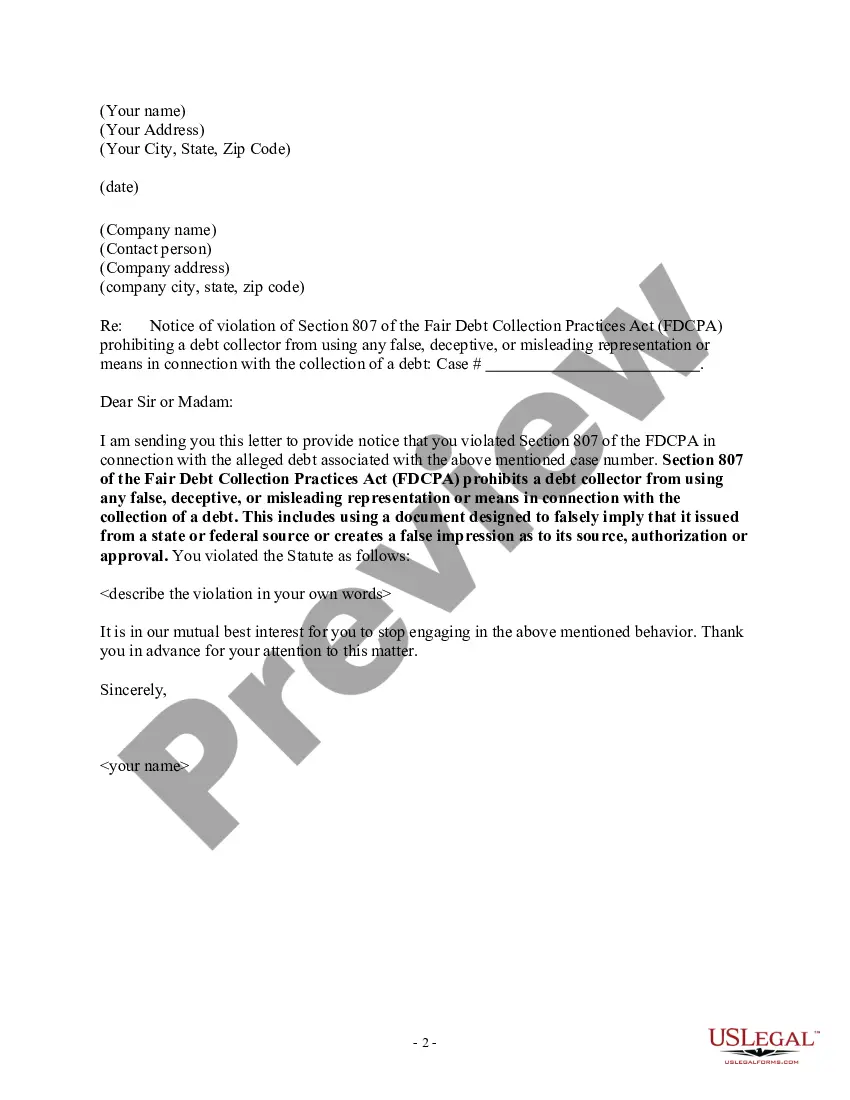

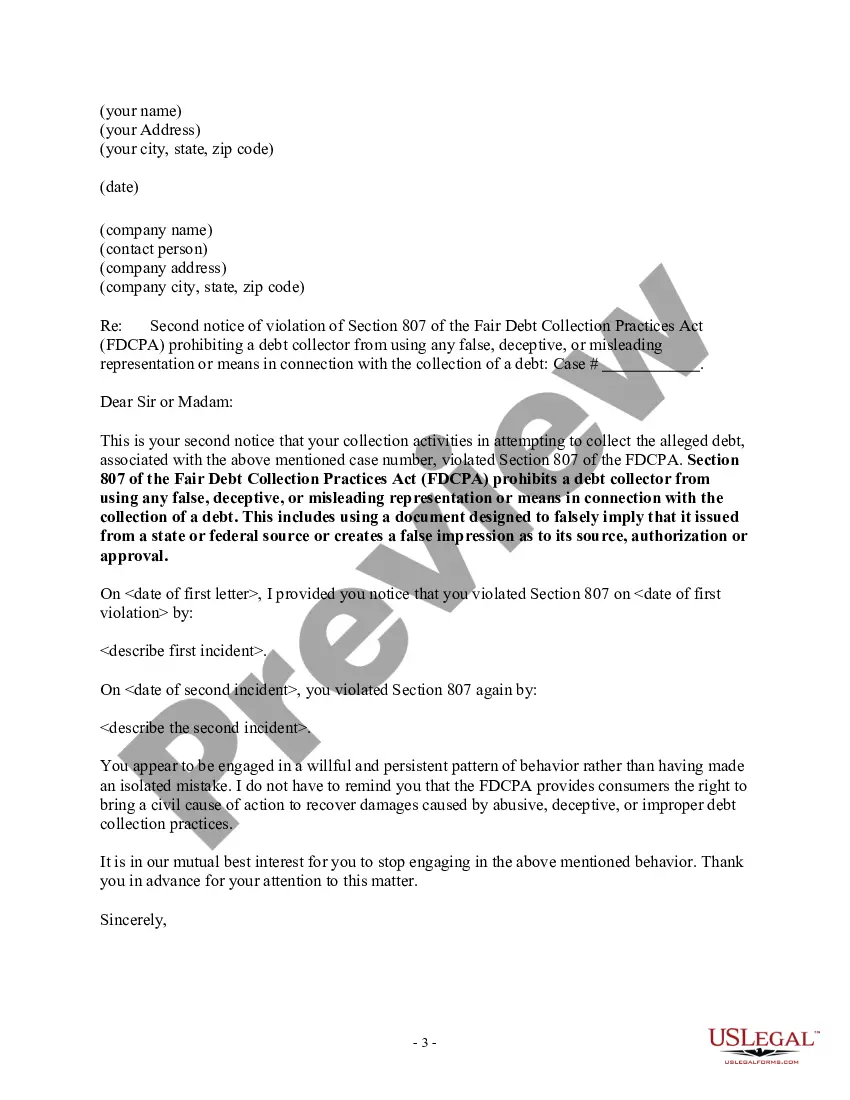

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval. Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority serves as an essential legal tool to protect consumers from the deceptive tactics of debt collectors. This notice aims to address a specific violation, namely when a debt collector falsely represents the authority of a document. Let's explore the details of this notice type and its significance in consumer protection laws. When a debt collector attempts to collect a debt, they might present documents that appear to have legal authority. However, in some cases, these documents can be deceitful or misleading, misrepresenting their legitimacy and the debt collector's authority. This action is considered a violation of the Fair Debt Collection Practices Act (FD CPA) and can be addressed through a Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority. One type of Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority is based on inaccurate or forged documents. This occurs when a debt collector presents documents that are not genuine or have been altered in an attempt to make them appear valid. This type of violation can mislead consumers and put them at a disadvantage when trying to dispute or negotiate the debt. Another type arises when a debt collector falsely represents the authority granted to them by a document. Debt collectors have limitations set by the FD CPA when it comes to their power and authority to collect debts. In some cases, collectors may exaggerate or misrepresent their rights, causing confusion and harassment for the consumer. They might claim legal actions that they are not authorized to take or assert a higher level of authority than they possess. A Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority is crucial for confronting such violations. It is an official statement demanding the cessation of these deceptive practices and requesting validation of the collector's authority and the document's legitimacy. By sending this notice, consumers can assert their rights, challenge the validity of the debt, and request proof of the debt collector's claims. The consequences of falsely representing a document's authority can be severe for debt collectors. Violating the FD CPA can lead to legal action against the collector, potentially resulting in penalties, fines, or even the revocation of their debt collection license. This notice empowers consumers, equipping them with a means to protect themselves against unfair practices and ensure compliance with the law. In summary, a Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority serves as an important legal tool for consumers dealing with debt collectors. By addressing violations related to misleading or misrepresented documents, consumers can safeguard their rights and ensure fair treatment throughout the debt collection process. It's crucial to be aware of these notice types and exercise them when encountering any deceptive practices by debt collectors.

Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority serves as an essential legal tool to protect consumers from the deceptive tactics of debt collectors. This notice aims to address a specific violation, namely when a debt collector falsely represents the authority of a document. Let's explore the details of this notice type and its significance in consumer protection laws. When a debt collector attempts to collect a debt, they might present documents that appear to have legal authority. However, in some cases, these documents can be deceitful or misleading, misrepresenting their legitimacy and the debt collector's authority. This action is considered a violation of the Fair Debt Collection Practices Act (FD CPA) and can be addressed through a Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority. One type of Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority is based on inaccurate or forged documents. This occurs when a debt collector presents documents that are not genuine or have been altered in an attempt to make them appear valid. This type of violation can mislead consumers and put them at a disadvantage when trying to dispute or negotiate the debt. Another type arises when a debt collector falsely represents the authority granted to them by a document. Debt collectors have limitations set by the FD CPA when it comes to their power and authority to collect debts. In some cases, collectors may exaggerate or misrepresent their rights, causing confusion and harassment for the consumer. They might claim legal actions that they are not authorized to take or assert a higher level of authority than they possess. A Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority is crucial for confronting such violations. It is an official statement demanding the cessation of these deceptive practices and requesting validation of the collector's authority and the document's legitimacy. By sending this notice, consumers can assert their rights, challenge the validity of the debt, and request proof of the debt collector's claims. The consequences of falsely representing a document's authority can be severe for debt collectors. Violating the FD CPA can lead to legal action against the collector, potentially resulting in penalties, fines, or even the revocation of their debt collection license. This notice empowers consumers, equipping them with a means to protect themselves against unfair practices and ensure compliance with the law. In summary, a Suffolk New York Notice to Debt Collector — Falsely Representing a Document's Authority serves as an important legal tool for consumers dealing with debt collectors. By addressing violations related to misleading or misrepresented documents, consumers can safeguard their rights and ensure fair treatment throughout the debt collection process. It's crucial to be aware of these notice types and exercise them when encountering any deceptive practices by debt collectors.