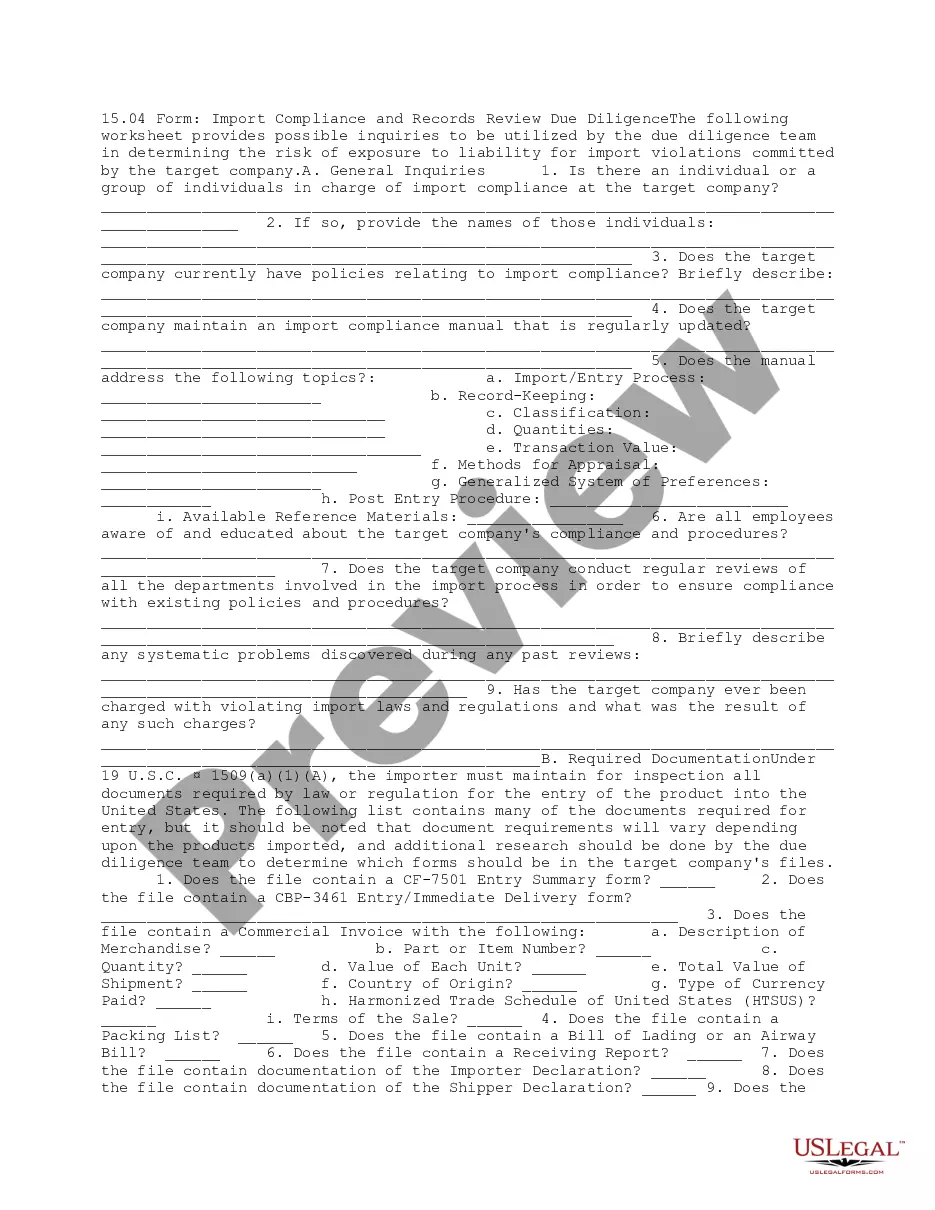

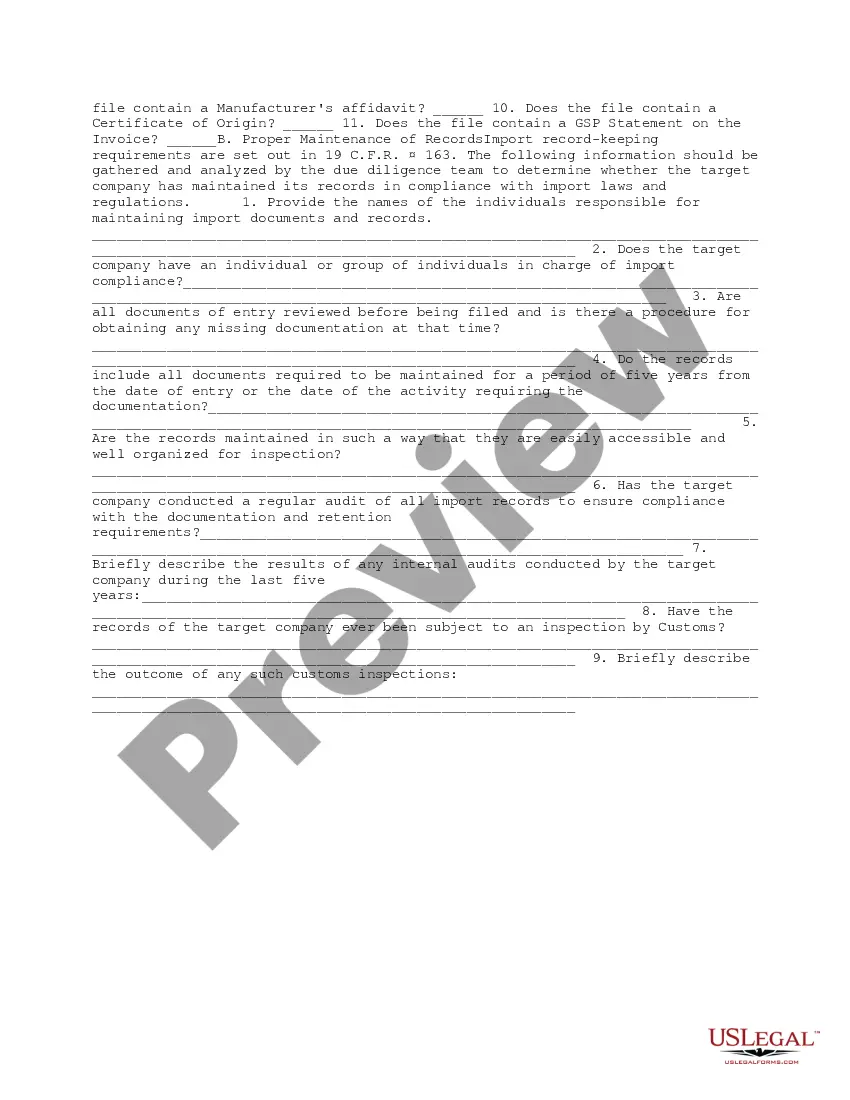

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Harris Texas Import Compliance and Records Review Due Diligence is a critical aspect of international trade, ensuring that businesses adhere to all legal and regulatory requirements while importing goods into Harris County, Texas, and maintaining accurate records of their activities. This process involves a thorough examination of various documents, transaction records, licenses, and permits related to the importation of goods. Import compliance refers to the process of complying with the laws and regulations imposed by the U.S. Customs and Border Protection (CBP) and other government agencies involved in trade. It ensures that importers meet all licensing, labeling, marking, classification, valuation, and tariff requirements. Import compliance professionals help businesses understand and comply with these complex regulations, avoiding penalties, delays, or even legal consequences. Records review due diligence, on the other hand, focuses on thoroughly examining and verifying all import-related records kept by the business. This includes reviewing invoices, bills of lading, customs forms, import/export declarations, certificates of origin, and other relevant documents that prove the legality and accuracy of import activities. Conducting due diligence is crucial to ensure compliance and mitigate potential risks associated with inaccurate records or fraudulent activities. In some cases, there might be specific types of Harris Texas Import Compliance and Records Review Due Diligence based on industry-specific regulations or business requirements. For example: 1. Pharmaceutical Import Compliance and Records Review: This type of due diligence focuses on complying with the specific regulations set by the U.S. Food and Drug Administration (FDA) for importing pharmaceutical products. It involves verifying product labeling, packaging, quality assurance, and adherence to good manufacturing practices (GMP). 2. Hazardous Material Import Compliance and Records Review: This type of due diligence targets businesses involved in importing hazardous materials or dangerous goods. It entails ensuring compliance with regulations set by agencies like the Environmental Protection Agency (EPA) or the Department of Transportation (DOT) to prevent any potential risks to public safety or the environment. 3. Agricultural Import Compliance and Records Review: This type of due diligence is commonly applicable to businesses importing agricultural products or commodities. It includes verifying compliance with regulations surrounding inspections, certifications, and licensing related to the import of live animals, plants, fruits, vegetables, or other agricultural commodities. In conclusion, Harris Texas Import Compliance and Records Review Due Diligence is essential for businesses engaged in international trade to comply with all relevant laws and regulations, maintain accurate records, and mitigate risks associated with importing goods into Harris County. It encompasses various aspects of compliance, and there may be specific types tailored to different industries or regulatory bodies.Harris Texas Import Compliance and Records Review Due Diligence is a critical aspect of international trade, ensuring that businesses adhere to all legal and regulatory requirements while importing goods into Harris County, Texas, and maintaining accurate records of their activities. This process involves a thorough examination of various documents, transaction records, licenses, and permits related to the importation of goods. Import compliance refers to the process of complying with the laws and regulations imposed by the U.S. Customs and Border Protection (CBP) and other government agencies involved in trade. It ensures that importers meet all licensing, labeling, marking, classification, valuation, and tariff requirements. Import compliance professionals help businesses understand and comply with these complex regulations, avoiding penalties, delays, or even legal consequences. Records review due diligence, on the other hand, focuses on thoroughly examining and verifying all import-related records kept by the business. This includes reviewing invoices, bills of lading, customs forms, import/export declarations, certificates of origin, and other relevant documents that prove the legality and accuracy of import activities. Conducting due diligence is crucial to ensure compliance and mitigate potential risks associated with inaccurate records or fraudulent activities. In some cases, there might be specific types of Harris Texas Import Compliance and Records Review Due Diligence based on industry-specific regulations or business requirements. For example: 1. Pharmaceutical Import Compliance and Records Review: This type of due diligence focuses on complying with the specific regulations set by the U.S. Food and Drug Administration (FDA) for importing pharmaceutical products. It involves verifying product labeling, packaging, quality assurance, and adherence to good manufacturing practices (GMP). 2. Hazardous Material Import Compliance and Records Review: This type of due diligence targets businesses involved in importing hazardous materials or dangerous goods. It entails ensuring compliance with regulations set by agencies like the Environmental Protection Agency (EPA) or the Department of Transportation (DOT) to prevent any potential risks to public safety or the environment. 3. Agricultural Import Compliance and Records Review: This type of due diligence is commonly applicable to businesses importing agricultural products or commodities. It includes verifying compliance with regulations surrounding inspections, certifications, and licensing related to the import of live animals, plants, fruits, vegetables, or other agricultural commodities. In conclusion, Harris Texas Import Compliance and Records Review Due Diligence is essential for businesses engaged in international trade to comply with all relevant laws and regulations, maintain accurate records, and mitigate risks associated with importing goods into Harris County. It encompasses various aspects of compliance, and there may be specific types tailored to different industries or regulatory bodies.