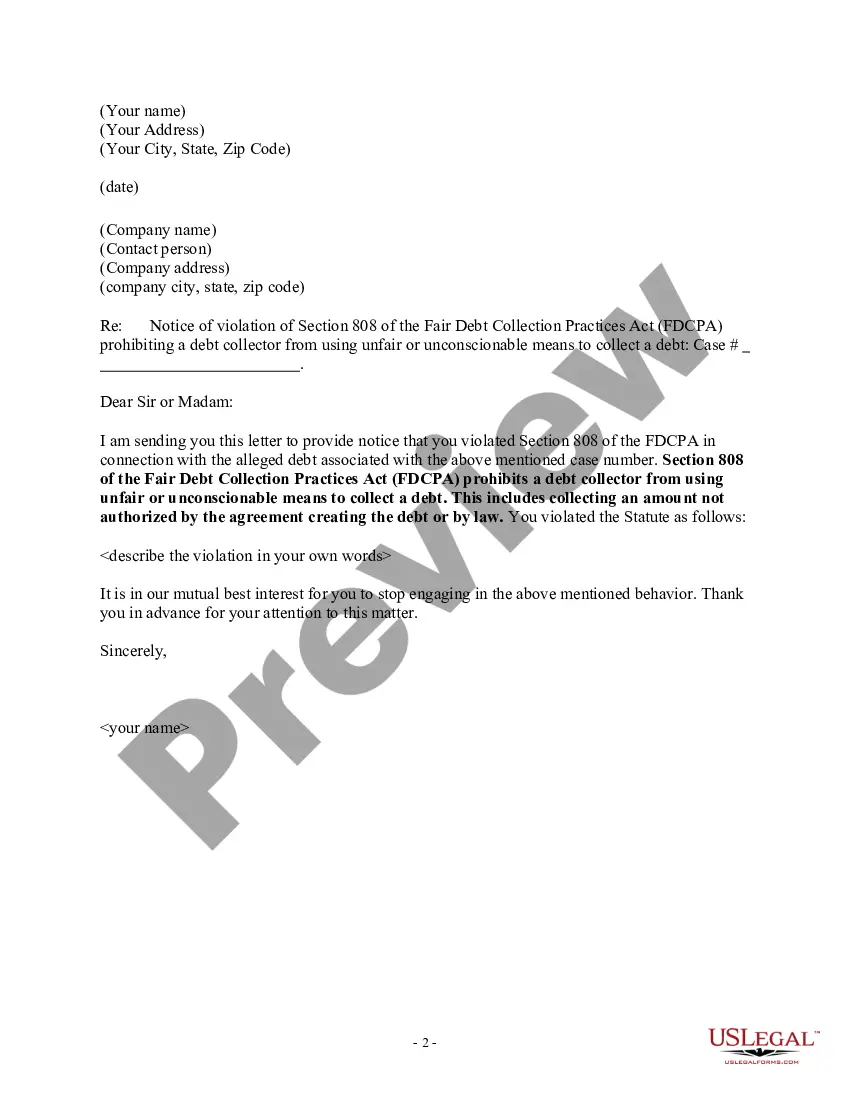

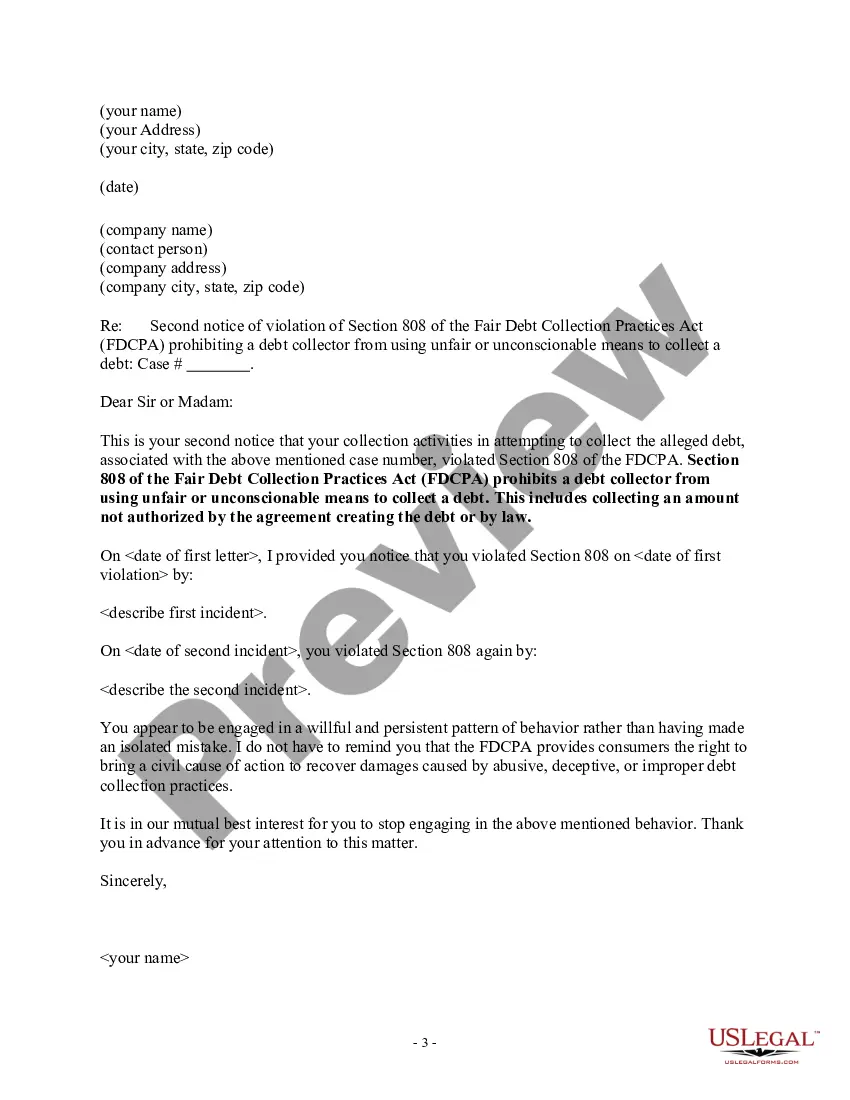

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law. Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law In Chicago, Illinois, individuals have legal protections against debt collectors who attempt to collect an amount that is not authorized by agreement or by law. This notice serves as a warning to debt collectors, informing them that their actions are in violation of the law and must cease immediately. Under the Fair Debt Collection Practices Act (FD CPA) and the Illinois Collection Agency Act, debt collectors are prohibited from collecting any amount that is not authorized by a signed agreement or mandated by law. This means that they cannot impose additional charges, fees, or interest beyond what is originally agreed upon or permitted by relevant legislation. It is crucial for individuals to understand their rights and options when faced with debt collectors who are unlawfully demanding more than they are entitled to. The Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law is designed to protect consumers and ensure fair debt collection practices. Different Types of Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law: 1. Formal Notice to Debt Collector: This type of notice is an official communication that individuals can send to debt collectors who are attempting to collect an amount not authorized by agreement or by law. It outlines the specific violations committed by the debt collector and warns them of the legal consequences if they continue their unlawful behavior. 2. Cease and Desist Letter: This is another form of notice that individuals can use to inform debt collectors that their actions are in violation of the law. A cease and desist letter demands that the debt collector immediately stop attempting to collect any amount that exceeds what is authorized by agreement or by law. 3. Complaint Filing: If the debt collector continues to collect an unauthorized amount despite receiving a formal notice or cease and desist letter, individuals have the option to file a complaint with the appropriate regulatory authorities. Complaints can be submitted to agencies such as the Consumer Financial Protection Bureau (CFPB) or the Illinois Attorney General's Office. These agencies have the power to investigate the violations and take legal action against the debt collector if necessary. It is essential for individuals to remember that they have rights and protections when dealing with debt collectors. They should not be subjected to unfair or unlawful debt collection practices. By utilizing the Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law and pursuing appropriate action, individuals can assert their rights and seek resolution against unscrupulous debt collectors.

Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law In Chicago, Illinois, individuals have legal protections against debt collectors who attempt to collect an amount that is not authorized by agreement or by law. This notice serves as a warning to debt collectors, informing them that their actions are in violation of the law and must cease immediately. Under the Fair Debt Collection Practices Act (FD CPA) and the Illinois Collection Agency Act, debt collectors are prohibited from collecting any amount that is not authorized by a signed agreement or mandated by law. This means that they cannot impose additional charges, fees, or interest beyond what is originally agreed upon or permitted by relevant legislation. It is crucial for individuals to understand their rights and options when faced with debt collectors who are unlawfully demanding more than they are entitled to. The Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law is designed to protect consumers and ensure fair debt collection practices. Different Types of Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law: 1. Formal Notice to Debt Collector: This type of notice is an official communication that individuals can send to debt collectors who are attempting to collect an amount not authorized by agreement or by law. It outlines the specific violations committed by the debt collector and warns them of the legal consequences if they continue their unlawful behavior. 2. Cease and Desist Letter: This is another form of notice that individuals can use to inform debt collectors that their actions are in violation of the law. A cease and desist letter demands that the debt collector immediately stop attempting to collect any amount that exceeds what is authorized by agreement or by law. 3. Complaint Filing: If the debt collector continues to collect an unauthorized amount despite receiving a formal notice or cease and desist letter, individuals have the option to file a complaint with the appropriate regulatory authorities. Complaints can be submitted to agencies such as the Consumer Financial Protection Bureau (CFPB) or the Illinois Attorney General's Office. These agencies have the power to investigate the violations and take legal action against the debt collector if necessary. It is essential for individuals to remember that they have rights and protections when dealing with debt collectors. They should not be subjected to unfair or unlawful debt collection practices. By utilizing the Chicago Illinois Notice to Debt Collector — Collecting an Amount Not Authorized by Agreement or by Law and pursuing appropriate action, individuals can assert their rights and seek resolution against unscrupulous debt collectors.