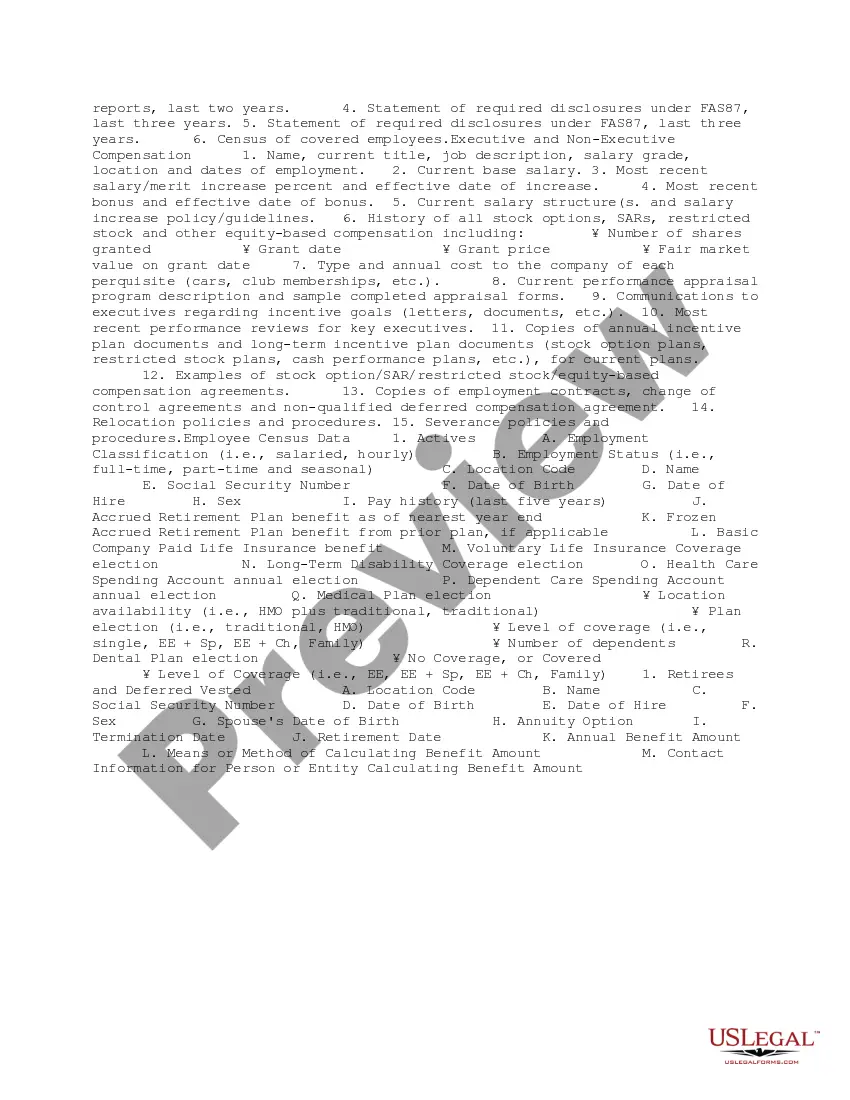

San Antonio Texas Benefits Consultant Checklist: A Comprehensive Guide for Individuals and Businesses Keywords: San Antonio Texas, benefits consultant, checklist, insurance, financial planning, employee benefits, retirement plan, healthcare coverage, compliance, cost-effective solutions Introduction: A San Antonio Texas Benefits Consultant Checklist is a crucial tool for individuals and businesses seeking professional guidance in managing their employee benefits, insurance plans, and financial well-being. It helps ensure that all necessary aspects are covered and highlights the key steps necessary to optimize benefits packages while remaining compliant with regulations. 1. Employee Benefits Checklist: This checklist focuses specifically on assisting businesses with designing and implementing employee benefits programs. It covers various essential elements, including: a) Health Insurance Coverage: Analyzing different health insurance plans, comparing costs and benefits, and ensuring compliance with regulations such as ACA (Affordable Care Act). b) Retirement Plans: Evaluating retirement plan options like 401(k) plans, pension schemes, and individual retirement accounts (IRAs), taking into account employee needs and maintaining compliance with ERICA (Employee Retirement Income Security Act). c) Life and Disability Insurance: Assessing the need for life insurance, disability coverage, and other related benefits for employees' financial protection. d) Wellness Programs: Assisting in the development of wellness initiatives like fitness programs, stress management, and preventive healthcare plans, all aimed at enhancing employee well-being and reducing healthcare costs. e) Voluntary Benefits: Providing guidance on voluntary benefits options such as dental and vision coverage, supplemental insurance plans, and flexible spending accounts (FSA's). f) Compliance: Ensuring businesses adhere to federal and state regulations, including HIPAA (Health Insurance Portability and Accountability Act), COBRA (Consolidated Omnibus Budget Reconciliation Act), and ADA (Americans with Disabilities Act). 2. Individual Benefits Checklist: Catering to the needs of individuals seeking professional assistance in managing their personal benefits and insurance plans, this checklist includes: a) Health Insurance Options: Evaluating individual health insurance plans, exploring marketplace options, and assisting in finding the most suitable coverage at the best cost. b) Retirement Planning: Developing personalized retirement plans, reviewing investment options, and optimizing savings vehicles like IRAs and annuities. c) Life, Disability, and Long-Term Care Insurance: Analyzing the need for these insurances to provide financial security for individuals and their families in case of unforeseen circumstances. d) Affordable Care Act Evaluation: Navigating the complexities of the ACA, determining eligibility, and understanding available subsidies. e) Social Security and Medicare Guidance: Assisting individuals with understanding their rights, options, and benefits associated with Social Security retirement and Medicare coverage. f) Tax Planning: Collaborating with tax professionals to identify potential tax deductions or credits related to healthcare expenses or retirement plans. In conclusion, a San Antonio Texas Benefits Consultant Checklist serves as a comprehensive guide for both businesses and individuals, ensuring optimal employee benefits and personal financial planning. Engaging with a reputable benefit consultant can considerably simplify the complex process, provide cost-effective solutions, and bring peace of mind to individuals and organizations alike.

San Antonio Texas Benefits Consultant Checklist

Description

How to fill out San Antonio Texas Benefits Consultant Checklist?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including San Antonio Benefits Consultant Checklist, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to locate and download San Antonio Benefits Consultant Checklist.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the similar forms or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase San Antonio Benefits Consultant Checklist.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate San Antonio Benefits Consultant Checklist, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to deal with an extremely complicated situation, we recommend using the services of a lawyer to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!