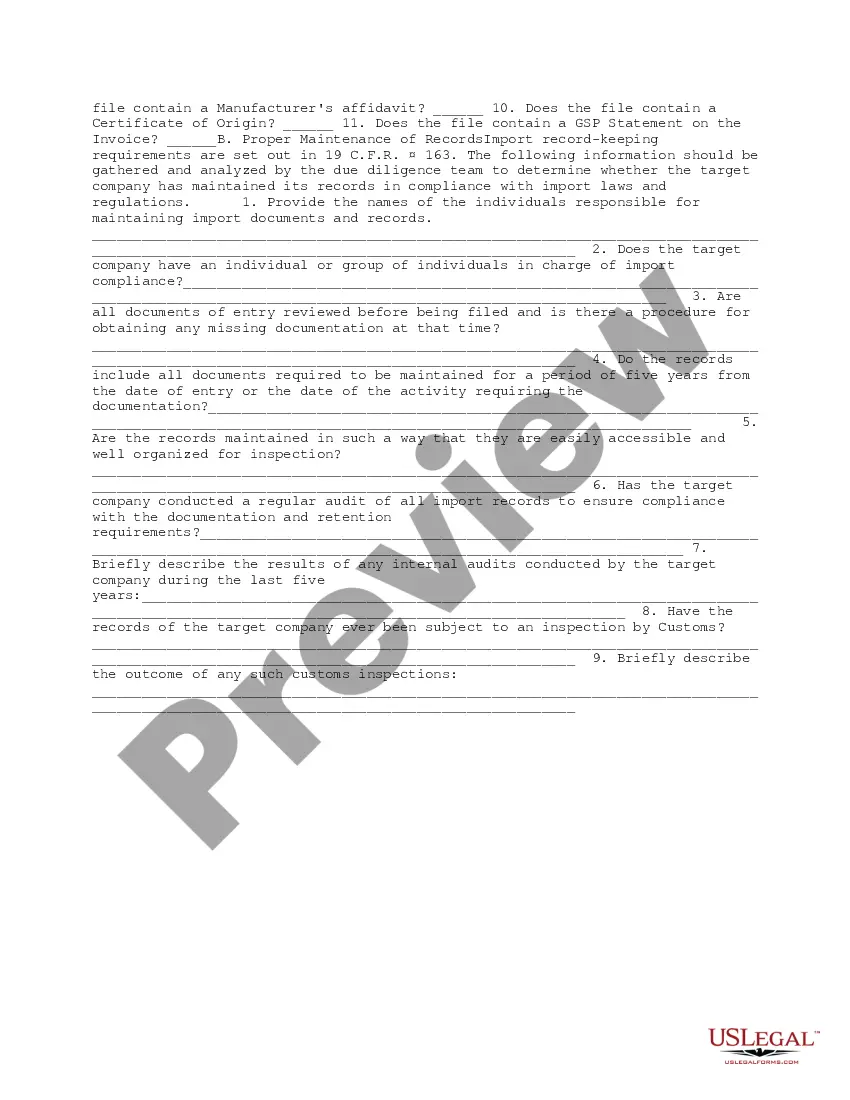

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Hennepin Minnesota Import Compliance and Records Review Due Diligence is a crucial process for businesses engaged in international trade. It involves ensuring that all imports comply with relevant laws, regulations, and trade agreements, while also conducting comprehensive records review to ensure accuracy and compliance. This stringent due diligence procedure serves to minimize legal risks, prevent potential penalties, and maintain a smooth importing process. With rapid globalization, businesses must navigate complex import regulations, making Hennepin Minnesota Import Compliance and Records Review Due Diligence an essential part of their operations. This compliance process involves thoroughly examining import documentation, including invoices, bills of lading, customs forms, and permits. By conducting meticulous record reviews, businesses can verify the accuracy of import declarations and identify any discrepancies that may trigger regulatory concerns or potential penalties. Given the diverse nature of imports, Hennepin Minnesota Import Compliance and Records Review Due Diligence can encompass several specialized types, including: 1. Hennepin Minnesota Import Compliance Due Diligence: This type focuses primarily on ensuring that imports adhere to local and international regulations. It involves assessing import classifications, duty rates, and eligibility for preferential trade programs. Compliance due diligence ensures that imports comply with customs laws, import restrictions, licensing requirements, and product safety standards. Reliable compliance prevents shipment delays, confiscations, and legal consequences. 2. Hennepin Minnesota Records Review Due Diligence: This type focuses on closely examining import records to check their accuracy, completeness, and consistency. It involves meticulous scrutiny of documentation, such as commercial invoices, packing lists, shipping terms, and bills of lading. Additionally, it verifies the declared value of goods, the correct application of tariff codes, and the validity of any exemptions or licenses claimed. This review is vital for uncovering potential errors, fraud, or intentional misrepresentations. 3. Hennepin Minnesota Customs Audit Due Diligence: A customs audit is a comprehensive review of a company's import transactions and compliance procedures conducted by customs authorities. It aims to evaluate a business's adherence to import regulations, record-keeping practices, and internal control systems. By conducting an internal customs audit, companies can proactively identify and address any shortcomings, ensuring their import activities fully comply with legal requirements. Considering the complexity and potential consequences of non-compliance, businesses in Hennepin Minnesota must prioritize Import Compliance and Records Review Due Diligence. By leveraging expert resources, such as lawyers, customs brokers, or trade consultants, companies can effectively navigate the complexities of international trade regulations, reduce risks, and maintain a favorable reputation in the marketplace.Hennepin Minnesota Import Compliance and Records Review Due Diligence is a crucial process for businesses engaged in international trade. It involves ensuring that all imports comply with relevant laws, regulations, and trade agreements, while also conducting comprehensive records review to ensure accuracy and compliance. This stringent due diligence procedure serves to minimize legal risks, prevent potential penalties, and maintain a smooth importing process. With rapid globalization, businesses must navigate complex import regulations, making Hennepin Minnesota Import Compliance and Records Review Due Diligence an essential part of their operations. This compliance process involves thoroughly examining import documentation, including invoices, bills of lading, customs forms, and permits. By conducting meticulous record reviews, businesses can verify the accuracy of import declarations and identify any discrepancies that may trigger regulatory concerns or potential penalties. Given the diverse nature of imports, Hennepin Minnesota Import Compliance and Records Review Due Diligence can encompass several specialized types, including: 1. Hennepin Minnesota Import Compliance Due Diligence: This type focuses primarily on ensuring that imports adhere to local and international regulations. It involves assessing import classifications, duty rates, and eligibility for preferential trade programs. Compliance due diligence ensures that imports comply with customs laws, import restrictions, licensing requirements, and product safety standards. Reliable compliance prevents shipment delays, confiscations, and legal consequences. 2. Hennepin Minnesota Records Review Due Diligence: This type focuses on closely examining import records to check their accuracy, completeness, and consistency. It involves meticulous scrutiny of documentation, such as commercial invoices, packing lists, shipping terms, and bills of lading. Additionally, it verifies the declared value of goods, the correct application of tariff codes, and the validity of any exemptions or licenses claimed. This review is vital for uncovering potential errors, fraud, or intentional misrepresentations. 3. Hennepin Minnesota Customs Audit Due Diligence: A customs audit is a comprehensive review of a company's import transactions and compliance procedures conducted by customs authorities. It aims to evaluate a business's adherence to import regulations, record-keeping practices, and internal control systems. By conducting an internal customs audit, companies can proactively identify and address any shortcomings, ensuring their import activities fully comply with legal requirements. Considering the complexity and potential consequences of non-compliance, businesses in Hennepin Minnesota must prioritize Import Compliance and Records Review Due Diligence. By leveraging expert resources, such as lawyers, customs brokers, or trade consultants, companies can effectively navigate the complexities of international trade regulations, reduce risks, and maintain a favorable reputation in the marketplace.