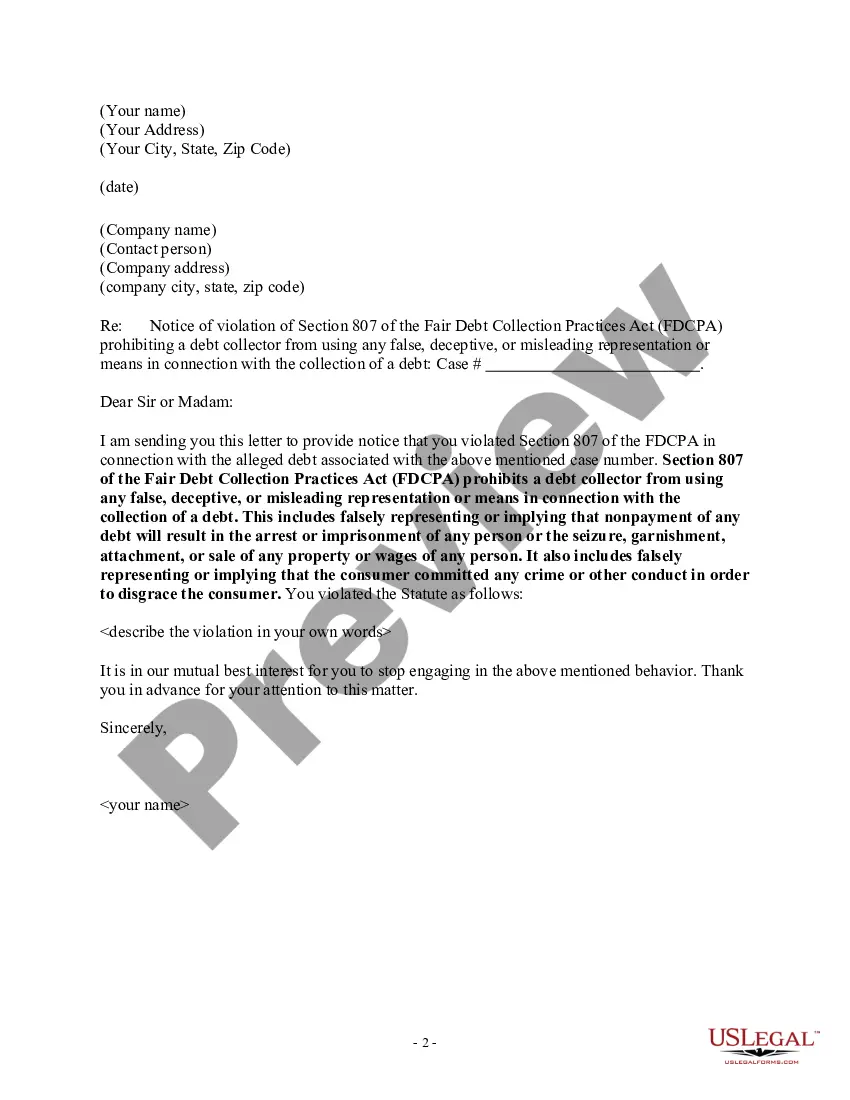

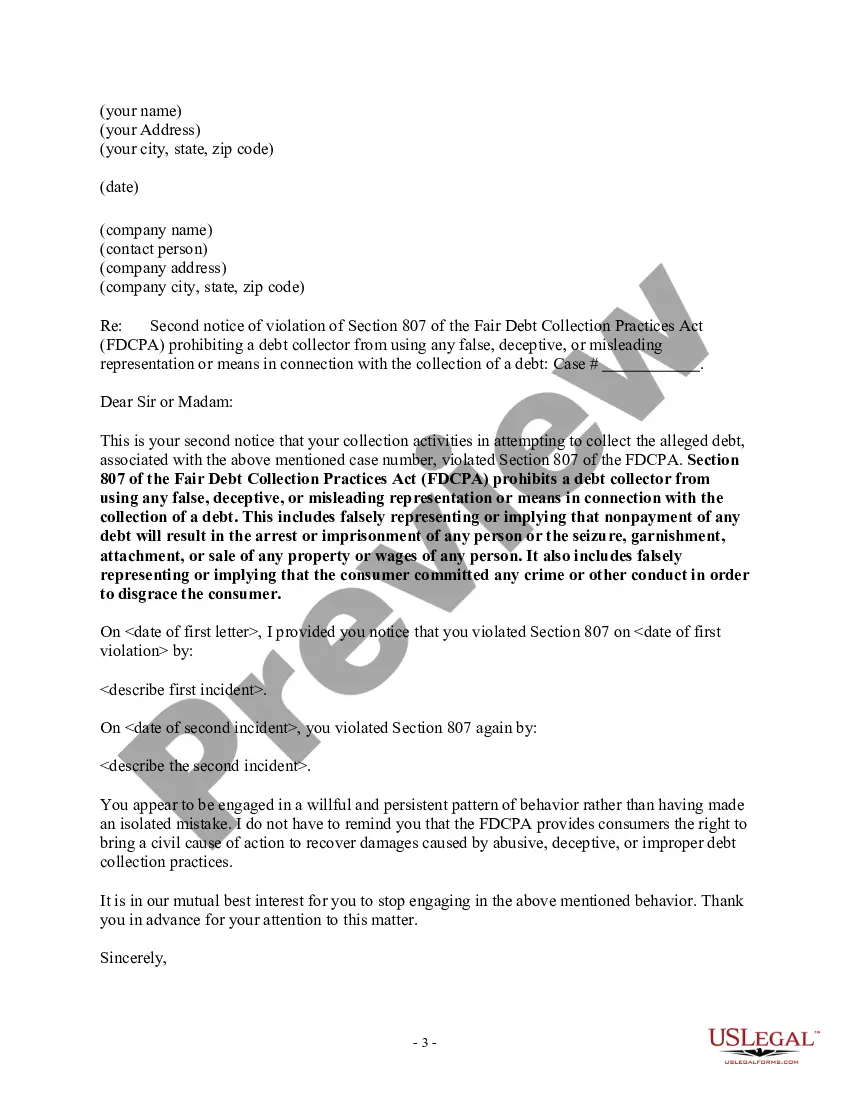

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes:

For instance, a debt collector may not: falsely allege that the consumer committed fraud; or misrepresent the law (e.g., tell a consumer they committed a crime by issuing a check that was dishonored when the law in their state applies only where there is a "scheme to defraud ).

Fulton Georgia, one of Georgia's most populous counties and home to the bustling city of Atlanta, implements a strict protocol to protect its residents from unscrupulous debt collectors. A Fulton Georgia Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt serves as a vital legal document that ensures debt collectors adhere to honest and fair practices. This notice is specifically designed to protect consumers in Fulton Georgia from misleading or aggressive tactics employed by debt collectors seeking payment on outstanding debts. Debt collectors are prohibited from falsely representing dire consequences that may result from nonpayment. This notice acts as a deterrent, holding debt collectors accountable for any misrepresentation or deceptiveness used to coerce individuals into making financial arrangements. By issuing this notice, the Fulton Georgia authorities strive to maintain transparency and integrity in debt collection processes. Consumers are encouraged to report any instances of debt collectors falsely threatening severe consequences, such as legal action, property seizure, or even arrest, as potential violations of their rights. There may be various types or instances of Fulton Georgia Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt to watch out for: 1. Misleading Legal Language: Some debt collectors might employ complex or confusing legal jargon to intimidate individuals into believing that dire legal actions are imminent. The Fulton Georgia notice ensures that collectors do not misrepresent their legal authority or exaggerate the severity of consequences. 2. False Impersonation: Debt collectors must also refrain from misrepresenting themselves as law enforcement officials or falsely claiming to work for government agencies. Such deceptive tactics are expressly prohibited by this notice. 3. Threats of Asset Seizure: Collectors may attempt to pressure individuals into making payments by falsely claiming that nonpayment will result in the seizure of personal assets, such as vehicles or real estate. The Fulton Georgia notice aims to prevent such unwarranted threats and protect consumers from misleading tactics. 4. Coercion through Arrest Warrants: Debt collectors are forbidden from falsely stating that failure to pay debts will lead to an individual's arrest. The notice ensures that consumers are not coerced or threatened with undue legal consequences. Fulton Georgia is committed to upholding the rights and well-being of its residents, safeguarding them against deceptive and unfair practices in debt collection. The Fulton Georgia Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt stands as a testament to the county's dedication to consumer protection and ensuring a just and equitable environment for all.