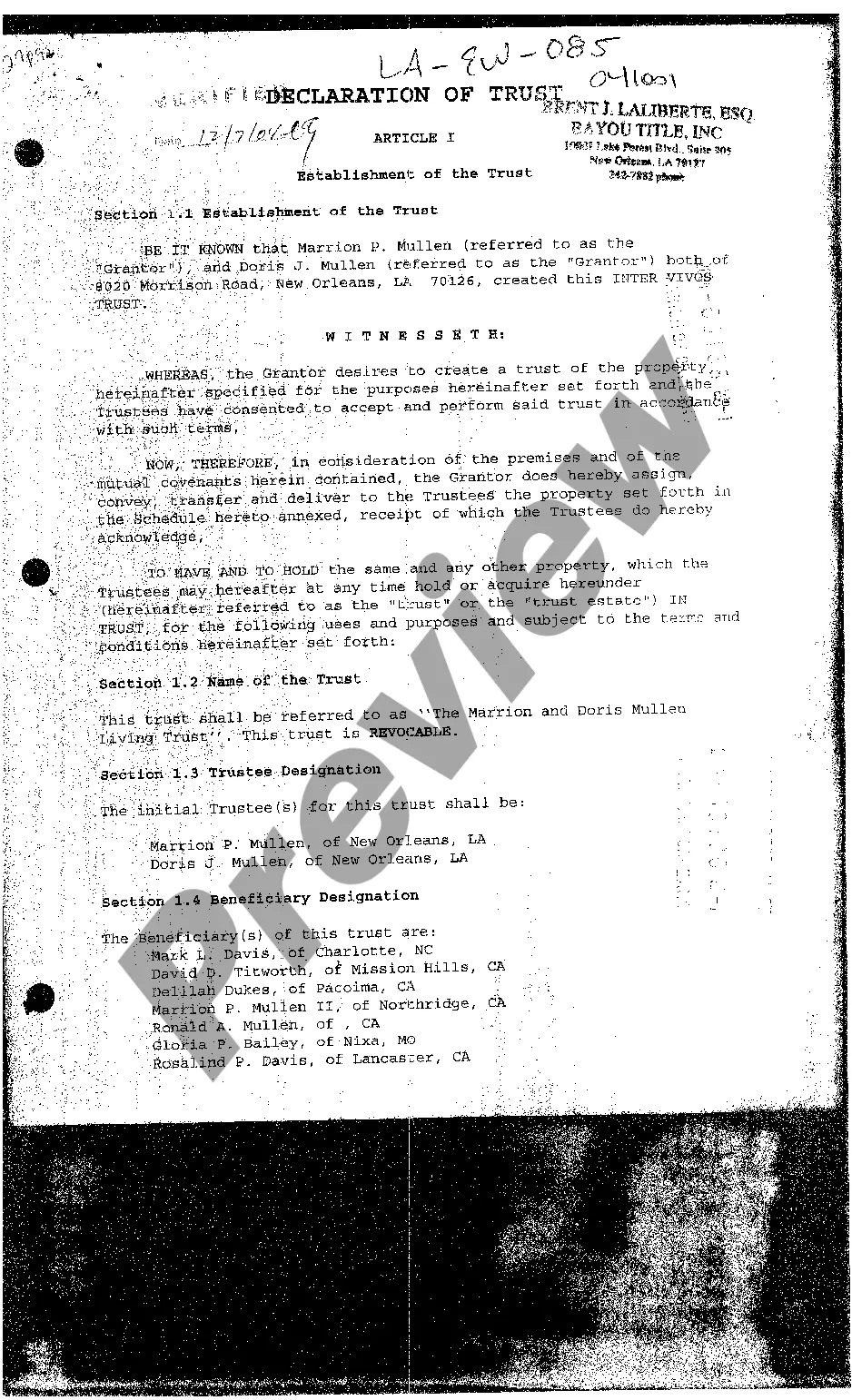

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Suffolk New York Notice to Debt Collector — Falsely Representing a Document is Legal Process In Suffolk County, New York, it is essential for individuals to understand their rights when dealing with debt collectors. One crucial aspect to be aware of is the use of false representation of a document as legal process by debt collectors. This deceptive tactic is prohibited by both state and federal laws, and individuals have the right to take action against any violation. When a debt collector falsely represents a document as legal process, they aim to intimidate or mislead debtors into believing that legal action has been initiated against them. Such deceptive practices can lead to unnecessary stress, confusion, and potential harm to the consumer. In Suffolk County, there are several types of notices that debt collectors may provide in such instances: 1. Suffolk New York Notice to Debt Collector — Falsely Representing a Summons: This notice applies when a debt collector attempts to pass off a document as a court summons or any other official legal notification. It highlights the illegality of misrepresenting any document to create a false impression of legal action being taken. 2. Suffolk New York Notice to Debt Collector — Falsely Representing a Court Order: Debt collectors occasionally present a document as a court order to coerce debtors into believing that the court has issued a judgment against them. This notice emphasizes that creditors cannot falsely claim authority from a court through fraudulent documentation. 3. Suffolk New York Notice to Debt Collector — Falsely Representing an Attorney's Letter: Some debt collectors may send intimidating letters disguised as correspondence from an attorney, misleading debtors into thinking they are facing legal consequences. This notice clarifies that sending fabricated attorney letters is not permitted. Regardless of the specific types of notices, individuals in Suffolk County should be aware of their rights and be vigilant in identifying any deceptive practices employed by debt collectors. If a person believes that a debt collector has falsely represented a document as legal process, several actions can be taken: 1. Document Preservation: It is crucial to retain any mailing envelopes, letters, emails, or other communications received from the debt collector. These pieces of evidence will help build a strong case against misconduct. 2. Complaint Filing: Individuals can file a complaint with the New York Attorney General's office, the Federal Trade Commission (FTC), or the Consumer Financial Protection Bureau (CFPB) to report the violation. Providing detailed information about the incident and including copies of relevant documentation will support the investigation. 3. Consultation with an Attorney: Seeking legal advice from an experienced consumer protection attorney can help determine the best course of action. They can guide individuals through the process of filing a lawsuit against the debt collector in question, seeking damages, and preventing further harassment. In conclusion, individuals in Suffolk County, New York, must be aware of their rights when it comes to debt collection practices. Debt collectors are prohibited from falsely representing any document as legal process. By understanding the different types of notices related to this violation and taking appropriate actions, individuals can protect themselves from deceptive tactics and potential harm.