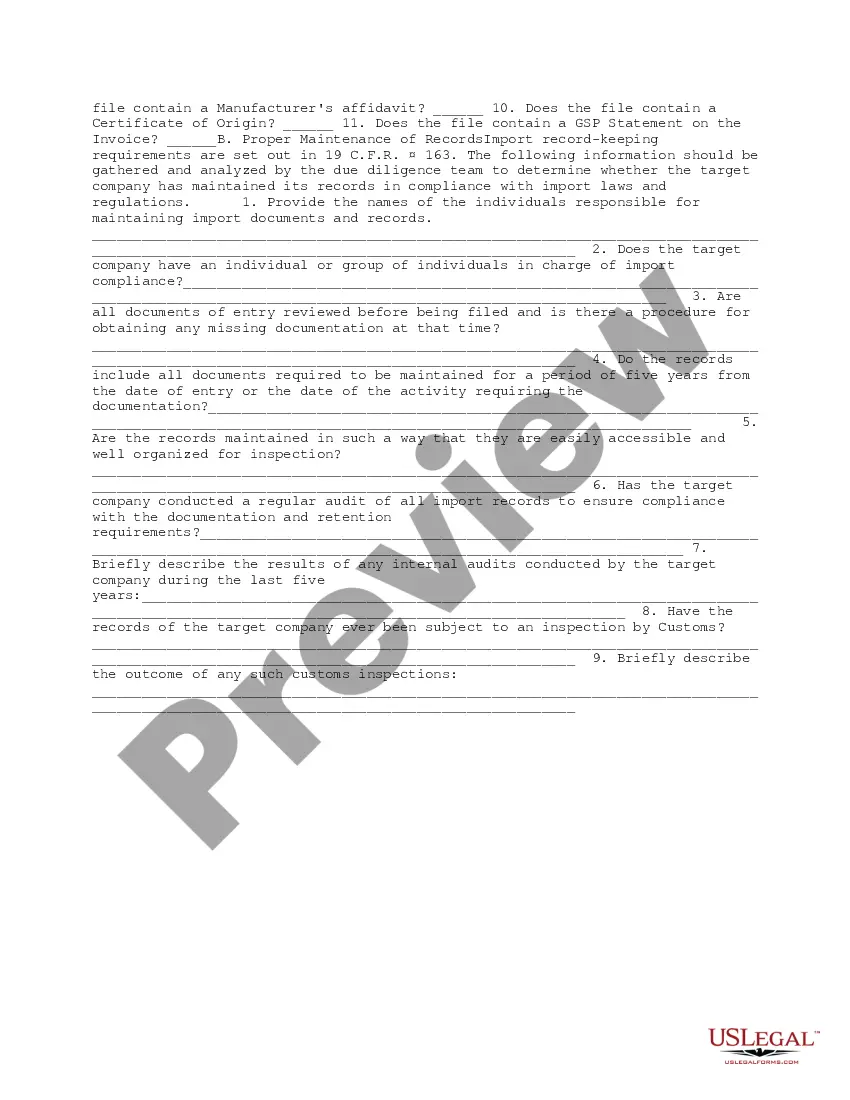

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Clark Nevada Import Compliance and Records Review Due Diligence is a crucial process in international trade operations that aims to ensure compliance with import regulations and maintain accurate records. It involves an in-depth examination of import activities, documentation, and processes to ensure adherence to customs laws and regulations. The primary objective of Clark Nevada Import Compliance and Records Review Due Diligence is to prevent any violations, penalties, or delays associated with imports. By carefully reviewing all import-related documents, data, and transactions, businesses can identify potential issues, rectify them, and establish robust import compliance systems. This diligence helps companies mitigate risks, maintain good standing with regulatory authorities, and streamline their import operations. There are several types of Clark Nevada Import Compliance and Records Review Due Diligence, including: 1. Document Verification: This involves an in-depth review of import documentation, such as invoices, packing lists, bills of lading, customs declarations, and permits. The purpose is to ensure that all documents are accurate, complete, and comply with the relevant import regulations. 2. Classification Review: Importers must classify their goods according to specific tariff codes or Harmonized System (HS) codes. This review ensures that the correct classification is applied, leading to accurate duty assessments, adherence to import restrictions, and compliance with product-specific regulations. 3. Valuation Compliance Check: Importers must accurately determine the value of their goods for customs purposes. This due diligence verifies whether the valuation methods employed by businesses comply with customs valuation guidelines, ensuring fair and lawful calculation of duties and taxes. 4. Country-Specific Compliance Assessment: Depending on the country of origin and destination, different import regulations and requirements may apply. Clark Nevada Import Compliance and Records Review Due Diligence aims to assess compliance with specific country regulations, including trade agreements, import restrictions, embargoes, and other customs laws. 5. Record keeping Audit: Maintaining accurate records is vital to import compliance. This type of due diligence involves verifying that businesses have organized and retained all import-related records, such as invoices, contracts, shipping documents, and customs declarations, according to the specified retention periods. Businesses and importers should prioritize Clark Nevada Import Compliance and Records Review Due Diligence to ensure seamless import operations, minimize risks, and stay compliant with customs regulations. By conducting an in-depth review of import activities and records, companies can identify any potential issues, rectify them promptly, and establish efficient import compliance management systems to avoid penalties, delays, and other adverse consequences.Clark Nevada Import Compliance and Records Review Due Diligence is a crucial process in international trade operations that aims to ensure compliance with import regulations and maintain accurate records. It involves an in-depth examination of import activities, documentation, and processes to ensure adherence to customs laws and regulations. The primary objective of Clark Nevada Import Compliance and Records Review Due Diligence is to prevent any violations, penalties, or delays associated with imports. By carefully reviewing all import-related documents, data, and transactions, businesses can identify potential issues, rectify them, and establish robust import compliance systems. This diligence helps companies mitigate risks, maintain good standing with regulatory authorities, and streamline their import operations. There are several types of Clark Nevada Import Compliance and Records Review Due Diligence, including: 1. Document Verification: This involves an in-depth review of import documentation, such as invoices, packing lists, bills of lading, customs declarations, and permits. The purpose is to ensure that all documents are accurate, complete, and comply with the relevant import regulations. 2. Classification Review: Importers must classify their goods according to specific tariff codes or Harmonized System (HS) codes. This review ensures that the correct classification is applied, leading to accurate duty assessments, adherence to import restrictions, and compliance with product-specific regulations. 3. Valuation Compliance Check: Importers must accurately determine the value of their goods for customs purposes. This due diligence verifies whether the valuation methods employed by businesses comply with customs valuation guidelines, ensuring fair and lawful calculation of duties and taxes. 4. Country-Specific Compliance Assessment: Depending on the country of origin and destination, different import regulations and requirements may apply. Clark Nevada Import Compliance and Records Review Due Diligence aims to assess compliance with specific country regulations, including trade agreements, import restrictions, embargoes, and other customs laws. 5. Record keeping Audit: Maintaining accurate records is vital to import compliance. This type of due diligence involves verifying that businesses have organized and retained all import-related records, such as invoices, contracts, shipping documents, and customs declarations, according to the specified retention periods. Businesses and importers should prioritize Clark Nevada Import Compliance and Records Review Due Diligence to ensure seamless import operations, minimize risks, and stay compliant with customs regulations. By conducting an in-depth review of import activities and records, companies can identify any potential issues, rectify them promptly, and establish efficient import compliance management systems to avoid penalties, delays, and other adverse consequences.