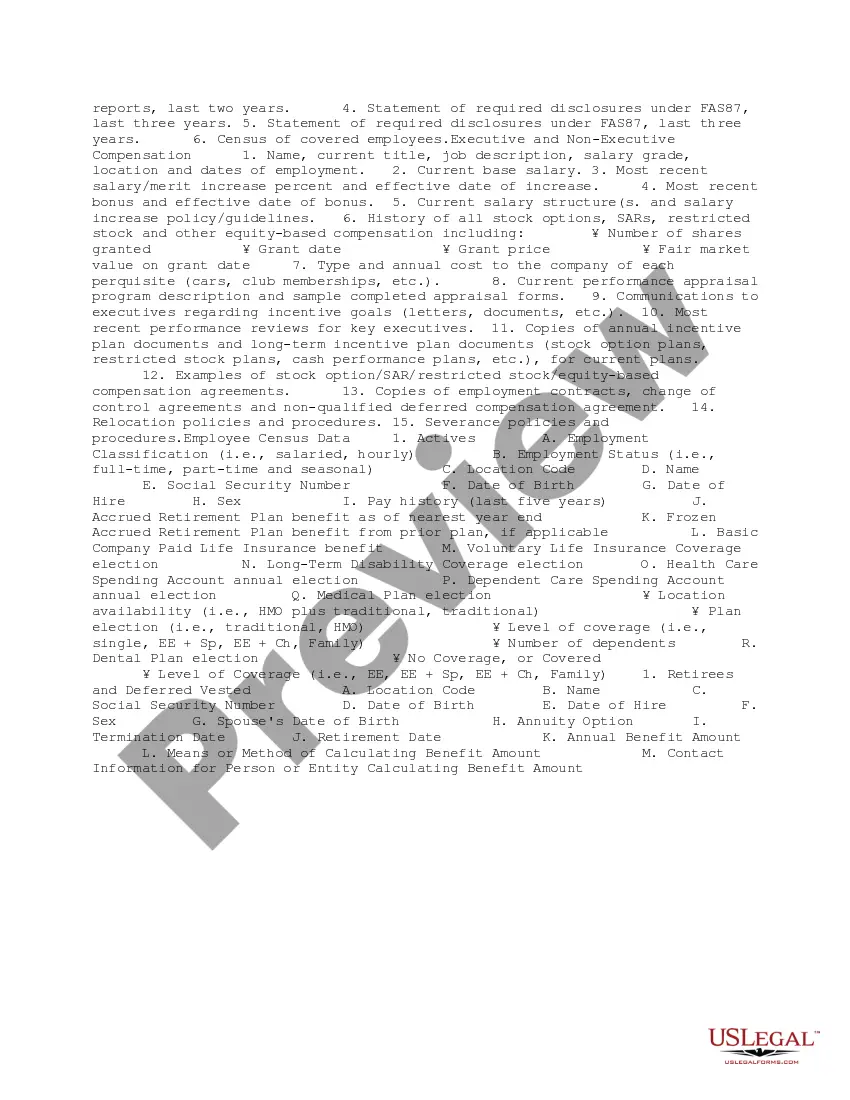

Houston, Texas Benefits Consultant Checklist: A Comprehensive Guide to Ensuring Expertise in Employee Benefits Consulting When it comes to employee benefits consulting in Houston, Texas, having a well-defined checklist is crucial to ensure the seamless provision of services. Houston, being a bustling city with a diverse workforce and thriving business community, requires benefits consultants to demonstrate thorough knowledge and expertise in various areas. A well-structured Benefits Consultant Checklist can help navigate the complex landscape and deliver exceptional results for clients. Key Keywords: Houston, Texas, benefits consultant, checklist, employee benefits, expertise, services, well-defined, thorough knowledge, business community, diverse workforce, complex landscape, exceptional results, clients. Here's an outline of the essential components that make up the Houston, Texas Benefits Consultant Checklist: 1. Understanding Client Needs: — Evaluate the unique requirements of each client. — Identify the specific goals they aim to achieve with their employee benefits program. — Conduct initial consultations to gather critical information about their businesses, employee demographics, and organizational culture. 2. Regulatory Compliance: — Stay up-to-date with federal, state, and local laws and regulations related to employee benefits. — Ensure clients fully comply with legal obligations such as the Affordable Care Act (ACA), ERICA, HIPAA, COBRA, and FMLA. — Establish a robust compliance process to mitigate potential risks and penalties. 3. Plan Design and Analysis: — Design customized benefit plans tailored to meet each client's objectives and budget constraints. — Analyze existing benefit plans to identify gaps, inefficiencies, or cost-saving opportunities. — Conduct benchmarking studies to compare client plans against industry standards and provide recommendations for improvement. 4. Benefit Plan Implementation: — Develop a detailed implementation strategy, including timelines and milestones. — Coordinate with insurance carriers, third-party administrators (TPAs), and other stakeholders. — Facilitate open enrollment meetings and communication strategies to ensure a smooth transition and maximize employee engagement. 5. Communication and Education: — Develop comprehensive employee communication materials to educate employees about their benefit options and changes. — Conduct employee meetings, webinars, and training sessions to address questions and clarify any concerns or confusion. — Provide ongoing support and resources to help employees make informed decisions regarding their benefits. Different Types of Houston, Texas Benefits Consultant Checklist: 1. Health and Wellness Benefits Checklist: — Focuses on health insurance, wellness programs, and other health-related benefits. — Includes detailed analysis of medical plans, dental and vision coverage, wellness initiatives, and preventive care options. 2. Retirement Benefits Checklist: — Concentrates on retirement plans, such as 401(k)s, pensions, IRAs, and other investment vehicles. — Addresses aspects like plan design, participant eligibility, contribution matching, vesting schedules, and compliance with IRS regulations. 3. Voluntary Benefits Checklist: — Explores optional benefits like life insurance, disability coverage, supplemental health plans, and flexible spending accounts (FSA's). — Assists clients in selecting voluntary benefits that align with their employees' needs and preferences. Each type of Benefits Consultant Checklist encompasses its unique set of considerations, but they all share the common goal of optimizing employee benefits to attract, retain, and engage top talent in Houston, Texas's competitive job market. Note: The specific names or brands associated with Houston, Texas Benefits Consultant Checklists may vary based on individual consulting firms and their offerings.

Houston Texas Benefits Consultant Checklist

Description

How to fill out Houston Texas Benefits Consultant Checklist?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Houston Benefits Consultant Checklist, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Houston Benefits Consultant Checklist from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Houston Benefits Consultant Checklist:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!