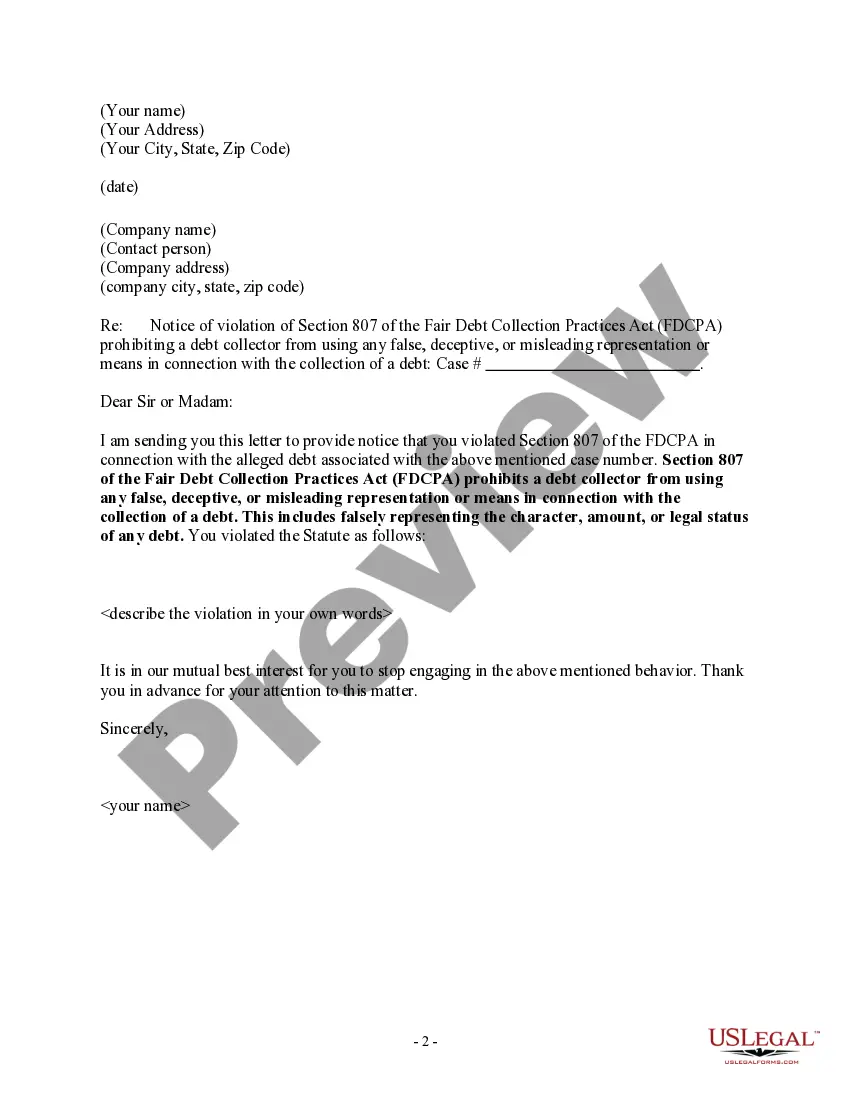

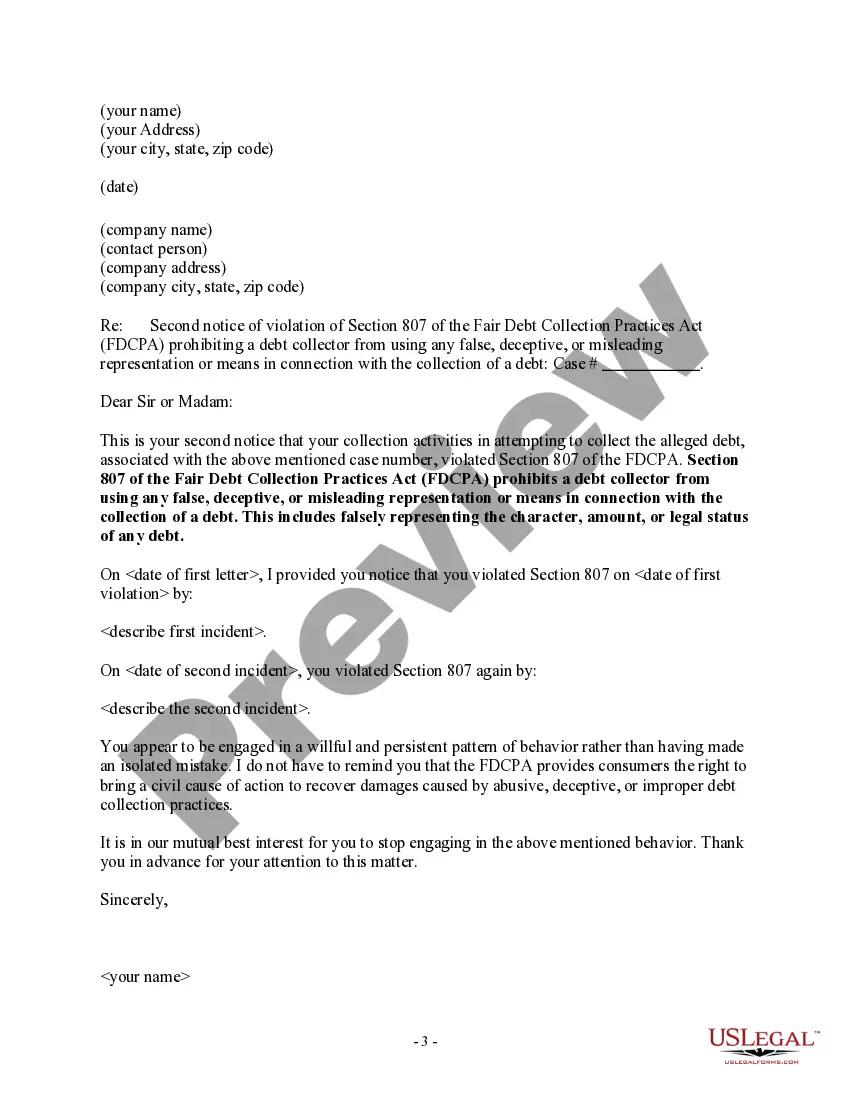

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing the character, amount, or legal status of any debt.

Some states have a statute of limitations limiting the length of time a debt may be collected. If a debt is older than the statute of limitations, it is considered "time barred." A debt collector might say you are legally obligated to pay a time barred debt. If so, they are falsely representing the legal status of the debt. Franklin Ohio Notice to Debt Collector — FalselRepresentingna Debkeywordsds: Franklin Ohio, notice to debt collector, falsely representing a debt Description: The Franklin Ohio Notice to Debt Collector — Falsely Representing a Debt is a legal document designed to protect consumers from misleading or inaccurate debt collection practices. This notice serves as a formal communication to debt collectors, notifying them that their actions or claims regarding a debt are false or deceptive. By utilizing this notice, individuals in Franklin Ohio can take appropriate measures to defend themselves against fraudulent debt collection practices. Types of Franklin Ohio Notice to Debt Collector — Falsely Representing a Debt: 1. False Debt Amount: This notice can be used when a debt collector intentionally misrepresents the amount owed, inflating the outstanding balance without proper justification or documentation. 2. Inaccurate Debt Origin: Individuals can utilize this notice if a debt collector falsely claims the individual owes a debt they do not owe, incorrectly linking their name to an account or loan. 3. Time-Barred Debt: This notice can be used if a debt collector attempts to collect on a debt that has surpassed the statute of limitations, misleadingly suggesting that the individual is responsible for an expired debt. 4. Identity Theft Related Debt: Individuals can issue this notice if a debt collector tries to collect a debt resulting from identity theft, falsely accusing them of owing when they are not the true debtor. 5. Fictitious Debt Collector: This notice can be utilized if the individual receives communication from an alleged debt collector who does not exist, aiming to deceive the individual into making payments to a fraudulent entity. 6. Misleading Debt Collection Tactics: This notice can be used when a debt collector utilizes deceptive tactics such as falsely representing the consequences of non-payment, threatening legal action they cannot take, or providing misleading information to coerce payment. It is essential for individuals in Franklin Ohio to be aware of their rights and take necessary actions to challenge deceptive debt collection practices. By issuing a Franklin Ohio Notice to Debt Collector — Falsely Representing a Debt, individuals can protect themselves from false or inaccurate claims and ensure fair treatment in debt collection efforts.

Franklin Ohio Notice to Debt Collector — FalselRepresentingna Debkeywordsds: Franklin Ohio, notice to debt collector, falsely representing a debt Description: The Franklin Ohio Notice to Debt Collector — Falsely Representing a Debt is a legal document designed to protect consumers from misleading or inaccurate debt collection practices. This notice serves as a formal communication to debt collectors, notifying them that their actions or claims regarding a debt are false or deceptive. By utilizing this notice, individuals in Franklin Ohio can take appropriate measures to defend themselves against fraudulent debt collection practices. Types of Franklin Ohio Notice to Debt Collector — Falsely Representing a Debt: 1. False Debt Amount: This notice can be used when a debt collector intentionally misrepresents the amount owed, inflating the outstanding balance without proper justification or documentation. 2. Inaccurate Debt Origin: Individuals can utilize this notice if a debt collector falsely claims the individual owes a debt they do not owe, incorrectly linking their name to an account or loan. 3. Time-Barred Debt: This notice can be used if a debt collector attempts to collect on a debt that has surpassed the statute of limitations, misleadingly suggesting that the individual is responsible for an expired debt. 4. Identity Theft Related Debt: Individuals can issue this notice if a debt collector tries to collect a debt resulting from identity theft, falsely accusing them of owing when they are not the true debtor. 5. Fictitious Debt Collector: This notice can be utilized if the individual receives communication from an alleged debt collector who does not exist, aiming to deceive the individual into making payments to a fraudulent entity. 6. Misleading Debt Collection Tactics: This notice can be used when a debt collector utilizes deceptive tactics such as falsely representing the consequences of non-payment, threatening legal action they cannot take, or providing misleading information to coerce payment. It is essential for individuals in Franklin Ohio to be aware of their rights and take necessary actions to challenge deceptive debt collection practices. By issuing a Franklin Ohio Notice to Debt Collector — Falsely Representing a Debt, individuals can protect themselves from false or inaccurate claims and ensure fair treatment in debt collection efforts.