Middlesex Massachusetts Employee Benefit Plan Document Checklist is a comprehensive tool used by employers in Middlesex County, Massachusetts, to ensure compliance with legal requirements and communicate necessary information about employee benefit plans effectively. This checklist helps employers organize important plan documents and maintain up-to-date records, ensuring smooth operations and adherence to regulatory standards. Key elements of the Middlesex Massachusetts Employee Benefit Plan Document Checklist include: 1. Plan Summary: A concise overview of the employee benefit plan, including its purpose, eligibility criteria, and effective dates. 2. Plan Documents: A checklist of essential plan documents that must be included, such as the plan's legal agreements, insurance policies, and administrative guidelines. This ensures that all necessary paperwork is in place and up to date. 3. Participant Communication: Guidelines for communicating the benefit plan details to employees, including the distribution of Summary Plan Descriptions (SPD), notices, and updates. This ensures employees understand their rights, responsibilities, and entitlements under the plan. 4. Eligibility Criteria: A detailed listing of the requirements employees must meet to qualify for different benefits offered by the plan, such as health insurance, retirement plans, disability coverage, and more. 5. Enrollment Procedures: A step-by-step guide for employees to enroll in the benefit plan during specific periods or due to qualifying life events. The checklist includes enrollment forms, deadlines, and instructions, ensuring a smooth enrollment process. 6. Contribution and Deduction Mechanisms: Documentation specifying the employer's and employees' contribution and deduction obligations for various benefits, such as a percentage of salary or fixed amount. 7. Vesting and Withdrawal Guidelines: Information regarding employees' ability to acquire ownership rights to employer contributions over time, the vesting schedule, and guidelines for withdrawal or rollover of funds in retirement plans. 8. Fiduciary Responsibilities: Outlines the responsibilities of plan fiduciaries, including investment managers and administrators, emphasizing their obligations to act prudently, avoid conflicts of interest, and adhere to ERICA (Employee Retirement Income Security Act) regulations. 9. Reporting and Disclosure Requirements: A checklist of reporting and disclosure obligations, such as filing Form 5500 annually, providing participant notices, and responding to external audit requirements. This ensures compliance with federal and state regulations. Different types of Middlesex Massachusetts Employee Benefit Plan Document Checklists may be tailored to specific industries, company sizes, or types of plans. For instance: 1. Middlesex Massachusetts Small Business Employee Benefit Plan Document Checklist: Designed for small businesses with fewer than 50 employees, this checklist caters to the specific needs and compliance requirements of such organizations. 2. Middlesex Massachusetts Health Insurance Plan Document Checklist: Focused on health insurance plans, this checklist emphasizes benefits, coverage details, and documentation relevant to medical, dental, or vision plans. 3. Middlesex Massachusetts Retirement Benefit Plan Document Checklist: Geared towards retirement plans, such as 401(k) or pension plans, this checklist emphasizes vesting schedules, contribution matching, and investment options. By utilizing the Middlesex Massachusetts Employee Benefit Plan Document Checklist, employers in Middlesex County can streamline their benefit plan administration, ensure regulatory compliance, and effectively communicate benefits to their employees.

Middlesex Massachusetts Employee Benefit Plan Document Checklist

Description

How to fill out Middlesex Massachusetts Employee Benefit Plan Document Checklist?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Middlesex Employee Benefit Plan Document Checklist, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

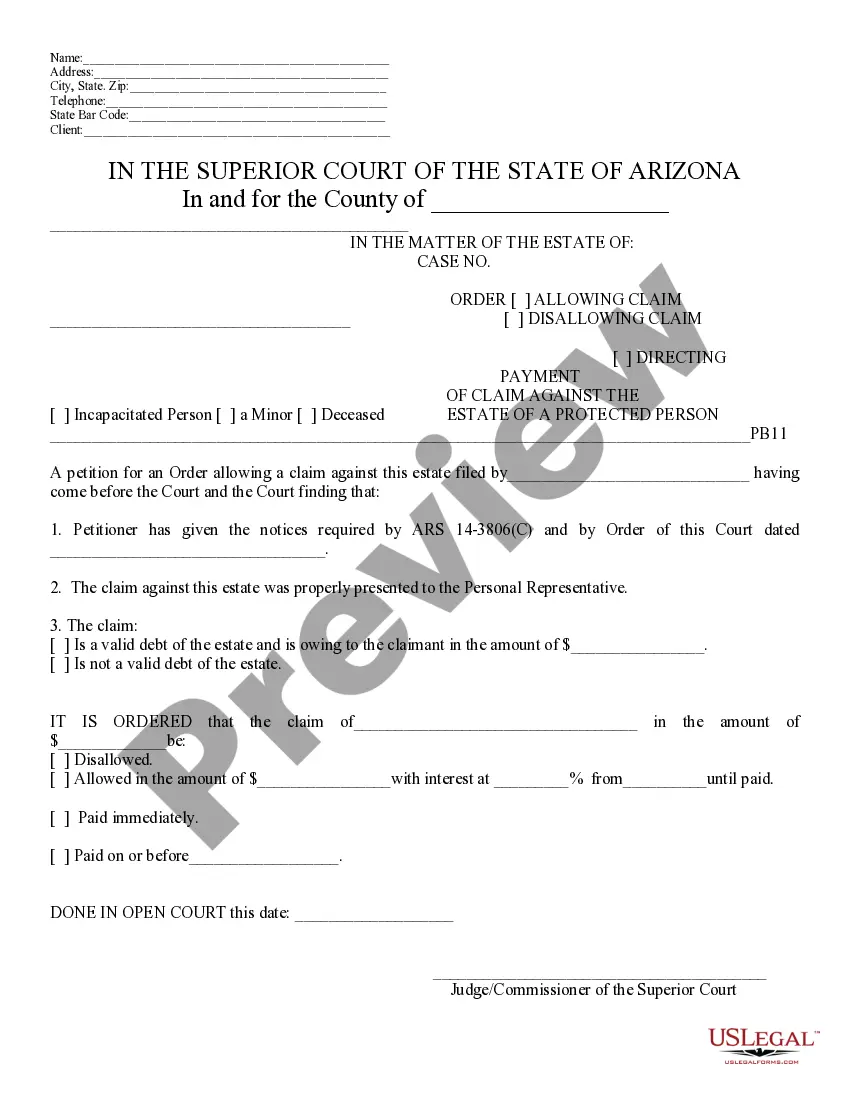

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Consequently, if you need the latest version of the Middlesex Employee Benefit Plan Document Checklist, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Employee Benefit Plan Document Checklist:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Middlesex Employee Benefit Plan Document Checklist and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

The SBC provides consumers with information so they can compare benefits and select a health insurance plan that meets their needs. In contrast, the SPD is an easy to understand document that tells participants what benefits the plan provides and how the plan operates.

The plan document is a written document that describes the participant's rights, benefits, and obligations within the plan, as well as the plan's terms and conditions for administering the plan. The plan document should include the Trust Agreement (if applicable) and Insurance Contract(s).

A 401(k) Plan is a defined contribution plan that is a cash or deferred arrangement. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the 401(k) plan.

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that the participants of the benefits plan can easily understand it. Unlike the plan document, the SPD is required to be distributed to plan participants.

The plan document tells the plan participants about the benefits they are entitled to under the plan and provides guidelines to be used by the plan administrator in decision-making when it comes to plan operations. It is not required to be distributed to the participants unless requested.

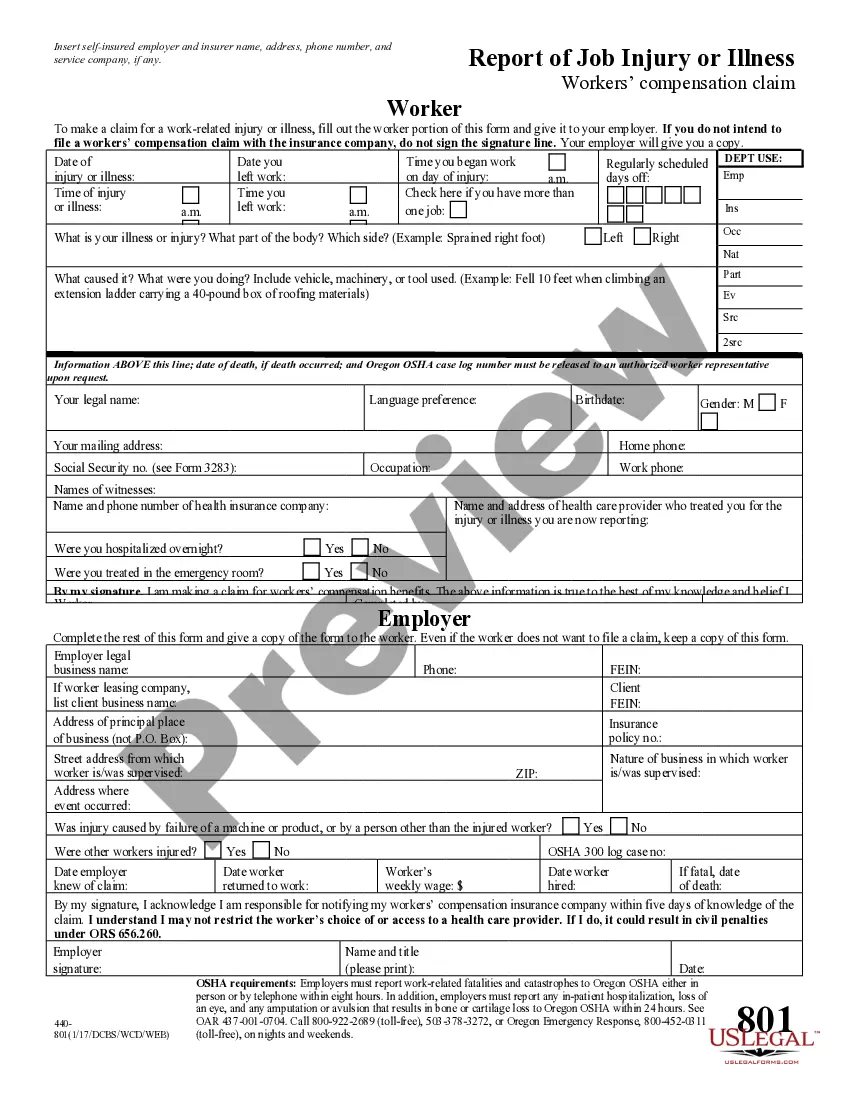

Journal Entries. When recording your employees' benefits in your payroll or general ledger, list the amounts you withheld from their paychecks for benefits under the respective accounts as credits. When recording wages paid, include fringe benefits paid to your employees, as a debit.

6 Steps to Design an Employee Benefits Plan Step 1: Set goals.Step 2: Define your budget.Step 3: Conduct a use assessment & survey your employees.Step 4: Consider compliance & additional factors.Step 5: Design your employee benefits plan.Step 6: Communicate with employees.Step 7: Re-evaluate your plan each year.

Take these steps to start building an employee benefits program that won't break the bank. Review your goals and budget.Know the required employee benefits.Pick optional benefits.Highlight special perks.Draw the total compensation picture.

How to Create an Employee Benefits Guide Flipsnack.com - YouTube YouTube Start of suggested clip End of suggested clip The only thing you need to do is upload it and flip SNAC add interactive elements such as linksMoreThe only thing you need to do is upload it and flip SNAC add interactive elements such as links videos or forms and publish it privately in your account.

How to Design an Employee Benefits Program Step 1: Identify the organization's benefits objectives and budget.Step 2: Conduct a needs assessment.Step 3: Formulate a benefits plan program.Step 4: Communicate the benefits plan to employees.