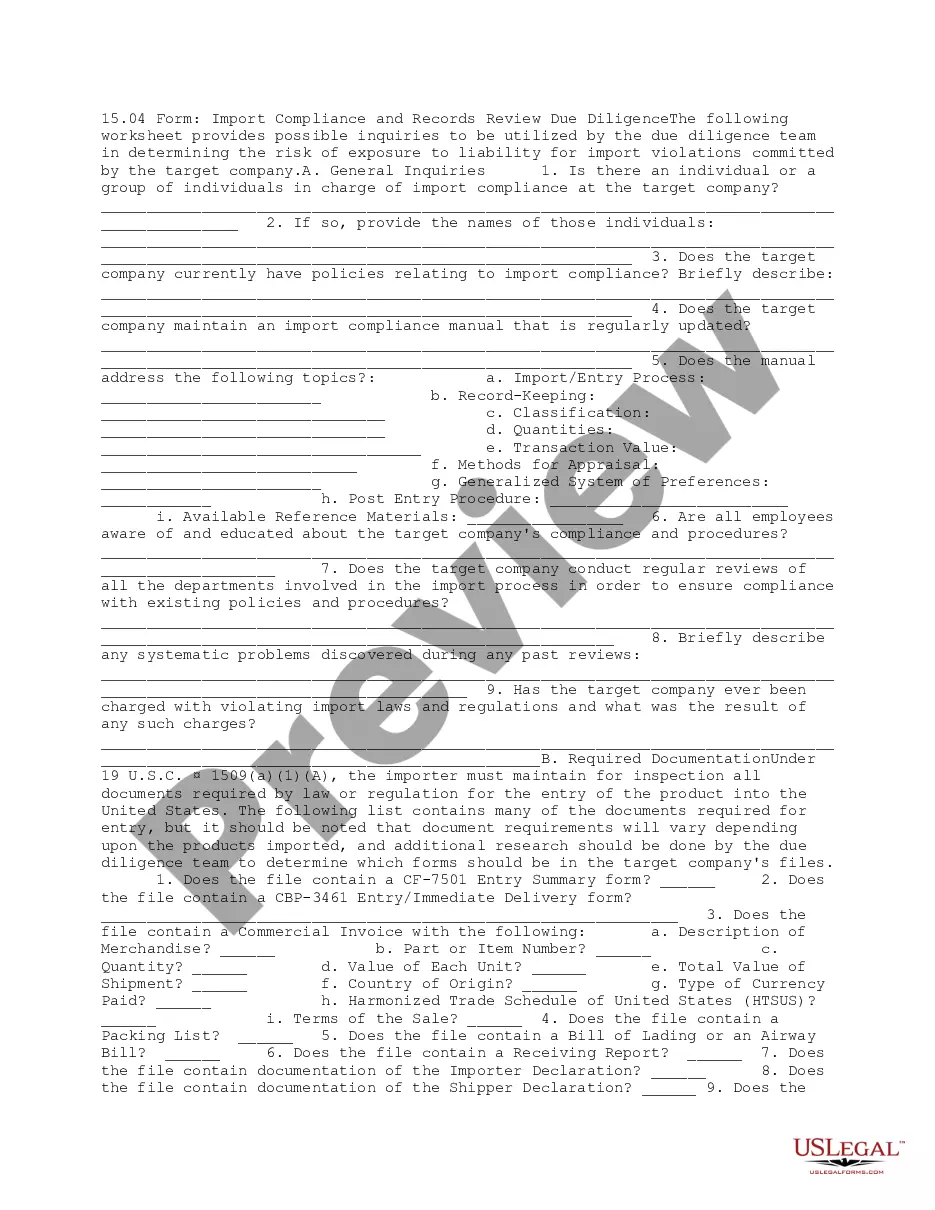

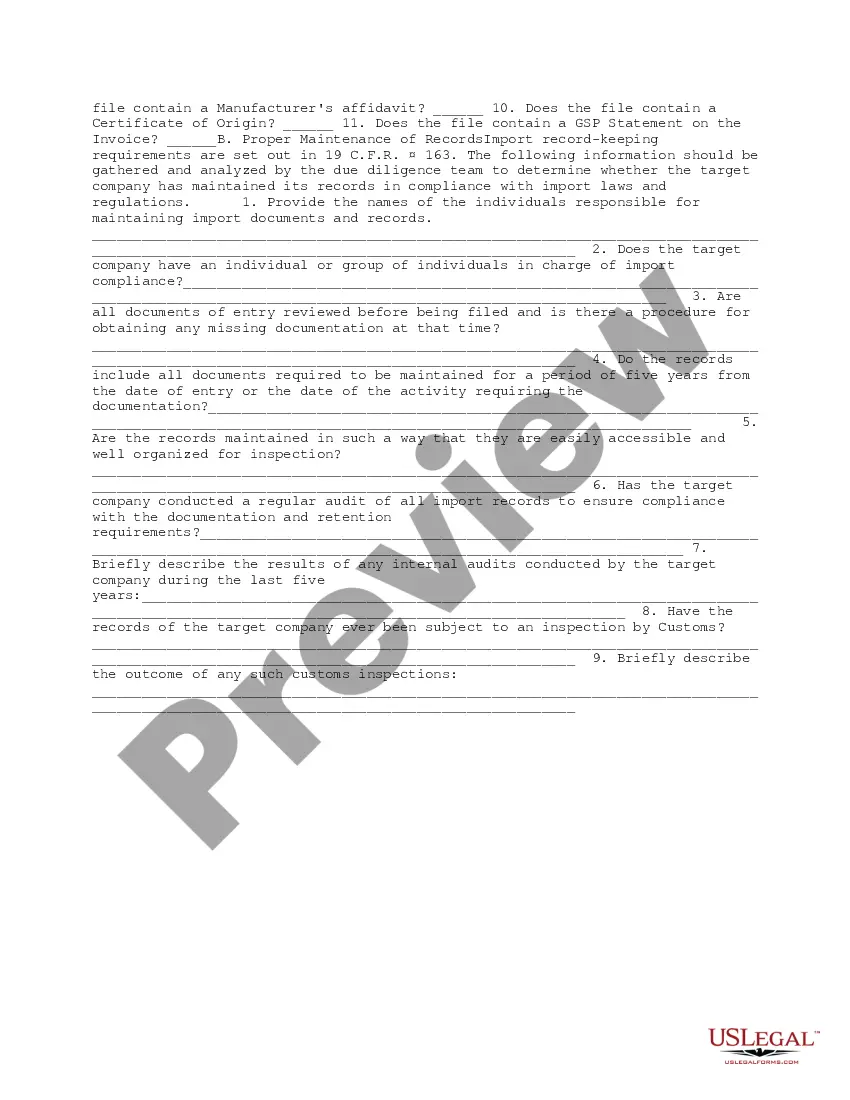

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Nassau New York Import Compliance and Records Review Due Diligence is a vital process that ensures businesses and individuals adhere to the necessary regulations and laws when importing goods to Nassau County, New York. This thorough examination of import documentation and records guarantees compliance with customs, trade, and tax requirements. As an important facet of international trade, Nassau New York Import Compliance and Records Review Due Diligence involve multiple stages and can be classified into various types based on specific focus areas. These include: 1. Customs Compliance Review: This type of due diligence focuses on verifying that all imported goods align with the rules and regulations set forth by customs authorities. It encompasses a comprehensive evaluation of import declarations, classification, valuation, origin, and required permits or licenses. 2. Trade Compliance Review: Trade compliance due diligence concentrates on adherence to trade laws and regulations, such as those pertaining to tariff quotas, anti-dumping measures, trade embargoes, and trade preferences. It ensures that imports comply with these regulations to avoid potential legal and financial consequences. 3. Tax Compliance Review: This type concentrates on assessing whether all applicable taxes, duties, and fees related to imports have been accurately calculated, reported, and paid. It involves reviewing customs declarations, invoices, and supporting documents to ensure compliance with Nassau County tax regulations and prevent potential penalties or disputes. 4. Record-Keeping Review: As importers are obligated to maintain accurate and complete records, this type of due diligence scrutinizes the documentation and records associated with imported goods. It verifies the availability and adequacy of records, including commercial invoices, bills of lading, packing lists, customs entries, and any other relevant documentation required by authorities. 5. Supplier Due Diligence: This aspect refers to evaluating and ensuring the compliance of suppliers or manufacturers with export control laws, ethical standards, and other requirements. By conducting this due diligence, businesses can mitigate the risk of unknowingly engaging with entities involved in illegal or unethical activities. Nassau New York Import Compliance and Records Review Due Diligence should be conducted by experienced professionals or specialized organizations well-versed in international trade laws and regulations. It ensures the smooth and lawful importation of goods, safeguards against legal and financial liabilities, and helps businesses maintain a high level of integrity and transparency in their import operations. By undertaking these measures, importers in Nassau County, New York, can thrive in the global marketplace while meeting their legal and regulatory obligations.Nassau New York Import Compliance and Records Review Due Diligence is a vital process that ensures businesses and individuals adhere to the necessary regulations and laws when importing goods to Nassau County, New York. This thorough examination of import documentation and records guarantees compliance with customs, trade, and tax requirements. As an important facet of international trade, Nassau New York Import Compliance and Records Review Due Diligence involve multiple stages and can be classified into various types based on specific focus areas. These include: 1. Customs Compliance Review: This type of due diligence focuses on verifying that all imported goods align with the rules and regulations set forth by customs authorities. It encompasses a comprehensive evaluation of import declarations, classification, valuation, origin, and required permits or licenses. 2. Trade Compliance Review: Trade compliance due diligence concentrates on adherence to trade laws and regulations, such as those pertaining to tariff quotas, anti-dumping measures, trade embargoes, and trade preferences. It ensures that imports comply with these regulations to avoid potential legal and financial consequences. 3. Tax Compliance Review: This type concentrates on assessing whether all applicable taxes, duties, and fees related to imports have been accurately calculated, reported, and paid. It involves reviewing customs declarations, invoices, and supporting documents to ensure compliance with Nassau County tax regulations and prevent potential penalties or disputes. 4. Record-Keeping Review: As importers are obligated to maintain accurate and complete records, this type of due diligence scrutinizes the documentation and records associated with imported goods. It verifies the availability and adequacy of records, including commercial invoices, bills of lading, packing lists, customs entries, and any other relevant documentation required by authorities. 5. Supplier Due Diligence: This aspect refers to evaluating and ensuring the compliance of suppliers or manufacturers with export control laws, ethical standards, and other requirements. By conducting this due diligence, businesses can mitigate the risk of unknowingly engaging with entities involved in illegal or unethical activities. Nassau New York Import Compliance and Records Review Due Diligence should be conducted by experienced professionals or specialized organizations well-versed in international trade laws and regulations. It ensures the smooth and lawful importation of goods, safeguards against legal and financial liabilities, and helps businesses maintain a high level of integrity and transparency in their import operations. By undertaking these measures, importers in Nassau County, New York, can thrive in the global marketplace while meeting their legal and regulatory obligations.