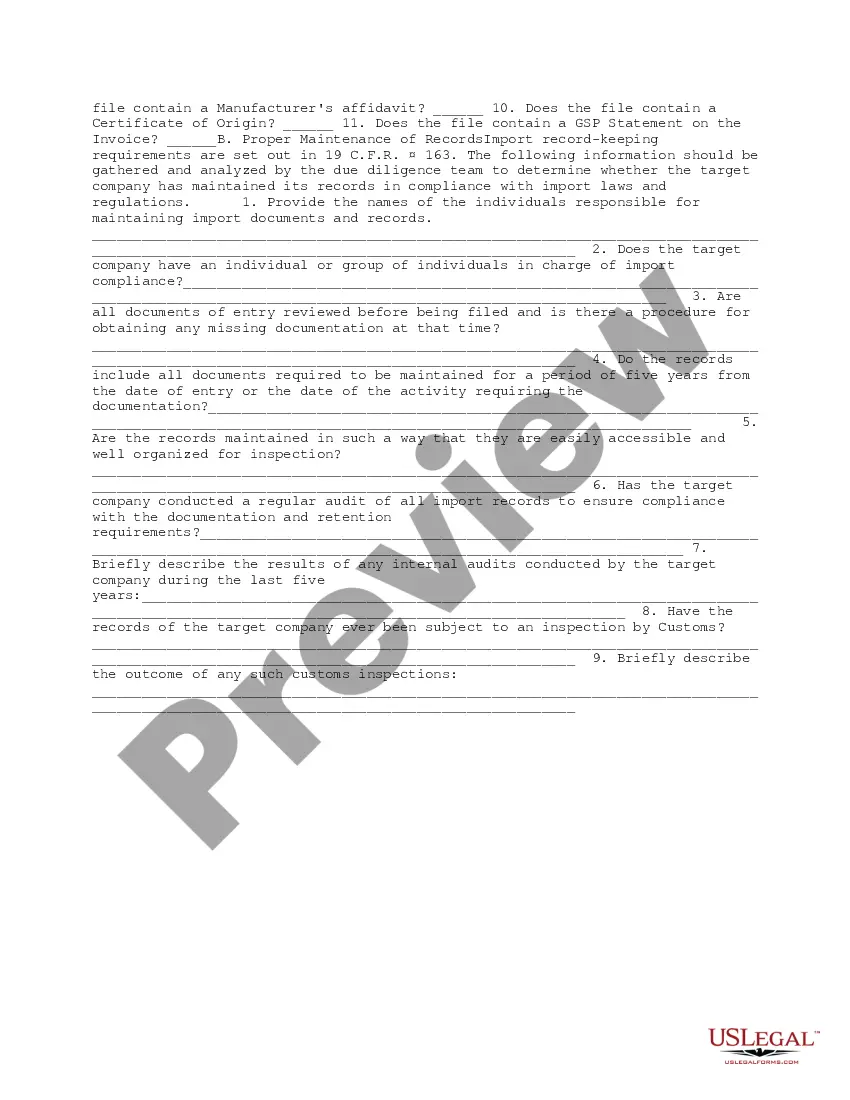

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Hillsborough Florida Import Compliance and Records Review Due Diligence: Import Compliance is a critical aspect of international trade, ensuring that businesses adhere to the laws and regulations imposed by the government when importing goods. In Hillsborough County, Florida, importers and businesses can rely on a specialized service known as Hillsborough Florida Import Compliance and Records Review Due Diligence. Import Compliance and Records Review Due Diligence is a comprehensive process that involves examining every aspect of an import transaction to validate compliance with the United States customs laws and regulations. It aims to ensure that businesses are meeting their legal obligations, minimizing the risk of penalties, and maintaining the integrity of the global trade system. Hillsborough Florida Import Compliance and Records Review Due Diligence covers various essential aspects, including: 1. Document Verification: Experts meticulously review and cross-validate all import documents, such as commercial invoices, packing lists, bills of lading, and customs declarations to ensure accuracy and compliance. 2. Tariff Classification: Accurate classification of imported goods is essential for determining applicable duties, taxes, and potential eligibility for trade agreements. A thorough examination of product descriptions and characteristics takes place to ensure correct tariff classification. 3. Country of Origin Determination: Country of origin is crucial for determining eligibility for preferential trade programs and the imposition of antidumping or countervailing duties. Professionals analyze manufacturers' information and production processes to establish accurate origin. 4. Valuation Assessment: Determining the customs value of imported goods is vital for calculating ad valor em duties. Hillsborough Florida Import Compliance and Records Review Due Diligence thoroughly evaluates pricing, assists in applying valuation methods, and ensures adherence to regulations. 5. Customized Compliance Programs: Experts assist companies in designing and implementing import compliance programs tailored to their specific needs, mitigating potential risks and ensuring ongoing compliance. Potential types of Hillsborough Florida Import Compliance and Records Review Due Diligence services may include: 1. General Import Compliance: A comprehensive review of all aspects of an import transaction, ranging from document verification to customs compliance. 2. Preferential Trade Program Compliance: Focused on assessing eligibility and compliance with trade programs, such as the North American Free Trade Agreement (NAFTA) or the Generalized System of Preferences (GSP). 3. Anti-Dumping and Countervailing Duty Review: A specialized review targeting imports subject to the imposition of additional duties due to unfair trade practices. In conclusion, Hillsborough Florida Import Compliance and Records Review Due Diligence is a vital service for businesses engaged in international trade, ensuring adherence to customs laws and regulations. It encompasses various crucial aspects and can be tailored to meet specific compliance needs, including general imports, preferential trade programs, or anti-dumping measures. By availing these services, businesses can ensure smooth and legally compliant import operations in Hillsborough County, Florida.