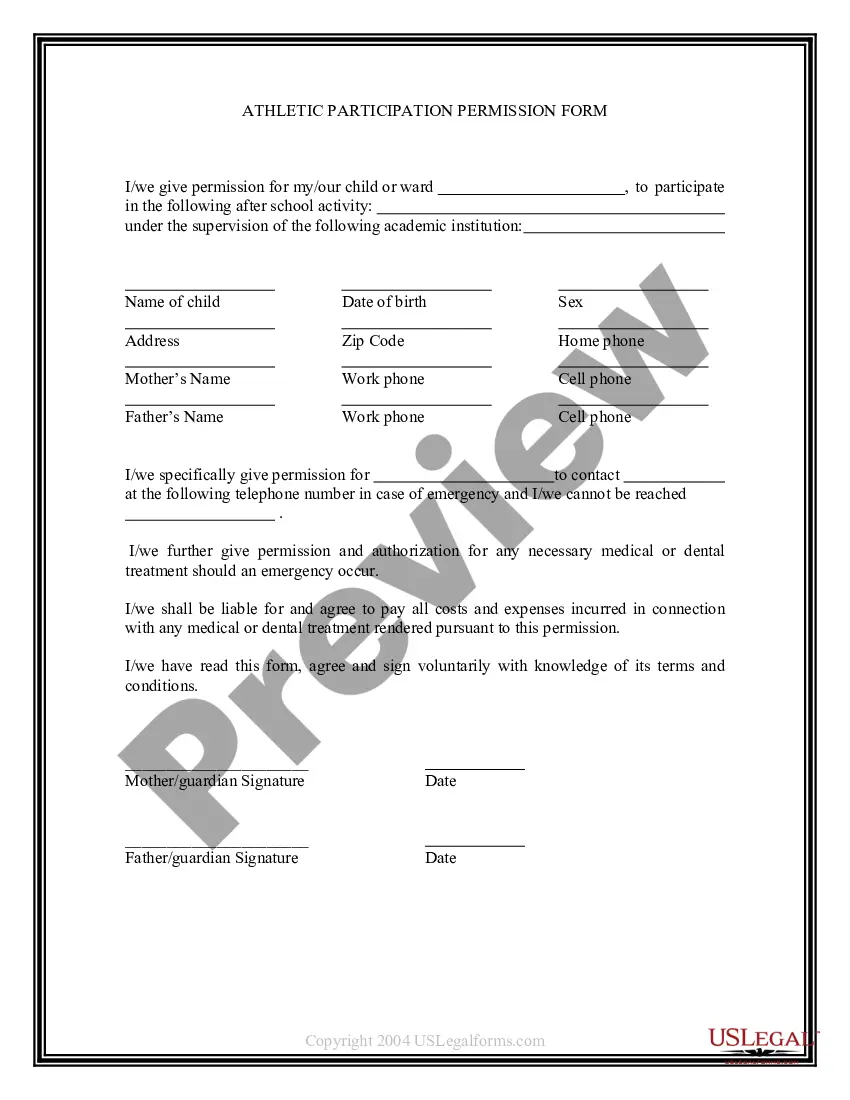

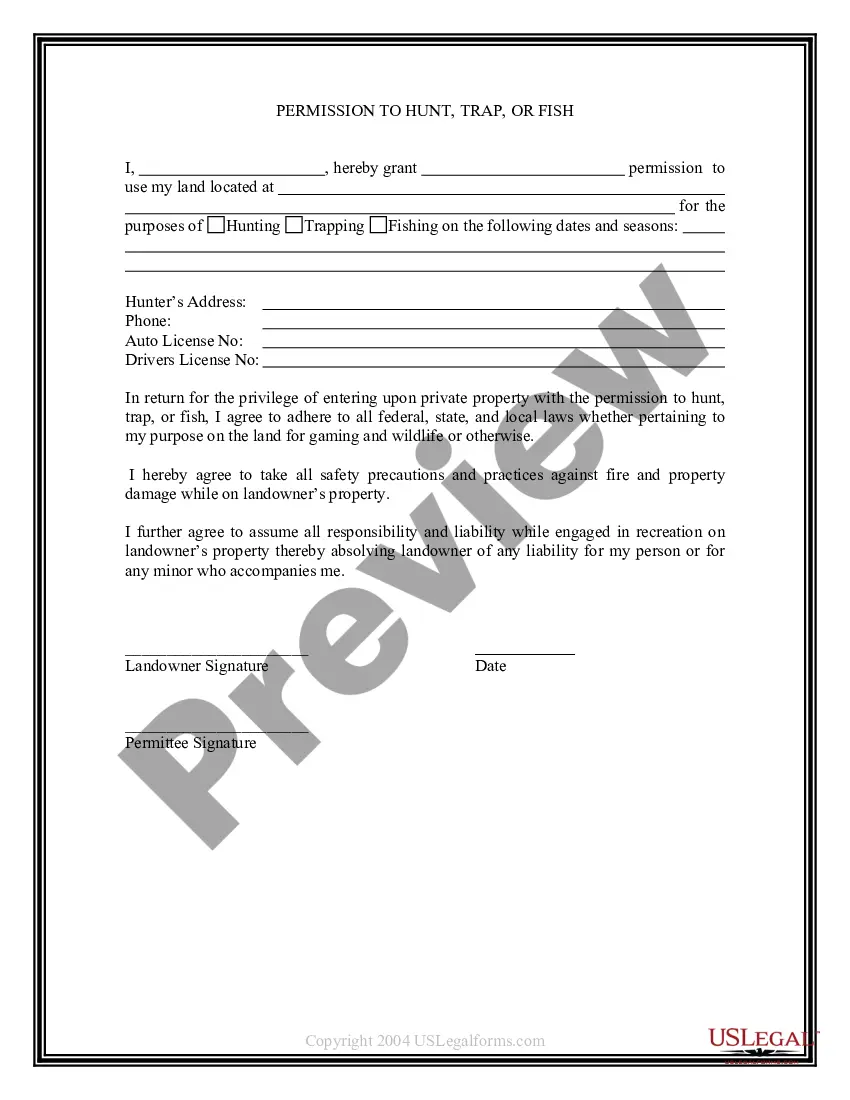

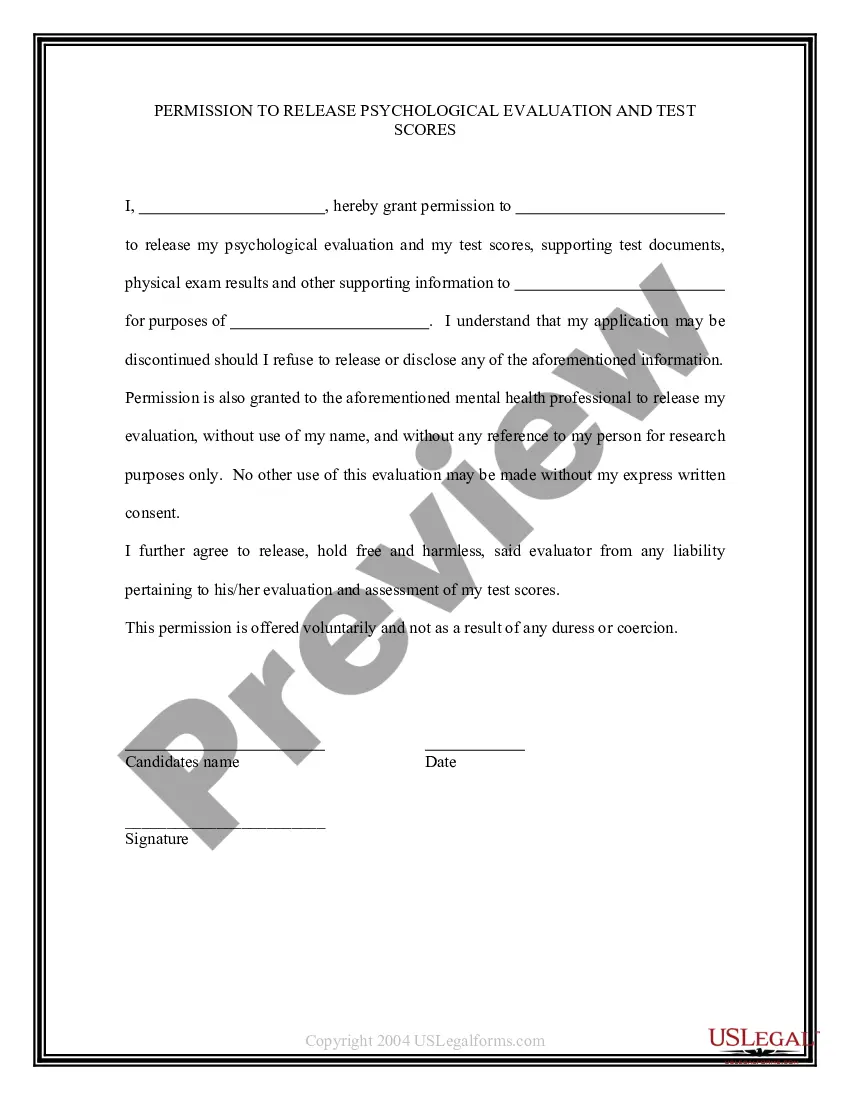

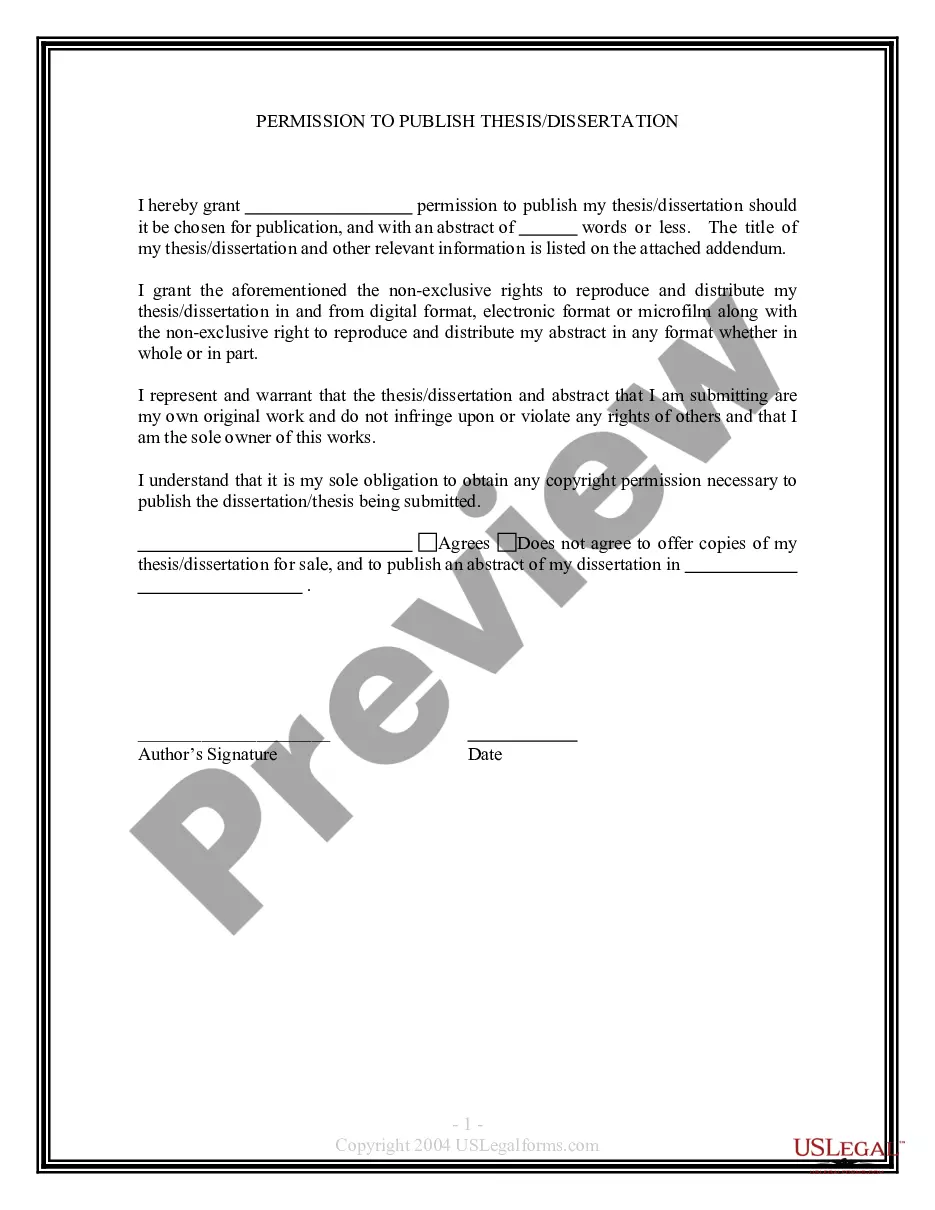

Santa Clara California offers a variety of Basic Debt Instrument Work forms to meet the financing needs of the city. These work forms are designed to provide a detailed understanding of the debt instruments used by the city to fund various projects and initiatives. The Basic Debt Instrument Work form outlines the key features and terms of the debt instruments issued by the city. It provides comprehensive information regarding the purpose of the debt, the amount to be borrowed, interest rates, maturity dates, repayment terms, and any additional covenants or clauses. The types of Santa Clara California Basic Debt Instrument Work forms include: 1. General Obligation Bonds: These work forms focus on debt instruments issued by the city backed by the full faith and credit of the city, which means that the repayment is guaranteed by the city's general taxing power. These bonds are commonly used to fund infrastructure projects such as schools, roads, and parks. 2. Revenue Bonds: Revenue bond work forms specifically outline debt instruments issued by Santa Clara California that are supported by the revenue generated from a specific project or source, such as tolls, fees, or charges. These bonds are typically utilized to fund revenue-generating projects like airports, toll roads, or utilities. 3. Lease Revenue Bonds: Santa Clara California’s lease revenunonworkrformSMSms describe debt instruments issued by the city, secured by lease payments from a specific facility or property. These bonds are commonly used to finance projects like public buildings or facilities, with lease payments covering both principal and interest. 4. Tax Increment Financing (TIF) Bonds: TIF bond work forms detail debt instruments issued under a tax increment financing district, where future property tax revenue growth is used to repay the bonds. Such bonds are often utilized to fund redevelopment and infrastructure projects aimed at revitalizing specific areas of the city. 5. Certificates of Participation (Cops): COP work forms provide information on debt instruments issued by Santa Clara California backed by lease payments, like lease revenue bonds. COP sallow investors to participate in the ownership of the underlying leased asset, such as a public building or facility. Each Basic Debt Instrument Work form offers a comprehensive understanding of the specific debt instrument's characteristics, repayment structure, and the obligations of both the municipality and the investors. These documents play a critical role in ensuring transparency and accountability in Santa Clara California's financial operations.

Santa Clara California Basic Debt Instrument Workform

Description

How to fill out Santa Clara California Basic Debt Instrument Workform?

Drafting documents for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Santa Clara Basic Debt Instrument Workform without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Santa Clara Basic Debt Instrument Workform by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Santa Clara Basic Debt Instrument Workform:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!