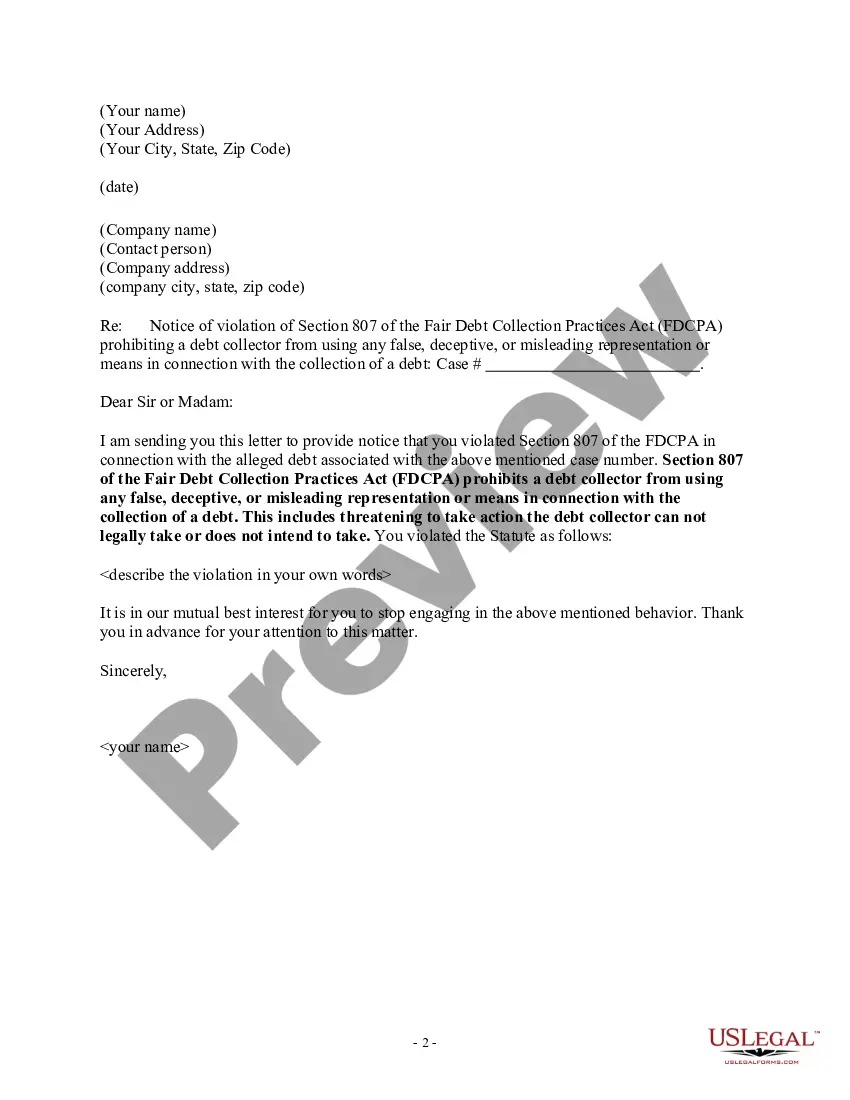

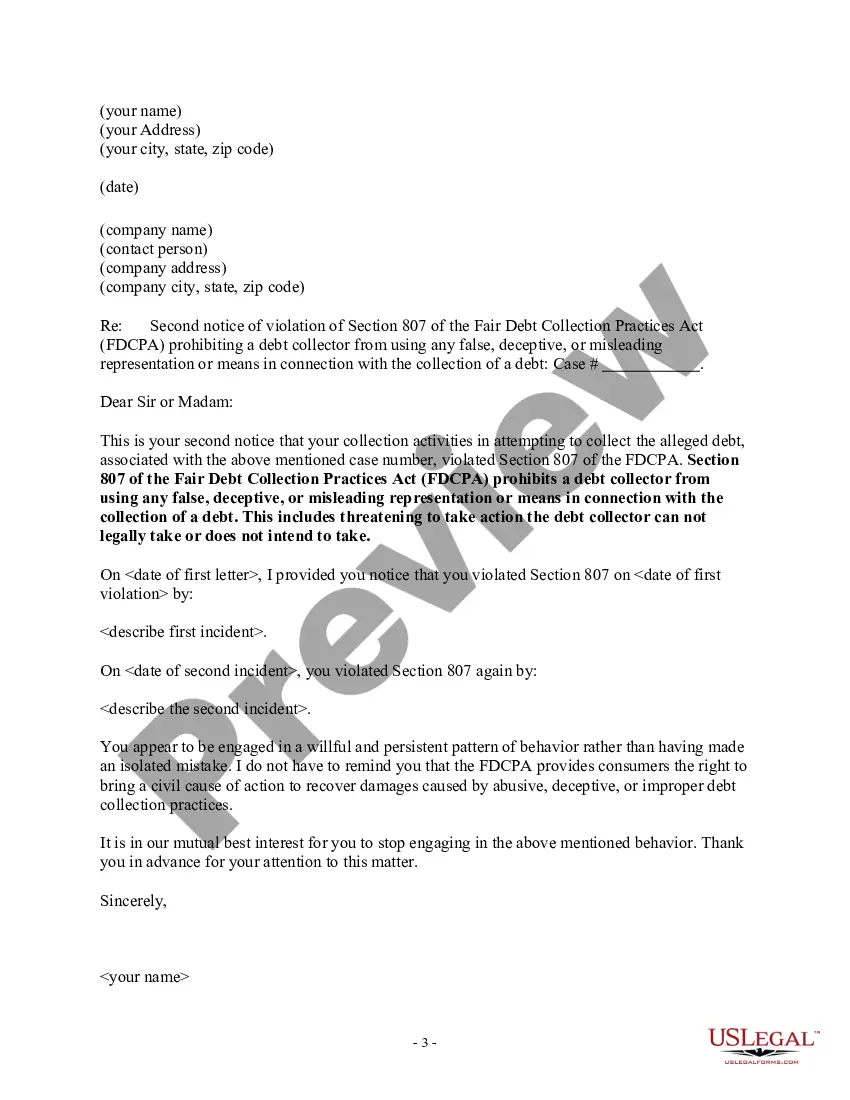

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes threatening to take action the debt collector can not legally take or does not intend to take.

Wording possibly constituting a threat includes:

Examples of permissible actions a debt collector may not take unless they intend to do so:

Examples of impermissible actions:

Lack of intent may be inferred if the amount of the debt is too small for the action to be feasible or when the debt collector has threatened an action their employer or the original creditor has not authorized them to take. Riverside, California is a vibrant city located in the Inland Empire region, known for its rich history, cultural diversity, and stunning natural landscapes. As the county seat of Riverside County, it boasts a population of over 300,000 residents and offers a wide range of amenities and attractions. One particular aspect that residents should be aware of is the Riverside California Notice to Debt Collector — Use of False Threats. This notice serves as a legal protection for individuals in the area who may be facing debt-related challenges and ensures that they are not subjected to unfair or deceptive practices by debt collectors. The Riverside California Notice to Debt Collector — Use of False Threats specifically targets the use of false threats by debt collectors in attempting to collect a debt from a consumer. Debt collectors are prohibited from making false statements or misrepresentations in their communication with debtors. It is essential for individuals to understand their rights under this notice, as it provides a safeguard against unlawful debt collection tactics. There are different types of Riverside California Notice to Debt Collector — Use of False Threats that residents should familiarize themselves with: 1. False Threats of Legal Action: Debt collectors are prohibited from making false threats regarding legal action that they do not intend to take. This includes threatening to file a lawsuit or implying that the debtor could face arrest or imprisonment if the debt is not paid. 2. False Threats to Garnish Wages: Debt collectors cannot make false threats of wage garnishment, suggesting that they have the authority to withhold a portion of the debtor's wages. Only certain entities, such as courts or government agencies, have the power to garnish wages. 3. False Threats of Property Seizure: It is illegal for debt collectors to make false threats of seizing a debtor's property, such as their house or car. Debt collectors must follow proper legal channels to pursue collection efforts and cannot make false claims about their ability to seize assets. 4. False Threats to Ruin Credit: Debt collectors cannot make false threats to damage a debtor's credit or misrepresent the impact that non-payment will have on their credit score. Misleading statements about credit reporting can be a violation of the Riverside California Notice to Debt Collector — Use of False Threats. Residents of Riverside, California should be aware of their rights and protections provided by the Riverside California Notice to Debt Collector — Use of False Threats. If they believe a debt collector has violated these regulations, individuals can seek legal recourse and may be entitled to financial compensation. It is important for residents to stay informed and educated about their rights as consumers in order to navigate any potential debt-related issues confidently.

Riverside, California is a vibrant city located in the Inland Empire region, known for its rich history, cultural diversity, and stunning natural landscapes. As the county seat of Riverside County, it boasts a population of over 300,000 residents and offers a wide range of amenities and attractions. One particular aspect that residents should be aware of is the Riverside California Notice to Debt Collector — Use of False Threats. This notice serves as a legal protection for individuals in the area who may be facing debt-related challenges and ensures that they are not subjected to unfair or deceptive practices by debt collectors. The Riverside California Notice to Debt Collector — Use of False Threats specifically targets the use of false threats by debt collectors in attempting to collect a debt from a consumer. Debt collectors are prohibited from making false statements or misrepresentations in their communication with debtors. It is essential for individuals to understand their rights under this notice, as it provides a safeguard against unlawful debt collection tactics. There are different types of Riverside California Notice to Debt Collector — Use of False Threats that residents should familiarize themselves with: 1. False Threats of Legal Action: Debt collectors are prohibited from making false threats regarding legal action that they do not intend to take. This includes threatening to file a lawsuit or implying that the debtor could face arrest or imprisonment if the debt is not paid. 2. False Threats to Garnish Wages: Debt collectors cannot make false threats of wage garnishment, suggesting that they have the authority to withhold a portion of the debtor's wages. Only certain entities, such as courts or government agencies, have the power to garnish wages. 3. False Threats of Property Seizure: It is illegal for debt collectors to make false threats of seizing a debtor's property, such as their house or car. Debt collectors must follow proper legal channels to pursue collection efforts and cannot make false claims about their ability to seize assets. 4. False Threats to Ruin Credit: Debt collectors cannot make false threats to damage a debtor's credit or misrepresent the impact that non-payment will have on their credit score. Misleading statements about credit reporting can be a violation of the Riverside California Notice to Debt Collector — Use of False Threats. Residents of Riverside, California should be aware of their rights and protections provided by the Riverside California Notice to Debt Collector — Use of False Threats. If they believe a debt collector has violated these regulations, individuals can seek legal recourse and may be entitled to financial compensation. It is important for residents to stay informed and educated about their rights as consumers in order to navigate any potential debt-related issues confidently.