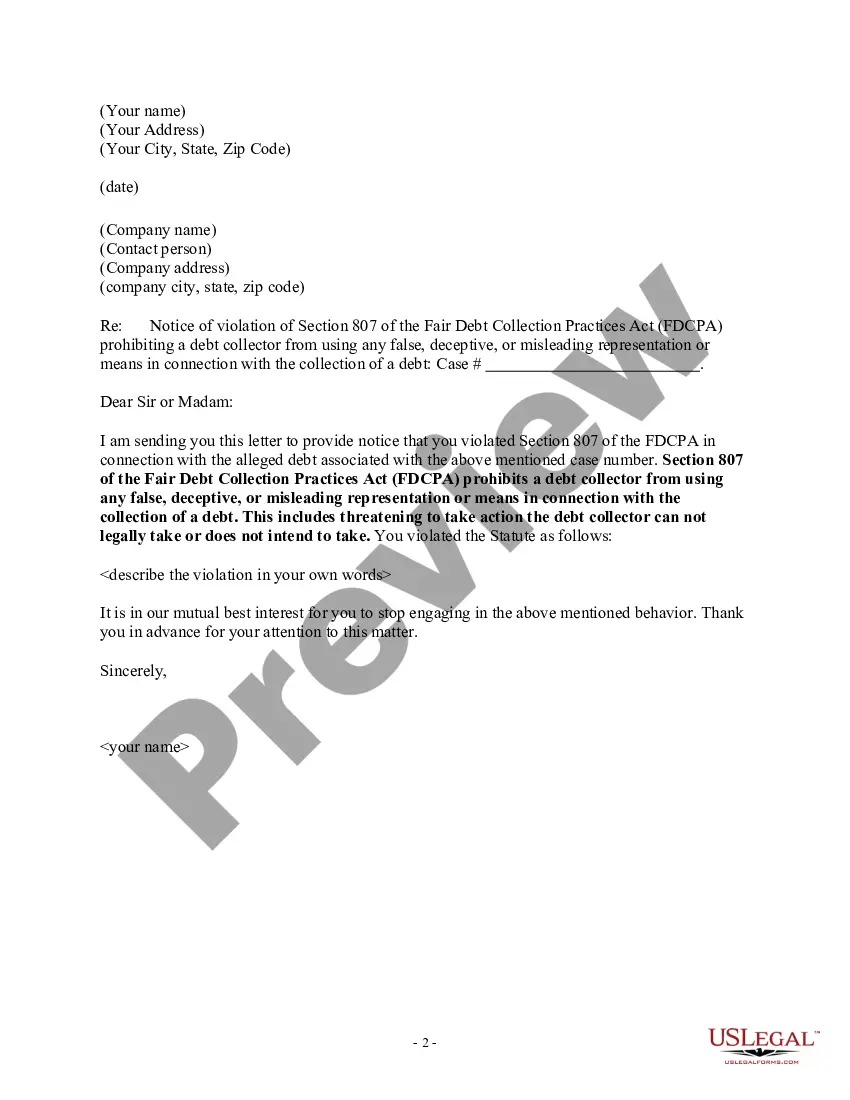

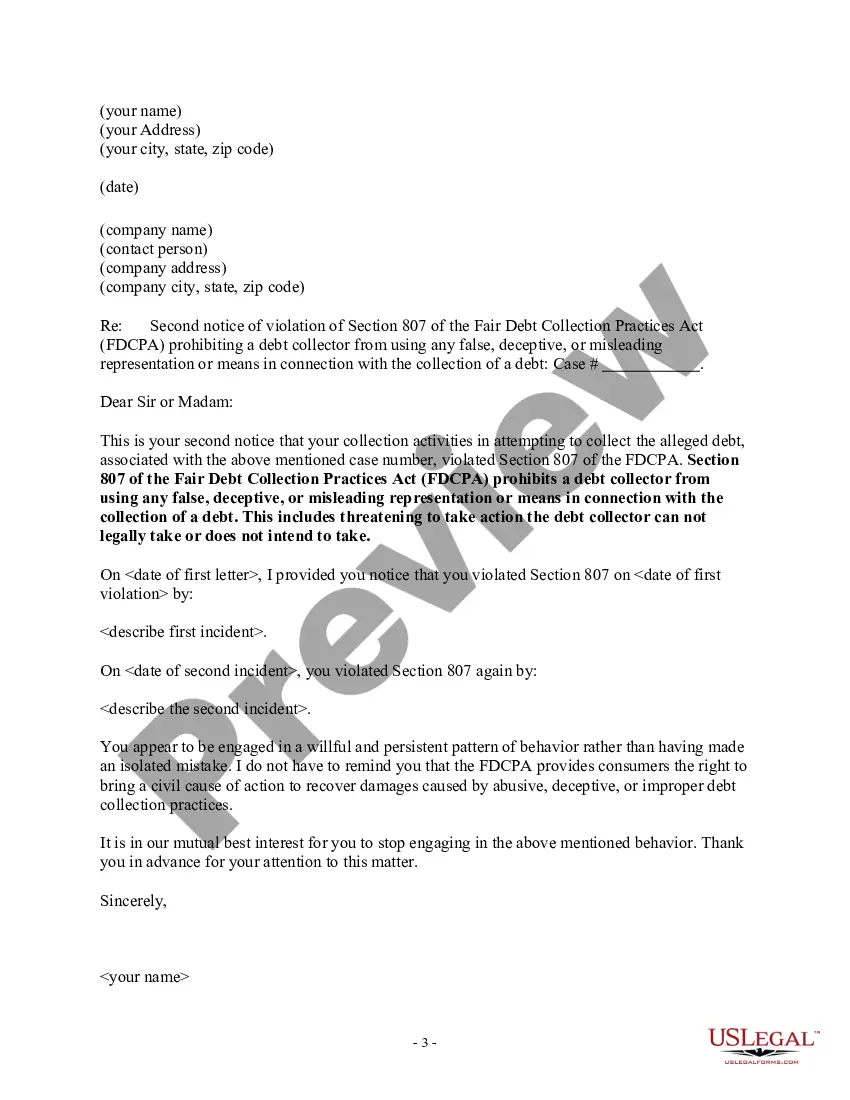

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes threatening to take action the debt collector can not legally take or does not intend to take.

Wording possibly constituting a threat includes:

Examples of permissible actions a debt collector may not take unless they intend to do so:

Examples of impermissible actions:

Lack of intent may be inferred if the amount of the debt is too small for the action to be feasible or when the debt collector has threatened an action their employer or the original creditor has not authorized them to take. Hillsborough Florida Notice to Debt Collector — Use of False Threats is a legal document that safeguards consumers from unethical and deceptive practices by debt collectors. Debt collectors must abide by specific regulations set forth by the Fair Debt Collection Practices Act (FD CPA) in order to protect consumers from abusive collection tactics. This notice specifically focuses on the use of false threats employed by debt collectors when attempting to collect outstanding debts. It serves as a warning to debt collectors who engage in deceptive practices, as well as a means for consumers to exercise their rights and hold collectors accountable. When debt collectors use false threats, they intimidate and mislead consumers in an effort to coerce payment. Some common false threats made by debt collectors may include: 1. Legal action threats: Debt collectors may threaten legal action, such as filing a lawsuit, garnishing wages, or seizing assets, even when they have no intention or legal basis to do so. 2. Harassment threats: Collectors may threaten consumers with increased harassment, excessive phone calls, or publicizing their debts to put pressure on payment. 3. Credit score threats: Debt collectors may falsely threaten that non-payment will immediately or drastically impact the consumer's credit score, even when it may not be the case. 4. Criminal charges threats: Some collectors may illegally threaten consumers with arrest, imprisonment, or criminal charges, which is a clear violation of the FD CPA. The Hillsborough Florida Notice to Debt Collector — Use of False Threats is a crucial tool for consumers who have faced these tactics. It provides step-by-step guidelines on how to accurately report false threats and take legal action against abusive debt collectors. This notice ensures that consumers are aware of their rights and can protect themselves from deceptive practices. By using this notice, consumers can seek legal remedies for any damages caused by debt collectors using false threats. It also enables them to pursue possible compensation for statutory damages and legal fees. It is important to consult with a qualified attorney or legal professional in Hillsborough, Florida, to fully understand the specifics and requirements of the Hillsborough Florida Notice to Debt Collector — Use of False Threats. They will provide the necessary guidance to ensure your rights are protected and that you are able to take appropriate legal action against any debt collectors engaging in such deceptive practices.

Hillsborough Florida Notice to Debt Collector — Use of False Threats is a legal document that safeguards consumers from unethical and deceptive practices by debt collectors. Debt collectors must abide by specific regulations set forth by the Fair Debt Collection Practices Act (FD CPA) in order to protect consumers from abusive collection tactics. This notice specifically focuses on the use of false threats employed by debt collectors when attempting to collect outstanding debts. It serves as a warning to debt collectors who engage in deceptive practices, as well as a means for consumers to exercise their rights and hold collectors accountable. When debt collectors use false threats, they intimidate and mislead consumers in an effort to coerce payment. Some common false threats made by debt collectors may include: 1. Legal action threats: Debt collectors may threaten legal action, such as filing a lawsuit, garnishing wages, or seizing assets, even when they have no intention or legal basis to do so. 2. Harassment threats: Collectors may threaten consumers with increased harassment, excessive phone calls, or publicizing their debts to put pressure on payment. 3. Credit score threats: Debt collectors may falsely threaten that non-payment will immediately or drastically impact the consumer's credit score, even when it may not be the case. 4. Criminal charges threats: Some collectors may illegally threaten consumers with arrest, imprisonment, or criminal charges, which is a clear violation of the FD CPA. The Hillsborough Florida Notice to Debt Collector — Use of False Threats is a crucial tool for consumers who have faced these tactics. It provides step-by-step guidelines on how to accurately report false threats and take legal action against abusive debt collectors. This notice ensures that consumers are aware of their rights and can protect themselves from deceptive practices. By using this notice, consumers can seek legal remedies for any damages caused by debt collectors using false threats. It also enables them to pursue possible compensation for statutory damages and legal fees. It is important to consult with a qualified attorney or legal professional in Hillsborough, Florida, to fully understand the specifics and requirements of the Hillsborough Florida Notice to Debt Collector — Use of False Threats. They will provide the necessary guidance to ensure your rights are protected and that you are able to take appropriate legal action against any debt collectors engaging in such deceptive practices.