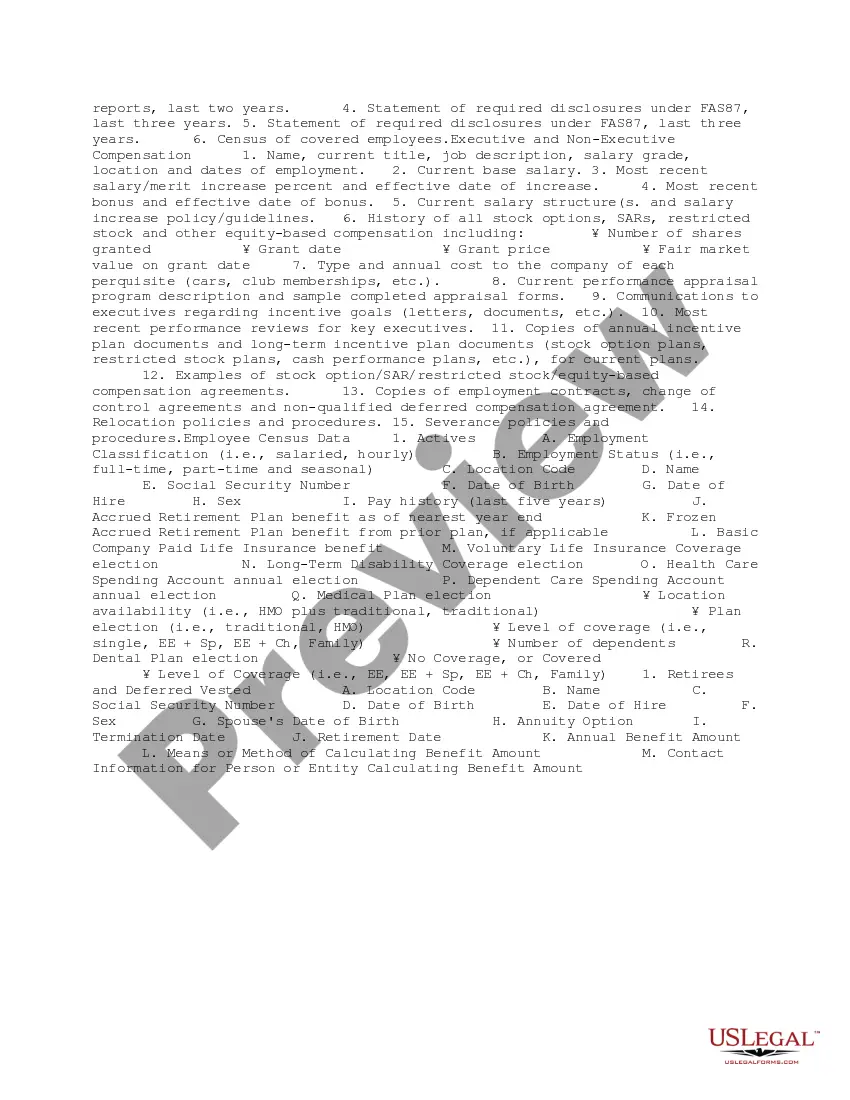

Title: Palm Beach Florida Benefits Consultant Checklist: A Comprehensive Guide to Streamline Your Employee Benefits Description: Are you seeking a reliable and proficient benefits' consultant in Palm Beach, Florida? Look no further! In this detailed description, we present the Palm Beach Florida Benefits Consultant Checklist, an essential resource that encompasses an array of important factors when choosing a benefits' consultant. Whether you are a business owner, a human resource professional, or an individual researching personal benefits, this checklist will guide you through the selection process. Keywords: Palm Beach Florida Benefits Consultant, Checklist, Employee Benefits, Palm Beach County, Business Benefits, HR Solutions, Retirement Plans, Comprehensive Benefits Analysis, Flexible Spending Account (FSA), Health Savings Account (HSA), Wellness Programs, Group Health Insurance, Voluntary Benefits. Types of Palm Beach Florida Benefits Consultant Checklists: 1. Business Benefits Consultant Checklist: — Evaluate the consultant's expertise in designing and implementing customized benefit plans tailored to your company's specific needs. — Assess their ability to provide cost-effective solutions while maintaining quality employee benefits. — Confirm their knowledge in compliance with federal and state regulations, including the Affordable Care Act (ACA) and ERICA. 2. HR Solutions Checklist: — Review the consultant's understanding of HR processes and their ability to integrate benefit programs within these systems. — Verify their expertise in modern HR technologies, such as automated employee enrollment systems and benefits administration platforms. — Determine whether they offer support for HR-related tasks like open enrollment, employee communication, and claims resolution. 3. Retirement Plans Checklist: — Evaluate the consultant's experience in designing retirement plans like 401(k) and pension plans. — Ensure they are capable of providing investment education and guidance to employees. — Verify their expertise in managing retirement plan compliance and documentation. 4. Comprehensive Benefits Analysis Checklist: — Assess the consultant's proficiency in conducting a thorough analysis of your current benefit packages. — Consider their ability to identify gaps in coverage and recommend suitable improvements. — Verify their experience in negotiating with insurance carriers to obtain the best possible rates and benefits for your organization. 5. Wellness Programs Checklist: — Determine if the consultant offers wellness program development and implementation services. — Evaluate their experience in creating initiatives that promote employee health, such as fitness programs, smoking cessation support, and stress management seminars. — Check if they provide tools to measure the effectiveness and ROI of wellness programs. 6. Group Health Insurance and Voluntary Benefits Checklist: — Confirm the consultant's proficiency in designing and managing group health insurance plans tailored to your organization's size and budget. — Evaluate their ability to offer voluntary benefits options, such as dental, vision, disability, and life insurance plans. — Determine whether they provide ongoing support, such as claims advocacy, plan renewal negotiations, and employee communication. The Palm Beach Florida Benefits Consultant Checklist is a comprehensive guide that empowers individuals and organizations to select the right benefits consultant in Palm Beach County. By following this checklist, you can ensure a smooth and successful partnership with a consultant who will enhance your employee benefits program and streamline the overall process.

Palm Beach Florida Benefits Consultant Checklist

Description

How to fill out Palm Beach Florida Benefits Consultant Checklist?

Drafting paperwork for the business or individual demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Palm Beach Benefits Consultant Checklist without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Palm Beach Benefits Consultant Checklist by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Palm Beach Benefits Consultant Checklist:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!