This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

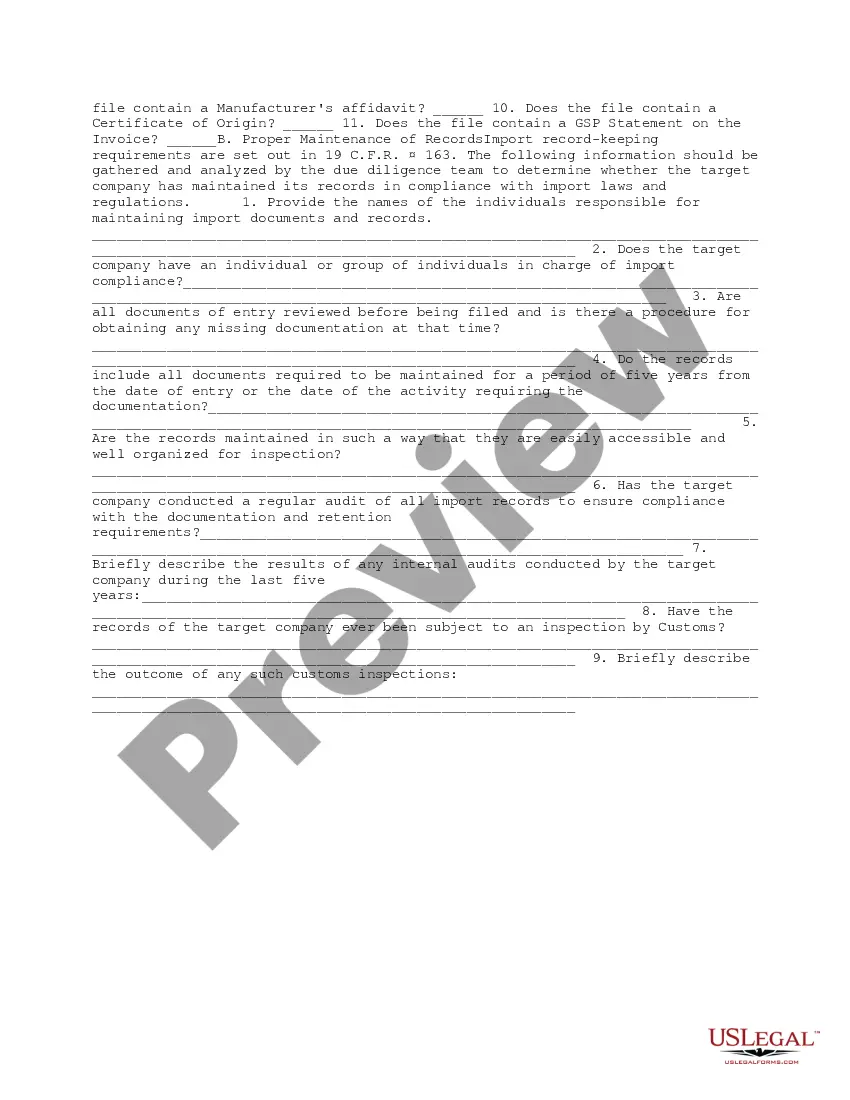

Chicago, Illinois Import Compliance and Records Review Due Diligence is a crucial process undertaken by businesses engaged in international trade to ensure adherence to the complex import regulations and maintain compliance. This comprehensive procedure involves an in-depth review of import records and documentation to identify any potential discrepancies, errors, or regulatory violations. By performing due diligence on import compliance, companies in Chicago, Illinois, can mitigate risks, minimize penalties, and maintain a healthy trade relationship with international partners. Import compliance in Chicago, Illinois involves meticulous scrutiny of various aspects of the import process, including customs documentation, tariff codes, product classifications, valuation methods, country of origin rules, and trade agreements, among others. These compliance measures aim to ensure that imported goods comply with relevant laws, regulations, and licensing requirements enforced by the U.S. Customs and Border Protection (CBP) and other governmental agencies. In Chicago, businesses typically conduct different types of Import Compliance and Records Review Due Diligence based on their specific industry, products, or trade practices. Some notable categories include: 1. Tariff Classification Due Diligence: This type of due diligence focuses on accurately classifying imported goods according to the Harmonized System (HS) codes, helping determine appropriate customs duties, taxes, and trade restrictions. 2. Country of Origin Due Diligence: This involves verifying the origin of imported goods based on rules defined by various trade agreements, certificates of origin, labeling requirements, and substantial transformation tests. 3. Customs Valuation Due Diligence: Companies must conduct proper due diligence to verify the accuracy of declared values for imported goods and ensure compliance with relevant customs valuation methods, such as Transaction Value, Deductive Value, Computed Value, or Residual Value. 4. Regulatory Compliance Due Diligence: This aspect requires businesses to assess whether imported goods meet specific regulatory requirements, such as health and safety standards, product regulations, intellectual property rights, and restricted/prohibited goods regulations. 5. Free Trade Agreement (FTA) Due Diligence: For companies dealing with countries with which the United States has established free trade agreements, this type of due diligence involves ensuring compliance with the specific rules of origin and preferential tariff treatments to benefit from the FTA provisions. 6. Record-Keeping Due Diligence: Maintaining complete and accurate import records is essential to demonstrate compliance with import regulations. This type of due diligence involves reviewing import records, invoices, bills of lading, customs entry documents, and other relevant documents to ensure their accuracy and completeness. By conducting Import Compliance and Records Review Due Diligence in Chicago, Illinois, businesses can proactively assess their import operations, identify potential risks, rectify any compliance issues, and establish robust internal controls to maintain a seamless and compliant import process. This diligent approach helps prevent disruptions, avoid penalties, and strengthen the overall import management system.Chicago, Illinois Import Compliance and Records Review Due Diligence is a crucial process undertaken by businesses engaged in international trade to ensure adherence to the complex import regulations and maintain compliance. This comprehensive procedure involves an in-depth review of import records and documentation to identify any potential discrepancies, errors, or regulatory violations. By performing due diligence on import compliance, companies in Chicago, Illinois, can mitigate risks, minimize penalties, and maintain a healthy trade relationship with international partners. Import compliance in Chicago, Illinois involves meticulous scrutiny of various aspects of the import process, including customs documentation, tariff codes, product classifications, valuation methods, country of origin rules, and trade agreements, among others. These compliance measures aim to ensure that imported goods comply with relevant laws, regulations, and licensing requirements enforced by the U.S. Customs and Border Protection (CBP) and other governmental agencies. In Chicago, businesses typically conduct different types of Import Compliance and Records Review Due Diligence based on their specific industry, products, or trade practices. Some notable categories include: 1. Tariff Classification Due Diligence: This type of due diligence focuses on accurately classifying imported goods according to the Harmonized System (HS) codes, helping determine appropriate customs duties, taxes, and trade restrictions. 2. Country of Origin Due Diligence: This involves verifying the origin of imported goods based on rules defined by various trade agreements, certificates of origin, labeling requirements, and substantial transformation tests. 3. Customs Valuation Due Diligence: Companies must conduct proper due diligence to verify the accuracy of declared values for imported goods and ensure compliance with relevant customs valuation methods, such as Transaction Value, Deductive Value, Computed Value, or Residual Value. 4. Regulatory Compliance Due Diligence: This aspect requires businesses to assess whether imported goods meet specific regulatory requirements, such as health and safety standards, product regulations, intellectual property rights, and restricted/prohibited goods regulations. 5. Free Trade Agreement (FTA) Due Diligence: For companies dealing with countries with which the United States has established free trade agreements, this type of due diligence involves ensuring compliance with the specific rules of origin and preferential tariff treatments to benefit from the FTA provisions. 6. Record-Keeping Due Diligence: Maintaining complete and accurate import records is essential to demonstrate compliance with import regulations. This type of due diligence involves reviewing import records, invoices, bills of lading, customs entry documents, and other relevant documents to ensure their accuracy and completeness. By conducting Import Compliance and Records Review Due Diligence in Chicago, Illinois, businesses can proactively assess their import operations, identify potential risks, rectify any compliance issues, and establish robust internal controls to maintain a seamless and compliant import process. This diligent approach helps prevent disruptions, avoid penalties, and strengthen the overall import management system.