Fairfax Virginia Employee Benefit Plan Document Checklist is a comprehensive document that outlines the necessary requirements, provisions, and guidelines for various employee benefit plans in Fairfax, Virginia. This checklist ensures compliance with relevant state and federal laws while facilitating proper documentation and administration of employee benefits. It is essential for employers and HR professionals to follow this checklist to ensure that employee benefit plans are structured and managed appropriately. The Fairfax Virginia Employee Benefit Plan Document Checklist includes several key components that must be addressed to develop and maintain effective employee benefit plans. Some areas covered in this checklist are: 1. Eligibility Criteria: This section outlines the requirements for employee eligibility to participate in the benefit plans, including factors such as length of service, hours worked, and job classifications. 2. Plan Design: This section focuses on the specific benefit plans offered to employees, such as health insurance, retirement plans, life insurance, disability insurance, and flexible spending accounts. It details the features, options, and coverage levels available to employees. 3. Contributions and Funding: This section explains the employer's and employee's responsibility for contributing funds to different benefit plans, including contribution percentages, frequency, and methods of payment. 4. Vesting and Account Balances: Here, the checklist clarifies the rules regarding employee vesting rights in retirement plans and the management of account balances for various benefit accounts. 5. Reporting and Disclosure: This part highlights the employer's obligation to provide employees with information about their benefit plans, including plan summaries, annual reports, and updates to plan documents. 6. Compliance and Legal Requirements: This checklist ensures adherence to all applicable laws, such as the Employee Retirement Income Security Act (ERICA), the Internal Revenue Code, the Affordable Care Act (ACA), and state-specific regulations. Types of Fairfax Virginia Employee Benefit Plan Document Checklists may vary based on the specific benefit plans offered by employers. Some common types include: 1. Health Insurance Checklist: Specific to health insurance plans, this checklist covers aspects like enrollment procedures, coverage options, co-pays, and provider networks. 2. Retirement Plan Checklist: Focused on retirement plans like 401(k) or pension plans, this checklist addresses investment options, contribution limits, distribution rules, and fiduciary responsibilities. 3. Life Insurance and Disability Insurance Checklist: Designed to ensure proper documentation and administration of life and disability insurance plans, this checklist covers employee eligibility, coverage amounts, beneficiary designations, and claims procedures. 4. Flexible Spending Account Checklist: This checklist outlines the rules and procedures for employees to contribute pre-tax dollars to a healthcare or dependent care flexible spending account, including eligible expenses and reimbursement processes. By following the Fairfax Virginia Employee Benefit Plan Document Checklist and its specific types, employers can ensure compliance, transparency, and successful management of employee benefit plans, fostering a positive work environment and facilitating employee satisfaction and retention.

Fairfax Virginia Employee Benefit Plan Document Checklist

Description

How to fill out Fairfax Virginia Employee Benefit Plan Document Checklist?

Preparing papers for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Fairfax Employee Benefit Plan Document Checklist without expert assistance.

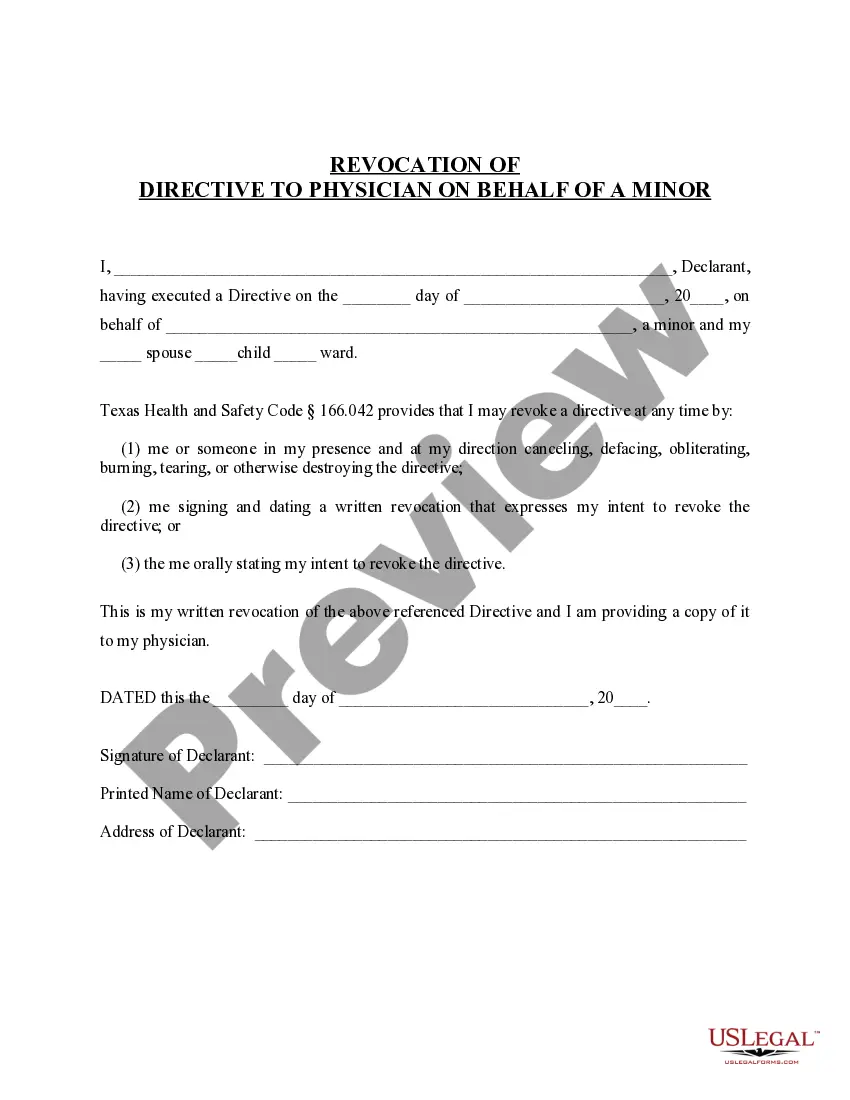

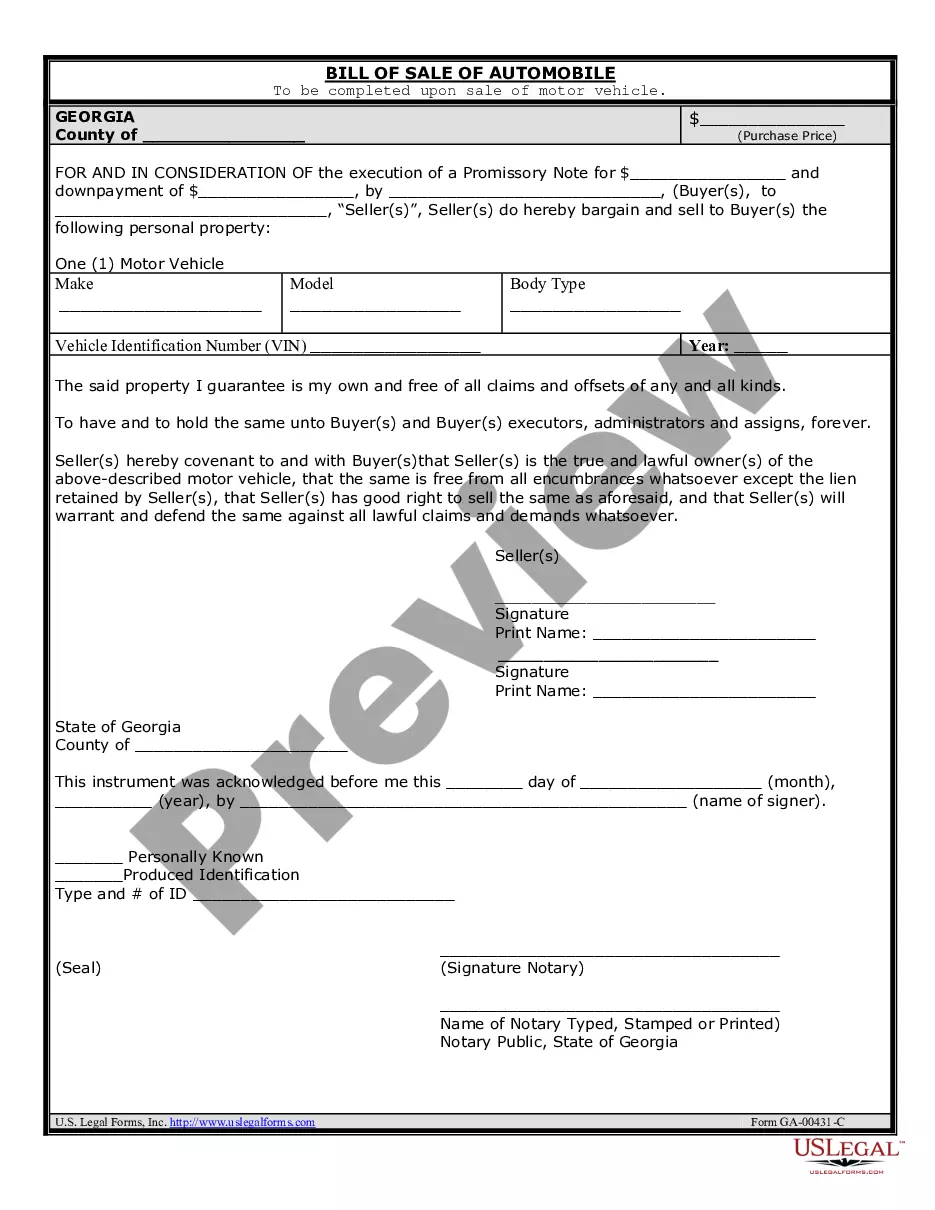

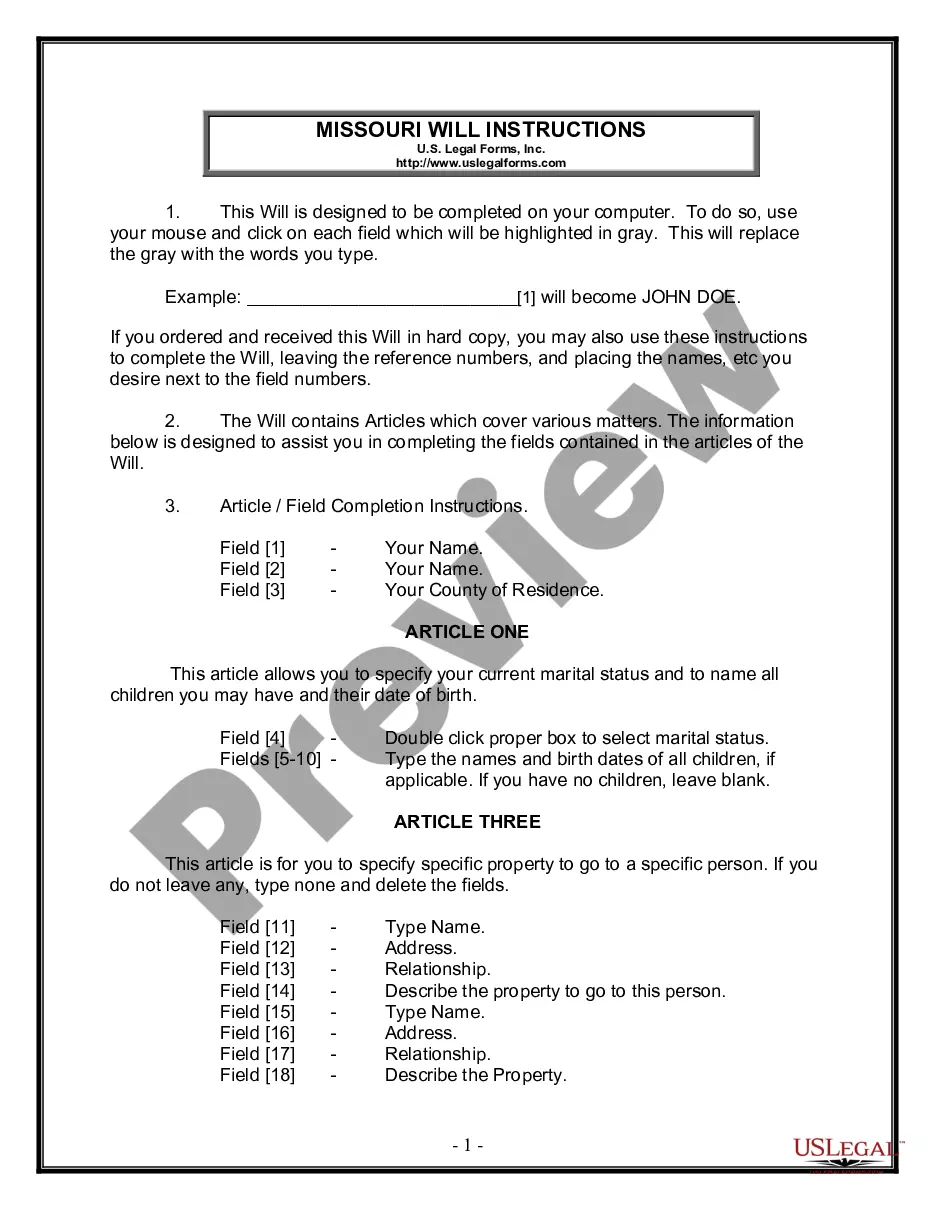

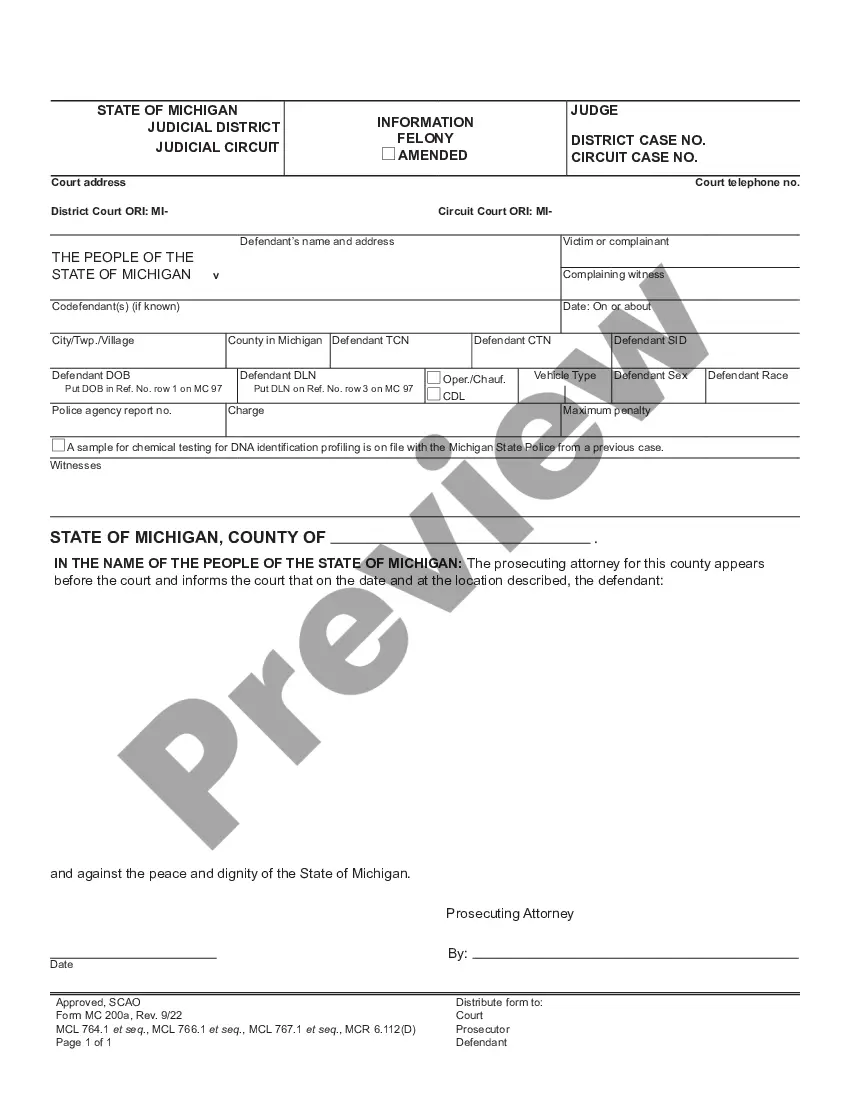

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Fairfax Employee Benefit Plan Document Checklist by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Fairfax Employee Benefit Plan Document Checklist:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Certain required benefits, like social security and workers' compensation, go into effect on an employee's first day of work. On the other hand, optional benefits, like health plans, can be largely within your control. Some businesses offer benefits to new employees immediately, others after 90 days.

Members include public school teachers, political subdivision employees (cities, towns, special authorities and commissions), state agency employees, public college and university personnel, state police, Virginia law officers and the judiciary. Approximately 835 employers participate in VRS.

The state of Virginia exempts all Social Security income from taxation.

The summary plan description is an important document that tells participants what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan and how to file a claim for benefits.

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that the participants of the benefits plan can easily understand it. Unlike the plan document, the SPD is required to be distributed to plan participants.

Participating employees, their spouses, and their dependents are eligible for Social Security retirement, disability, and survivor benefits. Social Security benefits are integrated with the County's retirement systems.

Calculate the average benefits load for all employees by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

VA employees are covered by the Federal Employees Retirement System (FERS). FERS is a three-tier retirement plan composed of Social Security benefits, FERS basic benefits and the Thrift Savings Plan (TSP).

The most common benefits are medical, disability, and life insurance; retirement benefits; paid time off; and fringe benefits. Benefits can be quite valuable.

When designing your benefits program, follow these six steps and apply them to whatever decision-making paradigm you use: Set Up a Budget.Decide Which Benefits to Include in Your Program.Analyze Total Compensation.Consider External Resources.Finalize Your Benefits Program.Roll Out the Plan to Employees.