A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing the character, amount, or legal status of any debt.

Some states have a statute of limitations limiting the length of time a debt may be collected. If a debt is older than the statute of limitations, it is considered "time barred." A debt collector might say you are legally obligated to pay a time barred debt. If so, they are falsely representing the legal status of the debt.

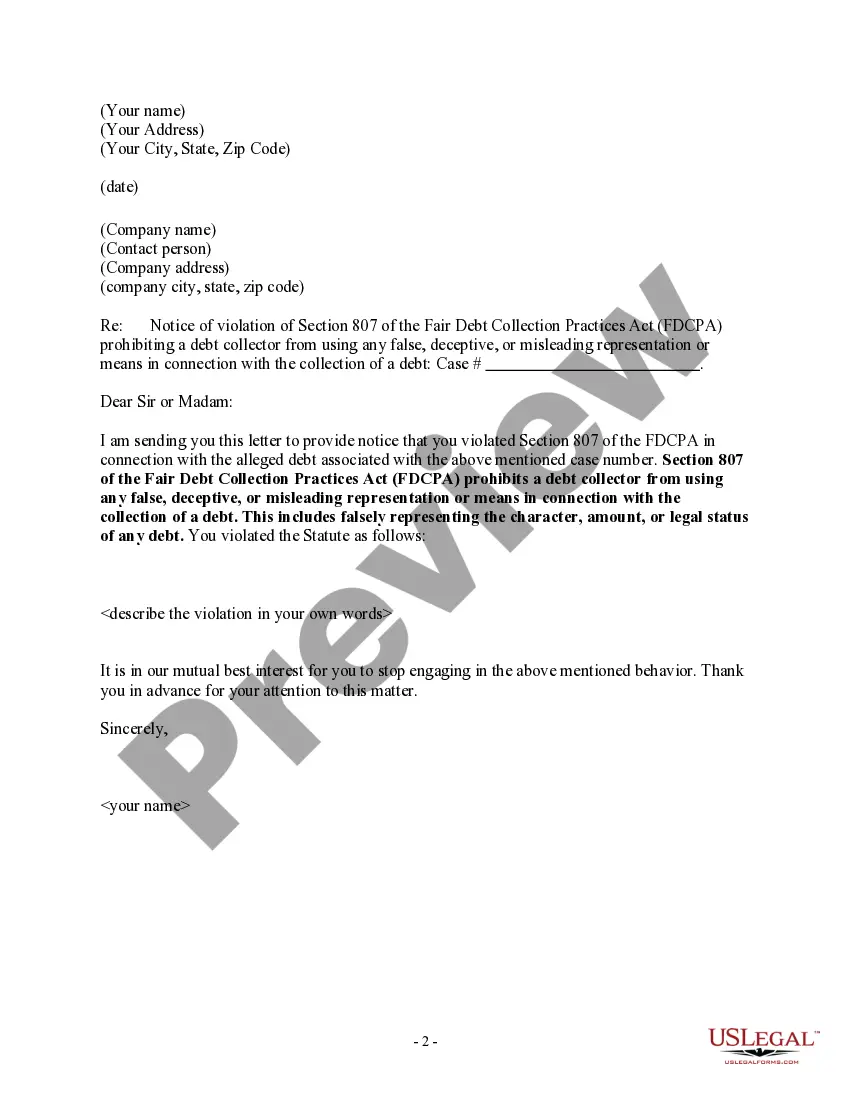

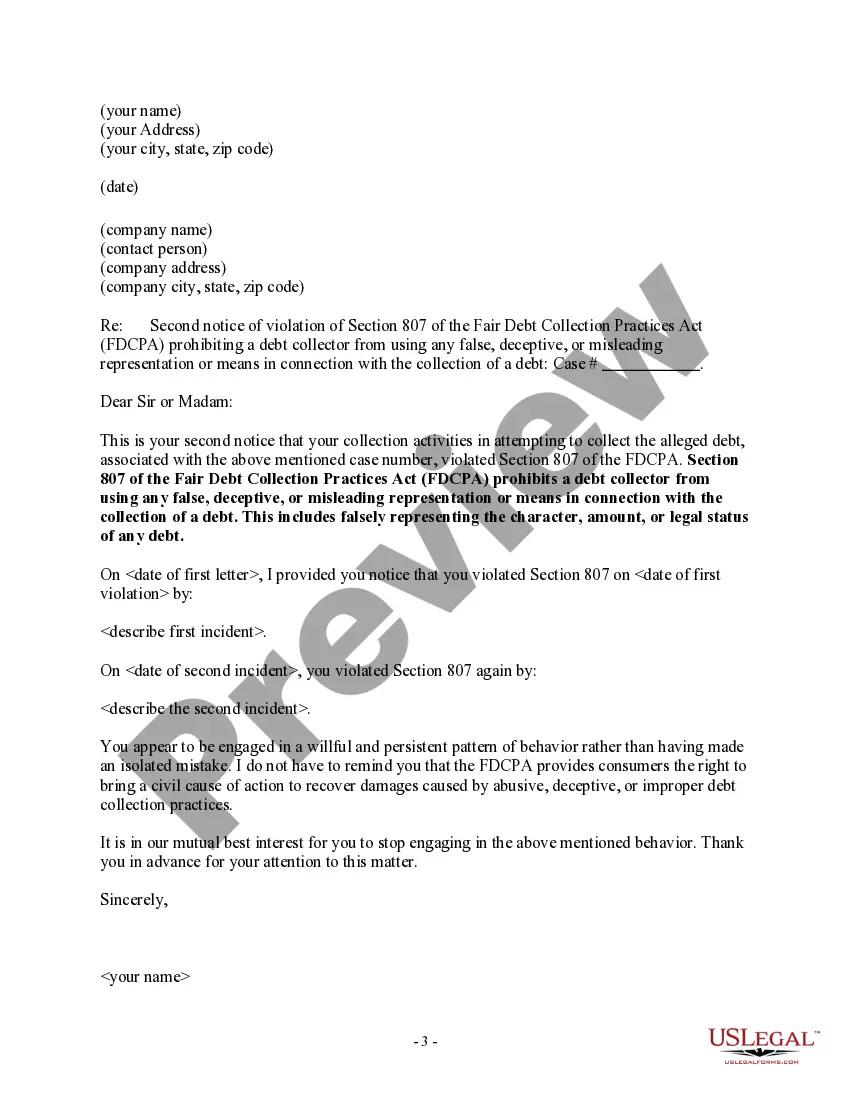

San Antonio Texas Notice to Debt Collector — Falsely Representing a Debt: In San Antonio, Texas, individuals are protected by various consumer laws that safeguard them from unscrupulous debt collection practices. One essential legal tool is the Notice to Debt Collector — Falsely Representing a Debt. This notice can be sent to debt collectors who are misrepresenting or fabricating debts, ensuring that their actions are brought to light and rectified. The Notice to Debt Collector — Falsely Representing a Debt is a formal written communication designed to inform the collector that they are engaging in illegal activities. By sending this notice, the debtor asserts their rights and seeks to address the false representation of the debt. This notice highlights that the debtor is well-informed, exercising their rights, and taking a proactive approach to resolve the issue. When dealing with a debt collector in San Antonio, it is crucial to understand that there may be different types of Notice to Debt Collector — Falsely Representing a Debt. These can vary based on the specific nature of the collector's fraudulent actions. Here are a few possible variations: 1. Notice to Debt Collector — Misrepresentation of Debt Amount: This notice is used when the debt collector falsely claims the debt amount is greater than what is owed. It serves to dispute and rectify any inaccuracies in the collector's representations. 2. Notice to Debt Collector — Invalid Debt Identification: This notice is employed when the collector asserts a debt that does not belong to the debtor. It clarifies and disputes the false identification and asserts that no such debt is owed. 3. Notice to Debt Collector — Fabrication of Debt: This notice is applicable when the collector completely fabricates a debt that does not exist. It confronts the collector's baseless claims and asserts that no lawful obligation exists. 4. Notice to Debt Collector — False Legal Actions: In instances where the collector threatens legal actions, such as lawsuits or wage garnishments, based on false representations of the debt, this notice can be used. It asserts the inaccuracy of their legal claims and demands the cessation of such deceptive tactics. Sending a San Antonio Texas Notice to Debt Collector — Falsely Representing a Debt requires careful attention to detail and adherence to legal requirements. It is advisable to seek guidance from an attorney or consumer protection agency to ensure compliance with the specific rules and regulations. By utilizing the appropriate Notice to Debt Collector, individuals can protect themselves from unjust debt collection practices while taking a proactive stance towards resolving any inaccuracies or fraudulent activities related to their debts. Remember, knowing your rights is the first step towards ensuring fair treatment and maintaining financial well-being.