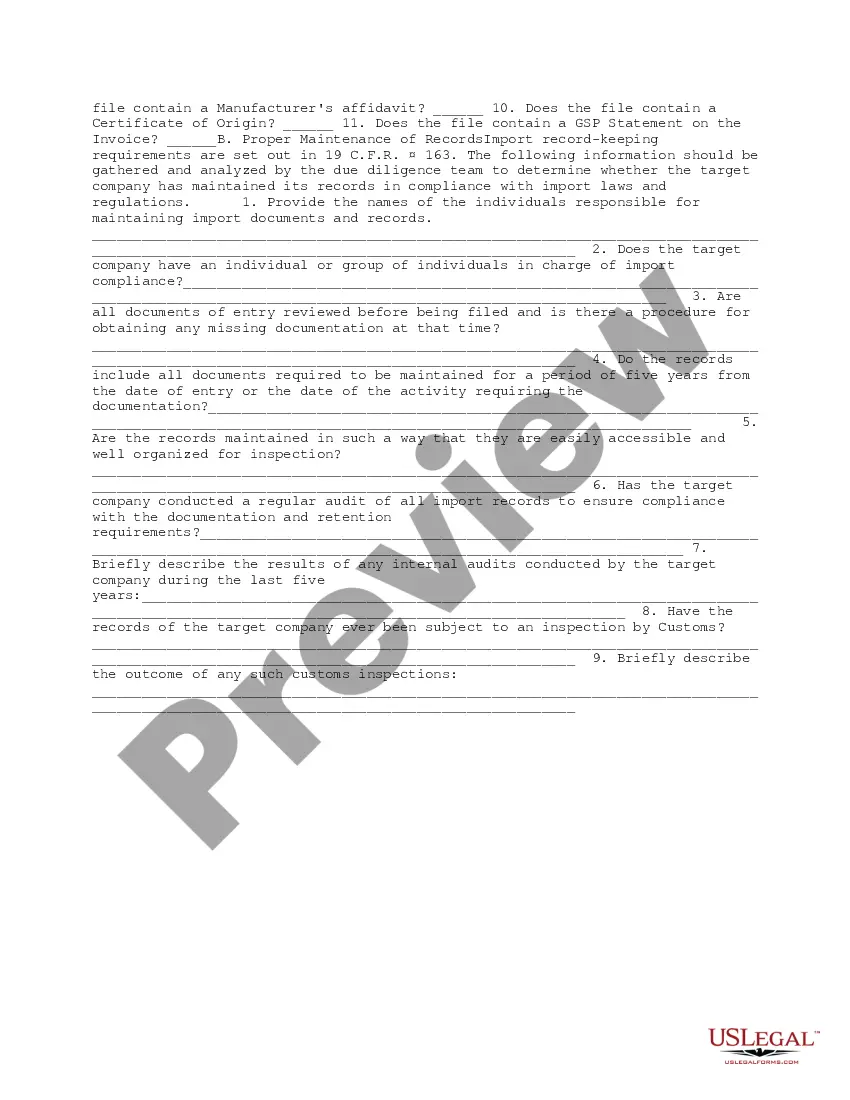

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Tarrant Texas Import Compliance and Records Review Due Diligence is a crucial process in the international trade industry that focuses on ensuring legal adherence to import regulations and verifying the accuracy of relevant records. This practice is essential for importers, exporters, and businesses involved in foreign trade, as it helps them mitigate legal risks, maintain regulatory compliance, and ensure efficient operations. One type of Tarrant Texas Import Compliance and Records Review Due Diligence is Import Compliance Due Diligence. This involves conducting a comprehensive assessment to determine if import activities comply with all relevant regulations, such as customs laws, trade agreements, import restrictions, and documentation requirements. By conducting a thorough review, businesses can avoid penalties, fines, and delays caused by non-compliance. Another type is Records Review Due Diligence, which entails a meticulous examination of import-related records, such as purchase orders, invoices, bills of lading, customs documentation, and compliance filings. The purpose of this review is to ensure the accuracy, completeness, and compliance of these crucial documents. By verifying the authenticity of records, businesses can reduce the risk of disputes, discrepancies, and audit-related issues. The key elements of Tarrant Texas Import Compliance and Records Review Due Diligence include: 1. Classification Verification: Ensuring proper classification of goods with the Harmonized System (HS) code, which facilitates accurate determination of import duties, taxes, and regulatory requirements. 2. Document Validation: Thoroughly reviewing import-related documents, including commercial invoices, packing lists, certificates of origin, and transport documentation, to ensure compliance with legal requirements. 3. Customs Compliance: Conducting an extensive analysis of customs procedures and regulations to verify compliance with import laws, duty rates, valuation methods, and other customs-related obligations. 4. Risk Assessment: Identifying potential risks and vulnerabilities in import processes, such as incorrect valuation, prohibited goods, compliance gaps, or incomplete documentation. 5. Due Diligence Documentation: Maintaining a comprehensive record of all due diligence activities performed, including findings, recommendations, and any necessary corrective actions taken. Businesses can benefit from outsourcing Tarrant Texas Import Compliance and Records Review Due Diligence to experienced professionals. By leveraging their expertise, businesses can streamline the importing process, enhance legal compliance, minimize risk exposure, and maintain smooth operations in international trade.Tarrant Texas Import Compliance and Records Review Due Diligence is a crucial process in the international trade industry that focuses on ensuring legal adherence to import regulations and verifying the accuracy of relevant records. This practice is essential for importers, exporters, and businesses involved in foreign trade, as it helps them mitigate legal risks, maintain regulatory compliance, and ensure efficient operations. One type of Tarrant Texas Import Compliance and Records Review Due Diligence is Import Compliance Due Diligence. This involves conducting a comprehensive assessment to determine if import activities comply with all relevant regulations, such as customs laws, trade agreements, import restrictions, and documentation requirements. By conducting a thorough review, businesses can avoid penalties, fines, and delays caused by non-compliance. Another type is Records Review Due Diligence, which entails a meticulous examination of import-related records, such as purchase orders, invoices, bills of lading, customs documentation, and compliance filings. The purpose of this review is to ensure the accuracy, completeness, and compliance of these crucial documents. By verifying the authenticity of records, businesses can reduce the risk of disputes, discrepancies, and audit-related issues. The key elements of Tarrant Texas Import Compliance and Records Review Due Diligence include: 1. Classification Verification: Ensuring proper classification of goods with the Harmonized System (HS) code, which facilitates accurate determination of import duties, taxes, and regulatory requirements. 2. Document Validation: Thoroughly reviewing import-related documents, including commercial invoices, packing lists, certificates of origin, and transport documentation, to ensure compliance with legal requirements. 3. Customs Compliance: Conducting an extensive analysis of customs procedures and regulations to verify compliance with import laws, duty rates, valuation methods, and other customs-related obligations. 4. Risk Assessment: Identifying potential risks and vulnerabilities in import processes, such as incorrect valuation, prohibited goods, compliance gaps, or incomplete documentation. 5. Due Diligence Documentation: Maintaining a comprehensive record of all due diligence activities performed, including findings, recommendations, and any necessary corrective actions taken. Businesses can benefit from outsourcing Tarrant Texas Import Compliance and Records Review Due Diligence to experienced professionals. By leveraging their expertise, businesses can streamline the importing process, enhance legal compliance, minimize risk exposure, and maintain smooth operations in international trade.