This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

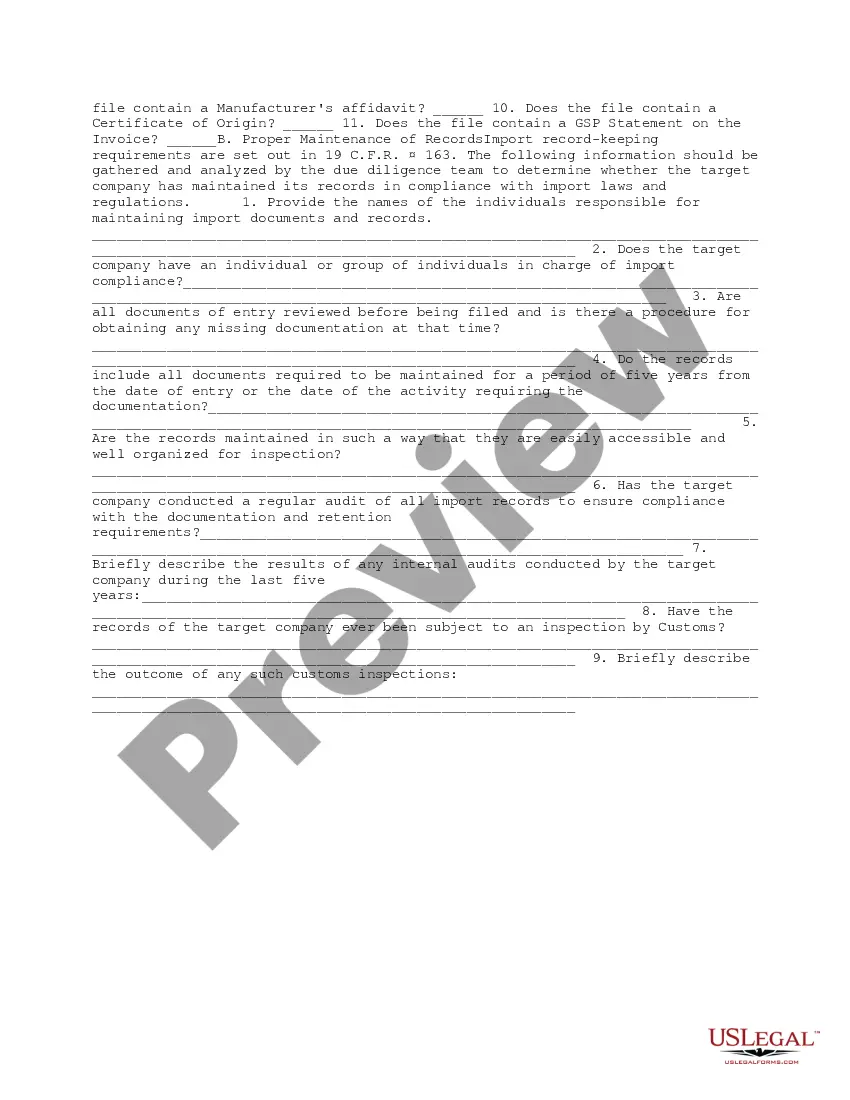

Philadelphia Pennsylvania Import Compliance and Records Review Due Diligence aims to ensure that all imports into the city meet the required legal and regulatory standards. This process involves a thorough examination of import documents, records, and procedures to mitigate risks and ensure compliance with local, national, and international import laws. By conducting due diligence, businesses and individuals can avoid penalties, fines, and legal complications associated with non-compliance. The different types of Philadelphia Pennsylvania Import Compliance and Records Review Due Diligence include: 1. Documentation Verification: This involves reviewing all import-related documents, such as purchase orders, invoices, bills of lading, and customs declarations, to ensure accuracy and completeness. Any discrepancies found are promptly addressed to prevent delays or potential violations. 2. Harmonized System (HS) Code Classification: HS codes are essential for international trade as they classify goods for customs and statistical purposes. Import compliance due diligence includes verifying HS code accuracy and ensuring that the declared codes align with the actual goods being imported. 3. Import Licensing and Permit Evaluation: Certain goods require specific licenses or permits to be imported legally. During the due diligence process, evaluators check the validity and compliance of these documents, ensuring that the necessary authorizations are in place. 4. Customs Valuation Review: The valuation of goods for customs purposes must be accurate and comply with relevant regulations. Import compliance and records review due diligence assesses the declared value against the supporting documentation, ensuring that the valuation is correct and in compliance with applicable rules. 5. Trade Agreement Eligibility: For imports eligible for preferential treatment under free trade agreements or other trade programs, due diligence involves verifying the eligibility criteria, ensuring compliance with specific rules of origin, and documenting any required certifications. 6. Importer Self-Assessment (ISA) Audits: ISA audits are voluntary assessments conducted by importers to demonstrate their compliance with customs laws and regulations. Due diligence may include reviewing ISA audit reports and records to assess an importer's compliance history and identify any potential areas of concern. 7. Record keeping and Compliance Procedures: Importers are required to maintain accurate records of their import transactions and related documents for a specified period. Due diligence involves examining an importer's record keeping processes and procedures, ensuring they comply with applicable laws and regulations. 8. Risk Assessment and Mitigation: As part of import compliance and records review due diligence, evaluators assess the overall risk associated with the importer's operations and implement measures to mitigate potential compliance risks. By conducting thorough Philadelphia Pennsylvania Import Compliance and Records Review Due Diligence, importers can ensure compliance with import laws, avoid legal issues, and establish a framework for smooth and efficient import operations within the city.Philadelphia Pennsylvania Import Compliance and Records Review Due Diligence aims to ensure that all imports into the city meet the required legal and regulatory standards. This process involves a thorough examination of import documents, records, and procedures to mitigate risks and ensure compliance with local, national, and international import laws. By conducting due diligence, businesses and individuals can avoid penalties, fines, and legal complications associated with non-compliance. The different types of Philadelphia Pennsylvania Import Compliance and Records Review Due Diligence include: 1. Documentation Verification: This involves reviewing all import-related documents, such as purchase orders, invoices, bills of lading, and customs declarations, to ensure accuracy and completeness. Any discrepancies found are promptly addressed to prevent delays or potential violations. 2. Harmonized System (HS) Code Classification: HS codes are essential for international trade as they classify goods for customs and statistical purposes. Import compliance due diligence includes verifying HS code accuracy and ensuring that the declared codes align with the actual goods being imported. 3. Import Licensing and Permit Evaluation: Certain goods require specific licenses or permits to be imported legally. During the due diligence process, evaluators check the validity and compliance of these documents, ensuring that the necessary authorizations are in place. 4. Customs Valuation Review: The valuation of goods for customs purposes must be accurate and comply with relevant regulations. Import compliance and records review due diligence assesses the declared value against the supporting documentation, ensuring that the valuation is correct and in compliance with applicable rules. 5. Trade Agreement Eligibility: For imports eligible for preferential treatment under free trade agreements or other trade programs, due diligence involves verifying the eligibility criteria, ensuring compliance with specific rules of origin, and documenting any required certifications. 6. Importer Self-Assessment (ISA) Audits: ISA audits are voluntary assessments conducted by importers to demonstrate their compliance with customs laws and regulations. Due diligence may include reviewing ISA audit reports and records to assess an importer's compliance history and identify any potential areas of concern. 7. Record keeping and Compliance Procedures: Importers are required to maintain accurate records of their import transactions and related documents for a specified period. Due diligence involves examining an importer's record keeping processes and procedures, ensuring they comply with applicable laws and regulations. 8. Risk Assessment and Mitigation: As part of import compliance and records review due diligence, evaluators assess the overall risk associated with the importer's operations and implement measures to mitigate potential compliance risks. By conducting thorough Philadelphia Pennsylvania Import Compliance and Records Review Due Diligence, importers can ensure compliance with import laws, avoid legal issues, and establish a framework for smooth and efficient import operations within the city.