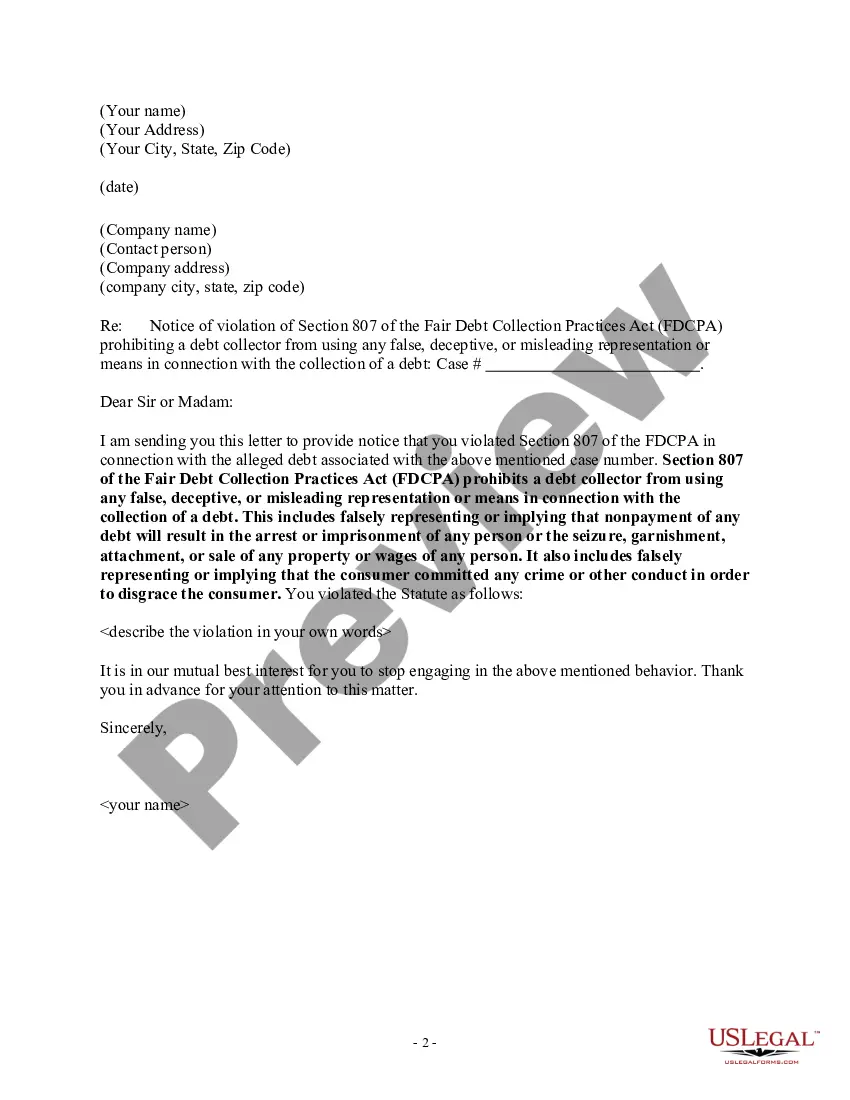

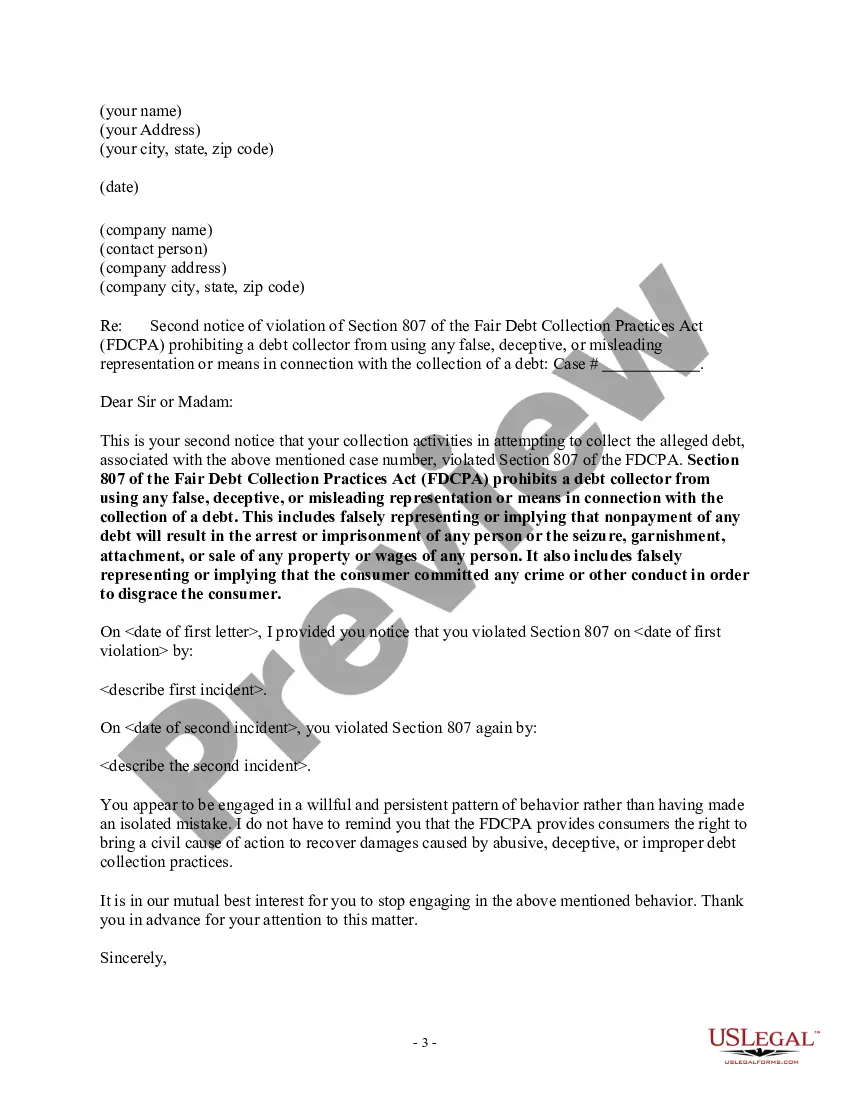

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes:

For instance, a debt collector may not: falsely allege that the consumer committed fraud; or misrepresent the law (e.g., tell a consumer they committed a crime by issuing a check that was dishonored when the law in their state applies only where there is a "scheme to defraud ).

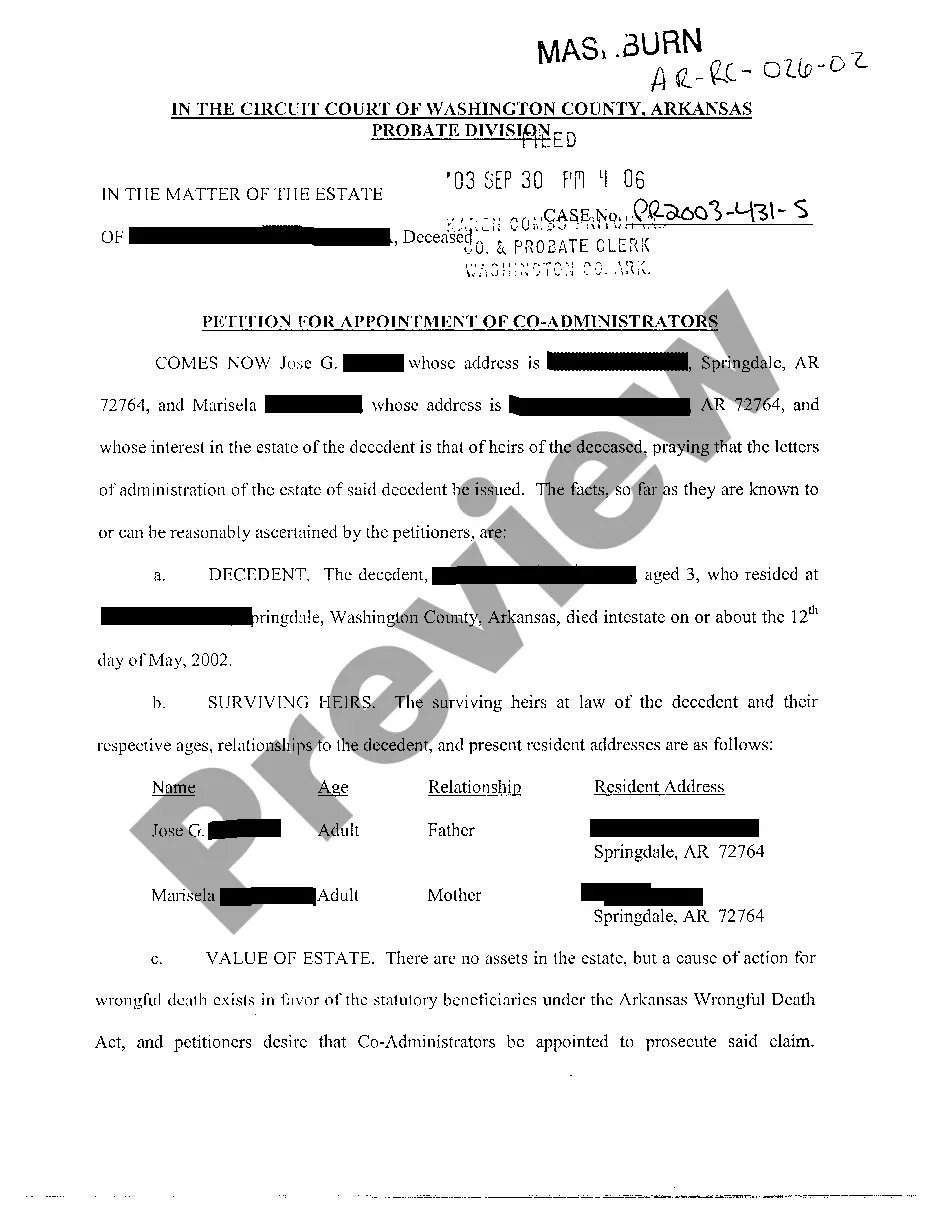

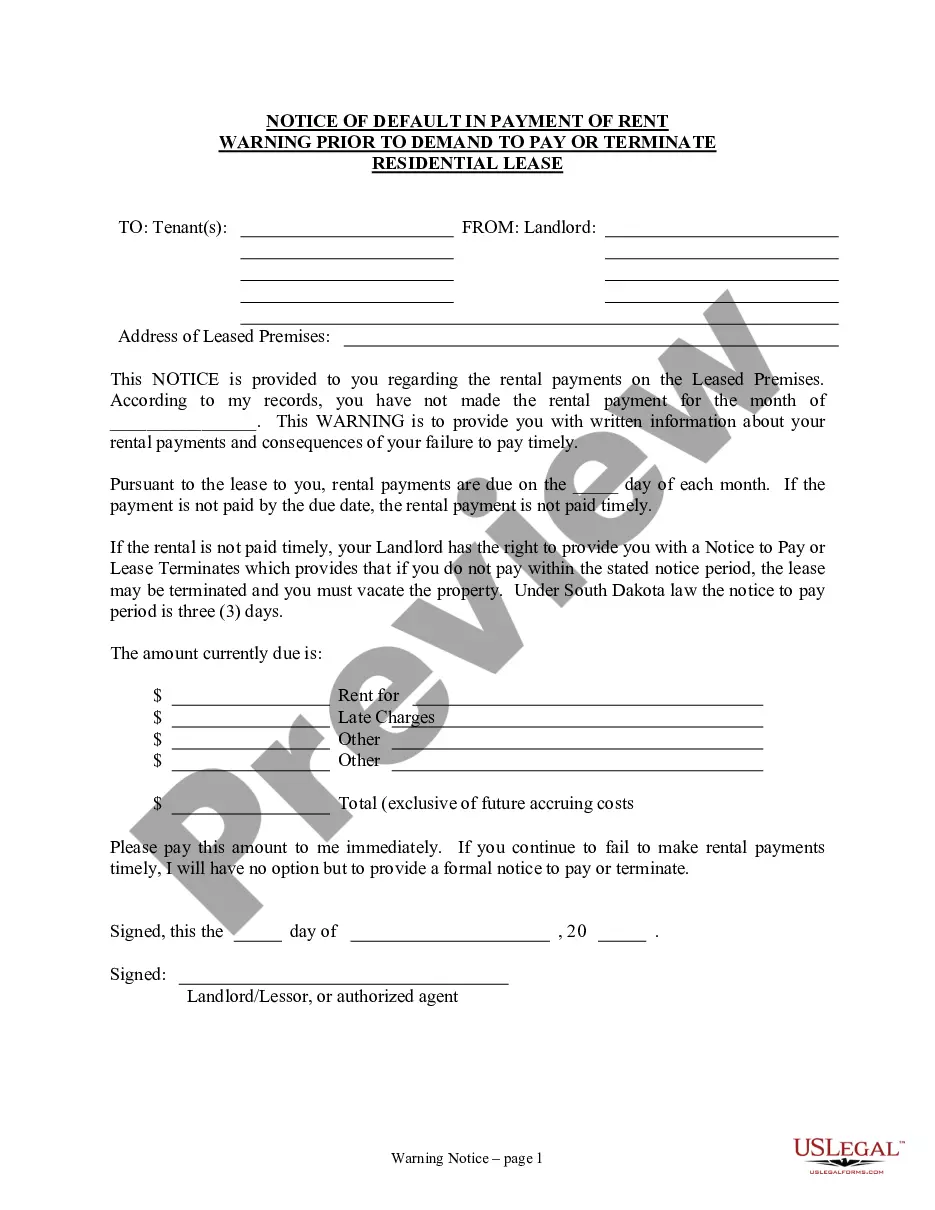

Allegheny, Pennsylvania: A Detailed Description Allegheny, Pennsylvania is a county located in the western region of the state. It encompasses the vibrant city of Pittsburgh and is known for its rich history, diverse culture, and stunning natural beauty. This article aims to provide a detailed description of the Allegheny area, specifically focusing on the topic of notice to debt collectors falsely representing dire consequences for nonpayment of a debt. In recent years, there has been an increasing concern regarding deceptive practices employed by some debt collectors in Allegheny, Pennsylvania. These unscrupulous collectors often resort to misinformation and intimidation techniques to coerce individuals into paying their debts. This article sheds light on such practices and aims to educate the readers about their rights and responsibilities when dealing with debt collectors. The Allegheny Pennsylvania Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt is a legal document that serves as a safeguard against these unethical tactics. Its main purpose is to inform individuals about the illegality of debt collectors' false claims regarding the severe consequences they may face if they don't make immediate payments. This notice ensures that debt collectors adhere to the Fair Debt Collection Practices Act (FD CPA) and respect the rights of debtors. There are several types of Allegheny Pennsylvania Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt, each designed to address specific situations. The most common ones include: 1. Notice for Personal Debts: This type of notice is relevant for individuals who owe personal debts such as credit card bills, medical expenses, or personal loans. 2. Notice for Business Debts: If a business entity in Allegheny, Pennsylvania is being falsely threatened by debt collectors for nonpayment of debts related to its operations, this notice comes into play. 3. Notice for Student Loans: Students who reside in Allegheny and are being subjected to false claims and intimidation techniques by debt collectors regarding their student loans can use this specific notice. 4. Notice for Mortgage Debts: Homeowners facing deceptive debt collection practices relating to their mortgage payments can utilize this notice to protect themselves from false representations of dire consequences. 5. Notice for Vehicle Loans: Individuals experiencing misleading tactics from debt collectors regarding nonpayment of vehicle loans in Allegheny can use this notice to assert their rights. By serving these notices to debt collectors, individuals in Allegheny, Pennsylvania can put an end to the false representation of dire consequences related to nonpayment of debts. These notices serve as a powerful tool to protect individuals' rights, maintain fair practices, and bring accountability to debt collection processes. It is essential to consult legal professionals or refer to regulatory agencies to ensure the accuracy and validity of these notices when using them in Allegheny, Pennsylvania. Protecting oneself from deceptive debt collection practices is crucial, and understanding the specifics of these notices is vital for any individual who finds themselves in such circumstances in Allegheny.