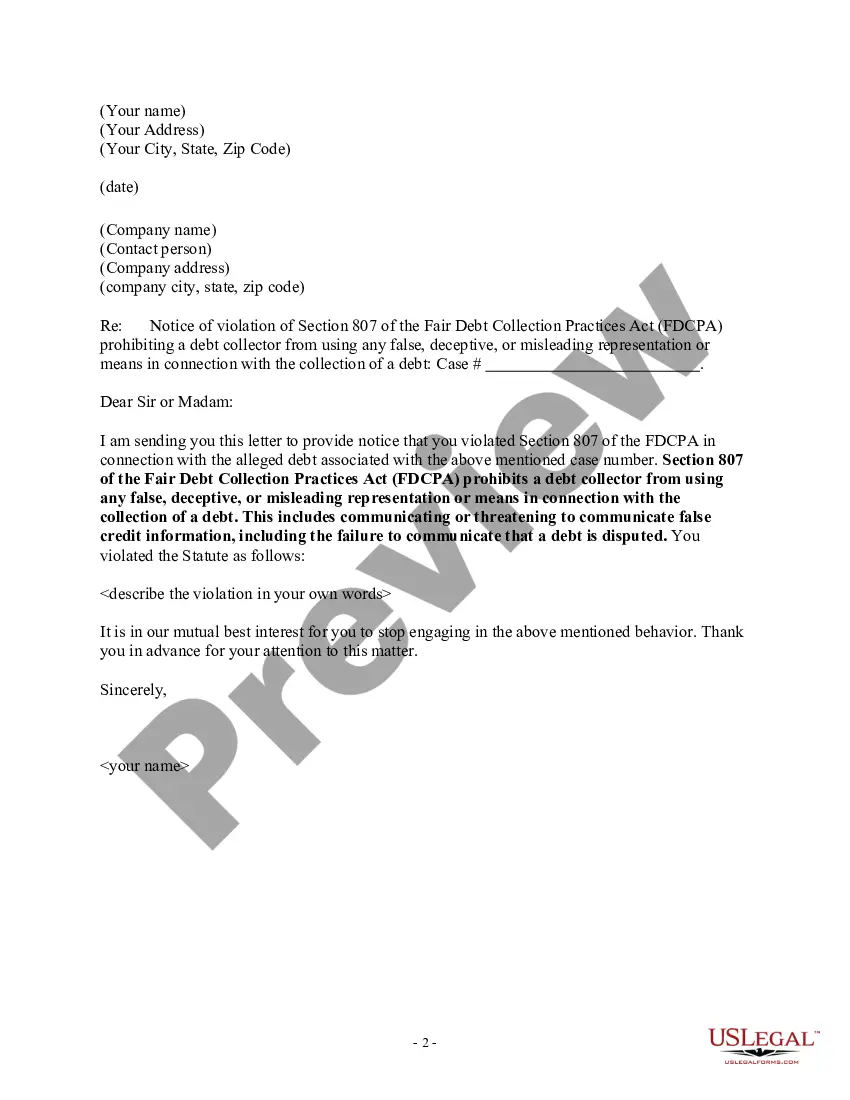

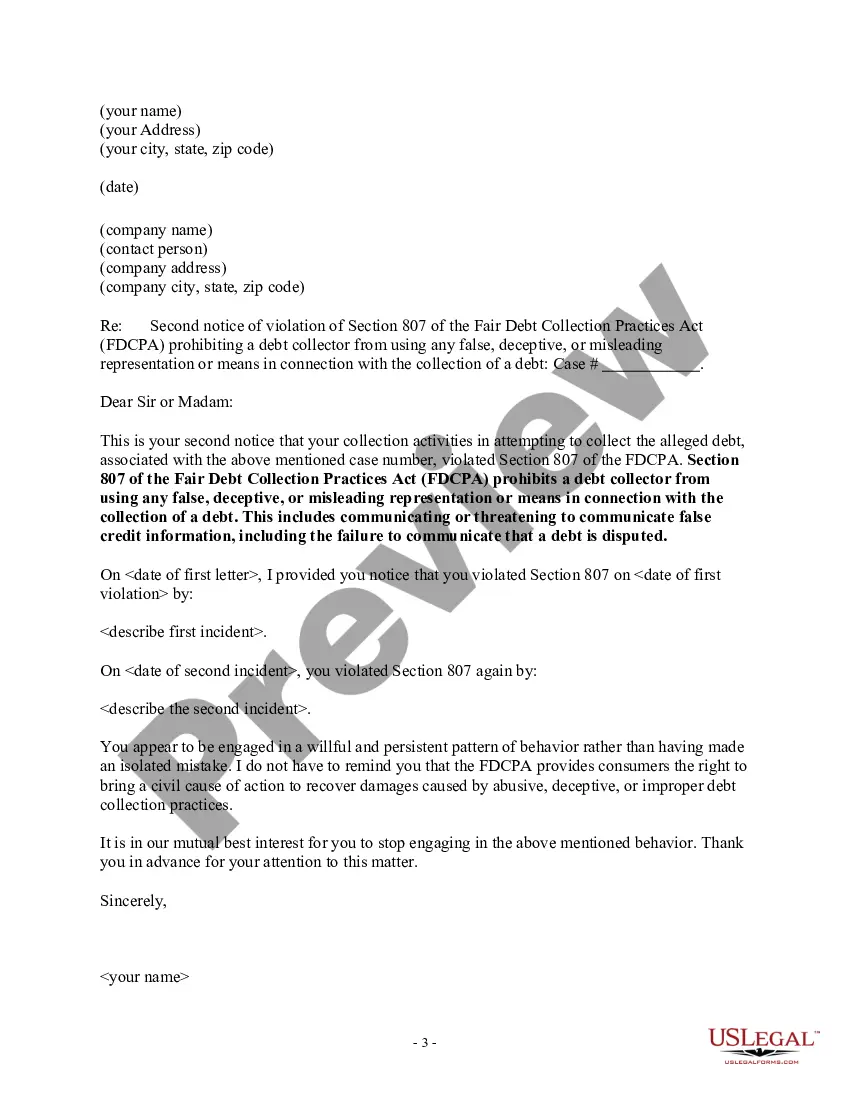

Chicago, Illinois Notice of Violation of Fair Debt Act — False Information Disclosed The city of Chicago, Illinois takes the fair treatment of consumers seriously, particularly in terms of debt collection practices. The Notice of Violation of Fair Debt Act — False Information Disclosed serves as a formal document informing individuals that their rights as debtors have been violated, specifically in regard to false information being disclosed. This violation is governed by the Fair Debt Collection Practices Act (FD CPA), a federal law designed to protect consumers from unfair and abusive debt collection practices. Types of Chicago Illinois Notice of Violation of Fair Debt Act — False Information Disclosed: 1. False Credit Reporting: This type of violation occurs when incorrect or inaccurate information regarding an individual's debt is reported to credit bureaus without proper verification. It can result in negative impacts on the debtor's credit score and overall financial well-being. 2. Misrepresentation of Debt: This violation involves debt collectors misrepresenting the amount, nature, or legal status of a debt to deceive or mislead the debtor. Companies may inflate the amount owed, misstate the collection agency's affiliation, or make false threats of legal actions, leading to unnecessary stress and financial burden. 3. Unauthorized Disclosure: This violation occurs when a debt collector discloses sensitive personal information about the debtor to unauthorized third parties, such as friends, family, or employers. Such unauthorized disclosure can be embarrassing, damaging to relationships, and may even violate the debtor's right to privacy. 4. False Threats and Harassment: This includes any form of harassment, abusive language, or false threats made by debt collectors to coerce debtors into paying their debts. Common examples include threatening legal action or wage garnishment that the collector has no intention of pursuing. Receiving a Chicago Illinois Notice of Violation of Fair Debt Act — False Information Disclosed is an indication that a debt collector or agency has engaged in one or more of these unlawful practices. Debtors who believe they have been subjected to such violations should consult legal professionals well-versed in the FD CPA to seek appropriate remedies and protection of their rights. It is essential to take prompt action to respond to the notice and document any evidence that supports the violation claims, as this can strengthen the case against the offending debt collector.

Chicago Illinois Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Chicago Illinois Notice Of Violation Of Fair Debt Act - False Information Disclosed?

Draftwing paperwork, like Chicago Notice of Violation of Fair Debt Act - False Information Disclosed, to manage your legal affairs is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms intended for a variety of cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Chicago Notice of Violation of Fair Debt Act - False Information Disclosed form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Chicago Notice of Violation of Fair Debt Act - False Information Disclosed:

- Make sure that your template is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Chicago Notice of Violation of Fair Debt Act - False Information Disclosed isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and download the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!