Alameda is a charming city located in the beautiful state of California, known for its historic neighborhoods, picturesque views, and vibrant community. Situated on the San Francisco Bay, Alameda offers its residents and visitors a unique blend of suburban tranquility and urban excitement. When it comes to the Fair Debt Act, individuals or entities who believe that a creditor has misrepresented themselves in Alameda, California, have the right to file a notice of violation. This notice serves as a formal complaint against the creditor, alleging that they have engaged in deceptive practices in relation to debt collection. The Fair Debt Act aims to protect consumers from unfair and misleading actions by debt collectors. If a creditor misrepresents themselves in Alameda, it can include actions such as falsely claiming to be someone they are not, providing inaccurate information about the debt or the debtor's rights, or using abusive or harassing tactics during debt collection. It's important to note that there may be different types of violations of the Fair Debt Act in Alameda, California: 1. False Identity Representation: This occurs when a creditor deliberately assumes a false identity or pretends to be someone else, such as a government official or law enforcement officer, to intimidate or deceive the debtor. 2. Misleading Information: Creditors may provide inaccurate or misleading information about the amount owed, interest rates, penalties, or the legal consequences of non-payment. They may also misrepresent the debtor's rights or the options available for resolving the debt. 3. Abusive or Harassing Tactics: This involves the use of aggressive, threatening, or abusive language or behavior during the debt collection process. This can include constant calls, insults, intimidation, or any form of harassment designed to coerce the debtor into payment. When filing a Notice of Violation of Fair Debt Act — Creditor Misrepresented Himself in Alameda, California, it's important to include relevant keywords such as Fair Debt Act, creditor misrepresentation, debt collection practices, deceptive tactics, false identity representation, misleading information, abusive behavior, and consumer protection. By bringing attention to these violations, individuals are taking necessary steps to safeguard their rights and ensure that creditors adhere to the regulations set by the Fair Debt Act.

Alameda California Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Alameda California Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

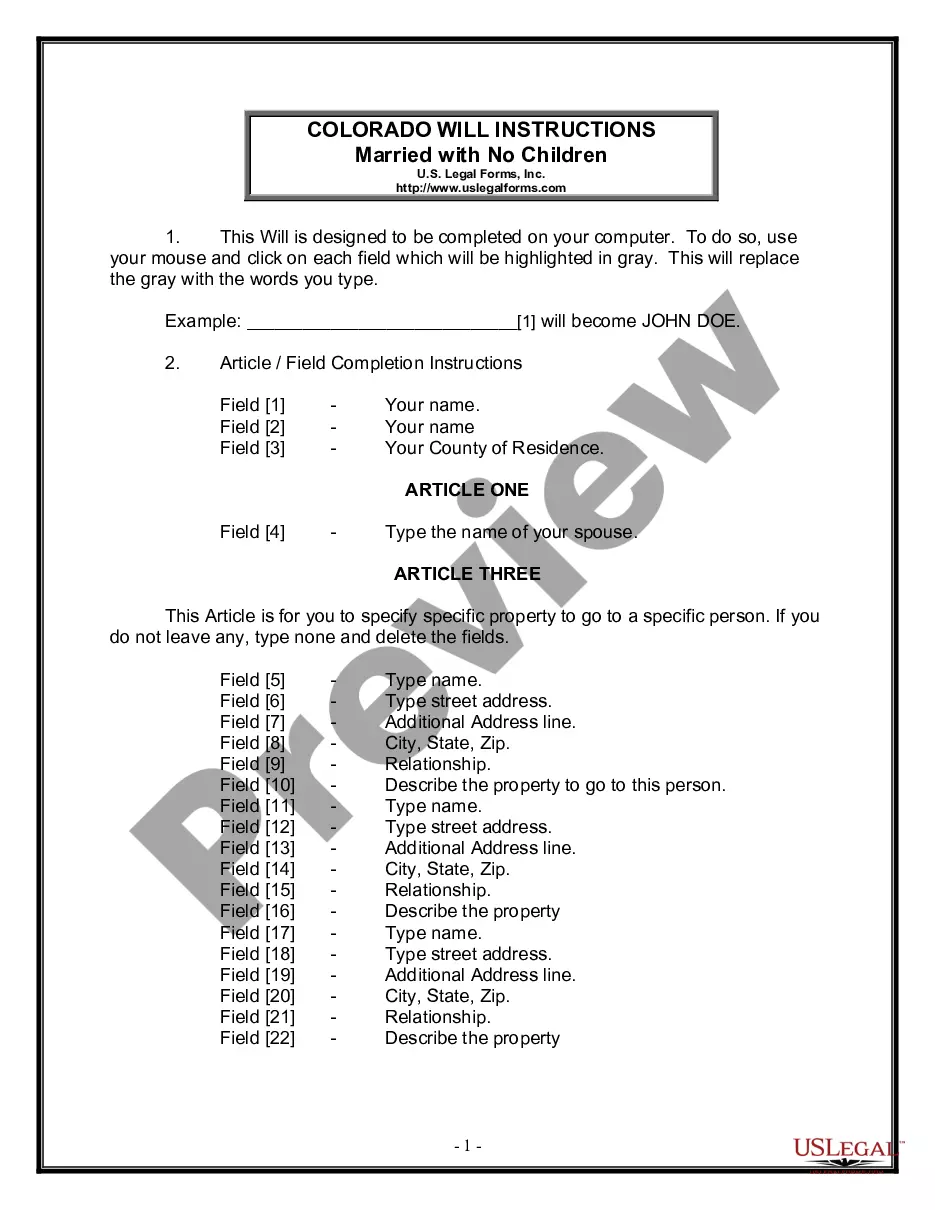

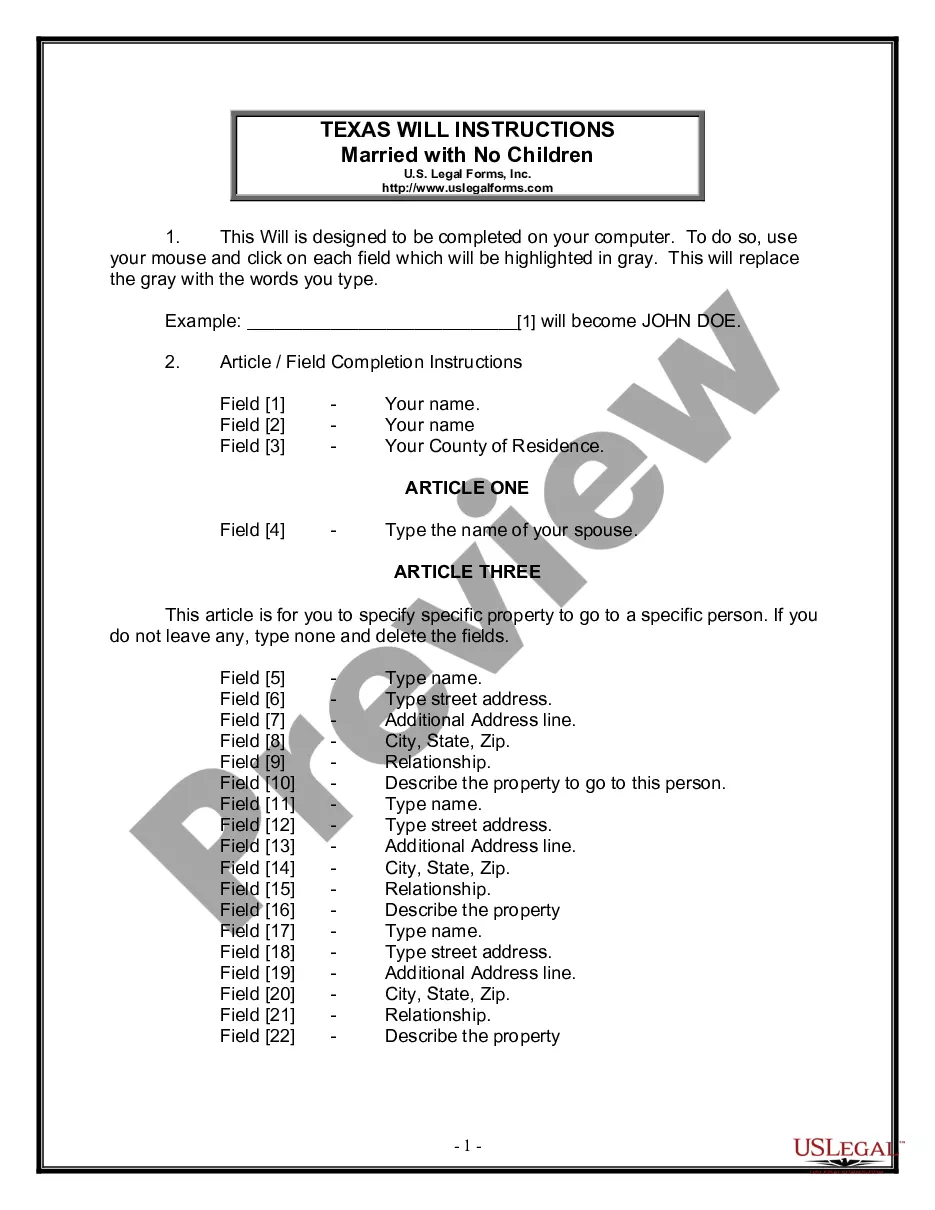

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Alameda Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any tasks related to document execution simple.

Here's how you can purchase and download Alameda Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related document templates or start the search over to locate the correct document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and purchase Alameda Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Alameda Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, log in to your account, and download it. Needless to say, our website can’t replace an attorney entirely. If you need to deal with an extremely challenging case, we recommend using the services of an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork with ease!

Form popularity

FAQ

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

What are the provisions of the FDCPA? Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Ask for a Goodwill Deletion If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Ask the debt collector if they own the debt. If not, you still might be able to negotiate with the original creditor. Often the last straw, the original creditor might sell the debt to a collection agency. In this case, the debt collector owns the debt, so any payment is made to the collection agency.

If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed. However, if they are a result of missed payments on accounts you own, disputing them will not change your credit file.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Interesting Questions

More info

The Medical Group is allowed to obtain a loan. In order to obtain the loan, the Medical Group must provide information to the Loan Officer about how much the loan applicant owes. This information is used by the Loan Officer to determine whether to loan money to the applicant, and to pay the applicant. The Loan Officer may not consider any other information, except the amount of the applicant's wages. The Loan Officer is required to tell the Medical Group all information about the applicant. The Medical Group may get medical certificates of health, to determine the suitability or ability of the applicant. (No medical certificates have been available to me until the past week, but it was my understanding that the law is that a qualified physician can obtain such a certificate. The applicant cannot be the applicant's employer: the medical examiner or the Loan Officer). The Loan Officer determines whether the applicant is able to repay the Loan Officer's loan.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.