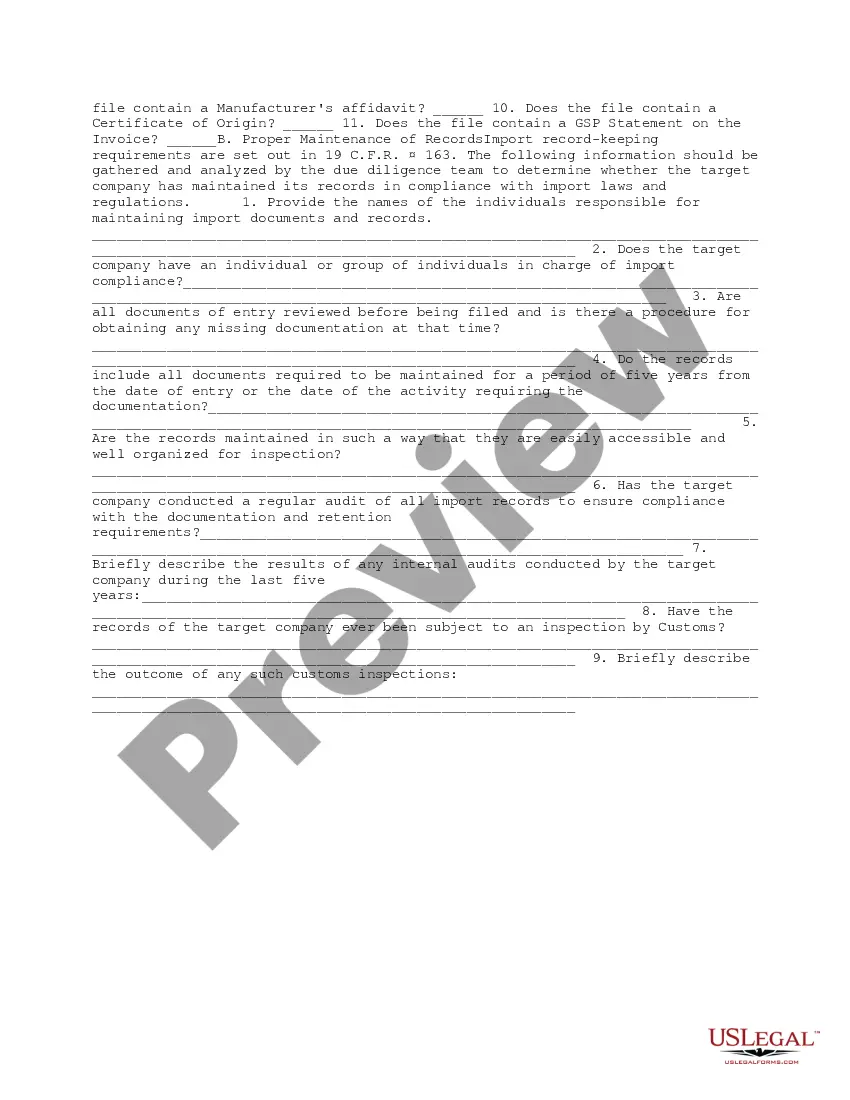

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Mecklenburg North Carolina Import Compliance and Records Review Due Diligence refers to the process and protocols that are followed to ensure compliance with import laws, regulations, and requirements specified by customs authorities in Mecklenburg County, North Carolina. This diligent practice helps businesses and individuals engage in import activities while fulfilling legal obligations and avoiding penalties or delays. Import compliance involves adhering to a range of legal, regulatory, and procedural requirements imposed by governments to maintain national security, public health, protect domestic industries, and prevent the entry of counterfeit or illegal goods. Mecklenburg County requires importers to comply with these regulations to ensure the smooth flow of trade and protect the community's interests. Records review due diligence is a critical aspect of import compliance, involving the thorough examination and verification of import-related documentation. This process includes assessing invoices, bills of lading, packing lists, import licenses, permits, certificates of origin, and any other relevant paperwork. By conducting a comprehensive review, importers can verify the accuracy and legitimacy of the import records, ensuring compliance with legal and regulatory requirements. Types of Mecklenburg North Carolina Import Compliance and Records Review Due Diligence include: 1. Tariff Classification Review: This type of due diligence involves accurately classifying imported goods according to the Harmonized System (HS) codes. The HS code determines import duties, taxes, and regulations applicable to specific product categories. Proper classification is essential for compliance and determining the correct customs' valuation. 2. Customs Valuation Review: This focuses on ensuring the accurate valuation of imported goods based on the methods defined by customs authorities. It involves reviewing invoices, transaction documents, and other relevant records to determine the proper customs value, which directly affects import duties, taxes, and fees. 3. Documentation Review: This due diligence focuses on reviewing all the necessary import documents, such as commercial invoices, packing lists, and shipping documents, to confirm their accuracy, completeness, and compliance with customs regulations. Valid documentation is crucial for smooth customs' clearance. 4. Trade Agreement Compliance Review: In cases where Mecklenburg County is a party to international trade agreements, such as free trade agreements (FTA), importers must ensure compliance with the specific requirements and provisions of these agreements. This type of review ensures importers take advantage of preferential duty rates and benefits made available through such agreements. 5. Restricted Goods Review: This due diligence involves reviewing goods subject to import restrictions, such as those related to endangered species, controlled substances, firearms, or specific industries and technologies. Importers must comply with all applicable permits, licenses, and regulations to import these restricted goods legally. The Mecklenburg North Carolina Import Compliance and Records Review Due Diligence process helps importers understand and meet the legal requirements necessary for successful importation. By conducting these reviews thoroughly and regularly, businesses and individuals ensure their compliance with customs regulations, safeguard their interests, and contribute to the efficient and secure movement of goods within Mecklenburg County, North Carolina.