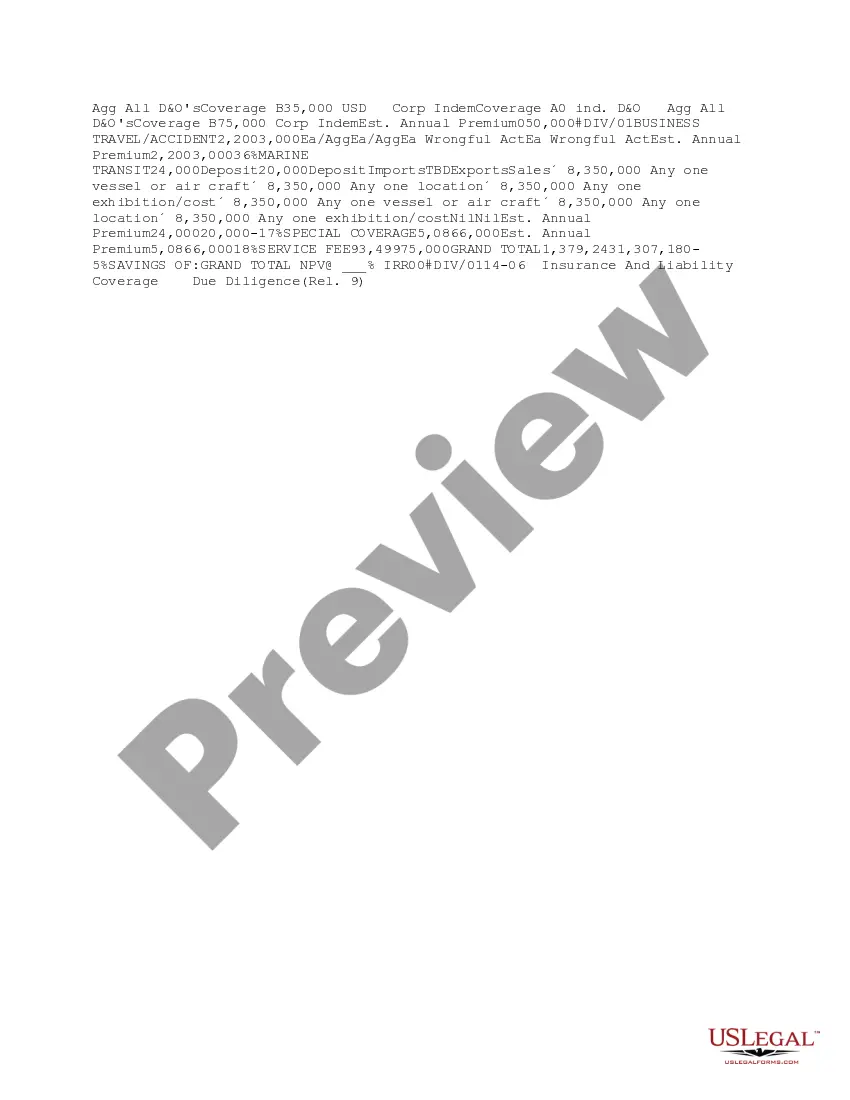

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

The Collin Texas Risk Evaluation Specialist Matrix is a comprehensive tool used in various industries to identify, assess, and manage risks effectively. It provides a structured framework for evaluating potential risks that may impact business operations, financial stability, and overall growth. This matrix is specifically designed for businesses and organizations operating in Collin County, Texas, to meet the unique challenges and comply with local regulations. It enables risk evaluation specialists to analyze and quantify different types of risks associated with specific industries or projects, allowing for better decision-making and risk mitigation strategies. The Collin Texas Risk Evaluation Specialist Matrix combines a range of factors, including financial, legal, operational, and environmental risks, to provide a holistic view of potential threats. By assigning scores or ratings to each risk factor, it helps prioritize risks based on their severity and likelihood of occurrence. Depending on the industry or sector, there are various types of Collin Texas Risk Evaluation Specialist Matrix that cater to specific needs. Some common types include: 1. Financial Risk Evaluation Matrix: It focuses on financial aspects such as credit risk, liquidity risk, market risk, and regulatory compliance. This matrix assists businesses in evaluating the potential impact of financial risks on their operations and making informed decisions to safeguard their financial well-being. 2. Operational Risk Evaluation Matrix: This matrix helps assess risks related to operational processes, including supply chain disruptions, equipment failure, human error, and cybersecurity threats. It enables businesses to identify weak areas and implement measures to minimize the impact of potential operational risks. 3. Compliance Risk Evaluation Matrix: Designed specifically for organizations operating in highly regulated industries, this matrix evaluates risks concerning legal and regulatory compliance. It assists businesses in identifying potential compliance gaps, ensuring adherence to relevant laws, regulations, and standards. 4. Strategic Risk Evaluation Matrix: This matrix focuses on risks associated with strategic decision-making and market fluctuations. It aids in assessing risks related to expansion plans, mergers and acquisitions, changing market trends, and competitive pressures. By identifying potential strategic risks, businesses can develop effective risk management strategies to maintain a competitive edge. In summary, the Collin Texas Risk Evaluation Specialist Matrix is a valuable tool for businesses and organizations in Collin County, Texas, enabling them to systematically identify, assess, and manage risks. By utilizing different types of matrices tailored to specific industries or risks, companies can enhance their overall risk management strategies and ensure operational resilience.The Collin Texas Risk Evaluation Specialist Matrix is a comprehensive tool used in various industries to identify, assess, and manage risks effectively. It provides a structured framework for evaluating potential risks that may impact business operations, financial stability, and overall growth. This matrix is specifically designed for businesses and organizations operating in Collin County, Texas, to meet the unique challenges and comply with local regulations. It enables risk evaluation specialists to analyze and quantify different types of risks associated with specific industries or projects, allowing for better decision-making and risk mitigation strategies. The Collin Texas Risk Evaluation Specialist Matrix combines a range of factors, including financial, legal, operational, and environmental risks, to provide a holistic view of potential threats. By assigning scores or ratings to each risk factor, it helps prioritize risks based on their severity and likelihood of occurrence. Depending on the industry or sector, there are various types of Collin Texas Risk Evaluation Specialist Matrix that cater to specific needs. Some common types include: 1. Financial Risk Evaluation Matrix: It focuses on financial aspects such as credit risk, liquidity risk, market risk, and regulatory compliance. This matrix assists businesses in evaluating the potential impact of financial risks on their operations and making informed decisions to safeguard their financial well-being. 2. Operational Risk Evaluation Matrix: This matrix helps assess risks related to operational processes, including supply chain disruptions, equipment failure, human error, and cybersecurity threats. It enables businesses to identify weak areas and implement measures to minimize the impact of potential operational risks. 3. Compliance Risk Evaluation Matrix: Designed specifically for organizations operating in highly regulated industries, this matrix evaluates risks concerning legal and regulatory compliance. It assists businesses in identifying potential compliance gaps, ensuring adherence to relevant laws, regulations, and standards. 4. Strategic Risk Evaluation Matrix: This matrix focuses on risks associated with strategic decision-making and market fluctuations. It aids in assessing risks related to expansion plans, mergers and acquisitions, changing market trends, and competitive pressures. By identifying potential strategic risks, businesses can develop effective risk management strategies to maintain a competitive edge. In summary, the Collin Texas Risk Evaluation Specialist Matrix is a valuable tool for businesses and organizations in Collin County, Texas, enabling them to systematically identify, assess, and manage risks. By utilizing different types of matrices tailored to specific industries or risks, companies can enhance their overall risk management strategies and ensure operational resilience.