A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes threatening to take action the debt collector can not legally take or does not intend to take.

Wording possibly constituting a threat includes:

Examples of permissible actions a debt collector may not take unless they intend to do so:

Examples of impermissible actions:

Lack of intent may be inferred if the amount of the debt is too small for the action to be feasible or when the debt collector has threatened an action their employer or the original creditor has not authorized them to take.

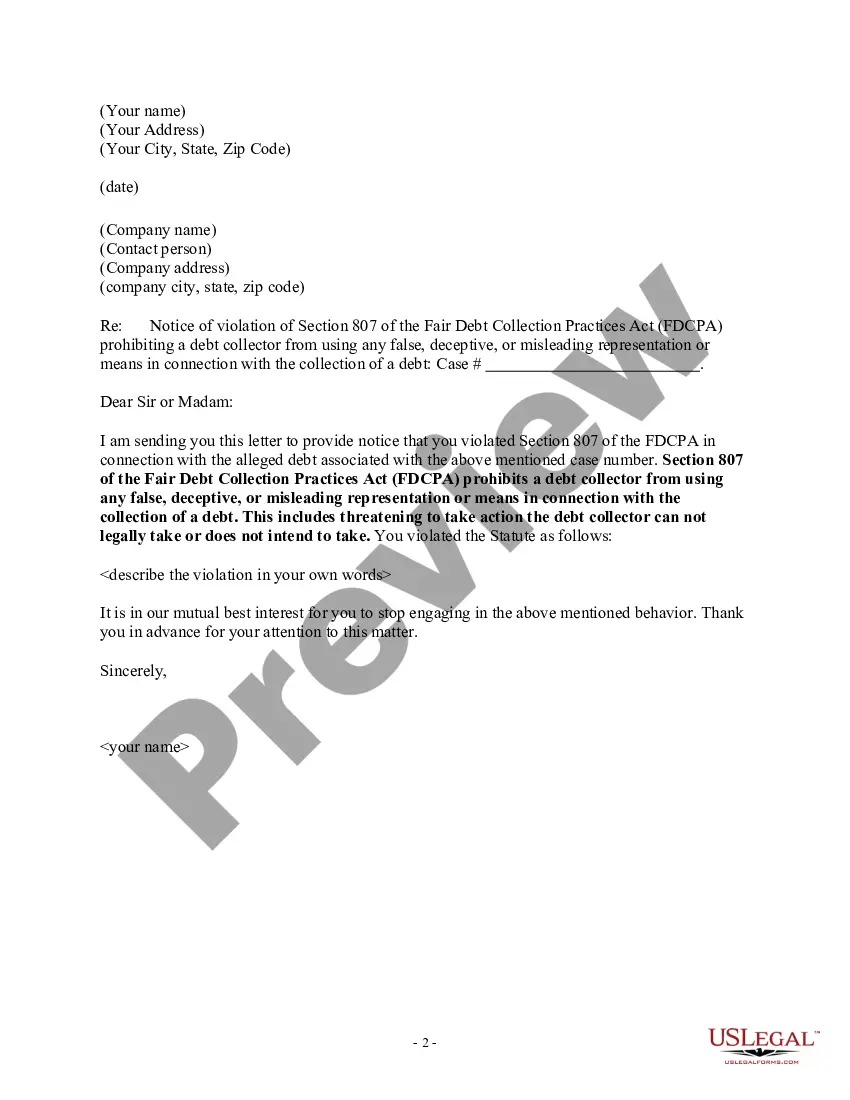

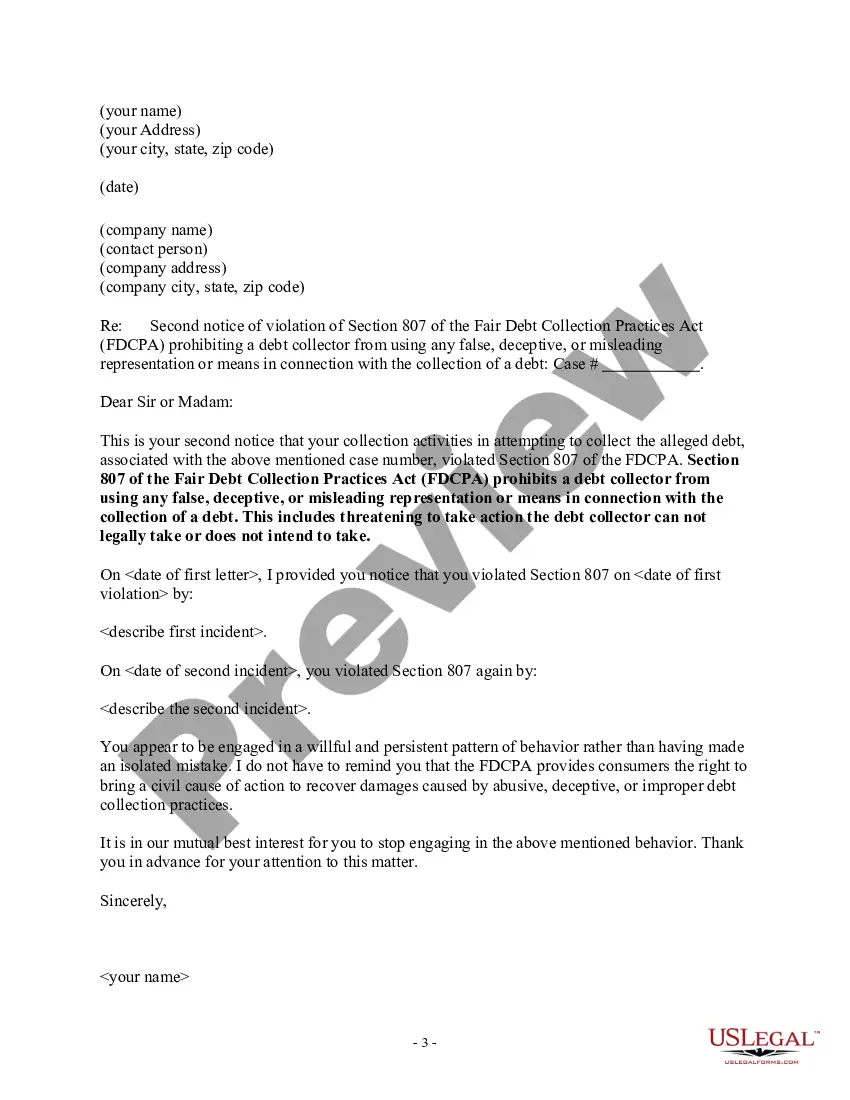

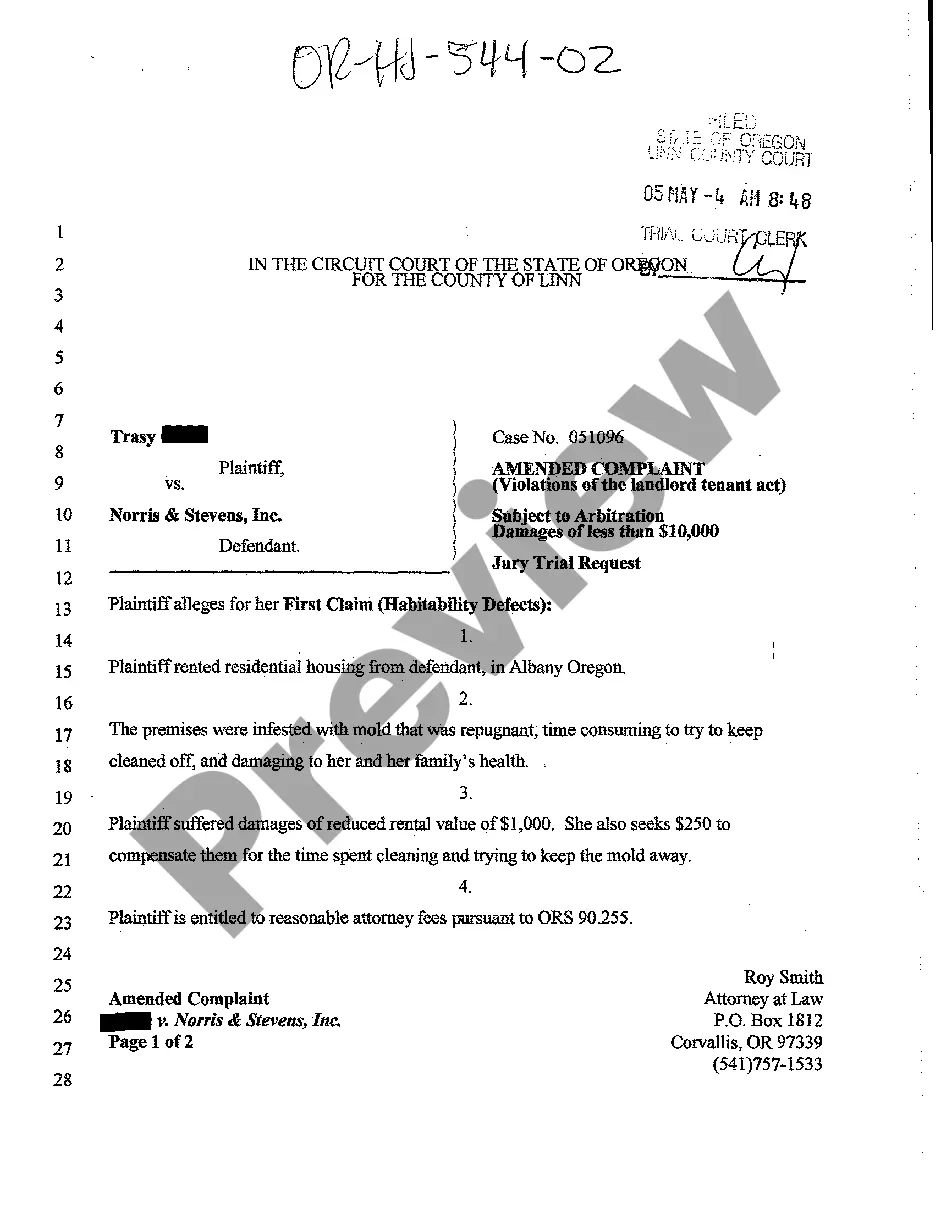

Los Angeles, California Notice to Debt Collector — Use of False Threats A Los Angeles, California Notice to Debt Collector — Use of False Threats is a legal document designed to address the issue of debt collectors using false threats or deceptive practices to coerce individuals into paying their debts. This notice serves as a warning to debt collectors that such actions are against the law and that legal action can be taken against them if they continue with these inappropriate techniques. Types of Los Angeles, California Notice to Debt Collector — Use of False Threats: 1. Cease and Desist Letter: This type of notice is commonly used when a debtor wants a debt collector to immediately stop all communications related to the debt, including any false threats or deceptive practices. The letter demands that the debt collector discontinue these tactics or face legal consequences. 2. Notice of Violation: Issued when a debtor believes that a debt collector has violated their rights by using false threats or misleading statements. This notice states specific details of the violation, demanding an immediate correction and an end to these practices. It often threatens legal action against the debt collector if they fail to comply. 3. Verification Request: Sometimes, a debtor may send a notice requesting that the debt collector provide proof of the debt being collected. This is often used when there are suspicions that the debt collector is fabricating or exaggerating the debt amount to influence the debtor through false threats. The verification request seeks to cement the debtor's rights and ensure transparency in the debt collection process. 4. Complaint to Regulatory Agencies: In more serious cases, debtors may file complaints with relevant regulatory agencies against the debt collector engaging in false threats. This type of notice alerts the regulatory bodies to investigate the unlawful actions of the debt collector and potentially revoke their license. In extreme cases, criminal charges may also be filed against the collector. 5. Lawsuit Notification: If the debtor has exhausted all other options or has suffered significant harm due to the debt collector's false threats, they may send a lawsuit notification. This notice informs the debt collector that the debtor intends to take legal action, seeking damages for the harm caused, such as emotional distress or financial loss. It is essential for debt collectors to be aware of their legal obligations to abide by fair debt collection practices, ensuring they do not employ false threats or deceptive tactics. Debtors should familiarize themselves with their rights, including the option to issue a Los Angeles, California Notice to Debt Collector — Use of False Threats when faced with such unlawful actions. Seeking legal advice is recommended to navigate the complexities of debt collection laws and protect one's rights.