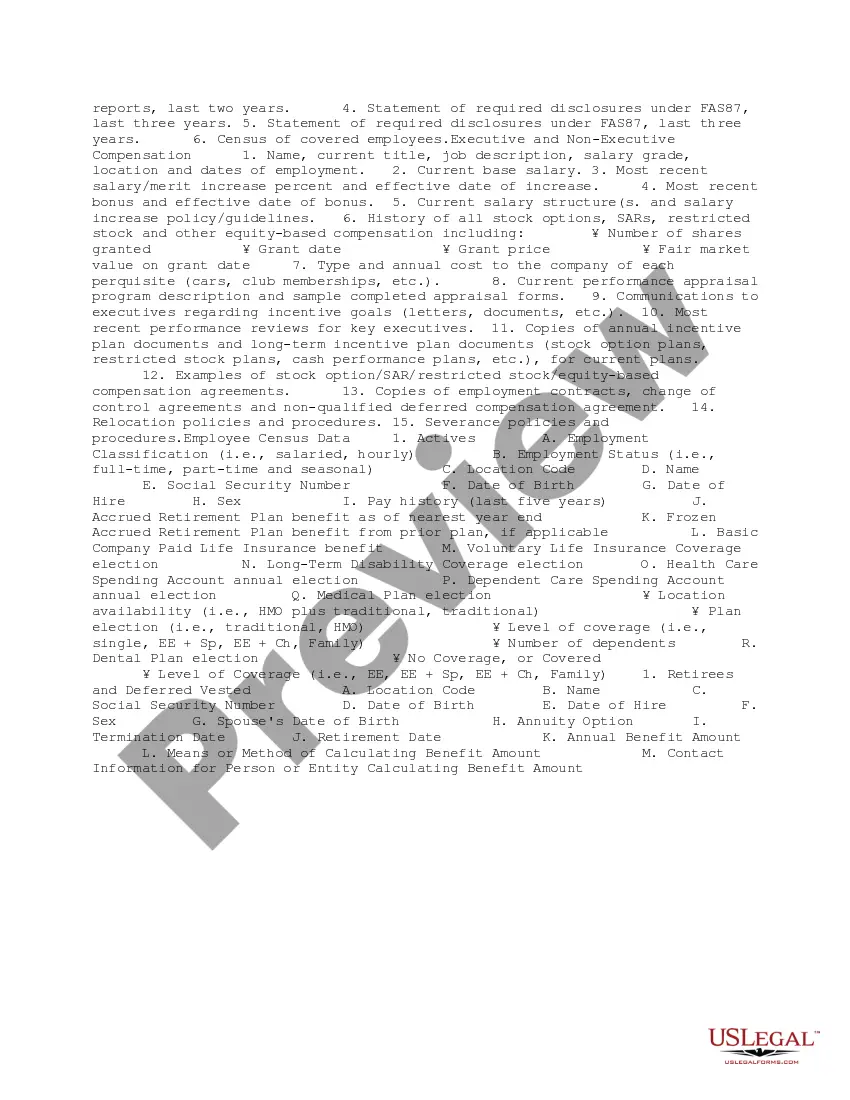

The Bexar Texas Benefits Consultant Checklist is a comprehensive guide designed to assist individuals and businesses in navigating the complex landscape of employee benefits. This checklist ensures that all necessary steps are taken to optimize benefits offerings and comply with relevant laws and regulations. Key points covered in the Bexar Texas Benefits Consultant Checklist include: 1. Comprehensive Benefit Analysis: Conduct a thorough analysis of existing benefit plans and identify areas for improvement or cost-saving opportunities. 2. Compliance Review: Ensure compliance with federal and state regulations, such as the Affordable Care Act (ACA), Employee Retirement Income Security Act (ERICA), and Texas-specific laws. 3. Benefit Plan Design: Collaborate with employers to design benefit plans that align with their specific goals and employee needs. Consider factors such as coverage options, contribution strategies, and cost-sharing arrangements. 4. Open Enrollment Preparation: Develop a timeline and detailed plan for the annual open enrollment period. Coordinate communication efforts, create enrollment materials, and educate employees about benefit options. 5. Vendor Evaluation and Selection: Assist employers in evaluating and selecting benefit vendors, such as insurance carriers, third-party administrators, and technology platforms. Review proposals, negotiate contracts, and ensure the chosen vendors meet the needs of the organization. 6. Employee Communication and Education: Develop communication strategies to effectively communicate benefit changes, updates, and plan provisions. Educate employees about available benefits, wellness programs, and resources. 7. Claims and Billing Management: Implement processes for efficient claims processing and billing management. Ensure proper documentation, accurate reporting, and timely resolution of any billing or claims issues. 8. Compliance Reporting: Prepare and submit required compliance reports, such as Form 5500, HIPAA Privacy Rule compliance, and ACA reporting (e.g., Forms 1095-C and 1094-C). 9. Ongoing Support and Evaluation: Provide ongoing support, answer employee inquiries, and address benefit-related concerns. Conduct periodic plan reviews to assess the effectiveness of benefit offerings and identify areas for improvement. Different types of Bexar Texas Benefits Consultant Checklists may include specialized focus areas, such as: 1. Health Insurance Consultant Checklist: Specifically tailored to the intricacies of health insurance benefits, including plan design, network evaluation, and cost-containment strategies. 2. Retirement Benefits Consultant Checklist: Focuses on retirement plans, such as 401(k) and pension programs, including compliance with the Employee Retirement Income Security Act (ERICA), plan design, investment options, and participant education. 3. Compliance Consultant Checklist: Primarily centers on ensuring legal compliance with state and federal employee benefits regulations, such as the Affordable Care Act (ACA), ERICA, and HIPAA. 4. Wellness Program Consultant Checklist: Concentrates on implementing and managing wellness initiatives, including employee engagement strategies, program design, and evaluation metrics. Note: The specific types of Bexar Texas Benefits Consultant Checklists may vary depending on the needs and focus areas of the consulting firm or individual.

Bexar Texas Benefits Consultant Checklist

Description

How to fill out Bexar Texas Benefits Consultant Checklist?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Bexar Benefits Consultant Checklist, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to document completion straightforward.

Here's how you can purchase and download Bexar Benefits Consultant Checklist.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the validity of some documents.

- Check the similar forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and purchase Bexar Benefits Consultant Checklist.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Bexar Benefits Consultant Checklist, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to cope with an extremely challenging situation, we recommend using the services of a lawyer to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-compliant documents with ease!