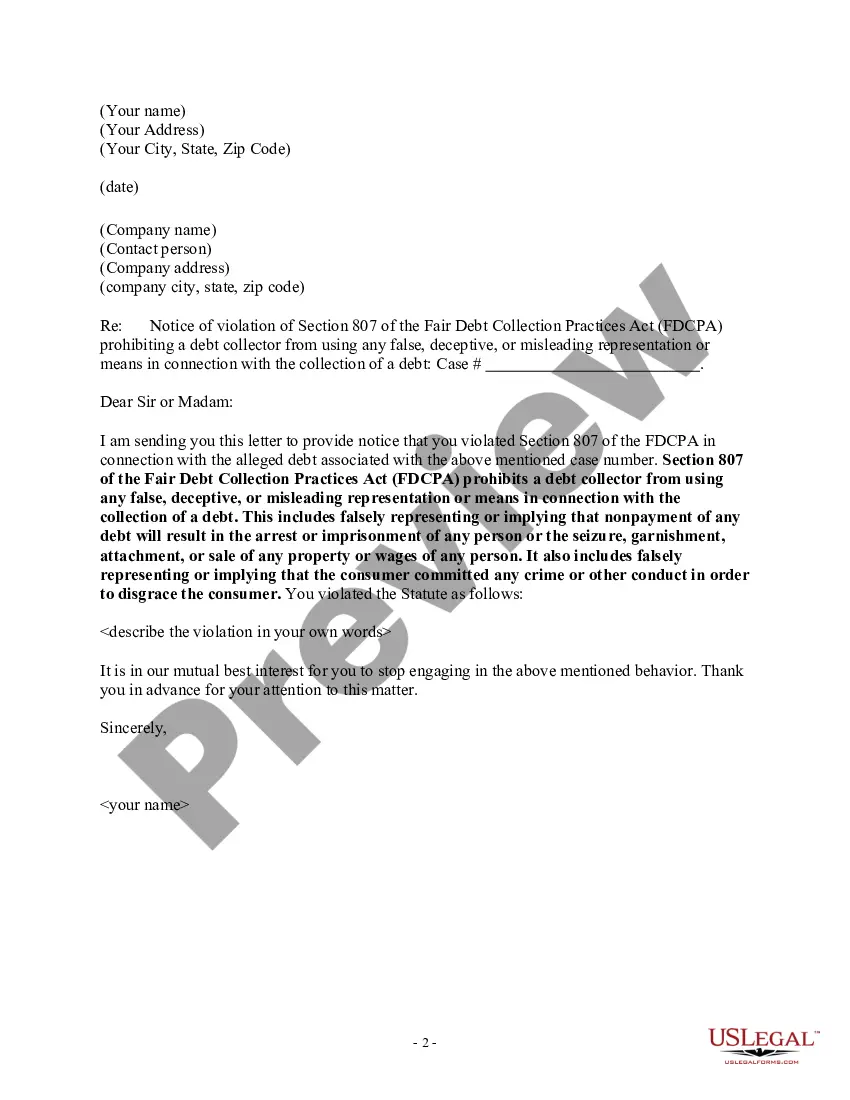

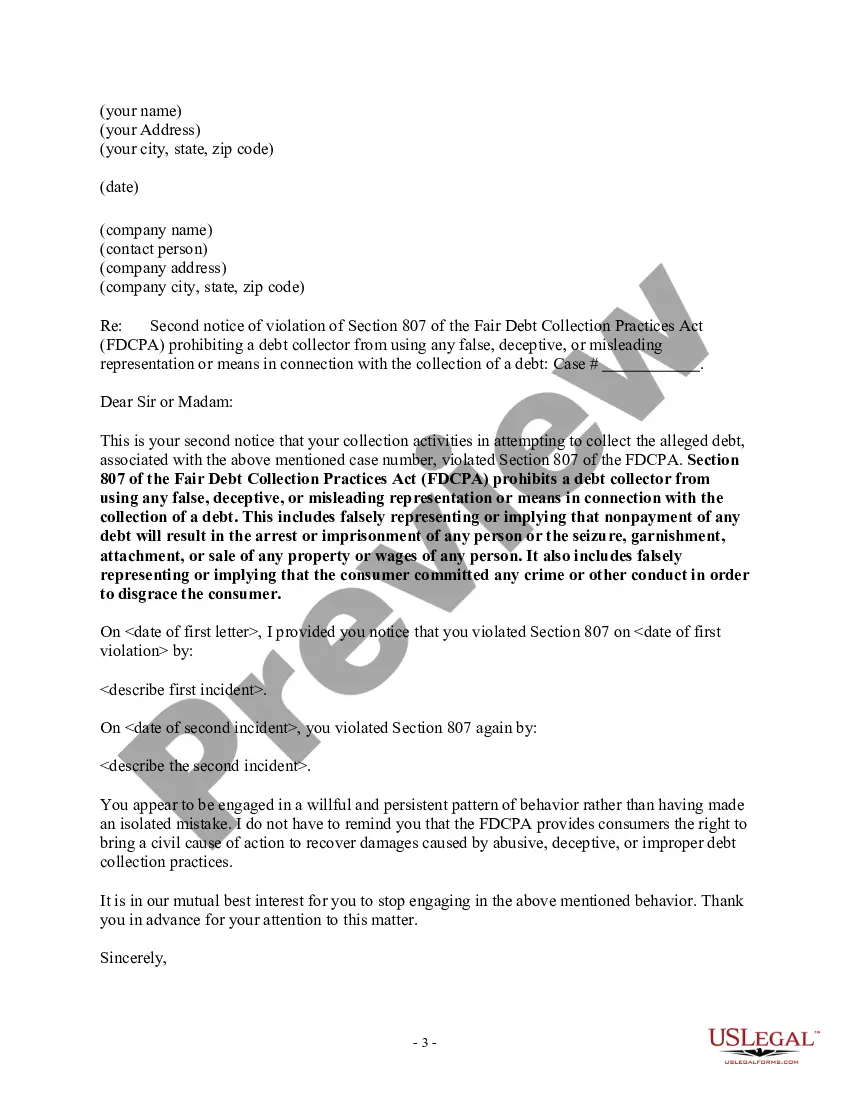

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes:

For instance, a debt collector may not: falsely allege that the consumer committed fraud; or misrepresent the law (e.g., tell a consumer they committed a crime by issuing a check that was dishonored when the law in their state applies only where there is a "scheme to defraud ).

What is Hennepin Minnesota Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt? In Hennepin County, Minnesota, there are specific legal regulations and notices in place to protect individuals from deceitful or misleading debt collection practices. One such notice is the Hennepin Minnesota Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt, which aims to prevent debt collectors from using false claims or misrepresentations to pressure or scare individuals into paying a debt. This notice serves as a warning to debt collectors operating in Hennepin County, making it clear that falsely representing dire consequences for nonpayment of a debt is strictly prohibited. Debt collectors are obligated to accurately and truthfully inform individuals about the actual legal consequences of nonpayment, without exaggeration or misrepresentation. Keyword variations: Hennepin Minnesota, Notice to Debt Collector, Falsely Representing Dire Consequences, Nonpayment of a Debt, Hennepin County, debt collection practices, misrepresentations, misleading debt collection, legal regulations, debt collectors, scare tactics. Different Types of Hennepin Minnesota Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt: 1. Hennepin Minnesota Notice to Debt Collector — Misrepresentation of Legal Actions: This type of notice specifically focuses on the debt collectors who falsely claim or misrepresent legal actions that could be taken against individuals for nonpayment of a debt. It warns against using scare tactics, false lawsuits, or exaggerated legal threats to coerce debt repayment. 2. Hennepin Minnesota Notice to Debt Collector — Exaggerated Consequences: This type of notice addresses debt collectors who inflate or misrepresent the potential consequences of nonpayment. It warns against falsely claiming severe credit damage, jail time, asset seizure, or other exaggerated outcomes to manipulate individuals into paying their debts. 3. Hennepin Minnesota Notice to Debt Collector — Deceptive Communication Techniques: This notice emphasizes the prohibition of debt collectors using deceptive communication techniques to mislead individuals into believing false repercussions for nonpayment. It covers tactics such as impersonating law enforcement or government agencies, creating false urgency, or issuing fake legal documents. 4. Hennepin Minnesota Notice to Debt Collector — Identification of Legal Obligations: This type of notice ensures debt collectors are aware of their legal obligations when discussing the consequences of nonpayment. It requires that they provide accurate and truthful information regarding the specific legal actions that can be taken, such as filing a lawsuit, obtaining a judgment, or pursuing wage garnishment. By implementing the Hennepin Minnesota Notice to Debt Collector — Falsely Representing Dire Consequences for Nonpayment of a Debt, Hennepin County aims to protect individuals from deceptive debt collection practices and ensure fair treatment in the debt repayment process.