San Jose California Employee Benefit Plan Document Checklist is a comprehensive collection of essential documents that employers must adhere to ensure compliance with employee benefit plans in San Jose, California. This checklist acts as a guideline to ensure that all necessary documents are in place and up to date to protect the rights and well-being of employees. It assists employers in organizing their benefit plans effectively and meeting legal obligations. The San Jose California Employee Benefit Plan Document Checklist includes various types of documents that need to be reviewed, updated, and maintained regularly. These documents include: 1. Summary Plan Description (SPD): This document provides a detailed overview of the employee benefit plan, including eligibility requirements, coverage details, claims procedures, and rights and obligations of both employers and employees. 2. Plan Enrollment Forms: These forms are used for employees to enroll in various benefit plans, such as healthcare plans, retirement plans, dental and vision plans, and other voluntary or supplementary benefit programs. 3. Plan Amendments: Employers must keep track of any amendments made to the benefit plans and ensure that these changes are communicated to the employees in a timely manner. These amendments may include changes in coverage, contribution amounts, or eligibility criteria. 4. ERICA Documentation: Employee Retirement Income Security Act (ERICA) establishes guidelines for administering employee benefit plans. Employers need to maintain ERISA-related documents such as Form 5500 for filing annual reports, plan trust agreements, and plan expense disclosures. 5. Summary of Material Modifications (SMM): If there are any material changes made to the benefit plans that significantly affect the rights or interests of the employees, employers must prepare and distribute SMM's. These modifications can include changes in coverage, cost-sharing arrangements, and other plan-related updates. 6. Notices and Disclosures: Employers must ensure that they provide necessary notices and disclosures to employees as required by federal and state laws. These may include COBRA notices, HIPAA privacy notices, Affordable Care Act (ACA) notices, and other mandatory disclosures. 7. Claims and Appeals Procedures: Employers need to have documented procedures outlining the process for employees to file benefit claims, as well as how to appeal any denials or disputes. These procedures should comply with relevant laws, such as ERICA guidelines. Different types of San Jose California Employee Benefit Plan Document Checklists may exist depending on the specific benefit plans offered by the employer, such as: 1. Health Benefit Plan Document Checklist: This checklist would focus on documents related to healthcare coverage, including insurance policies, employee handbooks, enrollment forms, and any health plan-specific notices and disclosures. 2. Retirement Plan Document Checklist: For employers offering retirement plans like 401(k) or pension plans, this checklist would include documents such as plan documents, PDS, enrollment forms, investment policies, and annual reports. 3. Voluntary Benefit Plan Document Checklist: This checklist would pertain to any additional voluntary benefits offered by the employer, such as life insurance, disability insurance, or flexible spending accounts (FSA's). It would encompass documents like plan summaries, enrollment forms, and related notices. In conclusion, the San Jose California Employee Benefit Plan Document Checklist is a crucial tool for employers to ensure compliance with local and federal regulations governing employee benefit plans. It encompasses a range of documents specific to various benefit plans, and employers must diligently review, update, and maintain these documents to safeguard the well-being of their employees.

San Jose California Employee Benefit Plan Document Checklist

Description

How to fill out San Jose California Employee Benefit Plan Document Checklist?

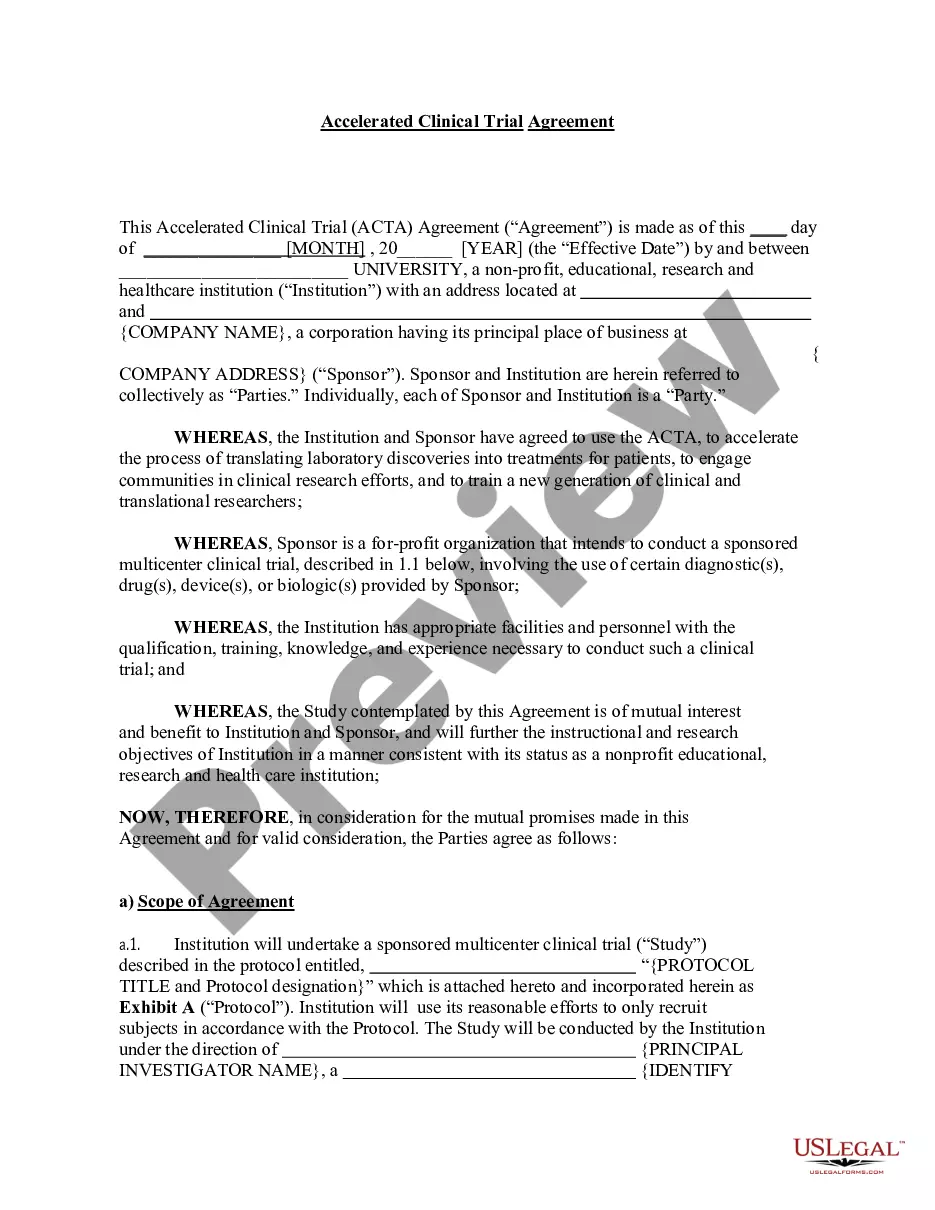

Are you looking to quickly create a legally-binding San Jose Employee Benefit Plan Document Checklist or probably any other form to manage your own or corporate matters? You can go with two options: hire a legal advisor to draft a valid document for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-compliant form templates, including San Jose Employee Benefit Plan Document Checklist and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, double-check if the San Jose Employee Benefit Plan Document Checklist is adapted to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the San Jose Employee Benefit Plan Document Checklist template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!