This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

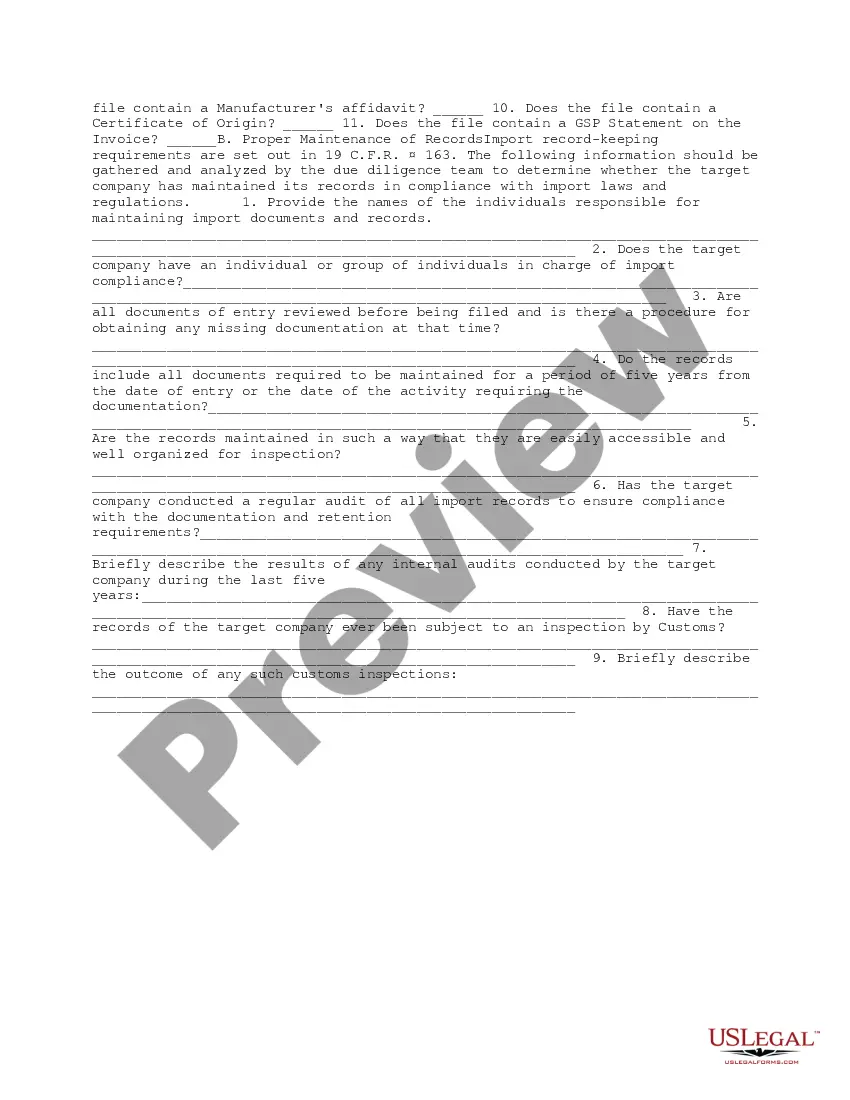

Cook Illinois Import Compliance and Records Review Due Diligence is a comprehensive process that aims to ensure compliance with all relevant import regulations and minimize the risk of legal and financial consequences associated with importing goods. By conducting these thorough due diligence procedures, importers can maintain transparency, accuracy, and efficient record-keeping systems that meet the requirements of various government agencies. The Cook Illinois Import Compliance and Records Review Due Diligence process involves meticulously inspecting all import-related documentation, including invoices, bills of lading, packing lists, import licenses, permits, and any other relevant documents. This review ensures that the imported goods are accurately classified, valued, and declared to the appropriate customs authorities, in adherence to the governing customs laws and regulations. By taking into account various compliance factors such as country of origin, tariff classifications, and valuation methods, importers can remain compliant with both U.S. federal laws like the Customs Modernization Act and international regulations such as the World Trade Organization's (WTO) guidelines on customs' valuation. There are different types of Cook Illinois Import Compliance and Records Review Due Diligence, each serving specific purposes. These types include: 1. Classification and Tariff Compliance: This focuses on the accurate classification of imported goods according to the Harmonized System (HS) code, a globally recognized standard for classifying products. It ensures that the appropriate duties, taxes, and restrictions are applied to the goods. 2. Valuation Compliance: This ensures the correct valuation of imported goods for duty assessment purposes. It involves verifying the accuracy of declared values, ensuring compliance with the applicable valuation methods (such as transaction value or alternative methods), and detecting any potential evaluation that could lead to undervaluation or transfer pricing issues. 3. Country of Origin Compliance: This type of due diligence examines the origin of imported goods to determine if they qualify for preferential treatment under free trade agreements or if any additional duties or import restrictions apply. It involves assessing the rules of origin and verifying that the goods meet the necessary criteria to claim preferential benefits. 4. Record Keeping and Documentation Compliance: This aspect of due diligence focuses on the maintenance and retention of accurate import records in accordance with the Customs Modernization Act's requirements. It includes keeping track of all documents related to import transactions, such as commercial invoices, bills of lading, import permits, and customs entry forms, for a specified period. By implementing these various types of Cook Illinois Import Compliance and Records Review Due Diligence, importers can ensure that their import activities align with the legal and regulatory frameworks, mitigate potential risks, gain cost savings, and enhance overall operational efficiencies.Cook Illinois Import Compliance and Records Review Due Diligence is a comprehensive process that aims to ensure compliance with all relevant import regulations and minimize the risk of legal and financial consequences associated with importing goods. By conducting these thorough due diligence procedures, importers can maintain transparency, accuracy, and efficient record-keeping systems that meet the requirements of various government agencies. The Cook Illinois Import Compliance and Records Review Due Diligence process involves meticulously inspecting all import-related documentation, including invoices, bills of lading, packing lists, import licenses, permits, and any other relevant documents. This review ensures that the imported goods are accurately classified, valued, and declared to the appropriate customs authorities, in adherence to the governing customs laws and regulations. By taking into account various compliance factors such as country of origin, tariff classifications, and valuation methods, importers can remain compliant with both U.S. federal laws like the Customs Modernization Act and international regulations such as the World Trade Organization's (WTO) guidelines on customs' valuation. There are different types of Cook Illinois Import Compliance and Records Review Due Diligence, each serving specific purposes. These types include: 1. Classification and Tariff Compliance: This focuses on the accurate classification of imported goods according to the Harmonized System (HS) code, a globally recognized standard for classifying products. It ensures that the appropriate duties, taxes, and restrictions are applied to the goods. 2. Valuation Compliance: This ensures the correct valuation of imported goods for duty assessment purposes. It involves verifying the accuracy of declared values, ensuring compliance with the applicable valuation methods (such as transaction value or alternative methods), and detecting any potential evaluation that could lead to undervaluation or transfer pricing issues. 3. Country of Origin Compliance: This type of due diligence examines the origin of imported goods to determine if they qualify for preferential treatment under free trade agreements or if any additional duties or import restrictions apply. It involves assessing the rules of origin and verifying that the goods meet the necessary criteria to claim preferential benefits. 4. Record Keeping and Documentation Compliance: This aspect of due diligence focuses on the maintenance and retention of accurate import records in accordance with the Customs Modernization Act's requirements. It includes keeping track of all documents related to import transactions, such as commercial invoices, bills of lading, import permits, and customs entry forms, for a specified period. By implementing these various types of Cook Illinois Import Compliance and Records Review Due Diligence, importers can ensure that their import activities align with the legal and regulatory frameworks, mitigate potential risks, gain cost savings, and enhance overall operational efficiencies.