A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes threatening to take action the debt collector can not legally take or does not intend to take.

Wording possibly constituting a threat includes:

Examples of permissible actions a debt collector may not take unless they intend to do so:

Examples of impermissible actions:

Lack of intent may be inferred if the amount of the debt is too small for the action to be feasible or when the debt collector has threatened an action their employer or the original creditor has not authorized them to take.

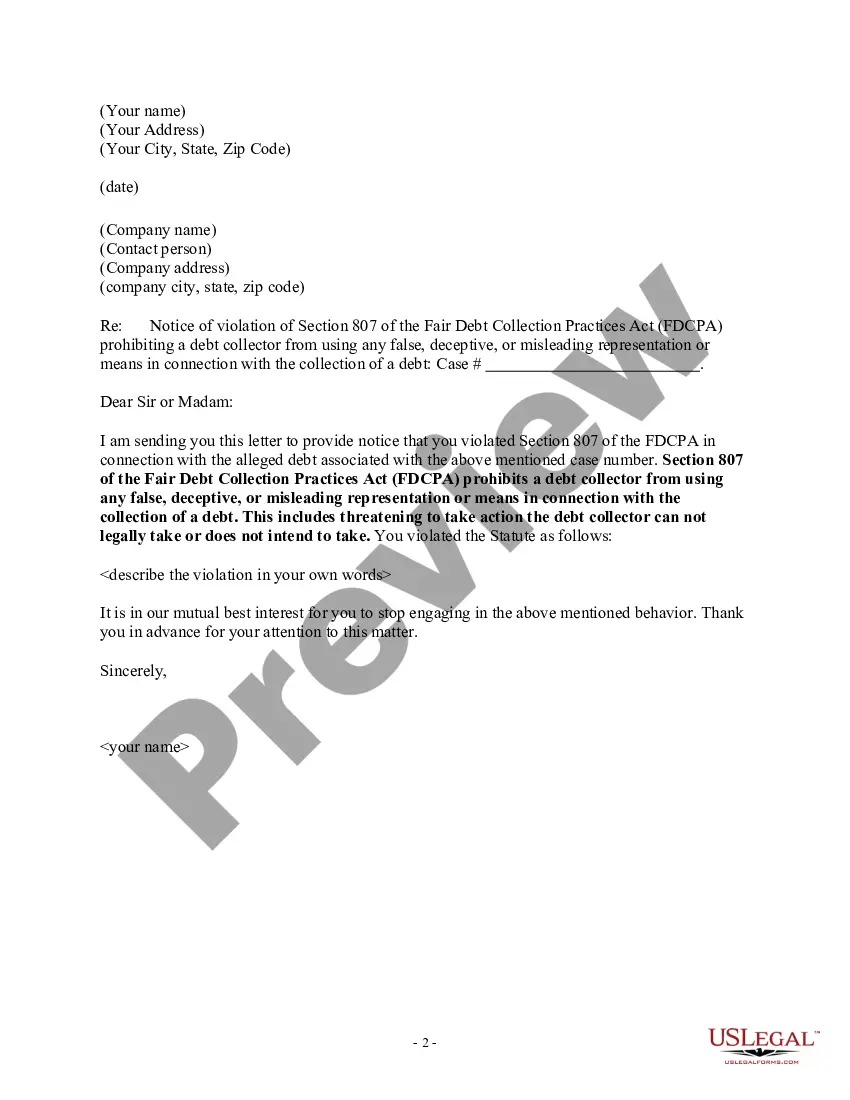

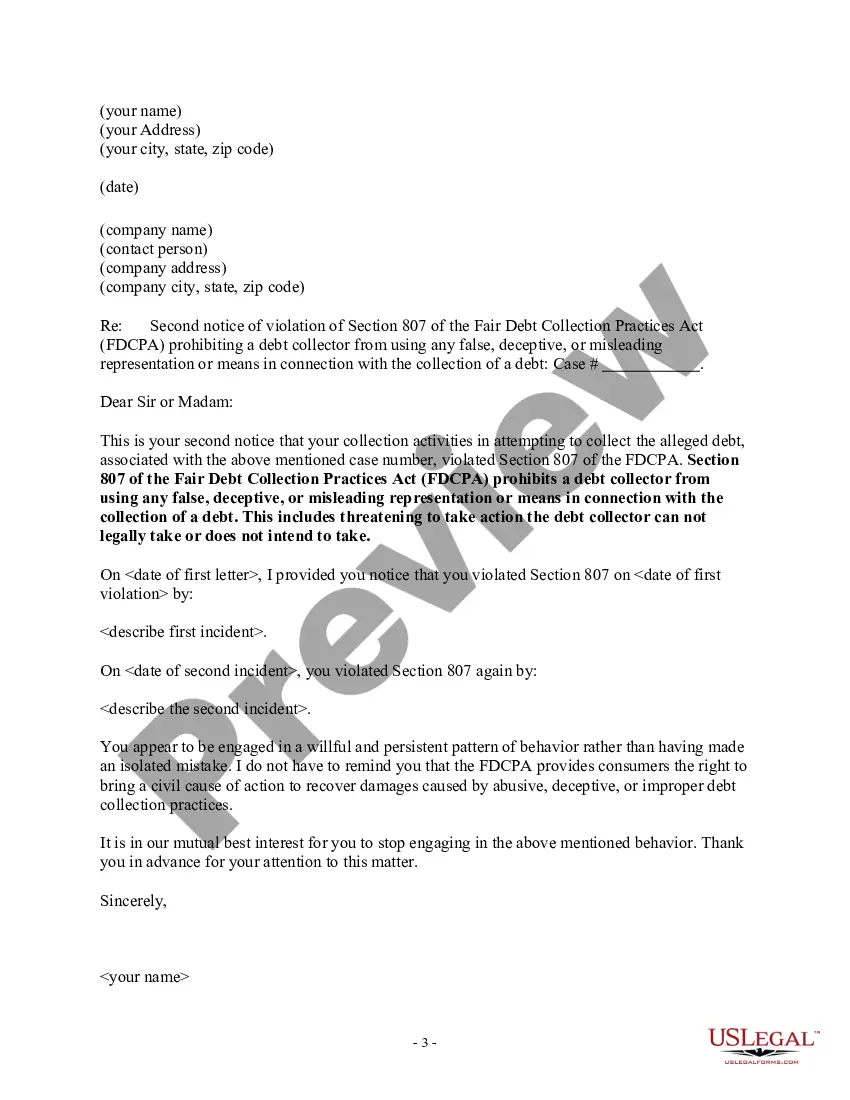

Queens New York Notice to Debt Collector — Use of False Threats In Queens, New York, there are specific legal guidelines in place to protect individuals from debt collectors who employ false threats in their collection practices. It is crucial for consumers to be aware of their rights and familiarize themselves with the Queens New York Notice to Debt Collector — Use of False Threats. When a debt collector resorts to using false threats, it means they are employing deceptive tactics to coerce consumers into paying off their debts. This is a violation of the Fair Debt Collection Practices Act (FD CPA) and is not tolerated in Queens, New York. The Queens New York Notice to Debt Collector — Use of False Threats serves as a formal written communication to inform debt collectors that their behavior violates the law. The notice outlines the specific actions considered as false threats, penalties associated with violating the law, and the consumer's rights regarding debt collection practices. Types of Queens New York Notice to Debt Collector — Use of False Threats: 1. False Threats of Legal Action: Debt collectors may threaten to initiate legal proceedings against consumers, such as filing lawsuits or seizing property, even when they do not have the authority or intention to do so. The Queens New York Notice to Debt Collector highlights that these threats are illegal and empower consumers with the knowledge to challenge such false claims. 2. Misrepresentation of Debt Owed: Sometimes, debt collectors may inflate the amount owed or falsely claim additional charges and fees. This type of false threat aims to pressure consumers into making immediate payments. The Queens New York Notice to Debt Collector ensures consumers are aware of their right to receive an accurate verification of the debt owed. 3. False Reporting to Credit Bureaus: Debt collectors may threaten to report inaccurate or false information to credit bureaus, damaging the consumer's credit score and reputation. The Queens New York Notice to Debt Collector educates consumers about their right to dispute inaccurate reporting and demand truthful and fair reporting practices. 4. Illegal Wage Garnishment Threats: Debt collectors cannot threaten to garnish wages unlawfully or without proper legal authorization. The Queens New York Notice to Debt Collector emphasizes that false threats regarding wage garnishment are prohibited and that consumers have the right to challenge such claims. By understanding the Queens New York Notice to Debt Collector — Use of False Threats, consumers can confidently take action against debt collectors who engage in deceptive practices. It is crucial for individuals facing such violations to consult with an attorney specializing in debt collection laws to protect their rights and pursue appropriate legal remedies.