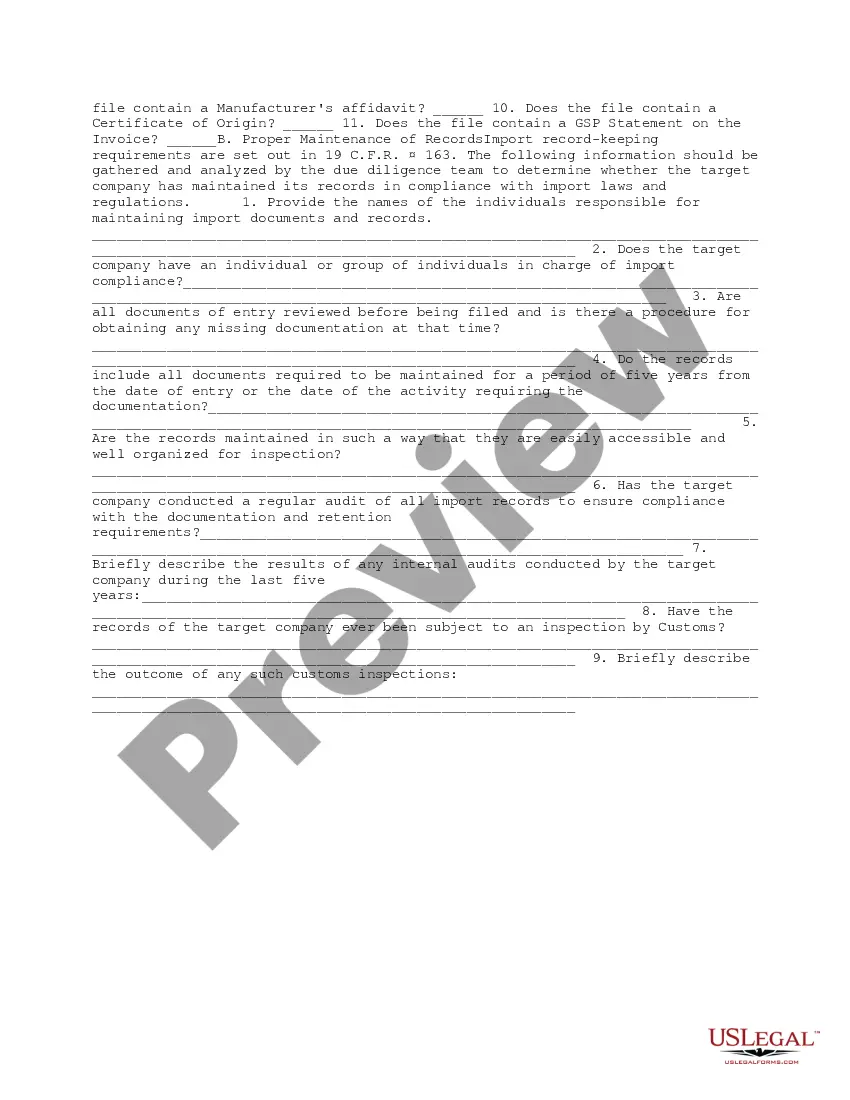

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Los Angeles California Import Compliance and Records Review Due Diligence refers to a series of processes and procedures that are conducted to ensure that businesses involved in international trade in Los Angeles comply with all relevant import regulations and maintain accurate records. It aims to mitigate potential risks and ensure the smooth flow of goods across borders. Import compliance involves adhering to various regulations set by different governmental agencies, such as the U.S. Customs and Border Protection (CBP), the Food and Drug Administration (FDA), and the Environmental Protection Agency (EPA). It includes proper classification of imported goods, accurate valuation, adherence to licensing and permit requirements, and compliance with trade agreements and embargoes. Records review due diligence is a critical component of import compliance, as it involves the comprehensive examination of business records related to import activities. It ensures that importers maintain complete and accurate documentation, including invoices, bills of lading, packing lists, import licenses, and certificates of origin. The records review ensures transparency, traceability, and accountability in international trade operations. Different types of Los Angeles California Import Compliance and Records Review Due Diligence may include: 1. Regulatory Compliance Audit: This type of due diligence involves a thorough examination of a business's import processes and procedures to identify any non-compliance issues with import regulations. It includes reviewing import documentation, internal controls, and conducting interviews with key personnel. 2. Classification and Valuation Audit: This type of due diligence focuses primarily on the accurate classification and valuation of imported goods. It ensures that goods are properly classified under the Harmonized System (HS) codes and valued appropriately to calculate duties and taxes accurately. 3. Documentation Review: This type of due diligence involves a comprehensive evaluation of import-related documents to verify their authenticity, completeness, and accuracy. It ensures that all required import documentation is properly maintained and readily available for customs authorities or auditors. 4. Trade Agreement Compliance Audit: This type of due diligence aims to ensure that businesses comply with various trade agreements, such as Free Trade Agreements (FTA), Preferential Trade Programs (Pops), or other bilateral or multilateral trade agreements. It involves reviewing eligibility criteria, rules of origin documentation, and ensuring adherence to preferential duty rates. 5. Risk Assessment and Management: This type of due diligence involves identifying potential import compliance risks and implementing measures to mitigate them. It includes evaluating the adequacy of internal controls, conducting risk assessments regarding potential violations, and designing appropriate risk management strategies. In conclusion, Los Angeles California Import Compliance and Records Review Due Diligence encompasses a range of activities related to ensuring import compliance and maintaining accurate records. This includes conducting audits, reviewing documentation, and managing import-related risks. By implementing these due diligence measures, businesses in Los Angeles can enhance their compliance efforts, minimize financial and reputational risks, and ensure smooth and efficient trade operations.Los Angeles California Import Compliance and Records Review Due Diligence refers to a series of processes and procedures that are conducted to ensure that businesses involved in international trade in Los Angeles comply with all relevant import regulations and maintain accurate records. It aims to mitigate potential risks and ensure the smooth flow of goods across borders. Import compliance involves adhering to various regulations set by different governmental agencies, such as the U.S. Customs and Border Protection (CBP), the Food and Drug Administration (FDA), and the Environmental Protection Agency (EPA). It includes proper classification of imported goods, accurate valuation, adherence to licensing and permit requirements, and compliance with trade agreements and embargoes. Records review due diligence is a critical component of import compliance, as it involves the comprehensive examination of business records related to import activities. It ensures that importers maintain complete and accurate documentation, including invoices, bills of lading, packing lists, import licenses, and certificates of origin. The records review ensures transparency, traceability, and accountability in international trade operations. Different types of Los Angeles California Import Compliance and Records Review Due Diligence may include: 1. Regulatory Compliance Audit: This type of due diligence involves a thorough examination of a business's import processes and procedures to identify any non-compliance issues with import regulations. It includes reviewing import documentation, internal controls, and conducting interviews with key personnel. 2. Classification and Valuation Audit: This type of due diligence focuses primarily on the accurate classification and valuation of imported goods. It ensures that goods are properly classified under the Harmonized System (HS) codes and valued appropriately to calculate duties and taxes accurately. 3. Documentation Review: This type of due diligence involves a comprehensive evaluation of import-related documents to verify their authenticity, completeness, and accuracy. It ensures that all required import documentation is properly maintained and readily available for customs authorities or auditors. 4. Trade Agreement Compliance Audit: This type of due diligence aims to ensure that businesses comply with various trade agreements, such as Free Trade Agreements (FTA), Preferential Trade Programs (Pops), or other bilateral or multilateral trade agreements. It involves reviewing eligibility criteria, rules of origin documentation, and ensuring adherence to preferential duty rates. 5. Risk Assessment and Management: This type of due diligence involves identifying potential import compliance risks and implementing measures to mitigate them. It includes evaluating the adequacy of internal controls, conducting risk assessments regarding potential violations, and designing appropriate risk management strategies. In conclusion, Los Angeles California Import Compliance and Records Review Due Diligence encompasses a range of activities related to ensuring import compliance and maintaining accurate records. This includes conducting audits, reviewing documentation, and managing import-related risks. By implementing these due diligence measures, businesses in Los Angeles can enhance their compliance efforts, minimize financial and reputational risks, and ensure smooth and efficient trade operations.