This due diligence worksheet provides detailed information regarding liability insurance for directors and officers in a company regarding business transactions.

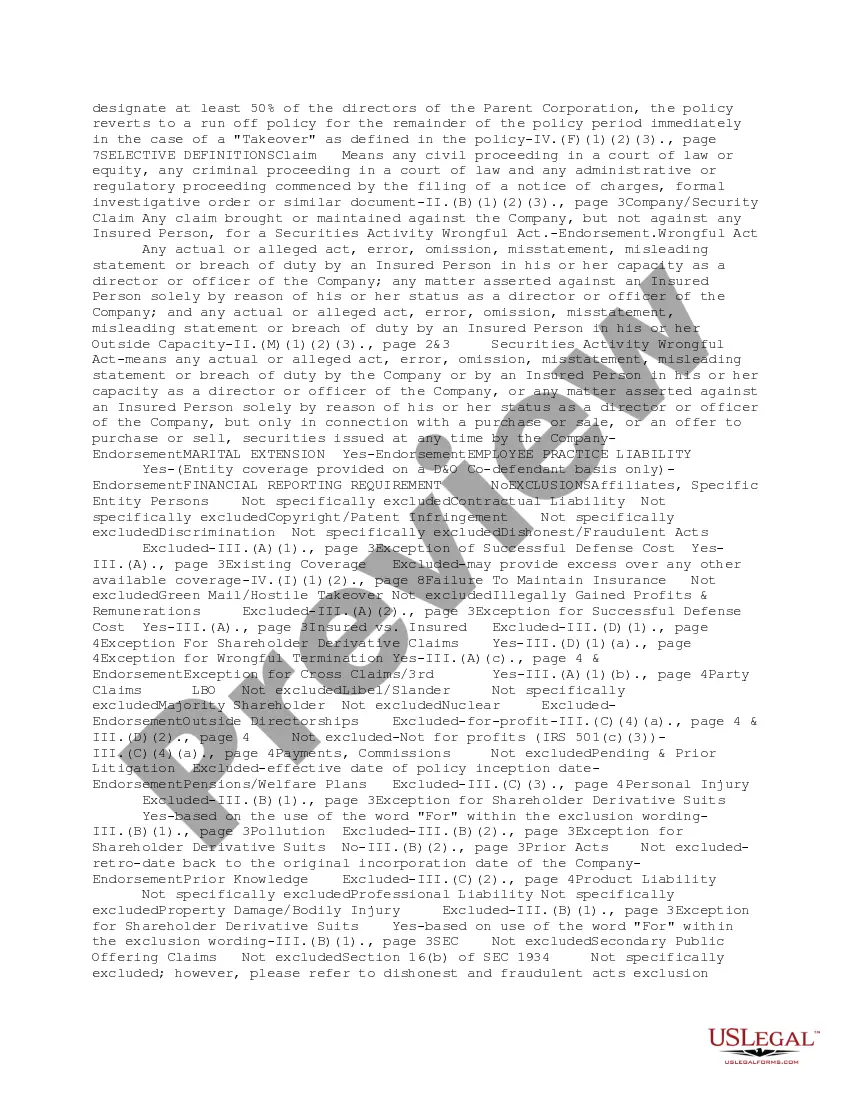

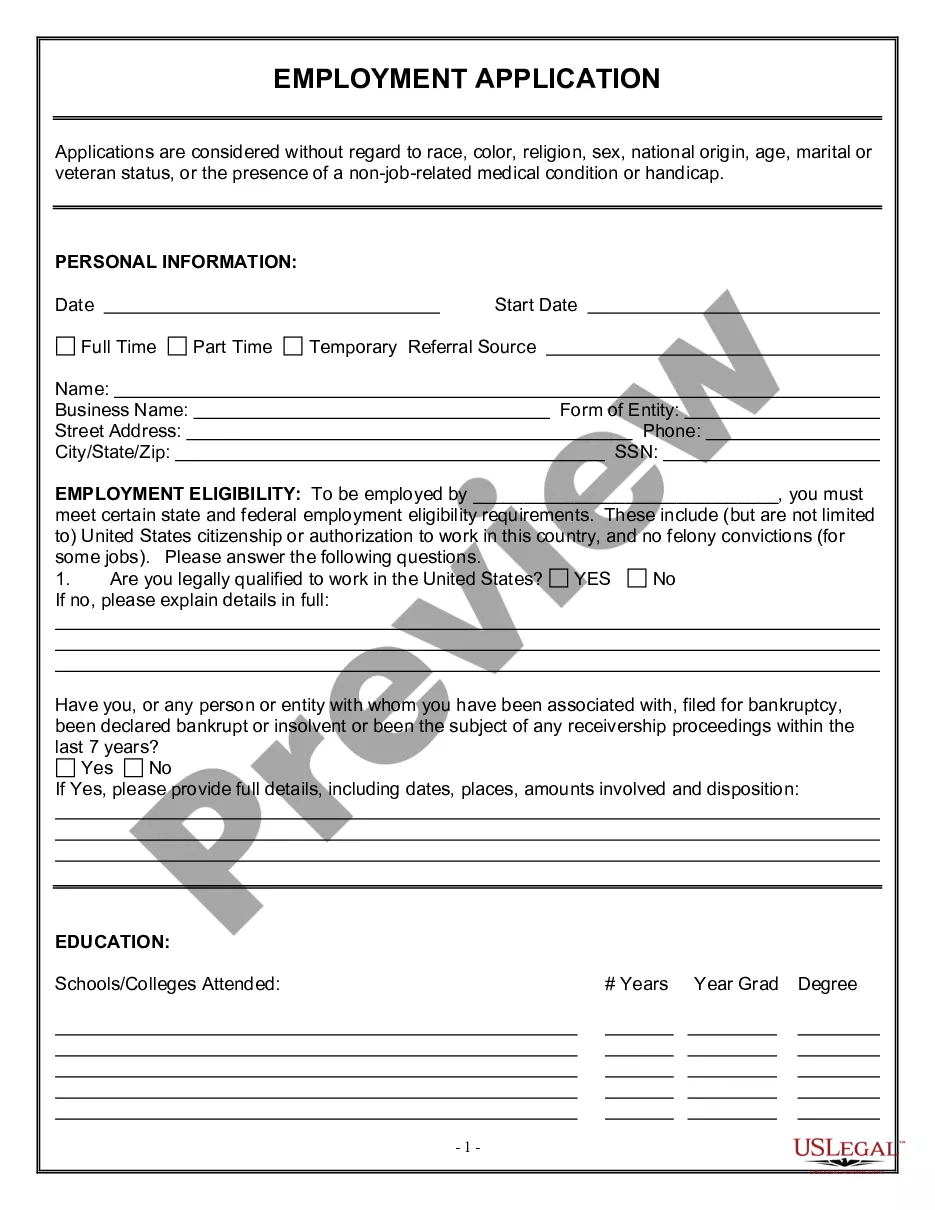

Franklin Ohio Directors and Officer Liability Insurance Information Worksheet is a comprehensive document designed to gather essential information related to Directors and Officer (D&O) liability insurance in Franklin, Ohio. This worksheet aims to assist businesses, organizations, and professionals in assessing their D&O insurance needs and facilitating the insurance application process. It is important to note that the specific worksheets may vary depending on the Insurance Company and policy requirements. Keywords: Franklin Ohio, Directors and Officer Liability Insurance, Information Worksheet, D&O insurance, liability insurance, insurance application, insurance needs, businesses, organizations, professionals. The Franklin Ohio Directors and Officer Liability Insurance Information Worksheet typically covers the following areas: 1. Business Information: This section collects basic details about the organization seeking D&O coverage, including the name, address, contact information, and nature of the business or professional services provided. 2. Key Officers and Directors: Here, the worksheet asks for the names, titles, roles, and responsibilities of key individuals in the organization such as directors, officers, executives, and managers. 3. Corporate Structure: This part requires information about the organization's legal structure, ownership, subsidiaries, and any changes in ownership or mergers/acquisitions planned or completed. 4. Prior Insurance History: To assess the organization's claims history, the worksheet requests details about previous D&O insurance policies, including carriers, policy periods, limits, and any previous claims made against the organization or its directors/officers. 5. Coverage Requirements: In this section, the worksheet prompts the organization to specify their desired coverage limits, deductible amounts, and any specific endorsements or additional coverage options required. 6. Risk Assessment: Here, a series of questions are provided to evaluate the organization's risk exposure, including inquiries about potential regulatory violations, pending lawsuits, involvement in bankruptcy proceedings, and shareholder disputes, among others. 7. Claims History Disclosure: The worksheet asks for disclosure of any pending, prior, or threatened claims against the organization or its directors/officers, including details such as claim dates, parties involved, and outcomes if applicable. 8. Financial Information: This section focuses on gathering financial data such as annual revenues, net income, total assets, outstanding debts, and any recent financial trends that might impact the D&O insurance policy. 9. Additional Information: A miscellaneous section where organizations can provide any additional relevant information or specific concerns not covered in the previous sections. Types of Franklin Ohio Directors and Officer Liability Insurance Information Worksheets may vary depending on the insurance provider or broker. Some insurance companies may have their own unique worksheets, ensuring they capture all necessary details for underwriting purposes. It is advisable to consult with specific insurance providers or brokers to obtain their respective D&O liability insurance information worksheets. Overall, the Franklin Ohio Directors and Officer Liability Insurance Information Worksheet serves as a valuable tool for organizations in Franklin, Ohio, to thoroughly assess their D&O insurance needs, understand their risk exposure, and facilitate the insurance application process by providing comprehensive information to insurance providers.Franklin Ohio Directors and Officer Liability Insurance Information Worksheet is a comprehensive document designed to gather essential information related to Directors and Officer (D&O) liability insurance in Franklin, Ohio. This worksheet aims to assist businesses, organizations, and professionals in assessing their D&O insurance needs and facilitating the insurance application process. It is important to note that the specific worksheets may vary depending on the Insurance Company and policy requirements. Keywords: Franklin Ohio, Directors and Officer Liability Insurance, Information Worksheet, D&O insurance, liability insurance, insurance application, insurance needs, businesses, organizations, professionals. The Franklin Ohio Directors and Officer Liability Insurance Information Worksheet typically covers the following areas: 1. Business Information: This section collects basic details about the organization seeking D&O coverage, including the name, address, contact information, and nature of the business or professional services provided. 2. Key Officers and Directors: Here, the worksheet asks for the names, titles, roles, and responsibilities of key individuals in the organization such as directors, officers, executives, and managers. 3. Corporate Structure: This part requires information about the organization's legal structure, ownership, subsidiaries, and any changes in ownership or mergers/acquisitions planned or completed. 4. Prior Insurance History: To assess the organization's claims history, the worksheet requests details about previous D&O insurance policies, including carriers, policy periods, limits, and any previous claims made against the organization or its directors/officers. 5. Coverage Requirements: In this section, the worksheet prompts the organization to specify their desired coverage limits, deductible amounts, and any specific endorsements or additional coverage options required. 6. Risk Assessment: Here, a series of questions are provided to evaluate the organization's risk exposure, including inquiries about potential regulatory violations, pending lawsuits, involvement in bankruptcy proceedings, and shareholder disputes, among others. 7. Claims History Disclosure: The worksheet asks for disclosure of any pending, prior, or threatened claims against the organization or its directors/officers, including details such as claim dates, parties involved, and outcomes if applicable. 8. Financial Information: This section focuses on gathering financial data such as annual revenues, net income, total assets, outstanding debts, and any recent financial trends that might impact the D&O insurance policy. 9. Additional Information: A miscellaneous section where organizations can provide any additional relevant information or specific concerns not covered in the previous sections. Types of Franklin Ohio Directors and Officer Liability Insurance Information Worksheets may vary depending on the insurance provider or broker. Some insurance companies may have their own unique worksheets, ensuring they capture all necessary details for underwriting purposes. It is advisable to consult with specific insurance providers or brokers to obtain their respective D&O liability insurance information worksheets. Overall, the Franklin Ohio Directors and Officer Liability Insurance Information Worksheet serves as a valuable tool for organizations in Franklin, Ohio, to thoroughly assess their D&O insurance needs, understand their risk exposure, and facilitate the insurance application process by providing comprehensive information to insurance providers.