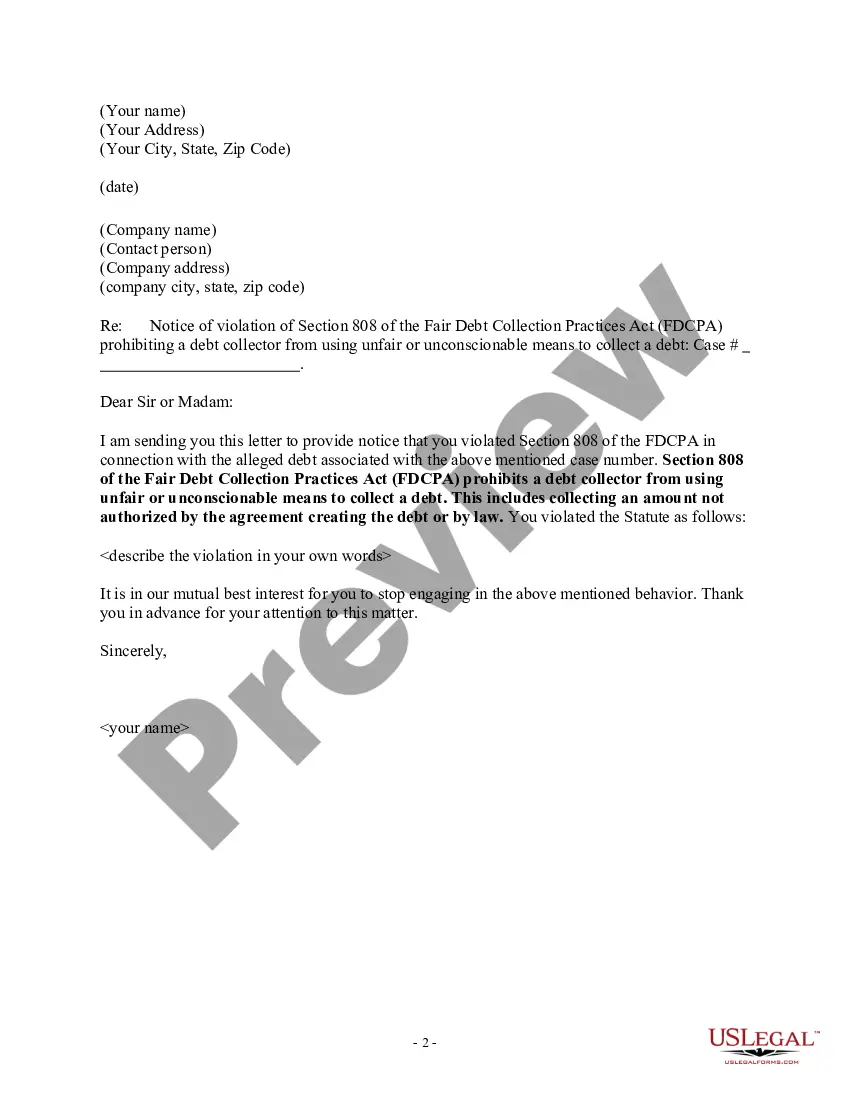

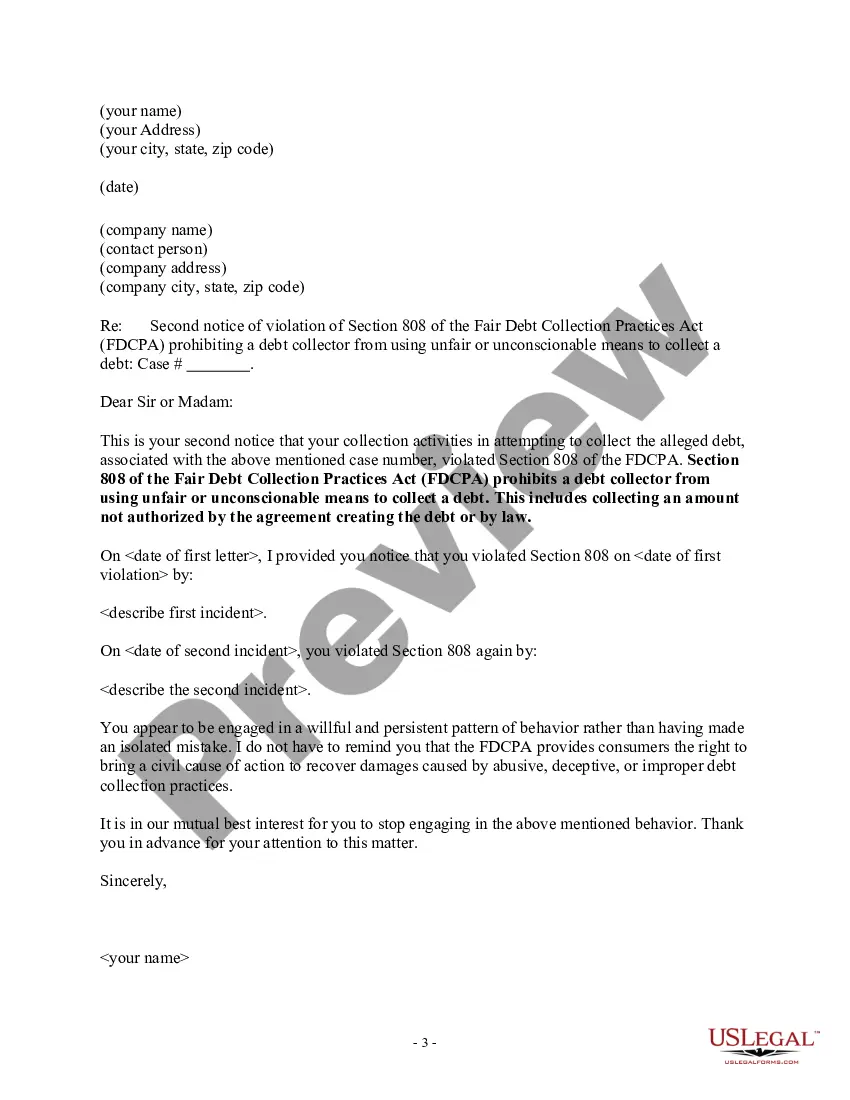

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law. Alameda, California: An Overview of Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law Alameda, California is a vibrant city located in Alameda County, California, United States. Known for its beautiful coastal scenery and rich cultural history, Alameda is home to a diverse community and offers a wide range of recreational and entertainment opportunities. One important aspect of living in Alameda is being informed about consumer rights, including protections against unethical debt collection practices. Consumers are entitled to receive fair treatment from debt collectors and should be aware of their rights when it comes to debt collection. In Alameda, California, a specific type of notice to debt collector exists, specifically targeting instances where an amount is being collected that is not authorized by agreement or by law. This notice functions as a form of legal protection for individuals who believe they are being harassed or unfairly treated by debt collectors. Here are some relevant keywords to further explore Alameda, California's Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law: 1. Debt Collection Practices: Understanding the legal framework governing debt collection practices is crucial for consumers dealing with debt collectors. This includes knowing what actions are considered legal and ethical, and what crosses the line into illegal harassment. 2. Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law that regulates debt collection practices and protects consumers from abusive, deceptive, and unfair treatment. It sets guidelines for debt collectors' conduct, including restrictions on the amount they can collect. 3. Unfair or Deceptive Acts or Practices (UDP): State laws exist in California, including Alameda, that prohibit debt collectors from engaging in unfair or deceptive acts or practices. These laws reinforce the protections provided by the FD CPA and may offer additional safeguards to consumers. 4. Unauthorized Collection Amounts: Debt collectors must adhere to the agreed-upon terms or applicable laws when collecting debts. However, some collectors may attempt to collect amounts that are not valid or authorized, such as unauthorized fees or inflated charges. The notice to the debt collector comes into play when a consumer realizes such discrepancies exist and seeks to rectify the situation. 5. Cease and Desist Letter: In some cases, when a debt collector continues to engage in unlawful collection practices, a consumer may need to send a cease and desist letter. This communication demands that the debt collector stops all communication and collection attempts. Knowing the proper steps to take when dealing with unlawful debt collection practices is essential for protecting one's rights. It is important for consumers to consult with legal professionals, such as attorneys specializing in consumer law or credit counseling agencies, to fully understand their rights and options when faced with unlawful debt collection practices. By being well-informed about their rights under the law, individuals in Alameda, California can ensure they are treated fairly and avoid unnecessary financial stress.

Alameda, California: An Overview of Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law Alameda, California is a vibrant city located in Alameda County, California, United States. Known for its beautiful coastal scenery and rich cultural history, Alameda is home to a diverse community and offers a wide range of recreational and entertainment opportunities. One important aspect of living in Alameda is being informed about consumer rights, including protections against unethical debt collection practices. Consumers are entitled to receive fair treatment from debt collectors and should be aware of their rights when it comes to debt collection. In Alameda, California, a specific type of notice to debt collector exists, specifically targeting instances where an amount is being collected that is not authorized by agreement or by law. This notice functions as a form of legal protection for individuals who believe they are being harassed or unfairly treated by debt collectors. Here are some relevant keywords to further explore Alameda, California's Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law: 1. Debt Collection Practices: Understanding the legal framework governing debt collection practices is crucial for consumers dealing with debt collectors. This includes knowing what actions are considered legal and ethical, and what crosses the line into illegal harassment. 2. Fair Debt Collection Practices Act (FD CPA): The FD CPA is a federal law that regulates debt collection practices and protects consumers from abusive, deceptive, and unfair treatment. It sets guidelines for debt collectors' conduct, including restrictions on the amount they can collect. 3. Unfair or Deceptive Acts or Practices (UDP): State laws exist in California, including Alameda, that prohibit debt collectors from engaging in unfair or deceptive acts or practices. These laws reinforce the protections provided by the FD CPA and may offer additional safeguards to consumers. 4. Unauthorized Collection Amounts: Debt collectors must adhere to the agreed-upon terms or applicable laws when collecting debts. However, some collectors may attempt to collect amounts that are not valid or authorized, such as unauthorized fees or inflated charges. The notice to the debt collector comes into play when a consumer realizes such discrepancies exist and seeks to rectify the situation. 5. Cease and Desist Letter: In some cases, when a debt collector continues to engage in unlawful collection practices, a consumer may need to send a cease and desist letter. This communication demands that the debt collector stops all communication and collection attempts. Knowing the proper steps to take when dealing with unlawful debt collection practices is essential for protecting one's rights. It is important for consumers to consult with legal professionals, such as attorneys specializing in consumer law or credit counseling agencies, to fully understand their rights and options when faced with unlawful debt collection practices. By being well-informed about their rights under the law, individuals in Alameda, California can ensure they are treated fairly and avoid unnecessary financial stress.