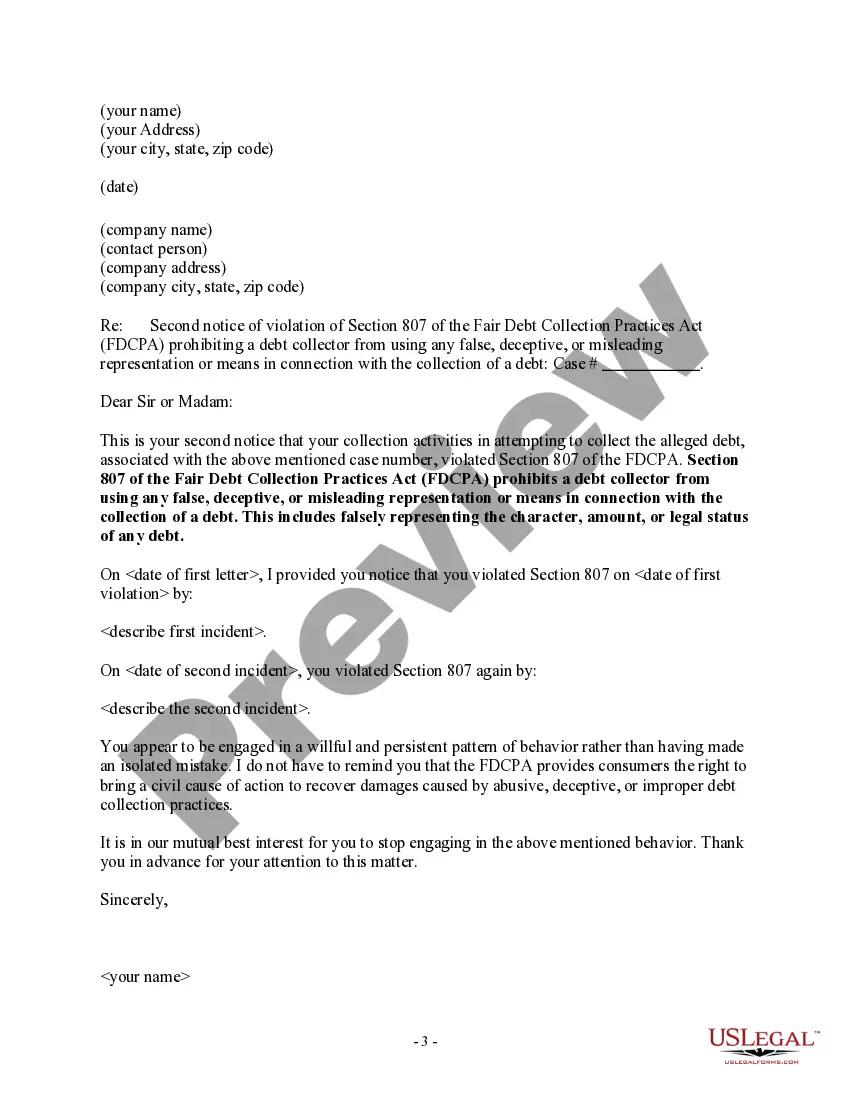

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing the character, amount, or legal status of any debt.

Some states have a statute of limitations limiting the length of time a debt may be collected. If a debt is older than the statute of limitations, it is considered "time barred." A debt collector might say you are legally obligated to pay a time barred debt. If so, they are falsely representing the legal status of the debt.

Cook Illinois Notice to Debt Collector — Falsely Representing a Debt The Cook Illinois Notice to Debt Collector — Falsely Representing a Debt is an important legal document used to address situations where a debt collector has falsely misrepresented a debt owed by an individual. This notice seeks to protect consumers from unfair and deceptive practices employed by debt collectors, ensuring their rights are upheld under the law. Debt collectors are legally obligated to provide accurate and truthful information regarding any outstanding debts. However, some debt collectors may resort to dishonest tactics, such as exaggerating the amount owed, misrepresenting the nature of the debt, or falsely claiming legal actions will be taken if the debt is not paid. In such cases, the Cook Illinois Notice to Debt Collector — Falsely Representing a Debt is a valuable tool for consumers to safeguard their rights and dispute any false claims made by debt collectors. Key elements covered in the Cook Illinois Notice to Debt Collector — Falsely Representing a Debt may include: 1. Personal Information: The notice should include the name, address, and contact details of the person challenging the debt collector's false representation. This ensures that the notice is directed to the appropriate parties involved. 2. Debt Collection Details: All pertinent information related to the debt collector should be mentioned, including their name, address, and contact details. It is crucial to provide specific details about the false representation made by the debt collector, such as wrongful claims, inaccurate information, or deceptive practices employed. 3. Description of False Representation: The notice should include a detailed account of the false representation made by the debt collector. This may include any misleading statements, inflated debt amounts, false threats of legal action, or any other deceptive tactics employed to pressure the consumer into paying an unjust debt. 4. Demand for Immediate Action: The notice should clearly state that the consumer demands the debt collector to cease all false representation activities and correct any inaccuracies immediately. Furthermore, it may request a written confirmation from the debt collector acknowledging the false representation and a clarification of the true debt amount or nature. Types of Cook Illinois Notice to Debt Collector — Falsely Representing a Debt: 1. Notice of False Representation of Debt Amount: This type of notice specifically addresses situations where a debt collector has falsely inflated the owed amount, misrepresenting the actual debt an individual owes. It seeks to hold the debt collector accountable for their misleading actions and requests an immediate correction. 2. Notice of False Legal Threats: This type of notice focuses on instances where a debt collector has made false claims or threats regarding potential legal actions that they do not have the authority to take. The notice aims to rectify the situation by demanding a cessation of such deceptive practices and an acknowledgment of their false representations. In conclusion, the Cook Illinois Notice to Debt Collector — Falsely Representing a Debt is a crucial tool for consumers facing unjust or dishonest debt collection practices. By addressing false representations of debts, individuals can protect their rights and ensure fair treatment in the debt collection process.